Markets: Stoics

Markets in Asia and Europe are bid for risk – albeit without much enthusiasm. There is a stoic side to today’s price action. The list of stoics starts with Epictetus, continues with Seneca and become part of the Western Philosophical Traditions with Marcus Aurelius. Virtue and wisdom is happiness and judgment should be on behavior, not words.

We can’t control the outside world, but can only be responsible for our reactions to it. This is as good a place to start for understanding Monday and what it means for risk trading ahead. Here are the things that are showing up on the radar screen in a light week for economic news and apart from the big three themes that still dominate trading US/China trade, Italy and the EU budget battle, UK/EU Brexit terms and UK political sustainability.

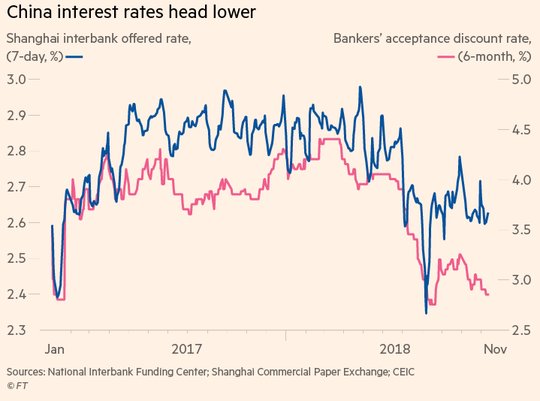

Think differently and you may have a better week – 1) USD shortage concerns. Cross-currency swaps suggest US yield curve flatness is pushing savers like Japan to buy into Europe and elsewhere. 2) China short-term rates are now below the US. The ability for the CNY not to weaken will follow. 3) Leveraged loans and corporate spreads are a key focus for risk again. Many of the new loans are held in CLOs and the level of debt has returned to pre-2008 crisis levels. 4) French-German proposal a “breakthrough” for Eurozone reform. France and Germany agreed on Friday to back a joint euro zone budget focused on financing investment and reforms that help euro zone economies converge. These stories are mostly negative for rates and FX leaving the equity rally in Asia and Europe suspect. Spending to grow is the mantra until borrowing makes this prohibitively expensive or central bankers lose their will to be easy or inflation really shows up. When you look at these stories and try to find the right barometer for risk we have to go back to CNY and wonder if the 7.00 level is back in play and matters.

Question for the Day:Is China winning the trade war? The battle for confidence still rests on the outcomes of the big three stories – UK Brexit, Italy’s Budget and the US/China trade tariffs. The ability for China to hold on for a longer battle remains in play post the APEC summit and Pence/Xi speeches. The doubt that markets are fully pricing in a prolonged conflict continues to be in play.

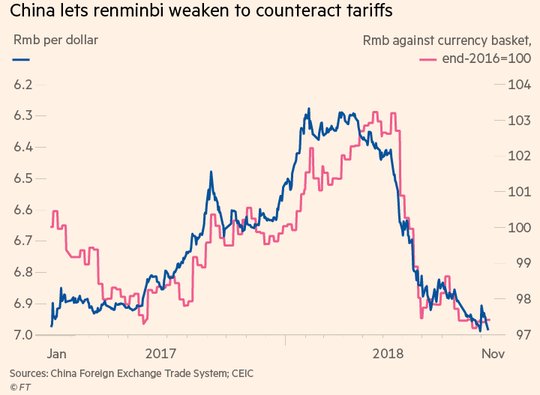

- On the currency front, the RMB weakness offsets the tariff impact. The RMB index and the RMB have been moving in lock step, which is different than in 2015. If the G20 meeting fails, expect further RMB moves.

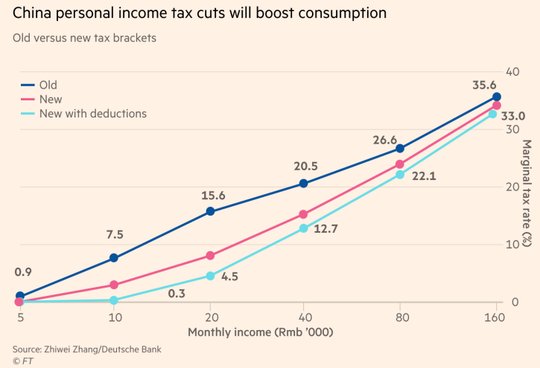

- On the tax front, the cuts will boost consumption and make up for some of the hit from weaker foreign demand. The power of 2.6% cut in top rate is still in question.

