Markets: No Divergence?

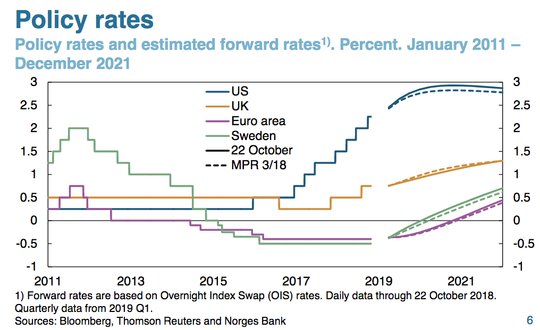

Markets are obsessing about price again, data has become an excuse to sell not buy risky assets. US divergence of rate policy and growth is in doubt. Diversity isn’t working in portfolios, as risk assets all continue to suffer. The US market moved towards correction status with the Russell 2000 dancing on a bear market. The catch-up of US stocks to the rest of the world may not be so simple with the ECB meeting the main focus for global markets as many hope for a dovish Draghi performance. Norges bank was a non-event and likely the ECB wishes to be the same. The pressure from US President Trump on FOMC Powell has kept him quiet as well.

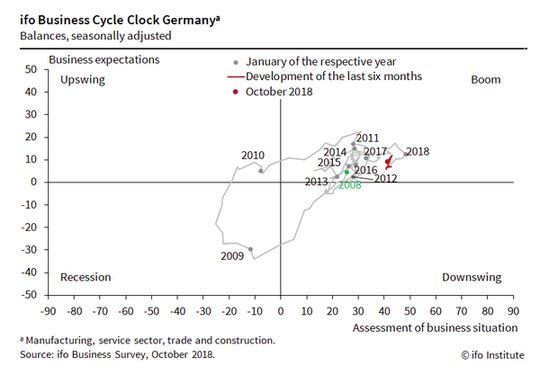

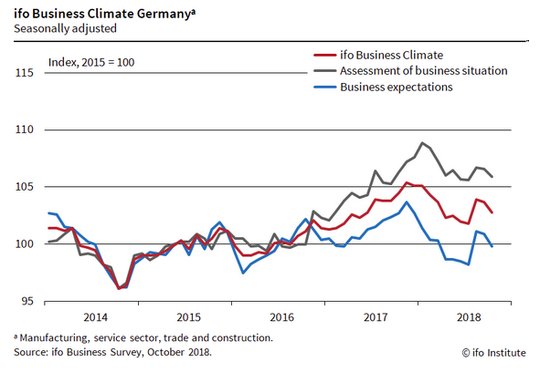

Markets are looking for a back-stop to buy but the clear shift in buying dips to selling rallies has been the October game. They aren’t getting that from central bankers. So the stability for markets will be in the more traditional games of value, government stimulus, and evidence of growth and earnings outperforming. The reasons for today to be different than yesterday’s rout are not just about the noise of increased volatility – though 50 point moves in the S&P500 should be expected. The fear list looks less obvious: UK May survived another political challenge, Italy and its budget battle waits for the ECB, US earnings continue with more winners than losers, China managed to hold stable as the CNY holds the line. Against this the Korea GDP miss reopens BOK hike doubts, the German IFO shows a clock moving to the bottom left instead of the top right.

While many would like to say that JPY is the best barometer for risk and AUD/JPY does have the longest track record, the role for Asia and EM shifted after August 2015. The 6.95 CNY level looks more important now than ever and its not going to be obvious until tomorrow that today’s modest bounce back in China, Europe and the US mood has meaning until after the US GDP report.

