Markets: No Weapons

The news from Asia overnight sets up today to continue the bounce back in risk mood. First, the Moon-Kim Korea summit produces another deal on denuclearization and peace. Second Chinese Premier Li vows not to use the CNY as a weapon in trade to boost exports and third, the BOJ stuck to its long-term promises of easy money. While this lifted Asia shares which continued the S&P500 bounce, the European session had two stories that mattered and stalled the rally – as Italy sees its BTP rally end on rumors that the 5-Star Leader pushed for more spending in budget – this was later denied but rates are higher in periphery. The second surprise came from the UK where CPI zoomed higher to 2.7% and that shifted up expectations for a BOE hike again.

The GBP has already squeezed, a bit like the EUR, and so the heavy lifting of markets pivots to fixed income today. The break out of US 10-year rates at 3.05% matters – with the Chinese selling of US treasuries as show from the TIC report yesterday evening one factor, but the budget deficit and better Emerging Markets the other two. Emerging Markets are bouncing today with TRY and ZAR both up over 1.5% driving capital flows as China seems to be winning the PR war on trade. No weapons in FX means that worries bleed elsewhere – with the correlation of FX to stocks in play in EM but not in developed markets as much. Focus today in the US will be on housing starts and the sensitivity of rates to growth.

Question for the Day: Does the 2-10Y rate move mean good news? The steeper US rate curve is notable in the last few days and yet the fear that US recessions will happen in late 2019 or early 2020 remain in play. The shift up in US rates has left many thinking that there is value in the front end finally with 2-5Y arbitrage in play as many see the FOMC doing 3-4 more hikes and then waiting. The risk of the FOMC doing too much rests on the data and inflation – with the tariff effects one worry and the labor market the other – so far neither have mattered. The lifting up of the curve in the US means something for other markets as well – correlation of USD to curve along with bank earnings are both likely to return to play. While many see the USD as vulnerable due to Chinese promises and the EM bounce back, there is more power in rates in attracting capital and in the growth implications for the curve move supporting equities.

What Happened?

- New Zealand 2Q Current Account Deficit NZ$9.5bn y/y at 3.3% of GDP after 2.6% in 2017 – worst since 2009– worse than 2.9% expected. The 2Q C/A was NZ$1.7bn q/q, marking a sharp reversal from a NZ$88 million surplus in Q1. But on a seasonally adjusted basis 2Q deficit was NZ$2.7bn after NZ$3.2bn in 1Q. This was despite a surplus in goods balance of NZ$192mn compared with a deficit of NZ$385mn in Q1. Trade in services recorded a surplus but this was significantly narrower than Q1. There was a deficit in primary income of NZ$2.5bn in Q2 compared with NZ$2.6bn in Q1.

- Japan August trade deficit Y444.6bn after Y231.9bn – near expectations of Y475bn. Exports rose 6.6% after 3.9% y/y – better than 5.6% expected – led by higher shipments of chip-making equipment, motor vehicles and ships. Imports rose 15.4% after 14.6% y/y - slightly more than the 14.9% expected – led by higher energy prices. Exports to the U.S. marked the first rise in three months while those to the European Union posted the 19th straight year-on-year increase. Exports to Asia and China showed the sixth straight y/y gains.

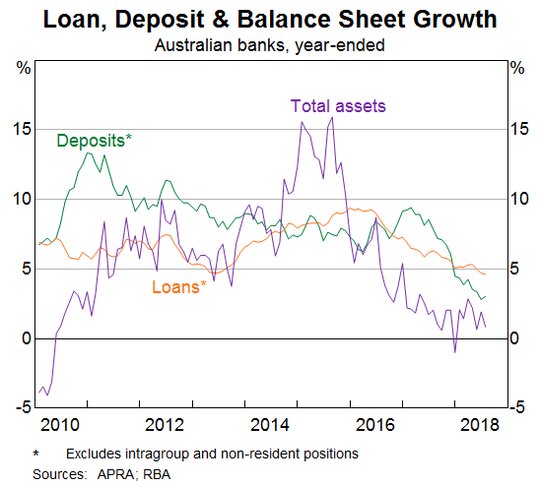

- RBA Kent: Slowing money growth little linked to short-term rates or deposits. Kent dismissed suggestions from some commentators that the sharp slowing in growth rate of money is one of the reasons for the rise in short-term money market rates in recent months. According to him, a gap between growth of deposits and credit has been commonplace over recent decades, and conditions in short-term money market were benign through much of those episodes. He also pointed to the fact that in recent quarters deposit growth has more than matched the growth in total assets on banks' balance sheets. Lastly, retail deposit rates haven't risen which would happen if banks really did have insufficient deposit funding.

