Markets: Steeper

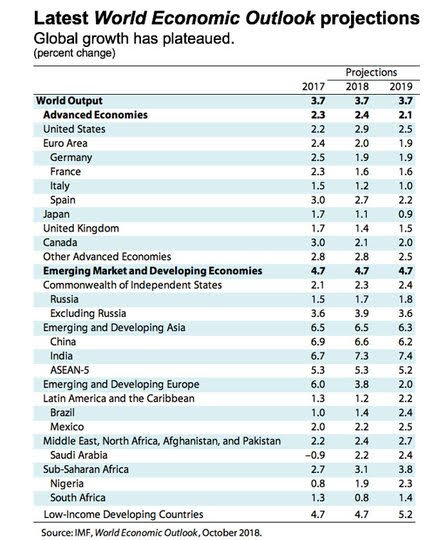

Some people hike mountains, while others hike rates. Just when the climb seems most impossible, there will be a plateau with the glory of a view from the top. The IMF cuts it global growth outlook from 3.9% to 3.7% suggesting a growth plateau, and yet, rates are higher globally with curves steeper and US 10-year touching 7-year high yields. Equities decline in Europe and Asia and futures point to lower in the US. The USD is up at 8-week highs. This is a continuation of the Friday storm with the usual suspects – US/China trade war turning into a cold war; EU/Italy budget battles turning into a EUR breakdown/banking crisis; UK/EU Brexit no deal outcome leading to a UK recession and uglier politics; US mid-term elections leading to a frozen government with fiscal recklessness; EM crisis getting worse – see Pakistan request an IMF bailout complicated by its China belt-road obligations; further natural disasters to drive up commodity prices and disrupt economies globally. There was little economic news that really drove the markets overnight leaving the IMF meetings as the focus. Things are clearly out of balance with financial stability no longer the third rail for central bankers. This puts the burden on markets to find equilibrium with the USD divergence in growth and policy standing out, the EUR is the focus with 1.14 and 1.1280 the next targets.

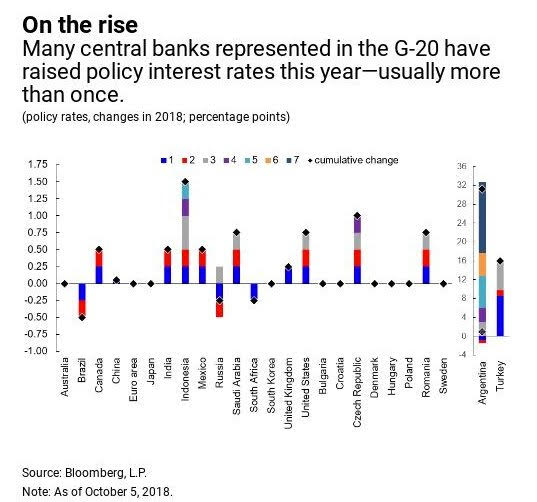

Question for the Day: Is 2019 lower growth, higher risk? The IMF WEO update was released overnight and it highlights the usual risks – with rates going up, debt risk follow. The IMF correctly notes that the US isn’t the only central bank raising rates in 2018.

The most interesting part of the WEO maybe in the US/China view of a prolonged trade war. “US growth will decline once parts of its fiscal stimulus go into reverse. Notwithstanding the present demand momentum, we have downgraded our 2019 US growth forecast owing to the recently enacted tariffs on a wide range of imports from China and China’s retaliation. China’s expected 2019 growth is also marked down. Domestic Chinese policies are likely to prevent an even larger growth decline than the one we project, but at the cost of prolonging internal financial imbalances.”

What Happened?

- Japan September EcoWatchers Outlook 51.3 from 51.4 – better than 50.6 expected, but current index 48.6 from 48.7 – weaker than 48.9 expected. The earthquake in Hokkaido and typhoons hit sentiment. The Cabinet Office left its overall economic assessment based on the survey unchanged, saying, "The gradual recovery continues." Last month, the government upgraded its assessment for the first time in five months. "Looking ahead, there are concerns over high costs and the impact of the trade dispute. But there are expectations for a recovery from the (natural) disasters," the Cabinet Office said.

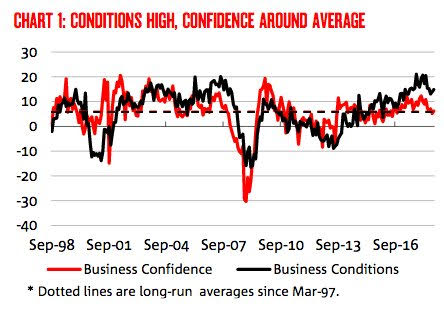

- Australia September NAB business conditions 15 from 14 – better than 9 expected. Confidence 6 from 5 – also better than 4 expected. Employment rose to 12 from 9, and labor costs rose to 1.3% from 0.9% q/q. even as final product prices fell to 0.9% from 1.3%. Forward Orders fell to 2 from 5 even while exports 0 from -1.