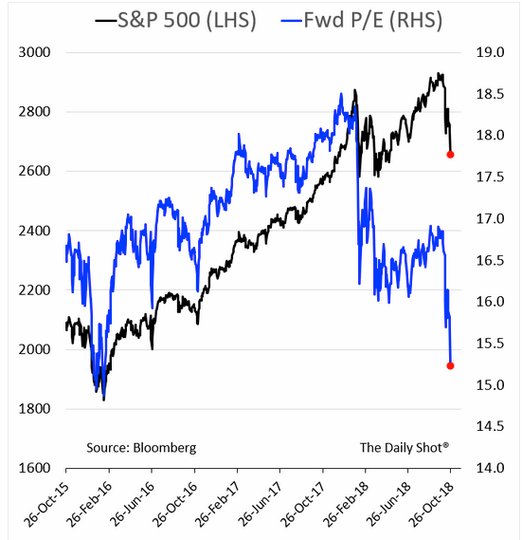

Question for the Day:Are risk markets oversold? The blame game for the October pain trade in equities has been put on US trade policy, US rate policy, the USD, the fear of peak earnings, the fear of global economic slowing, the geopolitical noises from Iran sanctions to South China Sea worries, to Brexit politics to Italian budgets. Markets have been able to climb a wall of worry until October but they have given back all the yearly gains. What this means is that positive news on growth and earnings will have a more profound effect going forward and today’s bounce will be watched to see if the selling rallies mantra of the month still holds. The relationship of rate policy to financial stability has been clear since 2008 but its been wobbly since 2014 and the tamper tantrum. The most important part of the weaker US market is in what expectations are for future earnings and growth. Value opportunities go up with the present share weakness.

The most interesting chart comes from the GS baskets of R&D vs Cash buyback shares. They highlight the view that the 9% move down in October is an opportunity for companies that have cash to buy back shares and they punish those that spend money on investments to improve growth and productivity.

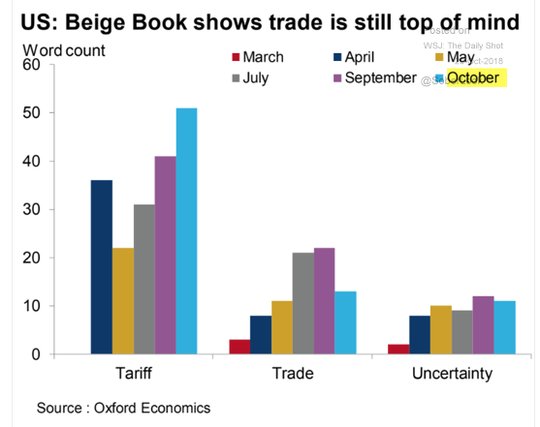

This makes the outlook for 2019 a different one and likely one that puts the FOMC in a position to pause. If the selling in shares gets worse, many see the FOMC pausing in December – as the chart suggests a 9% divot is good for pushing down the rate hike risk from 90% to 70%. The troubles about rates countering stocks are in the long-end and that rests with the term premium and roles of ECB and BOJ in setting demand for US bonds. The real issue behind this returns to trade doubts as the fear of China selling bonds and others following remains in play. Inflation from tariffs is the other outcome that many see hitting corporate margins. Trade more than rates maybe the key for risk going forward.

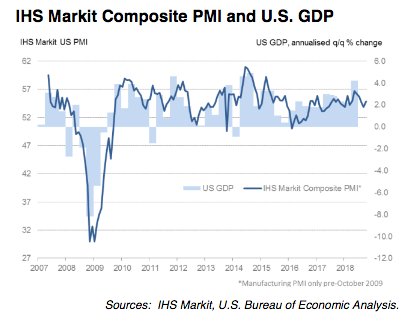

There are clearly positives that the markets chose to ignore yesterday, like the divergence of US flash PMI reports against that of Europe. Japan and the US are still upbeat on growth while Europe is clearly in a slowdown. The difference matters but perhaps not as much as rate policy going forward.

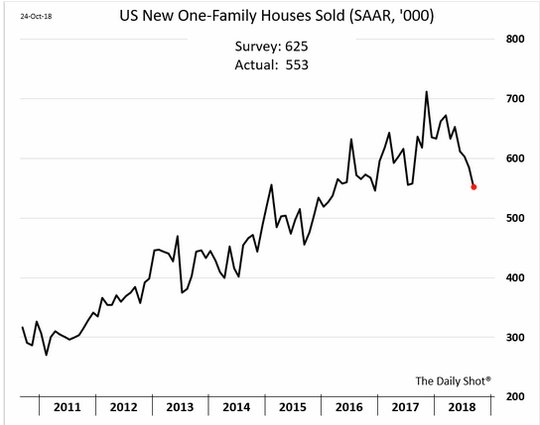

Against the positive news, the weakness in US autos and housing stands out as rate policy connects to the leverage game for consumers. The drop in US housing to 2-year lows makes many nervous for less wealth effects with consumers.

