Markets: Muddling - Wednesday, October 10

Best to find some mint and a mortar. This is a muddle-through market with little hard news to move it. Headlines are less dramatic like the price action. This time its US Treasury Mnuchin warning China not to devalue its currency, even as the technicals point to a 7.00 break soon. The IMF wants the governments of the world to pay more attention to their state assets as a source for money rather than new debt. Their blog also highlights the risk to EM but their central forecast of a muddle-through. Other than that markets remain hopeful for a Brexit deal, scared about the Italian Budget and EU, worried about US inflation and the FOMC reaction and waiting for more data to confirm any and all of the above. The overnight lack of fear was different though calling it a calm maybe too sanguine. There is still a lot of technical price pain in this market, which seems to enjoy the consolidation, but fears the next smash of the pestle. For tracking risk mood, stick to GBP with its trade and industrial production pointing to a 0.6% q/q growth in 3Q, and with hopes of a deal before the deadline with the EU on trade, the level of GBP becomes a barometer for the bigger global muddled hope trade.

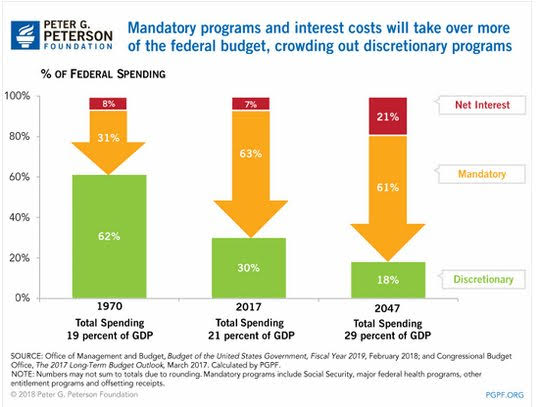

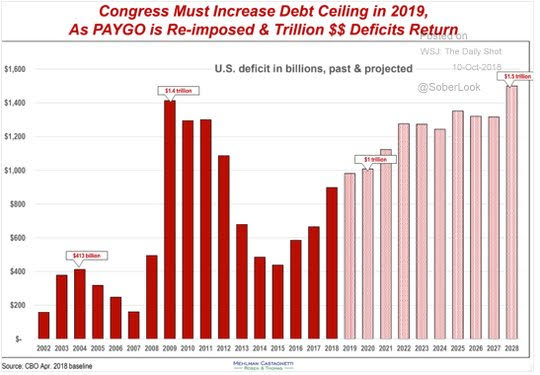

Question for the Day: Are we back to USD and debt concerns? The relative calm in markets today ahead of CPI tomorrow and after a modest dip in 10-year yields to 3.20% failed yesterday – all this brings back the focus on US debt and the supply that comes today and tomorrow. The US deficits matter and make US rate hikes that much more difficult for the government. The chart from the Peterson Foundation makes it simple to understand why the mid-term elections and the level of spending matters along with why politics have become so divisive.

There is no muddle through solution for fixing this situation without political consensus. The PAYGO plans worked to force a process to link debts to growth. This has been broken and the genie won’t get back into the bottle.

What Happened?

- Australia October Westpac Consumer Confidence up 1% to 101.5 from 100.5 – slightly less than 102 expected. This is a modest rebound from the August-September 5.2% drop. Current conditions rose to 103.6 from 102.5 while expectations rose to 100.1 from 99.2. View on economy 1Y was flat and 5Y out dips to 94.9 from 95.2. Sentiment for households with mortgages fell 6.4% in the last 2 months and house price expectations are the lowest since records started May 2009.

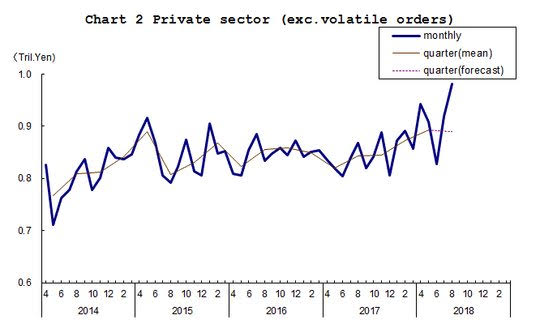

- Japan August core machinery orders +6.8% m/m after +11% m/m – better than -4% drop expected. The 3M average rose to 2.8% from -0.9% in July. The Cabinet Office upgraded its assessment from the previous month, saying, "Orders shows a sign of picking up." Previously, it said, "The pick-up in machinery orders is stalling." Orders from the manufacturing sector rose 6.6% on month in August, the second straight rise after +11.8% in July, while orders from the non-manufacturing sector excluding those for power generation and ships also rose 6.0% on month, the second straight rise after +10.9% in July.