- German August trade balance E18.3bn after E15.9bn – slightly less than E19.0bn expected. The July surplus revised up from E15.8bn. Exports -0.1% m/m, +2.2% y/y to E105.2bn after -0.9% m/m – less than the +0.2% m/m gain expected. The imports -2.7% m/m, +6.2% y/y to 88.1bn. Outside the EU, exports were E45.9bn and imports E39.7bn. The August C/A surplus was E15.3bn after revised E15.1bn – less than the E15.5bn expected.

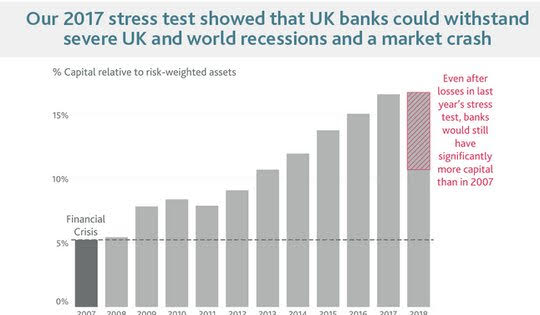

- UK FPC Meeting: Notes banks strength but sees derivative uncertainty. The BOE FPC issued a statement from its policy meeting saying that the major UK banks' capital strength is sufficient to accommodate severe stress test scenarios, including a cliff-edge no-deal Brexit. Risks, however, remain in the insurance and derivatives market. Whilst UK agents using EU clearing houses will have their derivative contracts serviced by the UK, as it stands the same cannot be said for EU agents using UK clearing houses, with the clearinghouses unable to manage exisiting derivative contracts without action from the EU. Both cleared and uncleared derivative contracts total GBP99trn in notional value. The FPC also noted strong increases in loans to highly leveraged companies. New stock of such loans in 2018 is anticipated to come in at GBP31bn - three times the amount Banks are lending to businesses.

Market Recap:

Equities: The US S&P500 futures are off 0.5% after losing just 0.04% yesterday. The Stoxx Europe 600 is off 0.4% - worst in 6 months – while the MSCI Asia Pacific fell 0.9% - worth in 15 months. The MSCI EM also down 0.3% - worst in 17 months.

- Japan Nikkei off 1.32% to 23,469.39

- Korea Kospi closed for holiday

- Hong Kong Hang Seng off 0.11% to 26,172.91

- China Shanghai Composite up 0.17% to 2,721.02

- Australia ASX off 1.01% to 6,155.50

- India NSE50 off 0.45% to 10,301.05

- UK FTSE so far off 0.35% to 7,207

- German DAX so far off 0.55% to 11,881

- French CAC40 so far off 0.35% to 5,282

- Italian FTSE so far off 0.65% to 19,725

Fixed Income: On one hand supply and on the other weaker equities, this is the key for steeper curves today. More headlines on Italy, more on US/China trade, less on growth from the IMF – all leave EU bonds lower – German Bund 10-year yields up 2bps to 0.547%, French OATs up 3bps to 0.90% and UK Gilts up 3.5bp to 1.705%. Periphery continues to wag the market – Italy up 11bps to 3.67%, Spain up 3bps to 1.615% and Portugal up 3.5bps to 1.995% while Greece is up 5bps to 4.635%.

- Germany sold E0.399bn of 8Y 0.1% Apr 2026 Linker at -1.12% with 2.7 cover.

- Belgium sold bills with weak demand -E1.1bn of 12M Sep 2019 bills at -0.567% with 0.928 cover.

- The Netherlands sold E0.735bn of 30Y 2.75% Jan 2047 DSL at 1.184%.

- Spain sold E4.606 of bills with good demand – E0.71bn of 6M Apr 2019 Letra at -0.434% with 4.7 cover – and E3.896bn of 12M Oct 2019 Letra at -0.292% with 1.89 cover.

- UK syndicates a 2071 Gilt with price guidance 1bps and orders over GBP28bn for GBP5.25bn likely issue

- ESM syndicates a 5Y E3bn issue with price guidance 20bps and orders over 5.8bn

- US Bonds see curve steeper into supply– 2Y off 0.8bps to 2.877%, 5Y up 0.5bps to 3.075%, 10Y up 1.3bps to 3.246%, 30Y up 2.6bps to 3.43%.

