Markets: Divergence

There is positive divergence this Monday as markets expect little for the week in terms of economic news or big decisions. The focus is on central bankers with their minutes and their speeches going into the Fed Jackson Hole Symposium. This means that the news behind the news drives markets and there was plenty of it last night – here is a partial list to get you going as Monday starts early. Note that Turkey which has been the headline risk barometer for the last 2 weeks is on holiday all this week. This passes the baton of fear to other stories.

- Shots were fired at the US embassy in Ankara – USD/TRY is higher – back over 6 – with focus on US new sanctions and escalation in the battle over the US Pastor release and Turkish bank fines. Also, Moody’s and S&P cut Turkish debt 1 notch – as most expected on Friday.

- China and the US trade talks start Wednesday with path to Xi/Trump meeting in November.

- China shadow banking continues to shrink, according to Moody’s.Shadow banking assets as a share of GDP dropping to around 73% at the end of June 2018 from 79% at the end of 2017 and the peak of 87% at the end of 2016. In absolute terms, shadow banking assets fell by RMB2.7 trillion in the first six months of 2018 to RMB62.9 trillion. "We expect the contraction in shadow banking assets to moderate in the rest of 2018, as regulators are taking a more gradualist approach in response to slower domestic credit growth and a more challenging external environment," noted Michael Taylor, a Moody's Chief Credit Officer for Asia Pacific.

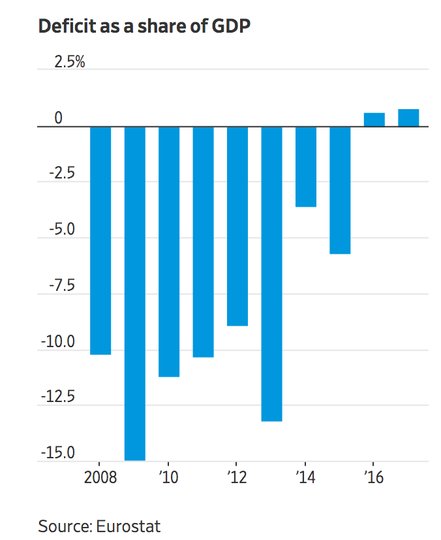

- Italy plans to roll out a new infrastructure package in September. After the tragic Genoa bridge collapse the new government plans to spend E80bn on better infrastructure. The plan is to invoke the “golden rule” which removes public investments from the budget deficit – used by the UK Brown previously – seen as smashing of EU rules.

- Oil markets focus on OPEC production as Iran reiterated that "no member country should be allowed to take over another member's share of oil exports. "This also comes at a time when questions continue to swirl regarding the stability of Libyan oil production.

- Merkel and Putin discuss Syria and Ukraine. The push of Putin to normalize relations with Germany is seen as taking an opportunity caused from US trade and foreign policy disruptions. The Kremlin said the pair discussed the transit of gas to Europe from Russia, the conflicts in Ukraine and Syria, the Iran nuclear deal, and the consequences of the US administration’s trade and economic policies for third countries.

Replacing the TRY for another risk barometer means focus on CNY, JPY and CHF and their crosses. The relationship of Japan to China and investments abroad maybe the quiet issue that captures FX risks driving other money flows in bonds and stocks.

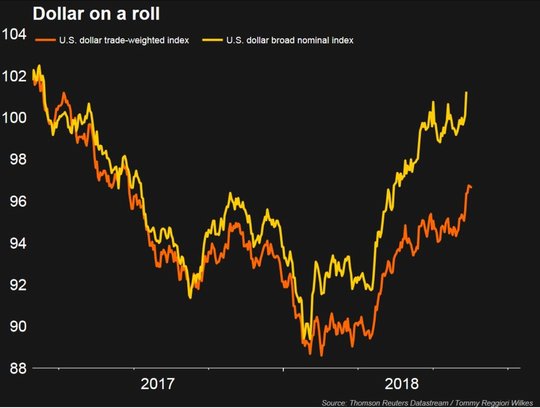

Question for the Day: Is the USD going to peak? Short answer – not anytime soon. The rally up in the USD this year was seen as a surprise in 2Q and has been taken as gospel in 3Q. The long USD, short EUR positions stand out and the Italian budget doubts, Turkey contagion to banks and the slowing growth in the EU are all blamed for the moves. This maybe more about EUR weakness than USD strength. However, the USD has also benefited from pain in EM – with the TRY, ARS. INR and BRL moves all highlighted, the current account positions and the need for global capital has been part of the story.