This puts today's economic data releases back into play as the trade deficit, durable goods and pending home sales may tip the balance back to US divergent growth.

What Happened?

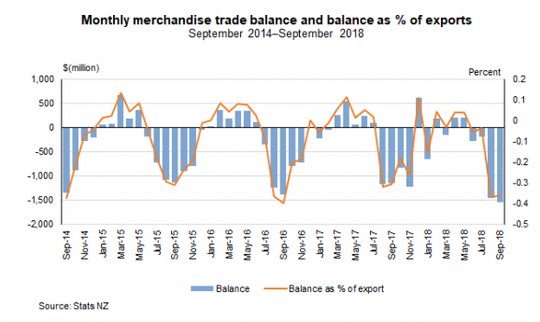

- New Zealand September trade deficit NZ$1.6bn – largest on record. Imports rose NZ$930mn up 19% y/y to NZ$5.9bn for the 12-months, while exports rose NZ$536mn up 14% to NZ$4.3bn.

- Korea 3Q GDP up 0.6% q/q, 2% y/y after 0.6% q/q, 2.8% y/y – weaker than 0.7% q/q, 2.3% y/y expected. The drags on growth were in lower investment in construction and business facilities. The government yesterday announced measures to boost growth and jobs by offering financial support to SME companies and a fuel tax cut to spur consumption.

- BOJ Wakatabe: Cautions over action to burst bubbles. "The central bank should not ignore asset price fluctuations completely, but there are still discussions, regarding whether to tighten monetary policy as a pre-emptive measure against a rise in asset prices," Wakatabe said at symposium on innovation at Keio University in Tokyo. "In the event of a financial crisis, ex post policy response becomes extremely important." "As downward pressure is exerted on the economy in the wake of the crisis, it will be necessary to respond with vigorous expansionary macroeconomic policies," Wakatabe said, adding, "If the response is inadequate or delayed, the economy will fall into deflation and face difficulty escaping from it."

- Norges Bank leaves rates unchanged at 0.75% - as expected – leaves future rate hike path unchanged with no substantial risk balance shift since September. The Executive Board's assessment was that the key policy rate would most likely be increased further in 2019 Q1. The outlook and balance of risks imply a gradual increase in the key policy rate. Economic growth has been a little lower and inflation somewhat higher than projected, but the outlook and the balance of risks do not appear to have changed substantially since the September Report.

- German October IFO business climate 102.8 from 103.7 – weaker than 103.1 expected. The current conditions drop to 105.9 from 106.6 – weaker than 106.0 expected while the outlook drops to 99.8 from 100.9 – also weaker than 100.3 expected. . Firms were less satisfied with their current business situation and less optimistic about the months ahead. Growing global uncertainty is increasingly taking its toll on the German economy. In manufacturing the index fell significantly(19.2 from 23.3) due to markedly less optimistic business expectations. Assessments of the current business situation fell to their lowest level since March 2017. Incoming orders continued to decline. Capacity utilization fell by 0.5 points to 87.1 percent. In the services sector the business climate deteriorated (31.4 from 32.7) due to far less favorable assessments of the current business situation. Business expectations, by contrast, were upwardly revised somewhat. In trade the index also declined this month(10.1 from 11.7). Traders scaled back their assessments of both the current business situation and their expectations. The index declined far more sharply in retailing than in wholesaling. More retailers intend to increase prices. In construction the business climate index hit another record high(32.7 from 31.8). Assessments of the current business situation were far better. Business expectations, by contrast, were scaled back slightly.

Market Recap:

Equities: US S&P500 futures are up 0.9% after losing 3.09% yesterday. The Stoxx Europe 600 is up 0.3%while the MSCI Asia Pacific fell over 1%. The MSCI EM index is off 1% to 19-month lows, the MSCI all-country World is off 0.3% - to 14-month lows.

