Markets: Splits

Markets love certainty, but Asian exporters get no relief as the US vote makes clear trade policy issues will remain in play. The US mid-term elections proved pollsters right with the House swinging to the democrats 219 vs. 193 republicans, while the Senate remains with 51 republicans, 2 independents and 43 democrats and 4 races too close to call. The common wisdom won with gridlock in US Congress seen as stalling new spending, helping US bonds and stocks while hurting the USD. Not everyone agrees and the role of US government spending and the growth trajectory of the economy will be in play with Pelosi as Speaker of the House. Of course there were plenty of other stories overnight to consider for driving markets –

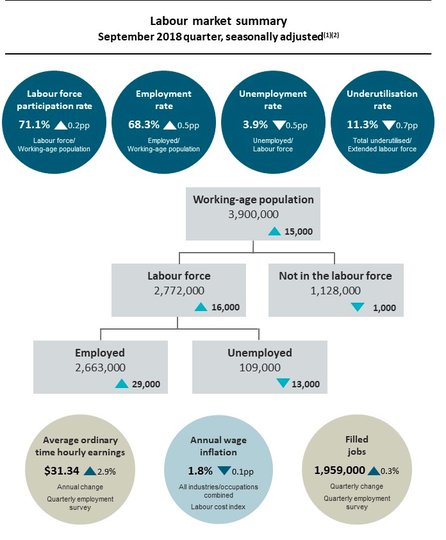

- New Zealand had an outsized jobs report putting the RBNZ easing hopes to the side.

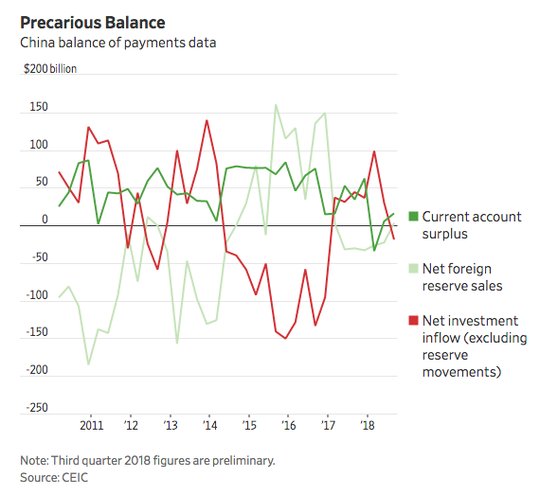

- China had an bigger drop in FX reserves suggesting more intervention in October and less hope that 7 holds for the CNY.

- Japan’s parliament passed an $8.3bn supplement to the budget for natural disaster recovery after earthquake and typhoons.

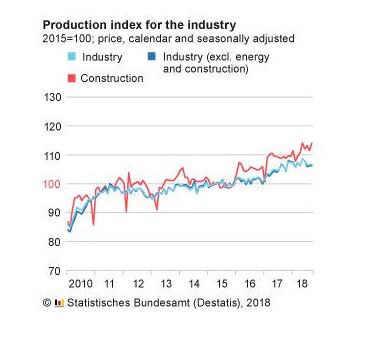

- Germany had a stronger industrial production gain adding to 4Q growth bounce hopes.

These stories matter but not to the broader mood of risk-on and a clear path to year-end rallies for equities in Europe and the US. The risk of is in the EUR today with the euphoria ignoring the ongoing Italy, UK and German political issues. A weaker USD helps US growth, slows Europe and it maybe the wrong medicine for the FOMC and the ECB. Markets like voters are split on what they really want growth without inflation or taxes. EUR 1.13-1.15 has been the prison, and no one is sure if today is a real breakout watching 1.1555 for 1.1610 test.

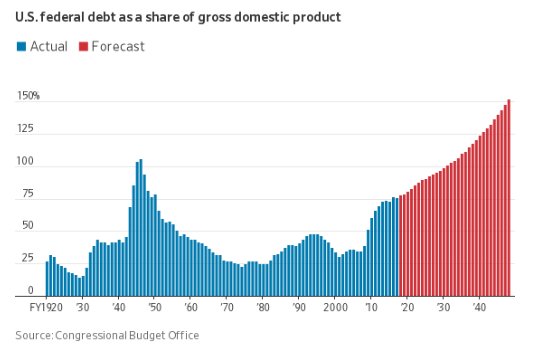

Question for the Day: Is this about China or about the US deficit next? Moods are still tender regarding US rates and China trade as issues that could derail the nascent November bounce back for equities. The US federal deficit is clearly in play again as the democrats control the house and push back on the Trump agenda with infrastructure spending one place for agreement, but tax increases to pay for it likely to follow. Lifting the deficit ceiling with be the next battle with March 2019 the deadline.

