Markets React On White House News

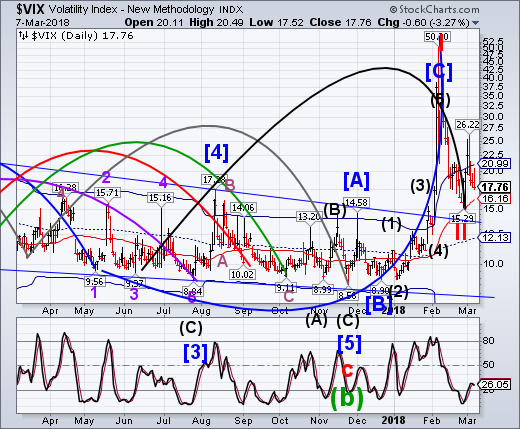

VIX made a 79.6% retracement of its rally from its Master Cycle low.The next rally may take out Cycle Top resistance at 20.99, giving the VIX a probable buy signal.The Cycles Model now indicates that the rally may continue for up to two more weeks.

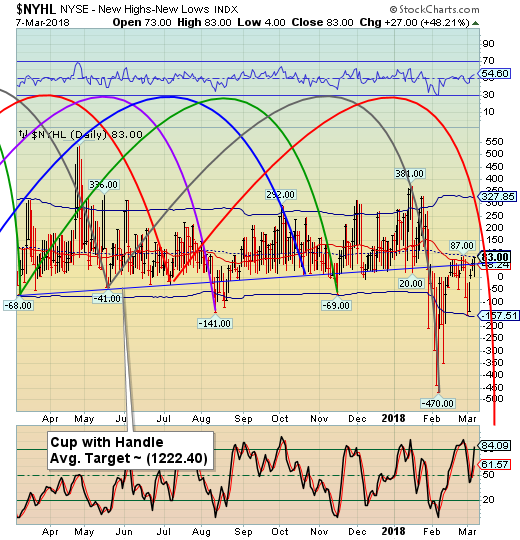

The NYSE Hi-Lo Index closed just beneath its mid-Cycle resistance today at 85.17.A close beneath the trendline at 50 gives the Hi-Lo a sell signal while a new low (below -154.00) confirms it.

(OfTwoMinds)The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses.

The conventional wisdom of financial advisors--to save money and invest it in stocks and bonds "for the long haul"--a "buy and hold" strategy that has functioned as the default setting of financial planning for the past 60 years--may well be disastrously wrong for the next decade.

This "buy and hold" strategy is based on a very large and unspoken assumption: that every asset bubble that pops will be replaced by an even bigger (and therefore more profitable) bubble if we just wait a few years.

SPX challenged the lower trendline of the Broadening Wedge formation, then rallied toward the 50-day Moving Average. Today it closed beneath the 50-day Moving Average where it has spent two days in a consolidation.The SPX remains on a confirmed sell signal.Fractal analysis and the Broadening Wedge formation both suggest proposed targets beneath Cycle Bottom support at 2336.55.However, crossing the blue trendline at 2675.00 implies a larger decline to 1800.00 is possible.

(USNews)"What does it mean for trade?" That question continued to guide Wall Street Wednesday, leading stocks to a mixed finish after President Donald Trump's top economic adviser resigned after opposing the administration's planned tariffs on imports of steel and aluminum.

Stocks fell in the morning as investors reacted to the departure of Gary Cohn, a former Goldman Sachs executive who was seen as a proponent of free trade. The losses deepened after Trump suggested on Twitter that the U.S. may impose penalties on China as part of intellectual property disputes. The Dow Jones industrial average fell as much as 349 points.

NDX rallied within 35 points of its Cycle Top this afternoon. While not yet on a sell signal, the lower highs suggest a probable turn down is likely.A decline beneath Intermediate-term support at 6791.54 and the nearby trendline at 6775.00 may trigger a sell signal.Note that two different chart patterns may share the same trendline.

(Bloomberg)The U.S. tech heavyweights, for months seen as an indestructible monolith that doesn’t go anywhere but to the sky, are starting to show some cracks in the foundation.

Case in point: this year’s performance of the FAANG group of Facebook Inc., Amazon.com Inc., Apple Inc., Netflix Inc. and Google parent Alphabet Inc.

As a whole, the group is still outperforming the market. But upon closer inspection, there’s a performance gap between the index’s winners and losers not seen since 2015.