- RBA Coombs: Sees signs of economic states convergence. Coombs' speech centred around the improvement in economic conditions in Western Australia, which means there is now less variation in the economic outcomes between different states in Australia. Overall, there was an optimistic tone to the speech with respect to all the three key perspectives she discussed: business investment, labor markets, and housing markets.

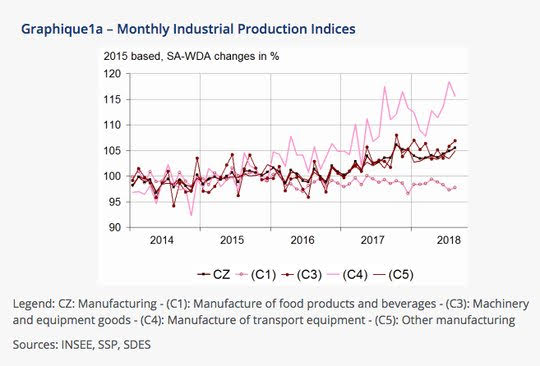

- French August industrial output +0.3% m/m after revised 0.8% m/m – as expected. July revised up from 0.7% m/m. Manufacturing was up 0.6% m/m from 0.5% m/m.

- Italy August industrial output rose 1.7% m/m after -1.8% m/m – better than +0.7% m/m expected. Mining fell 0.1% m/m, -4.7% y/y, Manufacturing rose 1.5% m/m, -0.4% y/y, electricity/water/gas rose 3.4% m/m, -1.5% y/y.

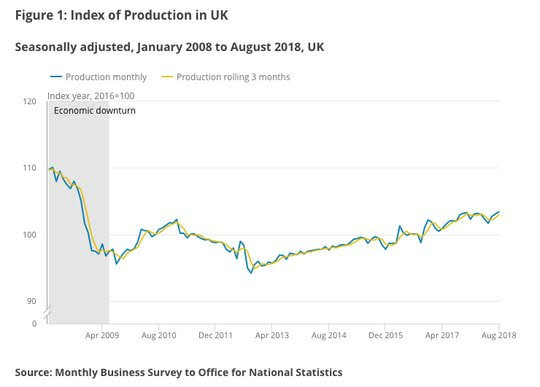

- UK Aug industrial production up 0.2% m/m, 1.3% y/y from +0.1% m/m, 0.9% y/y – better than +0.1% m/m, 1.1% y/y expected. Manufacturing -0.2% m/m after -0.2% m/m – weaker than 0.1% m/m gain expected but up 0.8% q/q. Electricity and Gas rose 1.8% m/m. In August, output growth receded in all but one of the output measures, production, which was boosted by higher utilities and mining and quarrying output. Construction fell 0.7% m/m, +2.9% q/q and Services 0% m/m, +0.5% m/m.