On the other hand, the pressure the US tariffs put on China coupled with its own debt and stimulus efforts leave the USD/CNY dancing closer to 7 than back to 6.80. Markets are wary of the upcoming trade report tomorrow and the risks for a harder line from Trump now that the election has left him with the Senate and less trouble than many “blue wave” talkers expected. The WSJ highlights the need for China to keep foreign money flows coming to offset some of the US pain.

What Happened?

- Australia October Construction PMI 46.4 from 49.3 – weaker than 50.1 expected – worst since Oct 2016. Engineering construction expanded (58.8 up 1.2) but faster declines in housing (44.8 off 1.2), commercial construction (45.6 off 1.3) and apartments (34.4 off 1.7) dominated. Tighter lending conditions, weaker home prices and weaker home-buyer sentiment were blamed.

- New Zealand 3Q unemployment drops to 3.9% from 4.5% - much better than 4.5% expected – best since June 2008.Unemployment fell 13,000 to 109,000 off 10.5% q/q. Employment rose 29,000 up 0.3% q/q with participation 71.1% up 0.2% - best on record (30-years). The Labor Cost Index rose 1.8% from 2.1% y/y – less than the 1.9% y/y expected with private wages up 1.9% and public up 1.5%.

- BOJ Funo speech: Pledges to keep easy policy for now. He noted CPI remains below 2% target. He also noted various uncertainties. "Particularly uncertain is the outlook of each country's trade policy, which warrants attention," Funo said in a speech to business leaders in Kochi, western Japan.

- Japan September preliminary LEI 103.9 from 104.5 – weaker than 104 expected. The coincident index 114.6 from 116.7.

- China October FX reserves drop $33.93bn to $3.053 trillion after $3.087trn – worse than $26bn drop expected – biggest fall in 18-months.China’s foreign exchange regulator attributed the fall to adjustments in global asset prices and currency valuation effects caused by a 2.1 percent rise in the dollar index. Some see this as a signal of intervention estimating $14bn in Oct vs. $17bn in September. Net foreign exchange sales by China’s commercial banks are likely to be around $3 billion in October, a drop of over 80 percent from September, the State Administration of Foreign Exchange said in a statement. The value of China’s gold reserves rose to $71.968 billion at the end of October, from $70.327 billion at the end of September.

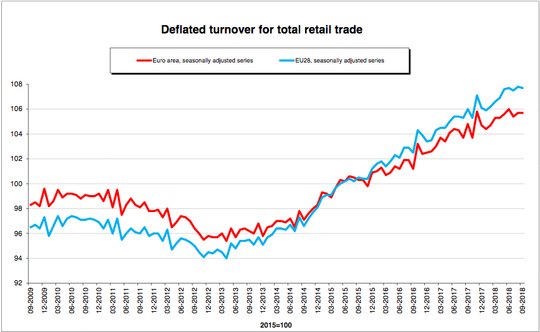

- Eurozone September retail sales -0.1% m/m after -0.2% m/m – weaker than +0.1% m/m expected. The volume of trade rose 0.4% m/m for food/drink and for gasoline while non-food products fell 0.5% m/m. Biggest increases by nation were in Ireland (+2.9%) while weakness was in Portugal (-1.7%), Austria (-1%), Belgium and UK (-0.8% m/m).

- Italy September retail sales -0.7% m/m, -2.8% y/y after +0.7% m/m – weaker than +0.1% m/m expected. By value sales -0.8% m/m, 2.5% y/y. Trend growth (3M average) rose 0.3% q/q in value and 0.2% in volume.

- German September industrial production up 0.2% m/m,up 0.8% y/y – after +0.1% m/m revised – better than +0.1% m/m expected. August revised sharply from -0.3% m/m. The gains were led by construction up 2.2% while energy fell 3.3% m/m. Intermediate goods -1%, consumer goods -0.3% but capital goods rose 0.9%.

Market Recap:

Equities: The US S&P500 futures are up 0.8% after a 0.63% gain yesterday. The Stoxx Europe 600 is up 1.1% - best in 4-weeks – with Spain’s IBEX leading up 1.65% after the Supreme Court reverses tax ruling. The MSCI Asia Pacific Index is up 0.2% while the EM index is up 0.5% - best in a month.

- Japan Nikkei off 0.28% to 22,085.80

- Korea Kospi off 0.52% to 2,078.69

- Hong Kong Hang Seng up 0.10% to 26,147.69

- China Shanghai Composite off 0.68% to 2,641.34

- Australia ASX up 0.39% to 5,982.00

- India NSE50 on Diwali Holiday

- UK FTSE so far up 1.35% to 7,136

- German DAX so far up 1.05% to 11,605

- French CAC40 so far up 1.45% to 5,148

- Italian FTSE so far up 1.55% to 19,563

Fixed Income: Modest risk-on slips core EU bonds down despite good German 10Y sale and mixed data – German IP better, EU retail sales worse. UK Gilts waiting for more on Brexit and politics – 10Y yields there are flat at 1.53%, while German Bunds up 0.5bps to 0.438% and French OATs up 0.2bps to 0.80%. Periphery bounces back with Italy off 7.5bps to 3.315%, Spain off 0.5bps to 1.575%, Portugal flat at 1.89% and Greece off 3bps to 4.25%.