- Japan Nikkei off 3.72% to 21,268.73

- Korea Kospi off 1.63% to 2,063.30

- Hong Kong Hang Seng off 1.01% to 24,994.46

- China Shanghai Composite up 0.02% to 2,603.80

- Australia ASX off 2.82% to 5,759.50

- India NSE50 off 0.98% to 10,124.90

- UK FTSE so far flat at 6.962

- German DAX so far up 0.40% to 11,236

- French CAC40 so far up 1.2% to 5,011

- Italian FTSE so far up 1.6% to 18,780

Fixed Income: The relative stability in EU equity markets has pushed bonds lower. Rallies in the periphery continue as ECB blinking hopes rise. German 10-year Bunds are flat at 0.395%, French OATs off 0.2bps to 0.765% while UK Gilts off 0.5bps to 1.45%. Italy off 9bps to 3.51%, Spain off 4.5bps to 1.575% and Portugal off 5.5bps to 1.92% with Greece leading off 9bps to 4.16%.

- US Bonds lower as equity markets calm – curve steeper into 7-year sale– 2Y up 1.6bps to 2.847%, 5Y up 2.5bps to 2.965%, 10Y up 2.3bps to 3.126%, 30Y up 2bps to 3.35%.

- Japan JGBs rally sharply on equity sell-off , curve bull flattens– 2Y off 0.5bps to -0.13%, 5Y off 1.1bps to 0.085%, 10Y off 1.6bps to 0.105%, 30Y off 2.8bps to 0.852%.

- Australian bonds rally sharply tracking global shares– 3Y off 2.5bps to 1.99%, 10Y off 5bps to 2.605%.

- China PBOC injects CNY100bn via 7-day reverse repos. Net CNY520bn has been added over the past 5-days. 7-day rates rose 0.5bps to 2.599% while O/N fell 18bps to 2.191%. 10Y bond yields are flat at 3.54%.

Foreign Exchange: The US dollar index is off 0.15% to 96.28 with 96.20-96.38 range. In EM FX, USD is mixed with Europe offered, Asia bid for dollars–EMEA: ZAR up 0.6% to 14.475 after budget hit yesterday, TRY up 1% to 5.543, RUB flat at 65.64; ASIA: TWD off 0.15% to 30.99, KRW of 0.5% to 1138 with GDP miss hurting BOK hike hopes, INR off 0.15% to 73.285.

- EUR: 1.1405 up 0.1%.Range 1.1391-1.1420 with market short EUR risk is 1.15 over 1.13 with Draghi perhaps more like Poloz than Powell.

- JPY: 112.30 up 0.1%.Range 111.82-112.36 with EUR/JPY 128.10 up 0.2% - 112 broke but no fireworks – still 110.50 risk before 114.

- GBP: 1.2900 up 0.15%.Range 1.2878-1.2919 with EUR/GBP .8840 flat – focus is on EUR still with Brexit politics back burner 1.28-1.30 keys

- AUD: .7085 up 0.3%.Range .7057-.7085 with copper up, China flat – hope for .72 again with .7050 base. NZD off 0.1% to .6525 with trade drag key.

- CAD: 1.3050 off 0.1%Range 1.3015-1.3058 with BOC hawk talk unlikely to matter if oil, stocks and US bonds are in play 1.2950-1.3150 keys

- CHF: .9995 up 0.15. Range .9955-.9999 with EUR/CHF 1.14 up 0.3% - less fear? 1.00 break opens 1.0080 again.

- CNY: 6.9409 fixed 0.08% weaker from 6.9357, trades into London weaker at 6.9490 from 6.9401 yesterday close. Now 6.9450 flat with 6.9388-6.9558 range.

Commodities: Oil mixed, Gold off, Copper up 0.4% to $2.8260.

- Oil: $66.74 off 0.1%.Range $65.99-$66.98. Brent up 0.15% to $76.29 with $75.37 lows.

- Gold: $1232.80 off 0.1%.Range $1231-$1236. Silver up 0.45% to $14.75. Platinum off 0.15% to $839 and Palldium off 1.25% to $1114.20.

Economic Calendar:

- 0745 am ECB rate decision – no change expected, details on tapering QE possible

- 0830 am ECB Draghi press conference

- 0830 am US weekly jobless claims 210k p 213k e

- 0830 am US Sep wholesale inventories (m/m) 1%p 0.5%e

- 0830 am US Sep goods trade deficit $75.8bn p $74.9bn e

- 0830 am US Sep durable goods orders (m/m) 4.5%p -1.3%e / ex trans 0.1%p 0.3%e

- 1000 am US Sep pending home sales (m/m) -1.8%p -0.1%e

- 0100 pm US Treasury sells 7Y notes

- 0700 pm Cleveland Fed Mester speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.