Markets: Overpaid

Obsession with Brexit continues to dominate news and trading in Europe while the US/China trade talks continue but hopes for a bigger fix by G20 meeting seems unrealistic and as FOMC Powell’s speech continues to guide rates hike expectations into 2019 – all of which puts the risk-mood as mixed rather than bouncing. There is a sense that volatility in all things has been overpaid and that we are grinding into the last bits of 2018 with a more balanced view apart from the UK uncertainty. If it wasn’t for Brexit, the story would be mostly upbeat today as Asia and EM equities bounced back. Better China house prices, better Australian jobs, and after surprise hikes from Indonesia’s central bank and the Philippine’s as they battle back on FX devaluations – all that put the rest of EM on a solid foot with TRY and ZAR leading gains so far today. However, back in developing markets, dissecting the worst case outcomes for GBP seems to be the only thing to do – with 1.2550 the first line, then 1.20 for the bears while bulls have to get over 1.38 to be relevant. UK Prime Minister May loses 2 cabinet members (her Brexit Minister Raab being the headline) and now faces the leadership challenge threat from her own party. Her job was to negotiate at deal with the EU and then manage it through parliament. Was she overpaid for the task? Few will be able to answer this or the effect on GBP until we see the reaction of Labor, the backbench Tories and the alternatives of no deal, her deal or something surprisingly different like another referendum as it tries to forge a path forward.

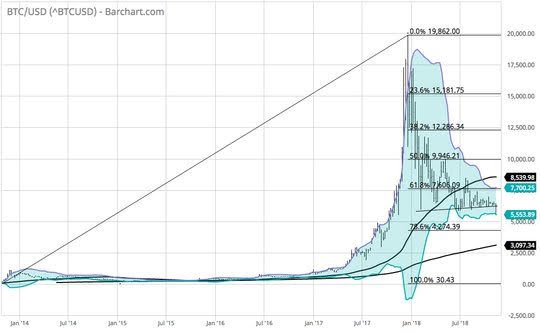

Question for the Day: Does a thaw in US/China trade means lower BTC, higher EM? The drop in BTC over 10% below the $6000 line drove many of the naysayers of crypto into overdrive as the alternative money drops to new yearly lows with technicians calling for $4500 next. The connection of better trade talks with China, ie less demand to get money out via BTC, maybe part of the story, while the Bitcoin Cash hard fork today is given most of the blame. Software has to be developed for new mining at the expense of the old BTC. The other side of the story today has been that China reactions to its slowdown – from stocks to consumer demand has been working well-enough and with a whiff of hope on better US trade risks, Emerging Markets find value buyers. Markets are looking for more risk today if it wasn’t for the UK.

The BTC drop, EM bounce and better China hopes are not uncorrelated and the chart of BTC suggests that we maybe still in the bear correction form its $20,000 nosebleed with $4275 support next against bounces to $6200. Alternatives to fiat matter in a world riddled with fear. Less fear, higher real rates and more seasonal pushes for buying equities maybe in play here.

What Happened?

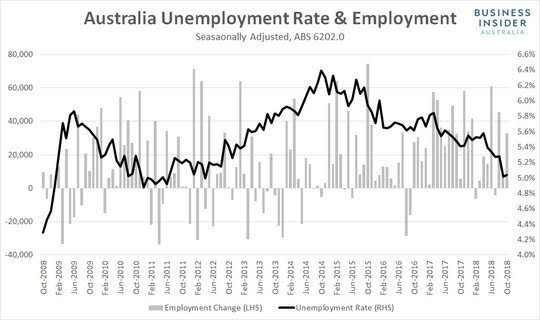

- Australia October jobs rose 32,400 after 7,800 – better than 20,000 expected. The unemployment rate held 5.0% better than the 5.1% expected. The participation rate rose to 65.6% from 65.4% - also more than 65.5% expected. Full-time jobs rose 42,300 while part-time fell 9,500.