The support for the USD has a number of key factors beyond the rest of the world – 1) US FOMC rate hikes and plans to continue through 2019 with inflation and growth supporting their actions, 2) US growth outperformance with the US tax reform and deregulation driving GDP well over potential; 3) US repatriation and Trump trade pushes – the ongoing focus on bilateral trade deals has forced some companies to keep spending at home and bring money back from abroad.

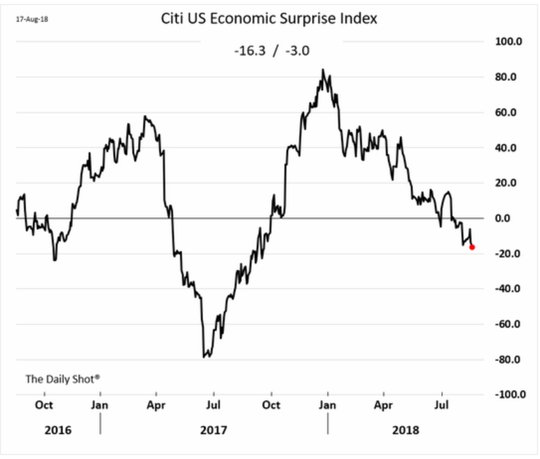

Against these factors are the usual list – 1) US trade policy will force economic war with China/Russia/Europe pulling back investments. 2) ECB and others will normalize rates when the US FOMC is starting to slow down.3) US growth is temporary and above potential forcing inflation and risk of policy mistakes in contrast to others. Perhaps the most important factor for the next few weeks and the USD trend is in the data as the CITI surprise index suggests, the USD and economic growth has been a kingpin to its trend.

What Happened?

- German July PPI up 0.2% m/m, 3% y/y after 0.3% m/m, 3% y/y – as expected. The Energy PPI was up 0.5% m/m, 6.5% y/y from 6.2%, capital goods up 0.2% m/m, 1.3% y/y from 1.3% y/y while basic goods were 0% m/m, 3.2% y/y from 3.2% y/y.

- Eurozone June Construction Output rose 0.2% m/m, 2.6% y/y after 0.3% m/m, 1.8% y/y – better than 1.6% y/y expected. This brings 2Q construction output up 1.3% q/q compared to -0.1% q/q in 1Q. In June, structural construction rose 0.1% m/m, civil engineering rose 0.3% m/m.

- Greece officially concluded its 3-year ESM financial assistance program.'Greece officially concludes its three-year ESM financial assistance program today with a successful exit. This follows the disbursement of E61.9bln by the ESM over three years in support of macroeconomic adjustment and bank recapitalization in Greece. The remaining E24.1bln available under the maximum E86bln program volume was not needed.'

Market Recap:

Equities: US S&P500 futures are up 0.2% after a 0.33% gain Friday. The Stoxx Europe 600 is up 0.7% with Germany leading while the MSCI Asia Pacific rose 0.2% with China leading.

- Japan Nikkei off 0.32% to 22,199

- Korea Kospi up 0.04% to 2,247.88

- Hong Kong Hang Seng up 1.41% to 27,598.02

- China Shanghai Composite up 1.11% to 2,698.47

- Australia ASX up 0.14% to 6,435.10

- India NSE50 up 0.68% to 11,548.65

- UK FTSE so far up 0.55% to 7,600

- German DAX so far up 1.1% to 12,343

- French CAC40 so far up 0.7% to 5,381

- Italian FTSE so far up 0.15% to 20,445

Fixed Income: Focus today was on periphery spreads narrowing and Germany curve steepening. Volumes are light like the news and most expect little to follow from the economic or even the Fed Jackson Hole event this week. Carry returns as a driver. Germany 10-year Bund yields up 0.5bps to 0.305% while French OATs off 0.5bps to 0.65% and UK Gilts up 0.5bps to 1.24%. Periphery bid – Italy off 3.5bps to 3.075%, Spain off 4bps to 1.40%, Portugal off 3.5bps to 1.8% and Greece off 3bps to 4.26%.

- The Dutch sold E1.82bn of Oct 2018 DTC at -0.61% with 1.53 cover – previously -0.6% with 1.61 cover.

- US Bonds see modest bull steepening trade into FOMC minutes, Jackson Hole – 2Y up 0.6bps to 2.612%, 3Y up 0.3bps to 2.681%, 5Y off 0.2bps to 2.74%, 10Y off 0.4bps to 2.857% and 30Y off 0.6bps to 3.014%.

