Markets Hold Bulk Of Gains

Most of the gains were posted pre-market, but bulls were able to hold gains after a couple of days of bullish strength.

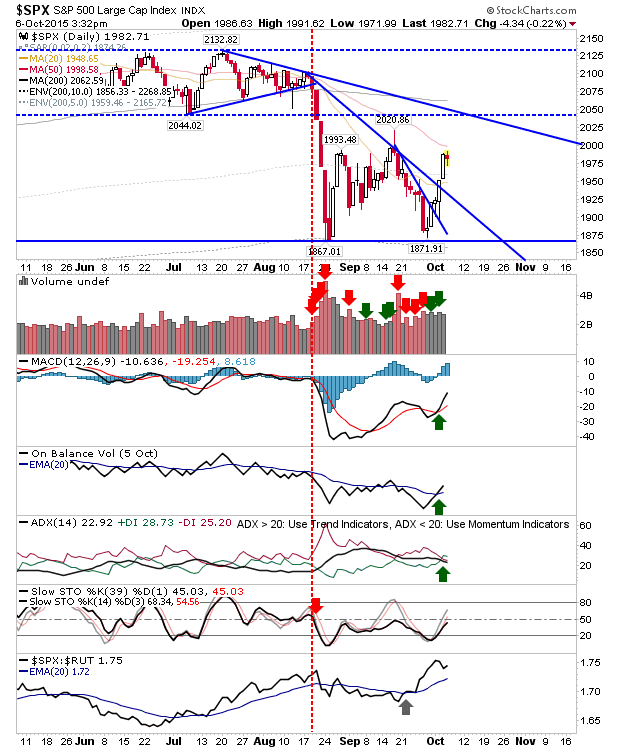

The S&P is on course to finish with a spinning top doji. The 50-day MA is just overhead and close to 2,000 psychological resistance. Technicals are close to turning net bullish.

The Nasdaq closed above 20-day MA and has room to run to overhead resistance. Like the S&P, it 's close to turning net bullish technically. Today was a typical consolidation, which given recent price action should be viewed as bullish.

The Russell 2000 was another index to close near the day's highs. It too is trading near its 20-day MA, but it hasn't yet turned bullish technically or adopted a relative leadership against Large Caps or Tech indices.

Today was a can kicking exercise for bulls. I took short positions at the 10:00am ET turning hour at good entry prices, but I suspect I'm going to get stopped out either in premarket tomorrow, or in the first half hour of trading. If bulls don't push on, then the doubts will emerge, and this will give shorts an opportunity to turn small losses into bigger ones. However, as thing stand now, bulls hold the cards (against my expectations).

Disclosure: None.