Markets: Not Enough

Sufficient and necessary conditions permeate all strategies for trading and today is no exception. The bounce back in US markets yesterday from the lows was a necessary condition to believing in the “buy-the-dip” function that has worked so well over the last 10 years of ZIRP and QE. Unfortunately, this is not enough to make the markets “bid” and keep them safe.

Bond markets in the US are reflecting this clearly as they continue to rally. So have the rest of the global safe-haven bonds – like Bunds and even French OATs. Rate hikes despite financial instability of late is the key worry and focus today with the Bank of Korea looking likely for a November move, KRW is better, Kospi is worse.

The Swedish Riksbank refrained from moving and talked about doing less so a December hike maybe a February one. SEK is weaker, and the OMX is flat. This leaves the Bank of Canada for the main entertainment on rates ahead – with the CAD off 0.1% - with almost everyone expecting 25bps hike but a dovish outlook – making it one and done. The pressure from Trump on the Fed Chair Powell continues though most see it as a mid-term election ploy while the Fed Beige Book today may paint a very different picture on inflation risks and need for more hikes. Overnight the focus beyond the equity tape and bond reactions was on PMI data, which clearly disappointed in Europe, UK May and her battle within her party (facing the 1922 committee over Brexit) grabs more headlines with GBP lower and Gilts bid, while the Italian budget issue continues with PM Conte saying there is no plan B, no budget change ahead for making it all good with the EU and yet BTPs are bid with ECB policy focus key. The dive in the EUR is the story in FX and it maybe something for the US markets as the USD bid combats better earnings and drives financial conditions. Watching 1.13 barrier for more trouble.

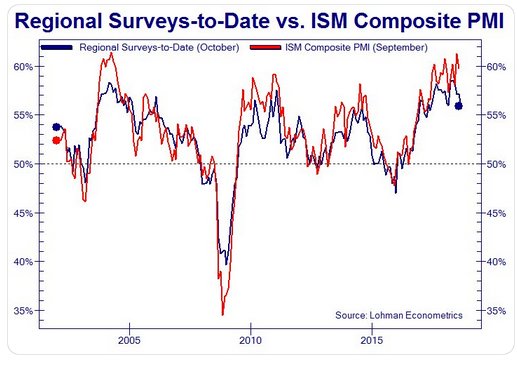

Question for the Day: Will US economic divergence drive markets again? The weakness in the European PMI reports puts the pressure on the US data to prove divergence. The GDP Friday for 3Q will be the pinnacle of this story but the risk-on mood that started in Asia faded quickly and the fear beating greed tape requires something “good” to reverse. Necessary conditions for another bounce in the US markets seem clear – 1) better US economic data, 2) less fear of FOMC overreactions – so speakers sound gradual rather than overshooting hikes, 3) better earnings, 4) less fears about China trade and geopolitical noise. All of these could happen but they may not be obvious at the open. So far the Fed Surveys for October suggest some weakness in the US data ahead.

What Happened?

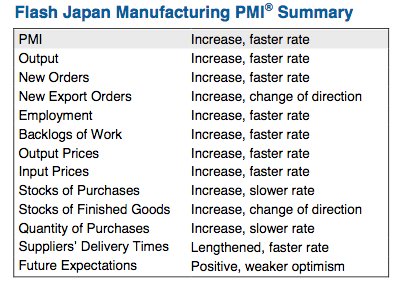

- Japan October flash Manufacturing PMI 53.1 from 52.5 – better than 52.1 expected. Rates in input and output price inflation rise to multi-year highs. Output, new orders and employment all accelerate.

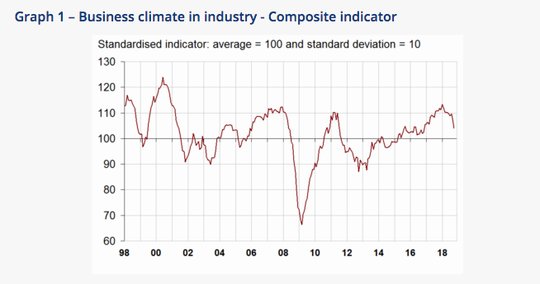

- French October business climate drops to 104 form 107 – weaker than 108 expected. The order books -12 from -5, exports worse to -6 from -4, workforce size expected shrinks to 0 from 2, production expectations general 7 from 8, but personal rise to 10 from 9.

