Markets: Resolution?

Event risks for the week are coming to a head. The UK Brexit saga is in the endgame, the Italy/EU budget clash has a deadline today, US/China trade hopes resume and the world gets a host of economic data again – most of it notably weaker and troubling for 2019 outlooks. Against this is the talking headlines that drive up some modicum of hope after a riotous sell-off in tech shares in the US yesterday. Markets are uneven and unsettled even with the talking hope – calling today a bounce back in risk would be an overstatement. Witness the ongoing downdraft in oil prices and the USD holding its gains.

- China/US talks resume– Liu to visit US ahead of Xi-Trump G20 meeting. The WSJ reports that a Friday call between Vice Premier Liu and US Treasury Mnuchin have both sides trying to reach accommodation.

- UK May sees Brexit talks “in the endgame.”Despite Johnson pushback and Labor pressure, FT reports UK PM sees Wednesday as a deadline.

- Abe/Pence talks lead to hope for expanding trade and investment flows along September agreement. They also agree on more North Korea sanctions.

- ECB Praet said the ECB plan for reinvestments of its QE will be communicated in December. Praet did his best to sound dovish but the EUR rallied and periphery bonds suffered after his speech.

The bellwether currency for risk confusions today is the GBP which has managed to shake off the weaker jobs report and focus entirely on the hope that UK Brexit deals bring back some value to the Pound. The 1.2770-1.3280 pennant formation suggests this is indeed a market coming to a head with the bear trend at 1.3770 holding for now and perhaps the bigger picture opportunity.

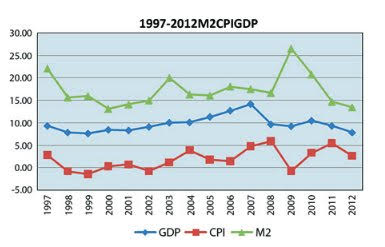

Question for the Day: Do trade talks matter more than money supply? The one reason that markets are slightly positive today rests with China and hopes that the US/China trade talks lead to some resolution or detente in the brewing cold war. The data out overnight paints a more troublesome picture as the China restructuring drives growth expectations lower as money supply drops, loan growth falls and the nascent private sector funding mechanisms that worked so well in 2010-2016 – social finance – collapses. Markets maybe blinded by the trade tariffs concerns and miss the on going tightening of policy that hits growth in China. The data tomorrow on retail sales, industrial production and investment will be watched accordingly. Academic literature on China GDP and CPI and M2 all points to the same conclusion, weaker money supply matters particularly in China. The drop in today’s total social financing reflects the seasonal pattern of October holidays along with the limit of annual quotas on local government special bond issuance – that hit a 6-month low at CNY86.8bn down from CNY738.9bn in September.

The expectation is that China will soldier on with more stimulus plans. The October fiscal budget report suggests there are limits there as well – with revenues down 5.1% to CNY1.35trn and spending up 8.2% y/y to CNY1.2trn. Revenue from individual income tax rose 7% y/y down sharply form 13.8% in September.

What Happened?

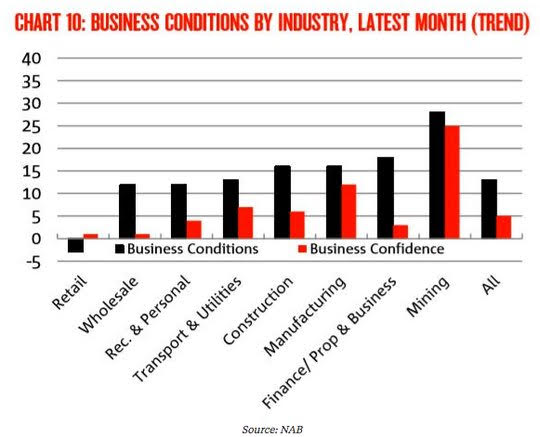

- Australia October NAB business conditions drop to 12 from 14 – weaker than 14 expected– while confidence drops to 4 from 6 – weaker than 8 expected and new lows for 2018. “Although conditions have eased since earlier in 2018, and have been a little volatile over recent months, business conditions remain well above average,” NAB chief economist Alan Oster said. The biggest drop was in the sub-index for employment falling to 7 from 11 while forward orders remained steady at 3 as did inventories at 1.

- German October final HICP unrevised at 0.1% m/m, 2.4% y/y after 0.4% m/m, 2.2% y/y – as expected. The National CPI also unrevised at 0.2% m/m, 2.5% y/y after 0.1% m/m, 2.2% y/y.

- French 3Q private payrolls rise 0.2% q/q, 1.1% y/y after 0.1% q/q – less than the 0.3% q/q expected. There were a net 30,200 jobs created after 22,400. Construction rose 0.5% after 0.4% q/q, market services rose 0.2% unchanged.

- China October M2 8% from 8.3% - less than the 8.4% expected. The new loans CNY697bn after CNY1.38trn – less than the CNY826bn expected. The total social finance slows to CNY728.8bn after CNY2.21trn - also less than the CNY2.30trn expected. Total loan growth slows to 13.1% from 1.32%.