- Australia August Westpac LEI 97.93 after 97.87.Deviation from 6M trend -0.2% after 0.5% as expected, but points to slightly slowing growth momentum in 2H2019 and start of 2019. This is at odds with RBA forecasts for above-trend growth. Westpac sees 2.5% GDP in 2H1028 and 2.7% in 2019.

- BOJ no change in policy target, rates to remain very low – as expected. The BOJ vote was 7-2 for continuing yield curve control framework and for vowing to keep rates low “for an extended period.” Reflationist board members Yutaka Harada, a former government economist, and Goushi Kataoka, a former private-sector economist, dissented again, following their objection to the July decision. Harada called the guideline for market operations "too ambiguous" while Kataoka continued to call for additional easing in the face of slow price gains and downside risks ahead. On forward guidance, Harada also dissented, arguing that it would be better to adopt one that would "further clarify its relationship" with the inflation target. Kataoka was also opposed. He repeated that it would be better to promise additional easing in the event of a downward revision to the board's longer-term inflation outlook. The BOJ will maintain the annual JGB purchases at around Y80bn, though the actual pace has declined, and the BOJ noted it will conduct the purchases in “a flexible manner.”

- BOJ Kuroda: No limit on central bank tools to fight financial crisis. He noted his concern on the long-term impact of recent natural disasters on Japan tourism. The BOJ Governor doesn’t see asset prices overheating now but continues to watch for it. He noted it was good to see regional banks housing loans slowing down. The BOJ continues to seek 2% inflation and doesn’t see a government gap on monetary easing side-effects.

- China Premier Li: Will keep CNY stable, won’t depreciate. China is "fully capable" of keeping yuan basically stable on a reasonable and balanced basis, and won't seek to boost exports through depreciating the currency, Premier Li Keqiang said at the Summer Davos in Tianjin. While noting global economic and trade conditions have changed, and there are anti-globalization backlash, Li said multilateralism is the solution and "inclusive" economic integration is gaining more strength. Growth in new drivers, such as consumption, has exceeded policymakers' expectations, even as changing trade conditions still present challenges, Li said without directly mentioning the trade spat with the US. China will create conditions for stable forex keep market-based reform and volatilities in yuan exchange rate not intended by the Chinese government, Li said. China will keep prudent monetary policy, stabilize leverage, keep reasonable liquidity, and stop the slide in infrastructure investment without repeating the old path of relying on investment, Li said.

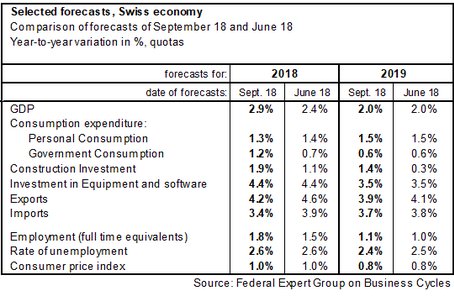

- Swiss SECO 3Q economic forecasts sees 2018 GDP at 2.9% from 2.4%, slowing to 2% in 2019. The favorable international economic development is stimulating foreign trade, and companies are investing heavily. The forecast for GDP growth in 2019 remains unchanged at robust 2.0%. However, the negative risks significantly outweigh the positives and threaten the global outlook.

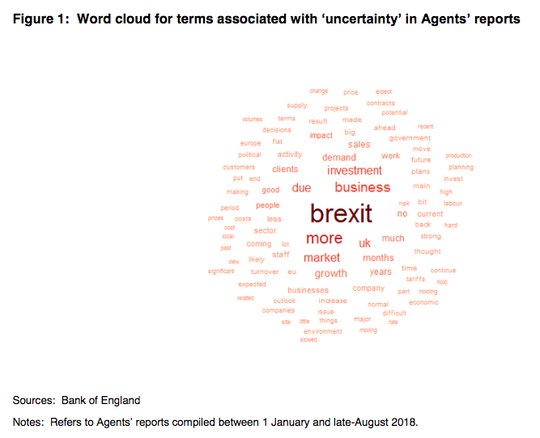

- BOE Haldane: Sees need for better central bank communications. “Despite a communications revolution, public understanding of central banks remains low and public trust in central banks has fallen. Improving both calls for a second revolution, focussed on educating and learning from the general public. The Age of Innocence may be over, but the Era of Engagement has only just begun,” Haldane concludes in his “Folk Wisdom” speech in Estonia. “This new era may mean 21stcentury central banks becoming more disbursed and personalized in their communications, creating new infrastructure to interact with the public and extract their folk wisdom.