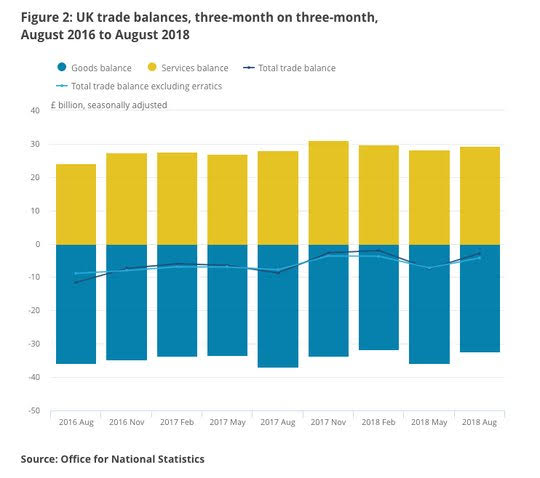

- UK August Goods Trade Deficit GBP11.195bn after GBP10.387bn – near expectations. The total trade deficit rose to GBP1.274bn after revised GBP0.572bn – less than GBP2bn expected. Imports rose 2.4% m/m while exports rose 1.1% m/m. For the 3M to August, total trade deficit narrowed to GBP 4.7bn to just GBP2.833bn mostly due to a GBP3.5bn narrowing in goods deficit and a GBP1.1bn widening of service surplus. According to an ONS official, there was no evidence of stockpiling of either food or chemical medicines in August. While the latter did spike higher in August, this was consistent with previous years and so could not be isolated specifically to Brexit.

- UK August GDP 0% m/m, 0.7% q/q, 1.5% y/y after July revised up to 0.4% m/m – mixed to expectations – warm weather notable driver. August was expected up 0.1% m/m, but the rise to 0.7% q/q follows the revision in July from 0.3% m/m. Even if September GDP growth is flat m/m, with no revisions, 3Q GDP will be 0.6% q/q – best since 4Q 2016.

Market Recap:

Equities: The S&P500 futures are off 0.1% after losing 0.14% yesterday. The Stoxx Europe 600 is off 0.4% - back to 6-month lows even with Italy bouncing. The MSCI Asia Pacific index fell less than 0.1% - after hitting 15-month lows. The MSCI EM fell 0.1% - its 5thdecline – and 17-month lows.

- Japan Nikkei up 0.16% to 23,506.04

- Korea Kospi off 1.12% to 2,228.61

- Hong Kong Hang Seng up 0.08% to 26,193.07

- China Shanghai Composite up 0.18% to 2,725.84

- Australia ASX up 0.13% to 6,163.80

- India NSE50 up 1.54% to 10,460.10

- UK FTSE so far flat at 7,237

- German DAX so far off 0.35% to 11,937

- French CAC40 so far off 0.5% to 5,291

- Italian FTSE so far up 0.2% to 20,106

Fixed Income: Supply hurts EU with German sale uncovered – last time this happened was August 22 then June 13. Focus remains on Italian budget battle with EU, hopes for Brexit deal and better risk-mood in equities. UK Gilt 10-year yields are up 0.5bps to 1.72%, German Bunds up 0.5bps to 0.55%, French OATs up 0.6bp so 0.89% while periphery rallies with Italy BTPs off 2bp sot 3.445%, Spain flat at 1.595%, Portugal off 3bps to 1.935% and Greece off 15bps to 4.38%.

- Germany sees technically uncovered 10Y sale– Sold E2.41bn of 0.25% Aug 2028 Bunds at 0.55% with 0.91 cover – previously 0.49% with 2.06 cover – after Bundesbank holdings cover lifted to 1.1.

- Greece sold E812.5mn of 3-month Jan 2019 bills at 0.65% with 1.39 cover.

- Ireland syndicates 12Y green bond with price guidance MS+15,

- Italy sold E6bn of 12-month Oct 2019 BOT at 0.949% with 1.63 cover–previously 0.436% with 1.91 cover.

- Portugal sold E0.782bn of 10Y 2.125% Benchmark Oct 2028 PGB at 1.939% with 2.78 cover– previously 1.73% with 2.02 cover.

- US Bonds are lower with curve steeper into supply/PPI– 2Y up 1.3bps to 2.898%, 5Y up 1.7bps to 3.073%, 10Y up 2.1bps to 3.227%, 30Y up 2.1bps to 3.39%.

- Japan JGBs see modest relief rally– 2Y off 0.1bps to -0.127%, 5Y off 0.3bps to -0.075%, 10Y off 0.8bps to 0.142%, 30Y off 0.7bps to 0.929%.

- Australian bonds rally with US, good auction– 3Y off 0.5bps to 2.065%, 10Y off 2bps to 2.75% – The AOFM sold A$1bn of 12Y 2.5% May 2030 #TB155 bonds at 2.7996% with 3.24 cover – previously 2.8035% with 2.466 cover.

- China PBOC skips open market operations, keeps liquidity neutral. 10Y bonds were flat at 3.61%. China sold CNY4.5bn of DimSum bonds at unchanged levels to July – Sold CNY1.5bn of 5Y at 3.8% and CNY3bn of 2Y at 3.65%.