- Japan JGBs sold across the board despite equities– 2Y up 0.4bps to -0.126%, 5Y up 0.3bps to -0.072%, 10Y up 0.5bps to 0.15%, 30Y up 0.3bps to 0.936%.

- Australian bonds see bear flattening after business confidence– 3Y up 1.6bps to 2.067%, 10Y flat at 2.765%.

- China PBOC skips open market operations, net drains CNY60bn on the day. Money market rates continued to ease – 7-day off 2bps to 2.61%, O/N off 2bps to 2.492%. 10Y bond yields were flat at 3.615%.

Foreign Exchange: The US dollar index up 0.3% to 96.06 with focus on 97 still. In EM USD is bid– EMEA: ZAR off 1.05% to 15.00, TRY off 0.3% to 6.13, RUB flat at 66.66; ASIA: TWD flat at 30.97, KRW off 0.25% to 1134.75 and INR off 0.25% to 74.25.

- EUR: 1.1445 off 0.4%.Range 1.1441-1.1503 – Italy, rates, and growth hitting with 1.1450 opening 1.14 barrier and 1.1285 target.

- JPY: 113.20 flat. Range 112.93-113.39 with 112-114 consolidation. EUR/JPY 129.55 off 0.45% - 130 break opens 128.

- GBP: 1.3045 off 0.3%.Range 1.3034-1.3106 with EUR/GBP .8770 off 0.1% - All about EUR not GBP today with 1.30 pivot for either 1.28 or 1.33.

- AUD: .7065 off 0.2%.Range .7062-.7094 with no relief despite metal bid and good confidence – focus is on China/crosses – NZD off 0.2% to .6435 with .6250 bear target.

- CAD: 1.2990 up 0.2%.Range 1.2952-1.2993 with 1.2880 or 1.3050 still in play – watching oil, rates and data.

- CHF: .9945 up 0.2%.Range .9921-.9951 with EUR/CHF 1.1385 off 0.2% - with Italy and safe-haven demand rising, 1.1340 key.

- CNY: 6.9019 fixed 0.09% weaker from 6.8957, trades weaker into London at 6.9220 from 6.9135 official close yesterday, Range 6.9307-6.9066.

Commodities: Oil up, Gold down, Copper up 0.9% to $2.8285.

- Oil: $74.78 up 0.65%. Range $74.18-$75.02 with bounce back from yesterday and focus on US Hurricane risk/Canadian refinery disruption. Brent $84.65 up 0.9%. WTI watching $73-$76 while Brent watching $84-$86

- Gold: $1186.80 off 0.1%.Range $1186-$1190. USD and rates still driving with $1181-$1200 key. Silver $14.30 off 0.5% with $14.50 needed for upside again. Platinum off 0.7% to $814 and Palladium off 0.3% to $1075.

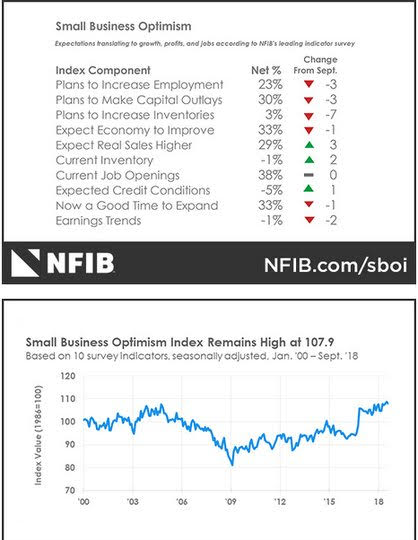

Conclusions: Confidence Continues. Despite the tape, markets remain fixed on US divergence, with view that US trade tariffs aren’t an issue yet. This leaves ongoing risks for squeezes up in US assets but for the cost of money – with the start of $230bn in supply starting today. The US September NFIB small business optimism drops to 107.9 from 108.8 – better than 107 fall expected. This is still the 3rdhighest reading on record. Actual capital spending in the past few months rose significantly. Average employment change per firm was solid. Owners bulked up inventories. Compensation increases set a new record. "This is the longest streak of small business optimism in history, evidence that tax cuts and regulatory rollbacks are paying off for the economy as a whole," said NFIB President and CEO Juanita D. Duggan, "Our members say that business is booming and prospects continue to look bright."

Economic Calendar:

- 0815 am Canada Sep housing starts 201k p 222k e

- 1000 am Chicago Fed Evans speech

- 1000 am US Oct IBD/TIPP economic optimism 55.7p 55.3e

- 1130 am US sells $48bn 3M and $42bn 6M bills

- 0100 pm US sells $40bn in 4-week and $26bn in 52-week bills

- 0400 pm Argentina central bank rate decision – no change from 60% expected

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.