Markets: Horses For Courses

The Bulletin sees this housing upturn as relatively advanced – i.e. getting old – and that price gains are stronger than historical averages. However, they see the investment cycle as less worrying and the flows for housing driven by the relative outperformance against other asset classes like bonds, deposits and equities.

Different horses for different courses– UK betting wisdom.

“Indeed it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time.…” - Winston Churchill House of Commons, 11 November 1947.

We all want the best person for the job, but many in the world are questioning whether democracy achieves this goal for government. As Churchill famously noted, consider the alternatives. This is the US Election Day and many are betting on political gridlock to support markets. We had a foreshadowing of how markets may be crushed with the Melbourne Cup today in Australia. Rain mattered to the bookies and so it does for voters. Quant models didn’t win either– they had the winner in 13th place. So too, the market risk today is in the consensus on the US election being wrong. Interesting to note that Marmelo, the horse that came in third was the right call by the bookies and quants – but unlike the track, elections don’t have third place payouts. US mid-term elections are normally not about the US President but Trump has campaigned to make it so.

The power of controlling the media agenda maybe sufficient to explain the lack of faith most traders feel in this risk today and their mistrust in polls and bookies. Odds are that the US House goes to the Democrats and the US Senate to the Republicans.

Most everyone sees risks in other outcomes with infrastructure spending, another tax cut, impeachment hearings and more on the agenda. Of course, there is real news out ahead of the US vote with stronger German factory orders, better than flash PMI from Europe (but real Italian weakness), an RBA on hold, Swedish IP weaker and EU PPI higher. Add into this that politics globally continues to matter to markets today perhaps even more than the US:

- with UK a bit less optimistic about a Brexit deal after a DUP member said they are heading for a no deal Brexit. The UK Trade Minister Fox also said it was “impossible” to say if a deal could be reached in a month or two. All that reversed earlier headlines for a deal.

- Oil continues lower with Iran selling more with US waivers.

- With CNY under pressure as PBOC fixed weaker and Ma said “hitting 7 to dollar isn’t that crucial.”

- The Italian BTP market slips as EU threatens sanctions if there is no deal on the budget.

This all puts the market into a waiting mode and that means we are all looking for safe-haven bets again. With the role of the USD central to the game still – watching 97.25 against 95.90 for a real breakout.

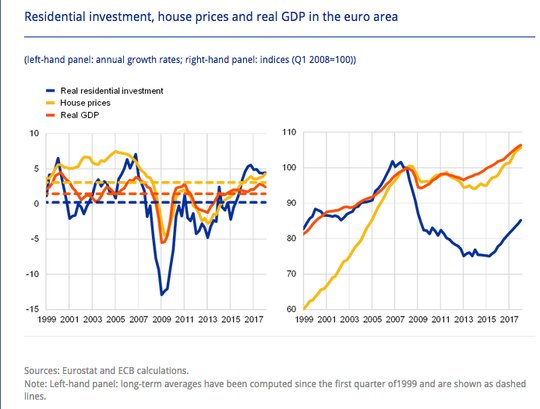

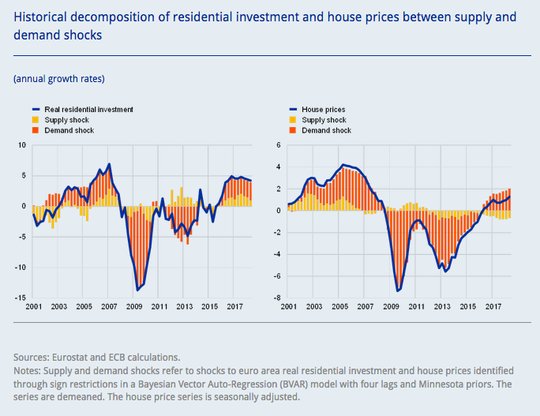

Question for the Day:Is the next bubble about housing again, but in Europe not the US? US worries about rates and housing are ongoing, EU ones not so much but perhaps that changes. The ECB Bulletin today has a report on the housing market upturn as it extends for the 4th year there. The key point from the chart below is that investment is stagnant, GDP slowing but house prices continue to rise – making this an important focal point for the central bank.

The Bulletin sees this housing upturn as relatively advanced – i.e. getting old – and that price gains are stronger than historical averages. However, they see the investment cycle as less worrying and the flows for housing driven by the relative outperformance against other asset classes like bonds, deposits and equities.

What Happened?

- RBA leaves cash rate unchanged at 1.5% - as expected – but growth outlook better. RBA Governor Lowe commented that the economy was “performing well” and revised higher growth. RBA now sees 3.5% GDP in 2018 and 2019 with unemployment dropping to 4.75% by 2020 from the present 5%. On the A$, the RBA noted: “The Australian dollar remains within the range that it has been in over the past two years on a trade-weighted basis, although it is currently in the lower part of that range.”