- On the interest rate front, PBOC has cut RRR three times, rates are lower from 3M to 30Y. The collapse in 2-5Y bonds is notable and reaching levels where they approach the US – making the RMB defense harder.

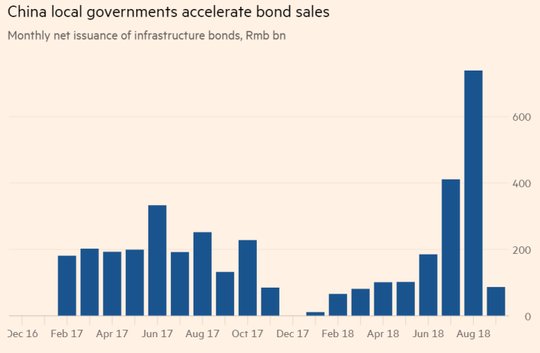

- On the issuance front, local bonds for infrastructure has accelerated. But as the M2/CNY loan data showed, many local government have reached the 2018 cap already. The ability for Beijing to increase this will rest on forcing savers to buy the bonds – something they are moving towards now.

China is facing the US trade war with determined policy actions that drive financial repression. The higher rates from tariffs many dampen global demand and their own growth but their printing of money and public appetite to support the government allows this to go on through 2019. Ability for China to “muddle through” still has bigger implications for Europe, Emerging Markets and commodities.

What Happened?

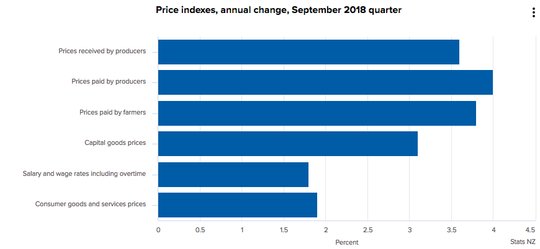

- New Zealand 3Q PPI output +1.5% q/q, 3.6% y/y after 0.9% q/q, while input rose 1.4% q/q, 4.0% y/y after 1% q/q. The capital goods rose 1.2% q/q, 3.1% y/y, salary and wages were up 0.5% q/q, 1.8% y/y while consumer prices rose 0.9% q/q, 1.9% y/y. Farm expenses rose 1.1% q/q, 3.8% y/y.

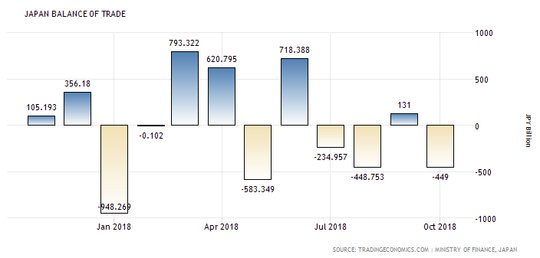

- Japan October trade deficit Y449.2bn after Y140bn surplus, worse than –Y70bn expected.Exports rose 8.2% to Y7.243trn after -1.3% - near expectations of +9% y/y, while imports rose 19.9% to Y7.692trn after 7% - more than the +14.5% y/y expected. Much of the deficit was energy related with petroleum up 33.7% and LNG up 49.3%. Japan exports were led by autos up 7.3%, car parts 5.9%, ships up 37.7% and aircraft 35.9% y/y. Among the major trading partners, imports rose with China 16.1%, South Korea 22%, Taiwan 24.8%, Europe 9.5% and the US 34.3% y/y, while exports with China rose 9%, South Korea 0.3%, Taiwan 5.4%, Hong Kong 5.2%, Europe 5.7% and US 11.6% y/y.

- BOJ Kuroda: Sees changing financial risks with aging population. In his conclusion to his speech in Tokyo, Kuroda concluded, “in countries with low interest rates amid population aging, financial institutions increase loans to and securities investment in emerging economies that offer relatively higher yields. While these kinds of capital flows could mitigate the negative impact of population aging, they may carry new risks to global financial stability.”