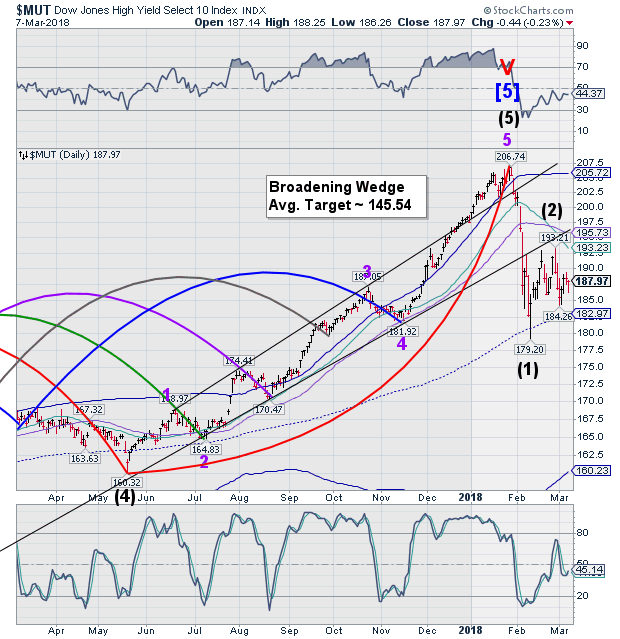

The High Yield Bond Index appears to have lost its upward momentum as it made a lower low this week. \A decline beneath mid-Cycle support at 182.97 may result in a panic, since there is no visible technical support down to the Cycle Bottom at 160.23.

(CNBC) Several interesting themes have emerged from the bond market recently, most notably in high-yield bonds.

One high-yield corporate bond exchange-traded fund, the HYG, has made some concerning bearish moves lately. Of course, the direction of the high-yield market is much more connected with the stock market than that of investment-grade corporate bonds, so this recent action is of concern to me.

Specifically, I'm watching the high-yield market's substantial underperformance relative to stocks since last summer.

UST may be running out of time to complete its bounce from its Trading Cycle low on February 21.The bounce has tested Cycle Bottom resistance and was repelled.There may only be a few days left to complete this retracement, if a further rally is on deck.Otherwise, the Cycles Model suggests the waterfall decline may resume through late March once the bounce is complete.

- CNBC)U.S. government debt yields rose slightly Wednesday after the White House suggested that Canada and Mexico could be exempt from tariffs on steel and aluminum.

The yield on the benchmark 10-year Treasury note was lower at around 2.888 percent at 3:48 p.m. ET, while the yield on the 30-year Treasury bond was slightly higher at 3.156 percent. Bond yields move inversely to prices.

Yields ticked upward late Wednesday afternoon after White House Press Secretary Sarah Sanders said that the U.S. may exempt Canada and Mexico from tariffs on imported steel and aluminum.

Questioned about whether the Trump administration would consider exemptions from tariffs, Press Sec. Sanders left the possibility open.

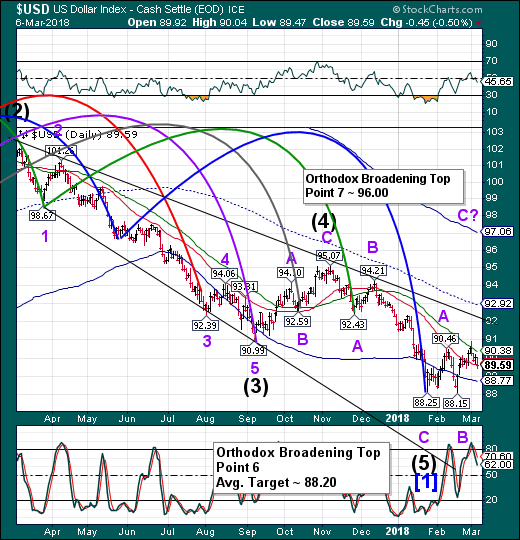

The U.S. Dollar pulled back to Intermediate-term support at 89.62 today.The Cycles Model indicates a probable move to the opposite side of the trading channel to point 7 of the Orthodox Broadening Top formation shown in the weekly chart, unless a crisis occurs.The next probable resistance point may be the trendline directly overhead.

(Reuters) - The U.S. dollar’s nosedive over the last year - only exacerbated by the recent threat of trade wars - is rekindling concerns that the greenback’s standing as the premier global reserve currency is at risk, but data compiled by Reuters suggests such fears are overblown.

Moreover, any real threat to its pre-eminent position would take years to materialize given its commanding share of global reserves and a relative paucity of alternatives.