- UK August PPI output prices up 0.2% m/m, 2.9% y/y after 3.1% y/y with core up 0.1% m/m, 2.1% y/y after 0% m/m, 2.2% y/y –as expected. The input PPI slows to 8.7% y/y after 10.9% y/y – less than 9.2% y/y expected. Petroleum and its products continue to dominate the price inflation.

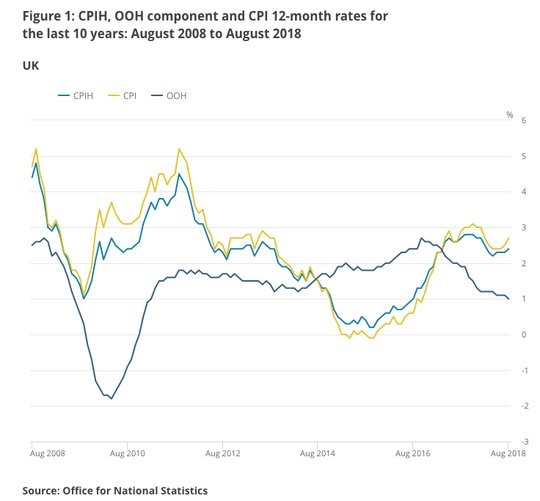

- UK August CPI up 0.7% m/m, 2.7% y/y after 0% m/m, 2.5% y/y – more than 0.5% m/m, 2.4% y/y expected– 6-monht highs led by higher recreation and transport prices. The August CPI core rose 0.8% m/m, 2.1% y/y after 1.9% y/y – also higher than 1.8% y/y expected. Recreation and Culture provided the largest contribution to the annual change in inflation (+0.07pp), with theatre tickets and PC games the biggest drivers, according to the ONS. Upward pressure was alos provided by transport (+0.06pp), with sea and air fares higher than normal for this time of year, and new season Autumn clothing. CPIH rose 0.6% m/m, 2.4% y/y after 2.4% and the RPIX rose 0.9% m/m, 3.4% y/y after 3.3% y/y. July House prices slow to 3.1% y/y after 3.2% - slowest since Aug 2013.

- Eurozone July construction output +0.3% m/m, 2.6% y/y after 0.7% m/m, 3% y/y revised – less than 5% y/y expected. June revised from 0.2% m/m, 2.6% y/y. 2Q construction output 1.4% q/q after -0.2% q/q. For July structural construction rose 1.9% m/m, civil engineering -4.4% m/m.

Market Recap:

Equities: S&P500 futures are flat after a 0.54% gain yesterday. The Stoxx Europe 600 was up 0.1% with auto sales better and after the MSCI Asia Pacific index rose 0.8% with MSCI EM up 0.7% and all-country up 0.2% - best in 2 weeks.

- Japan Nikkei up 1.08% to 23,672.52

- Korea Kospi off 0.02% to 2,308.46

- Hong Kong Hang Seng up 1.19% to 27,407.37

- China Shanghai Composite up 1.14% to 2,730.85

- Australia ASX up 0.44% to 6,297.0

- India NSE50 off 0.39% to 11,234.35

- UK FTSE so far up 0.1% to 7,308

- German DAX so far up 0.25% to 12,191

- French CAC40 so far up 0.3% to 5,381

- Italian FTSE so far off 0.3% to 21,170

Fixed Income: UK Gilts lead price action with CPI surprise driving selling. UK 10-year Gilt yields up 3.5bps to 1.6%, German Bunds up 0.5bps to 0.48%, French OATs up 0.2bps to 0.787% - while the periphery watches Italy still – 5-Star push for spending hurts today – with Italy BTPs up 4.5bps to 2.825%, Spain up 1bps to 1.51%, Portugal up 1.5bps to 1.86% and Greece up 1bps to 4.045%.