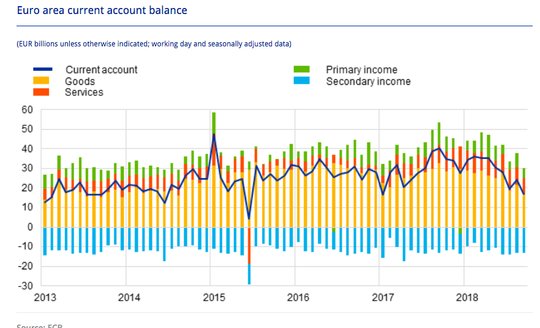

- Eurozone September current account surplus E17bn after E20.5bn – 3.1% of GDP. This was down from E24bn in 2017 September but steady as percent of GDP. In the financial account, foreign portfolio investments slowed to E324bn down from E572bn in 2017, while foreign inflows slowed to E98bn from E267bn a year ago.

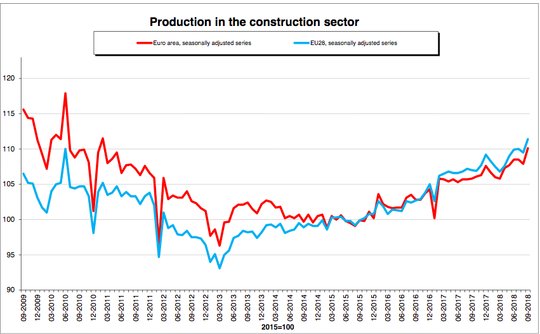

- Eurozone September construction output up 2% m/m, 0.8% q/q, 4.6% y/y after -0.6% m/m, 1.5% q/q, 2.2% y/y – better than 3.6% y/y expected. Building bounced in September up 2.2% after -0.6% in August and -0.1% in July – so 3Q was up 0.8% vs. 0.9% in 2Q. Civil Engineering rose 1.8% m/m after -0.6% in August and 0% in July slowing to 0.6% q/q from 3.5% q/q. France and Germany led the September gains.

Market Recap:

Equities: The S&P500 futures are off 0.2% after rising 0.22% Friday. The Stoxx Europe 600 is up 0.2% with focus on Nissan, tech. The MSCI Asia Pacific rose 0.6% with China and Japan leading. The MSCI all-country World index is up 0.2% - best in a week.

- Japan Nikkei up 0.65% to 21,821.16

- Korea Kospi up 0.39% to 2,100.56

- Hong Kong Hang Seng up 0.72% to 26,372.00

- China Shanghai Composite up 0.91% to 2,703.51

- Australia ASX off 0.63% to 5,786.40

- India NSE50 up 0.76% to 10,763.40

- UK FTSE so far up 0.45% to 7,044

- German DAX so far up 0.15% to 11,360

- French CAC40 so far up 0.20% to 5,036

- Italian FTSE so far up 0.35% to 18,942

Fixed Income: The French/German budget agreement for EU driving some of the hope and selling of bonds in Europe. The Italian and UK worries persist – 10-year yields in UK off 2bps to 1.39%, Italy up 3bps to 3.515%. German Bund yields up 1.5bps to 0.38%, French OATs up 1.7bps to 0.778% (watching fuel levies and push back), Spain up 1bps to 1.64%, Portugal flat at 1.96% while Greece off 1bps to 4.515%.

- US Bonds are lower with curve steeper, focus on Asia selling and equities– 2Y up 1.9bps to 2.818%, 5Y up 1.7bps to 2.895%, 10Y up 2bps to 3.083%, 30Y up 2.6bp to 3.343%.

- Japan JGBs hold bid with focus on BOJ and 20Y sale next– 2Y off 0.3bps to -0.153%, 5Y off 1bps to -0.11%, 10Y off 1bps to -0.082%, 30Y off 2.2bps to 0.827%. BOJ left buying of 1-3Y and 3-5Y unchanged. Talk of MOF issuing less 20Y adds to curve flattening today.

- Australian bonds rally with equities lower, catch up to US– 3Y off 1.5bps to 2.065%, 10Y off 1.6bps to 2.66%.

- China PBOC skips open market operations, leaves liquidity neutral. Bonds continue to rally – 2Y flat at 2.72%, 5Y off 3.5bps to 3.07%, 10Y off 1bps to 3.32%.