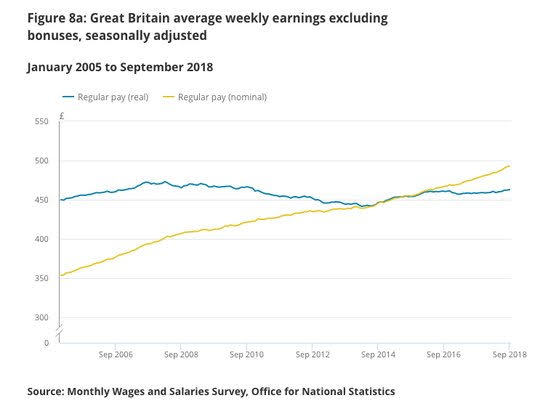

- UK October claimant count rose 20,200 after 23,200 – more than the 4000 expected. The claimant unemployment rate rose to 2.7% from 2.6% but the ONS noted that universal credit rollout makes this data more volatile. The ILO unemployment rate 3M September rose to 4.1% from 4% - also worse than the 4% expected with employment up 23,000 to 32.41mn in 3Q while unemployment rose 21,000 to 1.38mn. The average earnings rose 3% from 2.7% for the 3Q y/y – as expected – while the earnings ex-bonus rose 3.2% after 3.1% – better than the 3.1% expected.

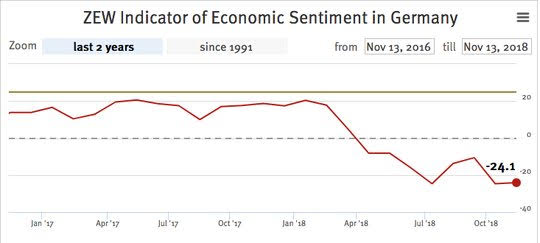

- German November ZEW economic sentiment improves to -24.1 after -24.7 – better than the -25.0 expected. Despite the improvement, the index remains well below the +22.7 long-term average. Also, German Current Conditions drops to 58.2 from 70.1 – worse than the 65 forecast. The Eurozone economic sentiment drops to -22 from -19.4 – worse than the -20 expected. “The figures for industrial production, retail sales and foreign trade in Germany all point towards a weak development of the German economy in the third quarter. This is reflected by the fact that the assessment of the current situation has experienced a decline. The expectations of the survey participants for the coming six months do not show any improvement. This means that, at the moment, they do not expect to see a speedy recovery of the currently weak development of the economy,” noted ZEW President Wambach.

Market Recap:

Equities: The S&P500 futures are up 0.4% after losing 1.97% yesterday. The Stoxx Europe 600 is up 0.3% while the MSCI Asia Pacific was lower – lead by Japan but moderated by China gains. The tech focus shifted after trade talk headlines. The MSCI all-country World index dips 0.2% to 2-week lows.

- Japan Nikkei off 2.06% to 21,810.52

- Korea Kospi off 0.44% to 2,071.23

- Hong Kong Hang Seng up 0.62% to 25,792.87

- China Shanghai Composite up 0.93% to 2,654.88

- Australia ASX off 1.74% to 5,922.60

- India NSE50 up 0.96% to 10,582.50

- UK FTSE so far up 0.15% to 7,065

- German DAX so far up 0.60% to 11,395

- French CAC40 so far up 0.25% to 5,070

- Italian FTSE so far off 0.20% to 19,014

Fixed Income: The Italian sale of E5.5bn bonds ahead of the EU budget deadline was a key focus for EU bonds today. The data and the on-again risk mood adding to the negative backdrop. UK focus on Brexit continues with UK Gilt 10-year yields up 2.5bps to 1.475%, German Bunds flat at 0.395% while French OATs flat at 0.777% but Italy up 4bps to 3.472%, Spain up 1bps to 1.605%, Portugal up 1bps to 1.95% and Greece up 3bps to 4.40%.

- Italy sold E1.25bn of 20Y 2.95% BTP at 3.90% with 1.41 cover– previously 3.79% with 1.90 cover – good auction but not enough to counter budget fears; Italy also sold E2.5bn of 3Y 2.3% 2021 BTP at 1.98% with 1.52 cover– previously 2.51% with 1.26 cover; and Italy sold E1.75bn of 7Y 2.5% 2025 BTPs at 3.12% with 1.52 cover– previously 3.28% with 1.90 cover.

- Germany sold E3.1465bn of 2Y 0% 2020 Schatz at -0.58% with 1.88 cover.

- Spain sold E3.851bn of 12M t-bills at -0.323% with 2.05 cover and E600mn of 6M t-bills at -0.419% with 4.59 cover.

- US Bonds rally with bull curve steepening catching up to equities– 2Y off 2.5bps to 2.899%, 5Y off 2.7bps to 3.008%, 10Y off 1.8bps to 3.164%, 30Y off 1.3bps to 3.371%.