- China October house prices rise 1% m/m, 8.6% y/y after 0.9% m/m, 7.9% y/y – more than the 8% y/y expected. In October, price gains in provincial capitals Guiyang, Shijiazhuang, and Wuhan were the biggest among the 70 cities surveyed by NBS. China’s 31 tier-2 cities - which include provincial capitals - saw an average price increase of 1.0 percent in October from a month earlier, slowing from the previous month even though more tier-2 cities posted gains than in September. China’s four biggest cities of Beijing, Shanghai, Shenzhen, and Guangzhou posted no change in their prices.

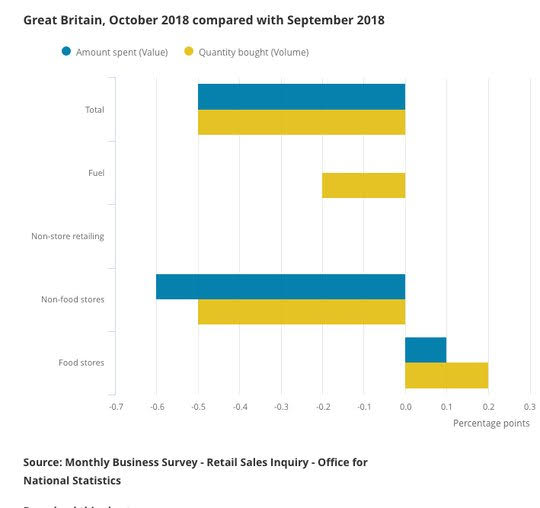

- UK October retail sales off 0.5% m/m, +2.2% y/y after -0.4%, 3.3% y/y – weaker than +0.2% m/m, +2.8% y/y expected. The ex-fuel sales were -0.4% m/m after -0.3% m/m – also weaker than expected. Online sales as a total of all retailing increased to 18.0% from the 17.7% reported in September 2018, with textile, clothing and footwear stores continuing a record proportion of online sales at 18.2%; this was despite a fall in total retail spending in this sector.

Market Recap:

Equities: The S&P500 futures are up 0.2% after losing 0.76% yesterday. The Stoxx Europe 600 is off 0.5% back to 2-week lows. The MSCI Asia Pacific rose 0.7% - biggest climb in a week. The MSCI EM rose 0.9% - best in a week.

- Japan Nikkei off 0.20% to 21,803.62

- Korea Kospi up 0.97% to 2,088.06

- Hong Kong Hang Seng up 1.75% to 26,103.34

- China Shanghai Composite up 1.36% to 2,668.17

- Australia ASX up 0.05% to 5,825.20

- India NSE50 up 0.38% to 10,616.70

- UK FTSE so far up 0.20% to 7,048

- German DAX so far up 0.10% to 11,420

- French CAC40 so far off 0.25% to 5,056

- Italian FTSE so far off 0.45% to 18,990

Fixed Income: All about Brexit and uncertainty – UK Gilts are up with 10Y yields off 9bps to 1.415%, German Buds are off 2.5ps to 0.37% and French OAT off 2bps to 0.76%. Periphery less focus with Italy off 1bps to 3.48%, Spain up 0.5bps to 1.62%, Portugal off 0.5bps to 1.955% and Greece up 4bps to 3.495%.

- US Bonds sold in Asia, bought in Europe, watching UK –2Y off 1.7bps to 2.85%, 5Y off 2bps to 2.936%, 10Y off 1.8bps to 3.107%, 30Y off 1.4bps to 3.353%.

- Japan JGBs rally further after decent 5Y sale, Nikkei pain. MOF sold Y2trn of 0.1% 5Y bonds at -0.087% with 3.89 cover but 0 tail. 2Y up 0.1bps to -0.147%, 5Y flat at -0.096%, 10Y flat at 0.099% and 30Y off 0.4bps to 0.853%.

- Australian bonds sold after strong jobs report, RBA 3Q 2019 hike half priced– also large corporate 3-5Y sale added to pressure. 3Y up 3bps to 2.102%, 10Y upf 1.5bps to 2.712%.

- China PBOC skips open market operations, leaves liquidity neutral. The 5Y bonds fell 1bps to 3.16%, 10Y fell 3bps to 3.39%.