Foreign Exchange: The US dollar index is up 0.2% at 95.68 with a range 95.54-95.79. In EM FX, USD mixed– EMEA: ZAR off 0.45% to 14.627, TRY up 0.4% to 6.0750, RUB up 0.2% to 66.10; ASIA:TWD off 0.1% to 30.997, KRW up 0.1% to 1133.50, INR up 0.2% to 74.22.

- EUR: 1.1500 up 0.1%.Range 1.1480-1.1515 with risk mood helping keep 1.1420 base with 1.1580 resistance.

- JPY: 113.25 up 0.25%.Range 112.93-113.27 with EUR/JPY 130.25 up 0.35% - equities support with 112-114 watch.

- GBP: 1.3170 up 0.2%.Range 1.3135-1.3185 with EUR/GBP .8730 off 0.1% - Brexit hopes high still – watching 1.3250 and 1.33 resistance

- AUD: .7100 flat.Range .7089-.7131 with focus on China/commodities still - .7050-.7250 consolidation. NZD .6465 off 0.15%.

- CAD: 1.2960 up 0.1%.Range 1.2927-1.2964 with focus on rates, data with 1.30 pivot and 1.2880 base for 1.3250 again.

- CHF: .9920 flat. Range .9907-.9934 with EUR/CHF 1.1410 up 0.1% - Italy relief but 1.00 in $ holding.

- CNY: 6.9072 fixed 0.09% weaker from 6.9019, now flat at 6.9220 with range 6.9129-6.9268 – focus is on 6.88-6.93 for next break.

Commodities: Oil off, Gold off, copper off 0.45% to $2.8245.

- Oil: $74.80 off 0.2%.Range $74.48-$75.08. WTI watching $73 the Oct 1 lows as base with $76.90 the Oct 3 highs as resistance with Hurricane Michael key, then API. Brent off 0.2% to $84.83 - watching $80 as base with $82.66 yesterday’s lows against $86.74 Oct 4 highs for $87 barrier and $90 resistance.

- Gold: $1188.70 off 0.1%.Range $1188-$1191. Still holding $1180.90 Sep 28 lows but 55-day caps now at $1200.50. Silver $14.39 flat -watching $14.18 Sep 27 lows and $14.269 yesterday’s lows for support with $14.50 pivot and 55-day at $14.677. Platinum off 0.3% to $822.80 and Palladium up 0.8% to $1080.

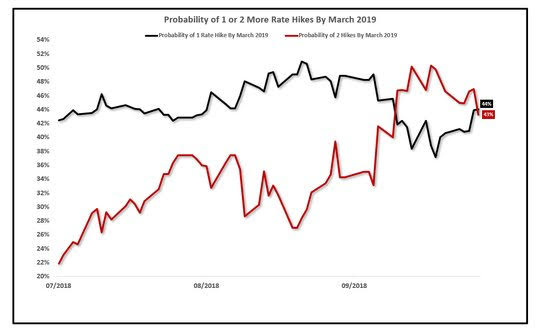

Conclusions: What is neutral? Dallas Fed Kaplan was clear in his view in a WSJ interview and this transparency matters for markets as they price in the CPI/PPI data next. “It’ll take probably three rate increases from here, which would get us in the range of 2¾ to 3 [percent]. That, for now, is probably my best—that gets us in the vicinity—and I would underline the word “vicinity,” “neighborhood,” whatever adjective you want to use there—that gets us in the vicinity of neutral.”

Economic Calendar:

- 0830 am US Sep PPI (m/m) -0.1%p +0.2%e (y/y) 2.8%p 2.8%e / ex food/energy -0.1%p +0.2%e

- 1000 am US Aug wholesale inventories 0.6%p 0.7%e

- 1130 am US sell $36bn 3Y notes

- 1215 pm Chicago Fed Evans speech

- 0100 pm US sells $23bn 10Y notes

- 0430 pm US weekly API crude oil stocks +0.907mn p -0.52mb e

- 0600 pm Atlanta Fed Bostic speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

The other Fed people have said neutral is not good enough. Are they aiming for just south of 4 percent?