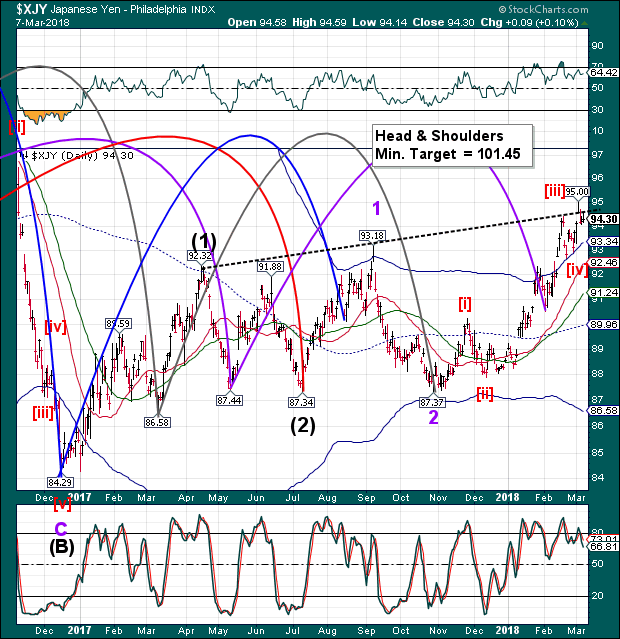

The Yen challenged the inverted Head & Shoulders neckline, but pulled back beneath it.The Cycles Model suggests a probable breakthrough in the next few days.Should the Yen exceed the proposed Head & Shoulders neckline at 94.41, the Yen may extend beyond 100.00.

(MarketPulse)he Japanese yen has edged lower in the Monday session. In North American trade, USD/JPY is trading at 105.96, up 0.20% on the day. On the release front, the sole Japanese event is the 30-year bond yield. In the US, the ISM Non-Manufacturing PMI slowed to 59.5, but managed to beat the estimate of 58.9 points.

It was a good week for the Japanese yen, which improved 1.3%. The currency received a boost on Friday after Bank of Japan Governor Haruhiko Kuroda said that the BoJ would consider exiting from its ultra-accommodative monetary policy if its inflation target of around 2020 was reached in early 2020. Kuroda’s remarks were unusual in that they mentioned a possible “exit” from its stimulus program, and this caught the markets off guard.

The Nikkei made a new low on Monday, then bounced to retest the mid-Cycle resistance.It has fallen back beneath it today.The Cycles Model suggests weakness through mid-March.If so, it suggests Nikkei Index may be set up for a crash starting this week.

(JapanTimes)Stocks turned lower on the Tokyo Stock Exchange on Wednesday, pressured by the yen’s rise against the dollar.

The 225-issue Nikkei average fell 165.04 points, or 0.77 percent, to end at 21,252.72, after surging 375.67 points on Tuesday.

The Topix index of all first-section issues closed down 12.34 points, or 0.72 percent, at 1,703.96. It gained 21.51 points the previous day.

The Tokyo market opened weaker, with investor sentiment battered by the yen’s strengthening against the dollar, brokers said.

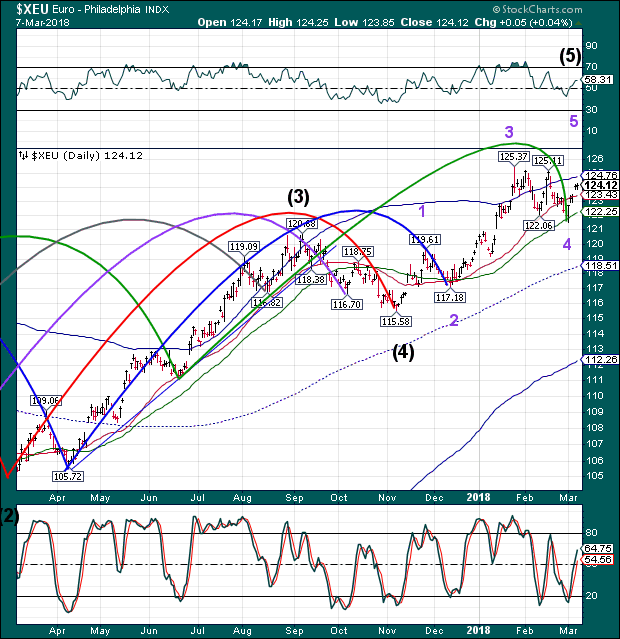

The Euro bounced off its 50-day Moving Average, negating any sell signal.Crossing above the Cycle Top resistance at 124.76 may reinstate the buy signal.Having established its Master Cycle low on March 1 implies another two weeks of rally.

(Reuters) - The euro edged higher on Monday after a short-lived sell-off tied to Italy’s inconclusive weekend election, helped by the creation of a coalition government in Germany that eased political uncertainty there.

The dollar rose versus the yen as traders reduced their safe-haven holdings of the Japanese currency on easing fears about a trade war stemming from U.S. President Donald Trump’s tariffs on imported steel and aluminum proposed last Thursday.

