Markets: Reactions

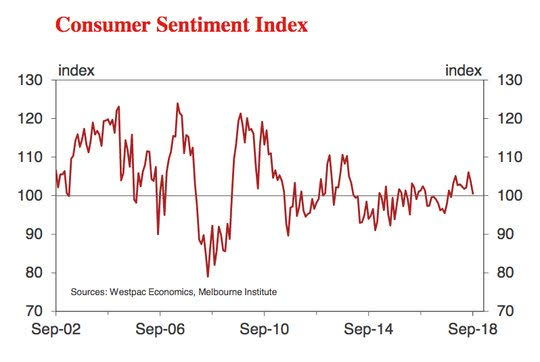

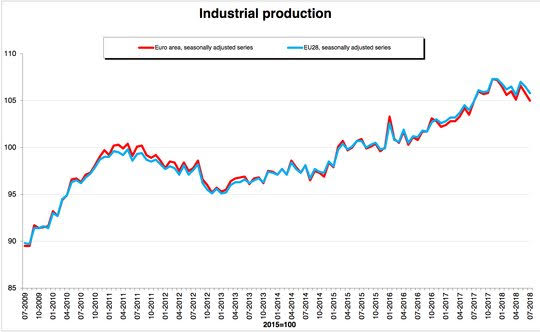

If yesterday was about Brazil election risks and China reaction to US tariffs, then today is also one about reactions just to different headlines. Economic news overnight was light and dark – Australian consumer confidence fell sharply due to mortgage hikes and politics, Korea unemployment jumps to 4.2% with KRW grazing near 1130, China M2 and loans are lower highlighting issues of easing needs to spark growth – with the PBOC adding liquidity for the first time in 3 weeks today. European and Italian July industrial production missed expectations and highlight the divergent growth paths in Europe vs. the US. On the positive side, hopes for a US/Canada trade deal rose and Brexit deal hopes remain buoyant – lifting GBP again. Also, two big storms move to hit the world – one to Hong Kong and the other to the US east coast – and energy prices bounce accordingly. In bonds, safe-havens are back in vogue except in Italy. Deputy PM Di Maio was quoted by Ansa saying that the government could face a 'serious problem' if it does not introduce a citizens' income in the next budget this unwound with the usual denials and ongoing focus on ECB tomorrow. The reaction function of markets to headlines has been modest but the driver as the sense of what is news is more about policy reaction processes from central bankers and politicians. The ECB and BOE hang heavily over the market as the key question for investors is about whether they are able to follow the FOMC down the path to “normalization.” The risk of a global liquidity traps remain linked to doubts that the Fed can hike gradually without a recession or an inflation spike and that the ECB and BOE are in the same trap. Inflation fears are more in the emerging market world than in developed ones and the reaction function of central bankers to EM pain seems to be the main focus since August. The bear market of shares in EM is notable and continues to dominate. Hong Kong moved into a bear market today. The MSCI Asia Pacific trades at 16-month lows and the MSCI EM at 14-month lows. Pain in EM remains notable with US divergence notable still. The focus in macro and the sense of policy reactions being key shows up most in the GBP/USD rate today where 1.26 seems less likely than 1.35 again should the BOE sound positive like the Brexit talks.

Question for the Day: Is US divergence about growth at home or trouble abroad? The value proposition of buying US assets seems less obvious given levels of equities and bonds. The size of the US current account hit with government budget deficits and trade deficits casts doubt on the sustainability of the USD up trend and on the US inflows of capital over time. Many want to see this linked to the mid-terms and the Trump deal-making on trade with Canada then Europe and then China. Fear that the US is near the end of its growth cycle pervade the argument.