- Japan JGB bid with global moves – watching 20Y sale tomorrow, CPI Friday – 10Y off 0.3bps to 0.085%.

- Australian bonds see bull flattening with focus on RBA minutes, RBA speeches this week – 3Y off 0.5bps to 2.00% and 10Y off 2bps to 2.52%

- China PBOC injects net CNY120bn on the day after adding CNY120bn via 7-day reverse repos. Money market rates rose with O/N up 2bps to 2.601% and 7-day up 1bps to 2.654%. 10Y China yields fell 0.5bps to 3.635%.

Foreign Exchange: The US dollar index is flat at 96.31 after losing 0.2% in Asia, rebounds in EU. In Asia EM FX – USD is offered: INR up 0.7% to 69.67, KRW up 0.15% to 1123.20 and TWD up 0.1% to 30.756. In EMEA – USD is mixed: ZAR up 0.9%to 14.505, RUB up 0.15 to 67.02 and TRY off 1.2% to 6.09.

- EUR: 1.1410 off 0.25%. Range 1.1403-1.1441 with focus on TRY and ECB speeches. 1.1380 next support against 1.1450 resistance.

- JPY: 110.65 up 0.1%. Range 110.41-110.68 – calm and waiting with 110-111.20 key. EUR/JPY off 0.1% to 126.25 with 125 still key

- GBP: 1.2740 off 0.1%. Range 1.2724-1.2755 with focus on Brexit politics still in quiet week. EUR/GBP off 0.2% to .8955 with .90 capping rallies

- AUD: .7310 off 0.1%. Range .7296-.7317 with focus on .7320-50 resistance against .7250 support. NZD .6620 off 0.25% with banks cutting RBNZ forecasts driving.

- CAD: 1.3075 up 0.1%. Range 1.3055-.13073 with NAFTA deal hopes and oil supporting along with BOC rate hike post CPI – BOC speeches key. 1.30-1.32 still contains trading.

- CHF: .9960 flat. Range .9943-.9968 with EUR/CHF 1.1365 off 0.2% - still watching Italy and ECB with 1.14 capping rallies.

- CNY: 6.8718 fixed 0.21% stronger from 6.8894, trades 6.8424-6.8698 now up 0.3% to 6.8570 with focus on spread to CNH and drop in RMB index.

Commodities: Oil up, Gold up, Copper up 1.6% to $2.71.

- Oil: $65.90 flat. Range $65.60-$66.10. WTI watching the $63.31 200-day m.a. as the base and $64.43 the August 16 lows with $65.94 the Fibonacci retracement resistance then $68.37 the Aug 14 highs. Brent $72.11 u 0.4% - watching $70.30 Aug 15 lows and $68.84 the 200-day m.a. against $73.93 Aug 14 highs.

- Gold: $1188.60 up 0.35%. Range $1184-$1189. Watching $1160.40 the Aug 16 lows then $1150 against $1198.8 the Aug 14 bounce highs. Silver $14.79 off 0.1% - watching $15.25 resistance and $15.554 the Aug 3 highs as ceiling against $14.30 uptrend support and $14.00. Platinum up 0.8% to $795.25 and Palladium up 0.3% to $917.20.

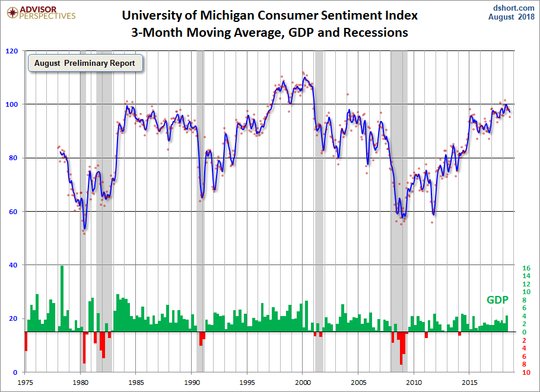

Conclusions: Does the mood matter? Investors look a bit more upbeat than consumers this week. The preliminary August Michigan Survey last Friday suggests that higher gasoline, more worries about trade and uglier US politics have taken a toll. Whether this matters or not is more about how the FOMC interprets the causes as they meet in Jackson Hole this week and listen to the woes of emerging markets and the ongoing worries about US trade policies.

Economic Calendar:

- 0815 am BOC Wilkins panel discussion in Frankfurt, Germany

- 1100 am Atlanta Fed Bostic fireside chat in Kingsport, TN

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.