Foreign Exchange: The US dollar index is off 0.1% to 96.37 with range 96.31-96.57 with focus on 95.90 base. In Emerging Markets, USD mixed – EMEA: ZAR flat at 13.989, TRY up 0.35% to 5.314, RUB up 0.15% to 65.865; ASIA: TWD flat at 30.905, KRW flat at 1128.50, INR up 0.35% to 71.655.

- EUR: 1.1420 flat. Range 1.1394-1.1435 with focus on rates, crosses 1.1350-1.1500 expectations

- JPY: 112.80 flat. Range 112.61-112.90 with risk mood mixed despite equities, US bonds, US/China trade key with EUR/JPY 118.80 flat.

- GBP: 1.2820 off 0.15%. Range 1.2795-1.2884 with 1.2750 focus and Brexit / UK politics driving still. EUR/GBP .8910 up 0.15%.

- AUD: .7295 off 0.5%. Range .7293-.7330 with focus on US/China trade, commodities and .7350 resistance. NZD off 0.8% to .6825 with PPI adding to selling as RBNZ on hold view persists.

- CAD: 1.3175 up 0.2%. Range 1.3142-1.3180 with oil, US/China and BOC comments ahead key. 1.3050-1.3250 watch.

- CHF: .9965 off 0.3%. Range .9957-1.0014 with EUR/CHF 1.1380 off 0.3% - back to safe-haven status with Italy, UK and US/China focus .9920-1.0080 key.

- CNY: 6.9245 fixed 0.21% stronger from 6.9377 Friday, trades weaker off 0.1% to 6.9430 with range 6.9345-6.9486.

Commodities: Oil mixed, Gold lower, Copper flat at $2.8085.

- Oil: $56.54 up 0.15%.Range $56.53-$57.33 – an early rally in Asia fizzles in Europe, Brent off 0.15% to $66.67 with $67.62 highs – focus remains on US inventories vs. OPEC vs. global demand with $68 Brent key.

- Gold: $1220.70 off 0.2%.Range $1219-$1224 with focus on USD, rates and risk appetite still. Silver off 0.4% to $14.36 with $14.50 key pivot. Platinum up 0.2% to $847.60 and Palladium up 0.25% to $1180.

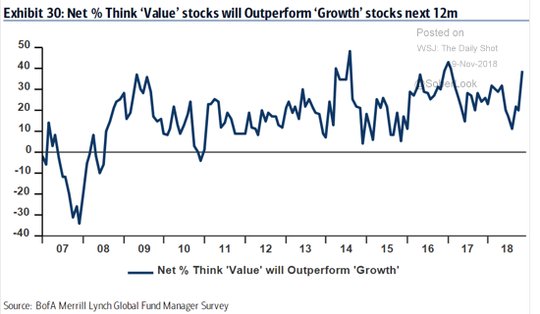

Conclusions: What leads the market? The drop in the FAANG over the last month has left Amazon in a bear market, Apple on the cusp and many wondering what leads the stock market now. Leadership in shares matters and the greater rotational plays that usually happen in late December have been playing out in early November instead. Value has returned to beat growth as the favorite in the year ahead. The drop of $575bn in capital in the FAANG since October opens up questions about how portfolio managers will react to the next 6 weeks.

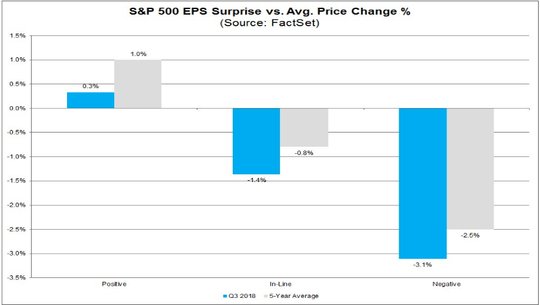

The fact that earnings in 3Q were even batter than expected and yet the reaction of the market has been poor highlights the forward-looking nature of equity trading. 14% is the expectation for 4Q earnings slowing to single digits into 2019.

Economic Calendar:

- 1000 am US Nov NAHB housing market index 68p 67e

- 1045 am NY Fed Williams speech

- 1130 am US Treasury sells 3M and 6M bills

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.