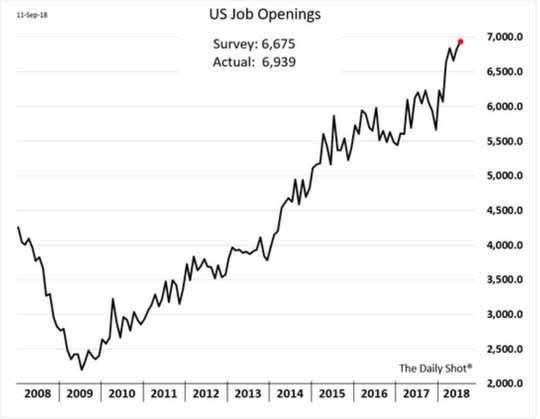

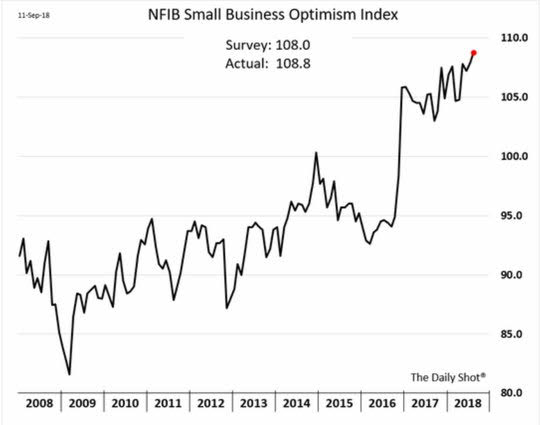

Against that, we have ever more data highlighting the upside of growth and inflation risks in the US. The CPI/PPI combination matter in the data ahead. FOMC policy reactions will be watched closely. The JOLTS and NFIB releases yesterday are evidence of this point.

The rest of the world seems less clear. While the German ZEW improved slightly yesterday, the EU and Italian industrial production pain today offset this. There is no obvious growth and consumer confidence outside the US. Perhaps Japan is the exception – and that makes the USD/JPY more interesting with risk of 110 higher accordingly.

What Happened?

- Australia September Westpac Consumer Confidence -3% m/m to 100.5 from 103.6 – weaker than 101 expected – weakest since Nov 2017. Views on unemployment improved, but “interest rates” dominated with house price expectations weaker to Dec 2015 lows. Politics also were a factor cited.

- China August M2 up 8.2% y/y after 8.5% y/y – weaker than 8.5% y/y expected. The CNY new loans rose 1.28trn after 1.45trn – slightly less than the 1.35trn expected. The Total Social Finance rose 1.52trn after 1.04trn – more than 1.3trn expected. The CNY loans outstanding held up 13.2% y/y same as July. Deposits slowed to 8.3% y/y from 8.5% y/y.

- Spanish August final unrevised at HICP 0.1% m/m, 2.2% y/y after 2.3% y/y – as expected. The National CPI rose 0.1% m/m, 2.2% y/y after 2.2% y/y while the core was up 0.1% m/m, 0.8% y/y after 0.9% y/y.

- Italian July Industrial Output -1.8% m/m, -1.3% y/y after +0.5% m/m, 1.7% y/y – weaker than the -0.4% m/m, 1.5% y/y expected. The capital, intermediate and consumer sectors all fell along with energy production. Capital goods fell 2.2% m/m driving the headline. The May-July fell 0.2% compared to Feb-Mar 2018.

- Eurozone July Industrial Production -0.8% m/m, -0.1% y/y after -0.8% m/m, 2.3% y/y – weaker than the -0.5% m/m, 1.1% y/y expected. The July output now -0.8% q/q after -0.2% q/q in 2Q. The 3M average 0% after -0.1% in June.

Market Recap:

Equities: The US S&P500 futures are flat after a 0.37% gain yesterday. The Stoxx Europe 600 is up 0.2% with energy and miners leading. The MSCI Asia Pacific fell 0.4% - off for the 10th day in a row.