- Sweden September Industrial Production rose 0.2% m/m, 1.7% y/y from 0.5% m/m, 2.8% y/y – weaker than 1% m/m, 5.2% y/y expected- slowest since April 2017. Manufactruring slowed to 1.8% y/y from 2.8% mostly due to fabricated metals, computer and electronic equipment while mining, electricity increased.

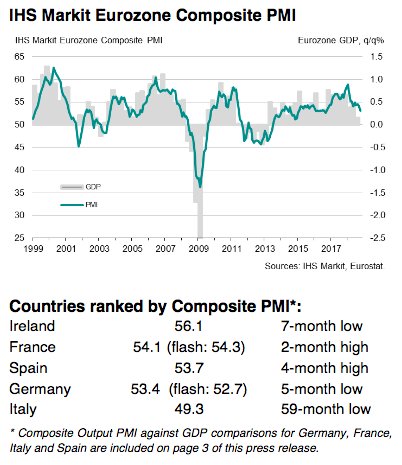

Eurozone October final Services PMI 53.7 from 54.7 – better than 53.3 flash. The Composite PMI 53.1 from 54.1 – also better than 52.7 flash but still the slowest expansion in over 2-years. Manufacturing was the weakest in 4-years, services the weakest since 1Q 2017. New business rose at the slowest pace since Sep 2016. Prices rose further with energy and fuel driving it. Confidence slips to near 4-year lows.

- Spanish Services PMI 54 from 52.5 – better than 51.8 expected – but employment at 2-year lows with subdued confidence.

- Italy Services PMI 49.2 from 53.3 – weaker than 52 expected – first contraction in 2 ½ years. New business at 44-month lows.

- French final Services PMI 55.3 from 54.8 – weaker than 55.6 flash. The Composite PMI 54.1 from 54 – also weaker 54.3 flash – but up from 21-month lows in September.

- German final Services PMI 54.7 from 55.9 – better than 53.6 flash – 3-month lows. The Composite PMI 53.4 from 55 – also better than 52.7 flash but 5-month lows

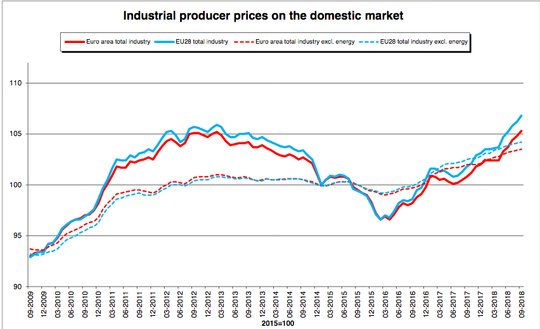

- Eurozone September PPI +0.5% m/m, 4.5% y/y after 0.3% m/m, 4.2% y/y – more than 0.3% m/m, 4.2% y/y expected. The ex-energy PPI was up 1.5% y/y. Energy prices rose 1.6% m/m, intermediate goods up 0.1% while capital goods and consumer goods were flat.

- German September factory orders rise 0.3% m/m after revised 2.5% m/m – better than -0.6% m/m expected. Domestic orders rose 2.8% m/m while foreign orders fell 1.4% m/m with Eurozone orders up 2.4% but non-EU off 3.7% m/m. Intermediate orders -1.7% m/m, capital goods up 1.4% m/m, consumer goods up 2.1% m/m.

Market Recap:

Equities: The US S&P500 futures are off 0.1% after a 0.56% gain yesterday. The Stoxx Europe 600 fell 0.2% - after opening up – while the MSCI Asia Pacific rose 0.7%.

- Japan Nikkei up 1.14% to 22,147.75

- Korea Kospi up 0.61% to 2,089.62

- Hong Kong Hang Seng up 0.72% to 26,120.96

- China Shanghai Composite off 0.23% to 2,659.36

- Australia ASX up 0.91% to 5,958.70

- India NSE50 up 0.06% to 10,530

- UK FTSE so far off 0.5% to 7,070

- German DAX so far off 0.20% to 11,471

- French CAC40 so far off 0.25% to 5,088

- Italian FTSE so far off 0.60% to 19,162

Fixed Income: Bonds are back with safe-haven demand given wobbly EU equities, weaker PMI and returning Italian budget worries. EU Moscovi said next steps rest on Italy’s budget response. German Bund yields are off 1.2bps to 0.412% (even with better factory orders), French OAT yields are off 0.5bps to 0.782% while UK Gilts are up 1.1bps to 1.508% as Brexit deal options on the Irish Border continue to spark fear with cabinet meeting today. The periphery suffers with Italy up 7.5bps to 3.395%, Spain up 0.5bps to 1.568%, Portugal up 0.5bps to 1.88% and Greece up 3bps to 4.275%.

- UK DMO sold GBP1.912bn of 10Y 1.625% Oct 2028 Gilts at 1.493% with 2.31 cover– previously GBP2.75bn sold at 1.596%

- US Bonds are bid with risk-off mood rising, waiting for vote and Fed– 2Y off 0.8bps to 2.899%, 5Y off 1.2bps to 3.016%, 10Y off 1.1bps to 3.189%, and 30Y off 0.7bps to 3.421%.