- Japan JGBs rally with risk-off focus, strong 30Y sale– 2Y off 0.1bps to -0.147%, 5Y flat at -0.093%, 10Y off 0.3bps to +0.104%, 30Y off 1bps to 0.863%. The MOF sold Y563bn of 30Y 0.9% JGBs at 0.874% with 3.99 cover up from 3.92% previously.

- Australian bonds rally with US, waiting for wage data next– 3Y off 1.5bps to 2.085%, 10Y off 1bps to 2.727%.

- China PBOC skips open market operations again, leaves liquidity neutral. Notable HIBOR CNH jumps to 1-month highs with 1M Hibor up 45bps to 4.407% and 3M up 24bps to 4.418%. China Development Bank sold 1Y bonds at 2.5908% today, while China Dalian sold 3Y at 3.51% and special 7Y at 3.88%. The local government bonds rallied on the weaker M2 data – 2Y flat at 2.85%, 5Y off 2bps to 3.25% and 10Y off 2.5bps to 3.45%.

Foreign Exchange: The US dollar index is off 0.1% to 97.44 after at 972.42-97.66 range – sold in Asia on trade talk hopes, bought back in Europe with Italy/UK doubts. In emerging markets – USD is mixed – EMEA: ZAR up 0.3% to 14.44, TRY off 0.45% to 5.49, RUB u 0.25% to 67.75; ASIA: TWD flat at 30.88, KRW flat at 1133, INR up 0.3% to 72.67.

- EUR: 1.1250 up 0.25%.Range 1.1217-1.1257 with focus on rates, ECB vs. FOMC talk and 1.1187 vs. 1.13.

- JPY: 114.00 up 0.15%.Range 113.58-114.15 with Abe and US/China trade comments driving – EUR/JPY 128.25 up 0.45%.

- GBP: 1.2925 up 0.55%.Range 1.2842-1.2925 with Brexit the only focus still – jobs ignored – EUR/GBP .8705 off 0.25%.

- AUD: .7200 up 0.35%.Range .7164-.7218 with China trade hopes driving but data ahead matters and .7220-50 resistance. NZD up 0.55% to .6750 with RBNZ and China driving.

- CAD: 1.3240 off 0.1%.Range 1.3215-1.3257 with oil and with BOC focus – little to prevent 1.34 again.

- CHF: 1.0095 off 0.1%.Range 1.0094-1.0128 with EUR/CHF 1.1360 up 0.2%. Focus is on Italy but EUR drives show 1.02 key for $.

- CNY: 6.9570 off 0.1%. Range 6.9467-.69739 even with weaker fixing 6.9629 off 0.22% from 6.9476, CNY gains vs. USD on trade talk hopes, tighter HIBOR rates.

Commodities: Oil lower, Gold lower, Copper up 0.85% to $2.7735.

- Oil: $58.59 off 2.25%.Range $58.24-$59.35 with focus on $58 and $56 next – new lows for 2018. Brent off 2% to $68.71 with $68 key support – Trump vs. Saudi vs. OPEC splintering vs. US inventories and global demand all driving.

- Gold: $1199 off 0.15%.Range $1198-$1205 – breaking down with $1190 and $1182 next in play with USD bid holding, equity mood stable enough. Silver up 0.2% to $14.02 with $13.90-$14.20 next consolidation hope. Platinum up 0.5% to $844.70 and Palladium up 0.7% to $1105.50.

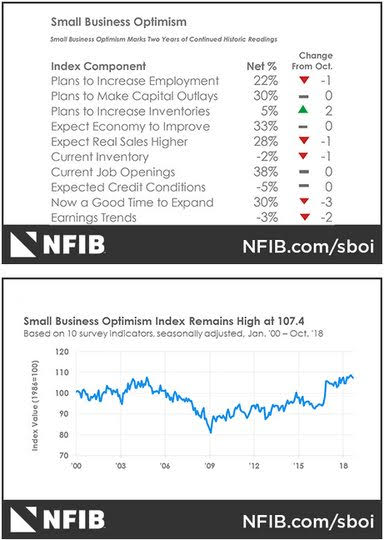

Conclusions: Does the US NFIB optimism matter today? The dearth of economic data yesterday and today in the US maybe part of the problem for fixing the US risk-mood. Fear about politics was a key focus in October and this report makes clear it’s the economy that really matters. The one release today of NFIB small business optimism was slightly less than expected at 107.4 after 107.90– missing the 108 forecast consensus – but still very much above the long-term average and signaling ongoing growth. Seasonally adjusted, 30 percent of owners think the current period is a good time to expand substantially, citing the economy (72 percent) and strong sales (14 percent). Nine percent of those who believe it is a good time to expand cited the political climate with 17 percent who believe it is a “bad time” to expand blaming politics. Although politics matter, the index indicates that economic factors, good or bad, are the main drivers of expansion decisions.

Economic Calendar:

- 1130 am US 1M, 3M, 6M bill sales

- 0200 pm US Oct budget statement $119bn p -$980bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.