- Japan Nikkei off 0.27% to 22,604.61

- Korea Kospi off 0.01% to 2,282.92

- Hong Kong Hang Seng off 0.29% to 26,345.04

- China Shanghai Composite off 0.33% to 2,656.11

- Australia ASX off 0.06% to 6,283.90

- India NSE50 up 0.58% to 11,353.25

- UK FTSE so far off 0.3% to 7,253

- German DAX so far up 0.2% to 11,996

- French CAC40 so far up 0.45% to 5,307

- Italian FTSE so far up 0.05% to 20,863

Fixed Income: UK Gilts are up slightly in a negative equity backdrop – 2Y off 0.5bps to 0.79%, 10Y off 2bps to 1.48%. Focus remains on data and UK BOE next. For Europe – bonds remain bid as well despite the ECB tomorrow. German Bunds 2Y yields off 0.5bps to -0.54% and 10Y off 2bps to 0.41% but 30Y flat at 1.105% - reflecting supply. Italy opened lower, reeling from the Ansa report, but recovers all morning. The 2Y yields were up almost 20bps to 0.83% but now 10Y off 3bps to 2.92%, Portugal also hit today on supply early, now off 3bps to 1.87%, Spain off 1bps to 1.46%.

- Germany DFA sold E0.768bn of 30Y 1.25% Aug 2048 BUXL at 1.1% with 1.5 cover – previously 1.02% with 1.4 cover.

- Italy sold E6bn of 12-month BOT at 0.436% at 1.91 cover – previously 0.679% and 1.79 cover.

- US Bonds are lower with risk mood mixed, supply vs. Asia jitters – 10Y off 1bps to 2.965%.

- Japan JGBs bid up with eye on Asia trade fears, EM pain – 10Y off 1bps to 0.105%.

- Australian bonds sold in sympathy with US – 10Y up 1bps to 2.59%.

- China PBOC injects CNY60bn on the day – first operation in 3-weeks. The PBOC noted the 7-day reverse repo was done to help keep liquidity ample to counter tax payments and bond issuance. The 7-day rate fell 1bps to 2.659% and O/N fell 3bps to 2.544%. 10Y bond yields fell 0.5bps to 3.67%.

Foreign Exchange: The US dollar index flat at 95.10. In Asia EM FX USD mixed: KRW off 0.3% to 1128.30 with 1130 next key. INR up 0.9% to 71.98 with 72.50 capping. In EMEA mixed as well: TRY up 0.6% at 6.3925, RUB flat at 69.394, ZAR 15.074 off 0.15%.

- EUR: 1.1595 flat. EUR stuck in range with 1.1550-1.1680 consolidation until ECB with Brexit and Italy issues drivers until then.

- JPY: 111.45 off 0.15%. EUR/JPY 129.25 off 0.2%. The hit to equities driving in Asia with 110.70 vs. 111.80 key.

- GBP: 1.3030 up 0.1%. EUR/GBP .8895 off 0.15% - all about Brexit comments with BOE next 1.30 base for 1.3250 next.

- AUD: .7120 flat. Metals up helping, relative calm – NZD also flat at .6525.

- CAD: 1.3055 flat. Waiting for NAFTA deal and ignoring weaker data – risk is 1.30 holds and 1.32 again.

- CHF: .9730 flat. EUR/CHF 1.1255 off 0.1% - Italy back in play. EM still an issue. 0.96-0.98 consolidation.

- CNY: 6.8546 fixed 0.2% weaker from 6.8488.Now up 0.1% to 6.8660.

Commodities: Oil up, Gold up, Copper up 1.2% to $2.6860.

- Oil: $69.65 up 0.6%. Range $69.50-$70.14. Brent $78.95 off 0.1%. Oil up on storm watch in the US but moderating into EIA today with $79.50 resistance in Brent and $70 in WTI.

- Gold: $1196.50 off 0.1%. Range $1192-$1197. USD going nowhere while EM jitters remain. Silver up 0.3% to $14.17 with $14.06-$14.18 range.

Economic Calendar:

- 0830 am US August PPI (m/m) 0.0%p 0.2%e (y/y) 3.3%p 3.2%e / core 2.7%p 2.8%e

- 0930 am St.Louis Fed Bullard speech

- 1030 am US weekly EIA crude oil inventory change -4.302mb p -1.3mb e

- 1200 pm US WASDE report

- 1245 pm Fed Gov Brainard speech

- 0100 pm US Treasury sells 10-year notes

- 0200 pm US Fed Beige Book

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.