- Japan JGBs lower with curve flatter after good 10Y linker sale– 2Y up 0.3bps to -0.135%, 5Y up 0.8bps to -0.086%, 10Y up 0.1bps to 0.119%, 30Y up 0.8bps to 0.877%. The 10Y linker sale prices was 103.90 better than 103.85 expected and with cover 3.70 from 3.12 previously. MOF sold Y399.5bn of 0.1% coupon Mar 2028 linkers at -0.305%.

- Australian bonds lower with RBA on hold, China shares– 3Y off 0.5bps to 2.07%, 10Y off 1.5bps to 2.725%. Fitch flagged A$ banks adding to bid and the NZ GDP risk warnings from Government.

- China PBOC skips open market operations today, keeps liquidity neutral. 2Y of 3bps to 3.00%, 5Y off 1.5bps to 3.32%, 10Y off 2bps to 3.50%. The China Dev Bank sold 1Y bonds at 2.62%, 3Y at 3.351% and 7Y at 4.005% today.

Foreign Exchange: The US dollar index up 0.15% to 96.41 with 96.22-96.44 range so far. USD is mostly bid in EM– EMEA: ZAR off 0.5% to 14.225, TRY off 1.05% to 5.367, RUB flat at 66.035; ASIA: TWD flat at 30.763, INR up 0.15% to 72.997, KRW flat at 11235.

- EUR: 1.1405 flat. Range 1.1392-1.1426 with holding pattern watching US equities, vote exit polls, economic data with 1.1350-1.1450 key.

- JPY: 113.15 off 0.05%.Range 113.10-113.45 with EUR/JPY 129.05 off 0.1% - nothing much moving here 112.80-113.80 keys.

- GBP: 1.3070 up 0.2%.Range 1.3021-1.3085 with EUR/GBP .8730 off 0.2% - hope for Brexit deal still driving. 1.30 pivot still 1.2880-1.3150.

- AUD: .7235 up 0.35%.Range .7205-.7240 with RBA growth and crosses driving while NZD .6680 up 0.3%.

- CAD: 1.3120 up 0.1%.Range 1.3103-1.3131 with US rates, oil, crosses driving 1.3050-1.3150 key

- CHF: 1.0040 flat.Range 1.0034-1.0056 with EUR/CHF 1.1455 flat – despite Italy pain trade, watching EUR and 1.0080 still.

- CNY: 6.9181 fixed 0.09%weaker from 6.9116, trades 6.9317-6.9096, now up 0.15% to 6.9160 but well off the 6.8850 lows yesterday.

Commodities: Oil lower, Gold higher, Copper off 0.15% to $2.8060.

- Oil: $62.83 off 0.45%.Range $62.69-$63.06 with focus on $62.45 and $65 still – Iran/US inventories driving – Brent off 0.75% to $72.63 with $72-$75 keys

- Gold: $1235.65 up 0.35%. Range $1231-$1236 with focus on $1245 and $1266 next but USD key with rates. Silver $14.70 up 0.4% with $17.92 still key. Platinum up 1.2% to $875.15 and Palladium flat at $1975.

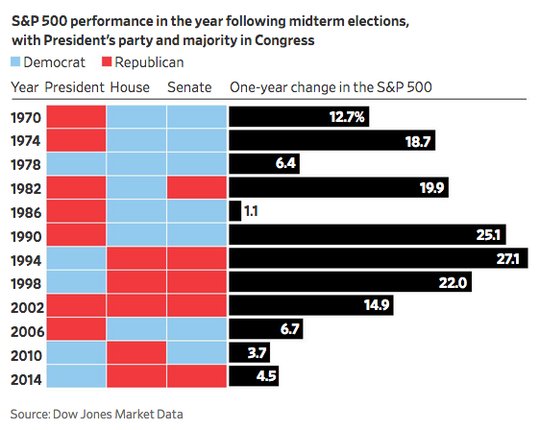

Conclusions: Is 2018 different for mid-terms? There is a certainty after every election and that maybe the most important factor for investors today. There is also history after mid-terms that many are betting on. This time its different arguments remain in play given the role of Trump in campaigning this year, given the $5.2bn spending on this vote and given the doubts about the US business cycle. The WSJ article on the history of sector rotations and worries this time is worth considering as we wait for results.

Economic Calendar:

- 0700 am ECB Lautenschlager speech

- 0830 am Canada Sep building permits (m/m) 0.4%p 0.3%e

- 1000 am US Sep JOLTS job openings 7.136m p 7.1m e

- 1000 am US Nov IBD/TIPP economic optimism 57.8p 59.2e

- 1130 am US sells 4-week and 52-week bills

- 0100 pm US sells $27bn 10Y notes

- 0430 pm US weekly API oil stocks 5.7mb p 4.1mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.