Italy’s election, which pointed to prolonged political jitters after right-wing and eurosceptic parties did better than expected, was somewhat balanced by Germany’s Social Democrats agreeing to join with Chancellor Angela Merkel’s conservatives, ending a period of uncertainty in Europe’s biggest economy.

EuroStoxx 50 Index tested its low on Monday, then bounced.The period of strength appears to have been extinguished and weakness may resume through mid-March.European stocks may be starting a panic phase in its decline this week.

(CNBC)European stocks closed provisionally slightly higher Wednesday, as the resignation of President Donald Trump's economic advisor and the European Union's threat of tariffs on U.S. The pan-European Stoxx 600 closed provisionally 0.36 percent higher Wednesday, with most sectors and major bourses in positive territory.

Europe's auto stocks were among the best performers, up 0.6 percent. Renault shot up by 8 percent after Reuters reported that it was in talks with Nissan to sell most of the French government's stake in the car-maker to its Japanese alliance partner. The stock later pared those gains as traders pointed to a denial of the plans by the Renault-Nissan-Mitsubishi alliance. The auto sector was rattled recently after Trump threatened a levy on imports of European cars.

Gold attempted a challenge of Intermediate-term resistance, but closed beneath it, confirming the sell signal. A break of the 50-day Moving Average implies a continued decline through the Broadening Wedge formation and possibly new lows.

(CNBC)Gold prices slipped on Wednesday on profit taking after hitting a one-week high earlier on news that a top economic advisor to the Trump administration had resigned, stoking fears of a trade war and knocking down the dollar.

Market watchers said the departure of economic adviser Gary Cohn, a former Wall Street banker, would embolden protectionist forces in the U.S. administration as U.S. President Donald Trump tries to impose hefty tariffs on steel and aluminum.

The dollar hovered near a 14-month low against the yen, while global equities fell. Equities fell, extending Tuesday's falls, which followed the Cohn resignation

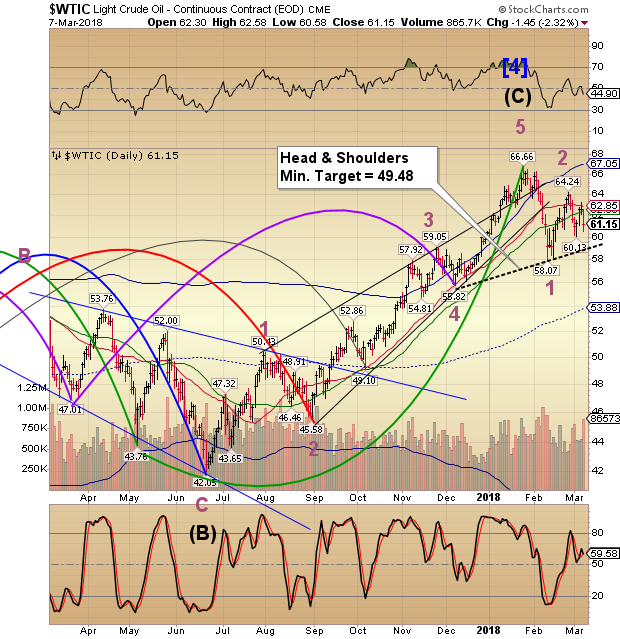

West Texas Intermediate attempted another rally late last week, but failed at the Intermediate-term resistance.It closed today beneath the 50-day Moving Average at 62.50, reconfirming the sell signal.The Cycles Model suggests the decline may resume through the end of March.

(NASDAQ)Risky assets like commodities that benefit from free-trade and global demand have seem ed to hit a wall lately. While selling has not taken over like many feared in early February, a month later, buying doesn't appear to have taken over either. Oil is a good example.

WTI held up before a wave of risk-off selling hit all markets from fixed-income to stocks and even cryptocurrencies with Bitcoin falling back below $10,000. The Inventory data showed the 11 th straight decline in Cushing, OK inventory with gasoline inventories also falling.

The Crude Oil Inventory build was not to concerning as it was below expectations at 2m barrels. While production is on the rise, so is demand as evidenced by the inventory drawdowns of Oil products.

The Shanghai Index mayhave begun its decline late last week, but bounced this week.The test of the id-Cycle resistance at 3317.10 appears complete and a new decline underway.The Shanghai is also due for a panic decline which may have begun today.The Cycles Model suggests a break of the neckline and Master Cycle low in the next 1-2 weeks.