Foreign Exchange: The US dollar index is up 0.35% to 97.14 with 96.76-97.38 range – with GBP key focus and driver. In EM, USD is soft – EMEA: ZAR up 1% to 14.245, TRY up 1.1% to 5.397, RBU up 0.85% to 66.505; ASIA: TWD up 0.25% to 30.85, KRW up 0.45% to 1129.2, INR up 0.45% to 71.98.

- EUR: 1.1315 flat. Range 1.1271-1.1351 with 1.12-1.14 the new envelope and focus is on UK with US rates sideshow.

- JPY: 113.45 off 0.15%.Range 113.30-113.68 with 112-114 back as consolidation – EUR/JPY 128.40 off 0.1% - focus is on equities, rates, US/China stories.

- GBP: 1.2830 off 1.25%.Range 1.2751-1.3030 with UK May politics of Brexit the driver -1.26-1.29 keys for now with volatility – EUR/GBP .8815 up 1.3% with 0.89 next.

- AUD: .7260 up 0.4%.Range .7229-.7298 with stronger jobs the RBA trigger and support .7220 base for .74 again. NZD .6805 up 0.1% - PM comments on trade factor.

- CAD: 1.3225 off 015%.Range 1.321-1.3249 with focus on commodities, crosses and 1.3180 base for 1.33 again.

- CHF: 1.0050 off 0.2%.Range 1.0039-1.0077 with EUR/CHF 1.1370 off 0.1% - focus is on UK then Italy.

- CNY: 6.9392 fixed 0.01% stronger from 6.9402, rises 0.2% to 6.9345 into London, trades 6.9380 up 0.15% now with 6.9296-6.9498 range.

Commodities: Oil mixed, Gold lower, Copper up 1.5% to $2.8170.

- Oil: $56.25 flat. Range $55.59-$56.49 with focus on EIA next after API reported a large 8.8mb crude inventory rise. Brent up 0.6% to $66.55 with focus on $65-$70 trading consolidation.

- Gold: $1209.30 off 0.15%.Range $1206-$1213 with focus on USD and $1200-$1215 consolidation. Silver off 0.14% to $14.12 with $13.90-$14.20 consolidation. Platinum off 0.3% to $833 and Palladium up 0.4% to $1133.

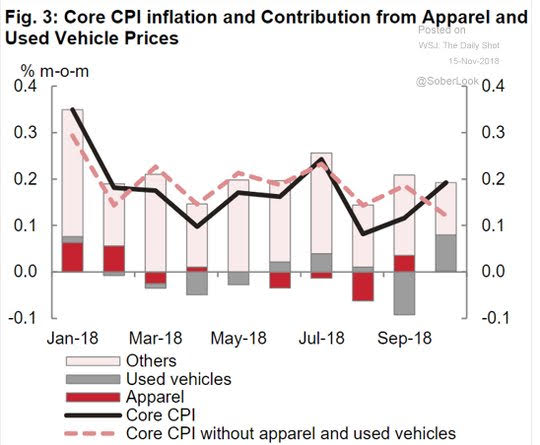

Conclusions: Was CPI benign enough? The FOMC Powell comments were taken as hawkish given his lack of concern about the October stock market weakness. The lack of reaction to financial conditions has put many on edge for more hikes in 2019 than a one and wait scenario. The CPI report maybe something that offered up a bit of hope yesterday but breaking out components is always a fun sport and one that Nomura did well yesterday with the used cars and new clothing story worth considering into the holidays ahead.

Economic Calendar:

- 0830 am US Nov NY Empire State manufacturing 21.1p 20e

- 0830 am US Oct retail sales (m/m) 0.1%p +0.5%e / ex-autos -0.1%p 0.5%e / control 0.5%p 0.3%e

- 0830 am US weekly jobless claims 214k p 215k e

- 0830 am US import prices (m/m) 0.5%p 0.1%e (y/y) 3.5%p / export (m/m) 0.0%p 0.1%e

- 0830 am US Nov Philly Fed Manufacturing 22.2p 21e

- 0830 am Canada Oct ADP employment change 28.8k p

- 1000 am US Sep business inventories 0.5% 0.3%

- 1030 am US weekly EIA crude oil stocks 5.78mb p 1.9mb e

- 0200 pm Mexico central bank rate decision – no change from 7.75% expected.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.