- Sweden Riksbank keeps rates on hold- no change from -0.5% as expected. Economic activity in Sweden is strong and inflation is at the target of 2 per cent. Since the monetary policy decision in September, developments have for the most part been as expected and the forecasts remain largely unchanged. Consequently, in line with the previous forecast, the Executive Board has decided to hold the repo rate unchanged at -0.50 per cent. If the economy develops in a way that continues to support the prospects for inflation, the Executive Board assesses that it will soon be appropriate to start raising the repo rate at a slow pace. The forecast for the repo rate is the same as in September and indicates that the repo rate will be raised by 0.25 percentage points either in December or February.

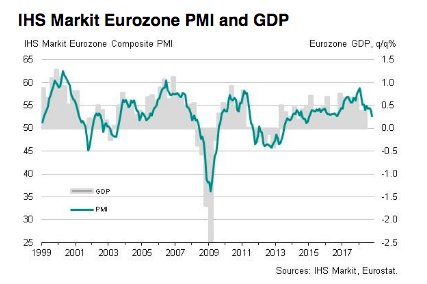

- Eurozone October flash Manufacturing PMI 52.1 from 53.2 – weaker than 53 expected – 26-month lows. The Manufacturing Output index fell to 51.2 from 52.7 – 46-month lows. The Services flash 53.3 from 54.7 – also weaker than 54.5 expected – 24-month lows. This puts the Composite flash at 52.7 from 54.1 – weaker than 53.9 expected – 25-month lows.

- French flash Manufacturing PMI 51.2 from 52.5 – weaker than 52.6 expected. Output slips to 48.8 from 50.3 – 27-month lows. Services 55.6 from 54.8 – better than 54.8 expected – 4-month highs. The Composite 54.3 from 54 – better than 53.8 expected.

- German flash Manufacturing PMI 52.3 from 53.7 – weaker than 53.4 expected– 29-month lows. Services flash 53.6 from 55.9 – weaker than 55.5 expected – 5-month lows. The Composite flash 52.7 from 55 – weaker than 54.8 expected – 41-month lows.

Market Recap:

Equities: The S&P500 futures are off 0.6% after losing 0.55% yesterday. The Stoxx Europe 600 is up 0.5% - first gain in a week – but Italy remains under pressure. The MSCI Asia Pacific Index fell 0.1% despite bounces in Japan and China – but remains on the edge of a bear market (-20%). The MSCI EM and all-country World indices were nearly flat.

- Japan Nikkei up 0.37% to 22,091.18

- Korea Kospi off 0.40% to 2,097.58

- Hong Kong Hang Seng off 0.38% to 25,249.78

- China Shanghai Composite up 0.33% to 2,603.30

- Australia ASX off 0.31% to 5,926.50

- India NSE50 up 0.77% to 10,224.75

- UK FTSE so far up 0.75% to 7,008

- German DAX so far up 0.35% to 11,316

- French CAC40 so far up 0.70% to 5,003

- Italian FTSE so far off 0.35% to 18,740

Fixed Income: The main driver for European bonds was the weaker PMI which puts some further focus on ECB Thursday. Periphery main winner – Italy 10Y BTP yields off 4.5bps to 3.54%, Spain off 4.5bps to 1.615%, Portugal off 5bps to 1.95% but Greece off just 1bps to 4.255%. The core is bid but barely – UK Gilt 10Y yields off 0.5bps to 1.46% while French OATs off 0.5bps to 0.775% and German Bunds off 0.25bps to 0.405%. The 5Y BOBL auction capped the rally being technically uncovered.

- Germany sold E2.425bn of 5Y 0% BOBL at -0.18% with 1 cover – target was E3bn sale – previously -0.04% with 1.55 cover. After Bundesbank holding cover 1.2 from 1.9 previously.

- US Bonds are bid with curve bull flattening, supply and Fed speak next– 2Y of 2.5bps to 2.87%, 5Y off 2.6bps to 2.985%, 10Y off 2.5bps to 3.143% and 30Y off 1.6bps to 3.352%.

- Japan JGBs rally with curve flattening– 2Y off 0.1bps to -0.125%, 5Y off 0.7bps to -0.074%, 10Y off 1.8bpsto 0.121% and 30Y off 2.4bps to 0.88%. BOJ leaves Rinban unchanged with offer to covers driving curve moves – Y450bn of 5-10Y with cover 1.70 from 2.73, Y180bn of 10-25Y with cover 3.24 from 3.50 and Y50bn of 25+Y with cover 3.17 from 3.52. 2Y sale tomorrow next focus.