- Germany sold #2.397bn of 10Y 0.25% Aug 2028 Bunds at 0.42% with 1.4 cover– previously 0.55% with 1.1 cover.

- US Bonds bull flatten as election cools deficit fears– 2Y off 0.8bps to 2.92%, 5Y off 2.6bps to 3.03%, 10Y off 4.1bps to 3.185%, 30Y off 5.1bps to 3.392%.

- Japan JGBs bid with US moves despite extra budget– 2Y flat at -0.135%, 5Y off 0.4bps to -0.09%, 10Y off 0.7bps to +0.112% while 30Y up 0.1bps to 0.878%.

- Australian bonds tread water– 3Y flat at 2.07%, 10Y flat at 2.725%.

- China PBOC skips open market operations, keeps liquidity neutral, Shibor O/N fixed 2.091%, 7-day fixed 2.595%. The MOF sold 3Y at 3.0729% with 2.76 cover, 7Y at 3.4443% with 2.75 cover. China bonds rally with 2Y off 8.2bps to 2.918%, 5Y off 2bps to 3.30% and 10Y off 3bps to 3.47%.

Foreign Exchange: The US dollar index is off 0.65% to 95.70 after 95.67-96.46 range overnight with focus back to 94.90 base and 96.50 resistance. In Emerging Markets, USD is offered – EMEA: ZAR up 1.3% to 13.93, TRY up 0.3% to 5.34, RUB up 0.4% to 65.87; ASIA: TWD up 0.1% to 30.725, KRW flat at 1123, INR up 0.15% to 73 - *holiday market.

- EUR: 1.1495 up 0.6%. Range 1.1395-1.1500 with 1.1350-1.1550 back as the focus – US rates key.

- JPY: 113.10 off 0.3%.Range 112.95-113.82 with EUR/JPY 130 up 0.25% and breaking out with equities mixed, rates driving 112.80 pivot for 111.50 again.

- GBP: 1.3165 up 0.5%.Range 1.3074-1.3175 with EUR/GBP .8730 up 0.1% - all about EUR with Brexit key, heavy data dump tomorrow

- AUD: .7295 up 0.7%.Range .7213-.7300 with upside washout – tracking crosses, watching RBNZ next with NZD up 0.65% to .6785 – risk for .68 barrier break after jobs report

- CAD: 1.3075 off 0.4%.Range 1.3073-1.3159 with US rates key driver then trade issues, growth 1.3050 pivot.

- CHF: .9955 off 0.7%.Range .9953-1.0051 with EUR/CHF 1.1445 off 0.1% - watching 1.00 break and .9880 target.

- CNY: 6.9141 fixed 0.13% stronger from 6.9230, now 6.9140 off 0.1% after 6.9445 highs. Focus remains on 7.00.

Commodities: Oil up, Gold up, Copper up 0.8% to $2.8250.

- Oil: $62.85 up 1.0%.Range $61.67-$63.12. Watching $62.40 as the pivot with $65 resistance. Brent $73.19 up 1.45%. OPEC discussing output cuts for 2019 as inventories rise. US API reported surprise 7.83mb gain but gasoline -1.2mb and distallates off 3.64mb. EIA today forecast is for 2mb crude build.

- Gold: $1234.10 up 0.55%.Range $1228-$1235 with focus on USD weakness post election gridlock. Silver $14.70 up 1.1% with focus still on $14.50-$14.92 range. Platinum up 0.9% to $877.45 and Palladium up 0.7% to $1125.60.

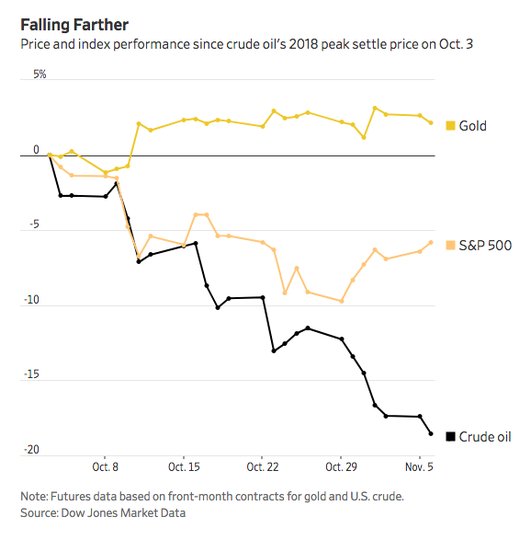

Conclusions: Is oil the deflationary risk for 4Q? The ECB maybe watching the oil reversal more than the FOMC but both maybe in for a surprise. The WSJ chart is worth considering today with EIA report at 10.30 am today. Bear markets in equities aren’t the talking point but oil is another story.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.