- Germany sold E2.43bn of 10Y 0.25% Aug 28 Bunds at 0.49% with 2.06 cover– after Bundesbank 2.5 cover –

- Portugal IGCP sold E1.49bn of 6M and 12M bills below target– E400mn of 6M Mar 2019 bills at -0.317% with 2.45 cover and E1bn of 12M Sep 2019 bills at -0.27% with 1.63 cover – previously -0.291% with 2.51 cover.

- US Bonds continue lower with 3.05% 10Y focus. 2Y up 0.2bps to 2.80%, 3Y flat at 2.882%, 5Y up 0.2bps to 2.945%, 10Y up 0.2bps to 3.057% and 30Y up 0.3bps to 3.204%.

- Japan JGB track US, ignore BOJ, waiting for 20Y sale and LDP leadership– 2Y up 0.5ps to -0.115%, 5Y up 0.4bps to -0.069%, 10Y up 0.2bps to 0.109% and 30Y up 1bps to 0.85%.

- Australian bonds struggle tracking US bonds, CNY Li comments.3Y up 5.6bps to 2.12%, 10Y up 5.2bps to 2.865%.

- China PBOC leaves liquidity unchanged after injecting CNY40bn via 7-day reverse repos and CNY20bn via 14-day.

Foreign Exchange: The US dollar index is off 0.2% to 94.44 with 94.32-94.68 range. USD is broadly lower in all EM- In EMEA, USD lower– ZAR up 1.45% to 14.688, RUB up 0.45% to 67.03, TRY up 1.5% to 6.287. In Asia, USD lower– KRW up 0.2% to 1120.70 with 1120 pivot, TWD up 0.1% to 30.775, INR up 0.55% to 72.57.

- EUR: 1.1695 up 0.25%.Range 1.1656-1.1715 with focus on China/EM and US rates with Draghi speech key.

- JPY: 112.35 flat. Range 112.23-112.45 with EUR/JPY 131.45 up 0.3% - watching 111.80 as base for 113.20 next. Equities, BOJ on hold driving

- GBP: 1.3180 up 0.25%.Range 1.3140-1.3215 with EUR/GBP .8870 flat – CPI lifts BOE rate hike expectations and supports GBP squeeze with 1.33 risk.

- AUD: .7255 up 0.5%.Range .7209-.7257 with CNY comments key, NZD .6610 up 0.45% despite C/A with .6620 pivotal.

- CAD: 1.2945 off 0.2%.Range 1.2945-1.2988 with A$ leading on China but C$ has 1.2880 key to watch with NAFTA in background.

- CHF: .9675 up 0.3%. Range .9634-.9678 with EUR/CHF 1.1320 up 0.55% - less Italy/China/EM fears or SNB next? Watching .9550-.9750

- CNY: 6.8569 fixed 0.02% weakerfrom 6.8554, trades stronger after Li up 0.1% to 6.8545 with 6.8694-6.8438 range.

Commodities: Oil lower, Gold higher, Copper up 0.25% to $2.7540.

- Oil: $69.75 off 0.15%.Range $69.65-$70.22. WTI watching $71.40 Sep 4 and $70 as pivot against $68 base. Brent off 0.25% to $78.84 - watching $80.13 the Sep 13 highs against the 20-day at $77.50.

- Gold: $1203.40 up 0.4%.Range 1198.50-$1204.50. Gold watching $1212 the 55-day with $1214.4 Aug 28 after that with $1200 as new base. Silver $14.18 up 0.2% still watching $13.942 Sep 11 lows as base against $14.38 20-day resistance. Platinum up 0.5% to $817.85 and Palladium up 0.4% to $1017.15.

Conclusions: Housing Matters? The WSJ highlights that single-family home construction accounted for 1.4% of GDP in 2Q – best in 10 years but well below the long-term average of 2%. Home improvement, on the other hand, is close to all-time highs. Less trading up in homes means more improvements on what you own now. This is something to watch this week as rate moves in the US continue to dominate.

Economic Calendar:

- 0830 am US Aug housing starts (m/m) 0.9%p 5%e / 1.168m p 1.23m e

- 0830 am US 2Q Current Account Deficit $124.1bn p $120.0bn e

- 1000 am ECB Draghi Speech

- 1030 am US weekly EIA crude oil stocks 5.296mb p -1mb e

- 0500 pm Brazil COPOM rate decision – no change from 6.5% expected.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.