- Australian bonds bid tracking risk moods, with solid auction helping– The 3Y off 0.8bps to 2.014%, 10Y off 1.9bps to 2.655%. The AOFM sold A$1bn of 12Y 2.5% may 2030 bonds TB155 at 2.719% with 4.035 cover – previously 2.7996% with 3.244 cover.

- China PBOC adds CNY150bn via 7-day reverse repos. The 7-day average repo fell 1.5bps to 2.594% while the O/N fell 6bps to 2.375%. 10Y bond yields fell 3bps to 3.54%.

Foreign Exchange: The US dollar index is up 0.4% to 96.37 with range 95.90-96.43 – more about EUR weakness than USD strength? In Emerging Markets the USD is mostly lower– EMEA: ZAR up 0.5% to 14.185, TRY up 0.5% to 5.71, RUB off 0.15% to 65.625 with Putin/oil key; ASIA: TWD up 0.1% to 30.94, KRW up 0.5% to 1132, INR up 0.55% to 73.15.

- EUR: 1.1400 off 0.6%.Range 1.1363-1.1421 – focus is on weaker PMI, less ECB expectations and 1.1320 lows retesting.

- JPY: 112.65 up 0.2%. Range 112.32-112.67 with tepid rally up on stocks – EUR/JPY 128.40 off 0.45% - dragged on EUR but with 125.50 risk.

- GBP: 1.2910 off 0.55%.Range 1.2900-1.2991 with EUR/GBP .8830 off 0.05% - focus is on Brexit but EUR is driving with 1.2850 pivotal for 1.2550 risk.

- AUD: .7095 up 0.1%.Range .7079-.7106 with China holding, copper up, crosses helping (AUD/JPY). The NZD .6445 off 0.1% with nothing new but PM headlines on support key.

- CAD: 1.3095 up 0.1%.Range 1.3070-1.3100 with BOC front and center and dovish hike priced – risk in oil and US rates with 1.3250 still in play.

- CHF: .9975 up 0.25%.Range .9942-.9976 with EUR/CHF 1.1370 off 0.4% with EUR driving and risk-off despite equities holding. Watching 1.1320 and 1.00 for resistance.

- CNY: 6.9357 fixed 0.03% weaker from 6.9338 yesterday. The CNY trades off to 6.9410 at London open from 6.9374 official close yesterday. Now 6.9420 off 0.1% with 6.9328-6.9453 range.

Commodities: Oil lower, Gold flat, Copper up 0.2% to $2.8155

- Oil: $66.38 off 0.1%.Range $66.05-$66.67. The break down yesterday was on Saudi promises to pump and then API reports over 9mb crude stocks but Asia bought the dip and eyes equities and the USD. The 200-day in WTI is $65.19 and that is key now with 55-day at $69.36 the resistance. Brent off 0.5% to $76.04 with focus on $75.20 the Sep 6 lows then 200-day $72.38 with resistance at $78 and $80.

- Gold: $1230.50 flat.Range $1229-$1234. Gold watching $1220 and $1202 (55-day) as base for $1266 July 9 highs. Silver up 0.15% to $14.76 with focus on $14.849 – Oct 16 highs – then $15 the Aug 28 highs with support at $14.50 and $14.454 Oct 18 lows. Platinum off 0.15% to $831.45 and Palladium off 0.5% to $1138.50

Economic Calendar:

- 0900 am US Aug FHA housing price index (m/m) 0.2%p

- 0945 am US Oct flash Manufacturing PMI 55.6p 55.4e / Service 53.5p 54e / Composite 53.9p 53.8e

- 1000 am US Sep new home sales (m/m) 3.5%p -0.8%e / 0.629mn p 0.625mn e

- 1000 am Bank of Canada rate decision – 25bps hike to 1.75% expected

- 1030 am US weekly EIA crude inventories 6.49mb p 1.9mb e

- 1115 am BOC press conference

- 1130 am St. Louis Fed Bullard speech

- 0100 pm US Treasury sells 5Y notes

- 0200 pm US Fed Beige Book

- 0200 pm Atlanta Fed Bostic speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.