(ZeroHedge)Having reached a record high trade deficit with China this morning, President Trump turned his attention from "global" tariffs to China. China trade deficit (in red) below... In his latest tweet, Trump explained that:

"China has been asked to develop a plan for the year of a One Billion Dollar reduction in their massive Trade Deficit with the United States. "

Which judging from the chart above is a drop in the ocean. But then Trump turned a little more diplomatic:"Our relationship with China has been a very good one, and we look forward to seeing what ideas they come back with. We must act soon!"

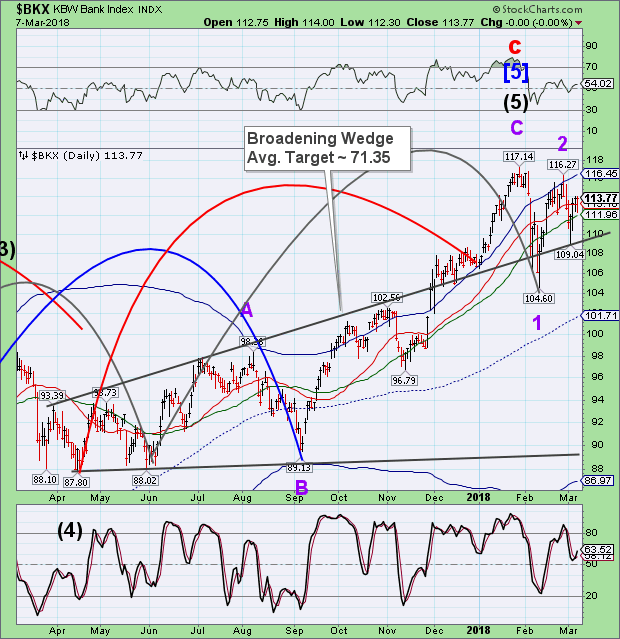

The BKX bounced off the upper Broadening Wedge trendline on Friday, closing above Intermediate-term support/resistance today. Gravity may take over the index again as weakness may take over for the next week or two.A decline back beneath the 50-day Moving Average at 111.96 puts the Banking Index on a sell signal that may be confirmed beneath the Broadening Wedge trendline at 109.00.

(BBC)The US Senate is poised to loosen banking rules instituted in the wake of the 2007-2009 financial crisis, marking a key turning point in the long-running debate over the regulations.

The proposal would reduce the number of firms subject to strict oversight.

Supporters, who include Democrats and Republicans, say the plan will offer relief to smaller, community banks burdened by high compliance costs.

Critics say measures go much further, relaxing rules on major institutions.

The Senate began its debate on Wednesday and is expected to approve the measure in a vote as soon as this week, sending the bill to the House. The House has already shown its appetite for change, passing a far more radical rollback last year.

(TheIntercept)THE CONGRESSIONAL BUDGET Office confirmed on Monday that bank lobbyists had successfully altered language of the so-called Citigroup carve-out, potentially allowing mega-banks Citi and JPMorgan Chase to add leverage and put more debt-fueled risk on their balance sheets. CBO gave Citi and JPMorgan a 50 percent chance of convincing regulators to let them take the carve-out, and their lobbyists are still working to increase that probability to 100 percent.

Factoring in the reality that the major banks will be lobbying regulators in the Trump administration could plausibly increase the likelihood of their success.

(CNNMoney)America could soon have a mega-competitor to its biggest banks: Amazon.

Amazon (AMZN) could wind up with more than 70 million banking customers over the next five years if it started to offer checking and other financial products, according to a recent report from management consulting giant Bain & Co.

To put that in context, that's about the same number of customers that Wells Fargo (WFC)currently has.

(ZeroHedge)AS dozens of corporations have bowed to corporate pressure and severed their relationship with the NRA, Bloombergreports Wednesday that none other than Wells Fargo is the biggest financial institution lending money to the country's two largest gun manufacturers.

Not only that, but Wells Fargo also has a long relationship with the National Rifle Association, inherited from banks that Wells took over. The San Francisco-based Wells Fargo created a $28 million line of credit for the NRA and operates the primary accounts for the pro-Second Amendment group, financial documents show.

(ZeroHedge)After a massive surge in consumer credit in the last three months of 2017, when October thru December saw a massive increase in revolving and non-revolving credit, amounting to a total $73 billion, the Fed reported that 2018 started off with a whimper, with a modest $701 million increase in credit card debt, coupled with a $13.2 billion increase in non-revolving, or auto and student loan, credit in the first month of the year.

Revolving credit was the clear outlier, with the monthly increase of $0.7BN far below December's $6.1BN and last January's $934 million, and the smallest increase since February 2015 (excluding the December 2015 series revision). Still, the increase pushed the latest revolving credit total to $1.0298 trillion, a new all time high.

Disclaimer:

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a ...

more