Markets: Delays - Friday, August 3

It’s Friday and Jobs day in the US so most woke up in the US expecting nothing but a delayed market waiting for 8.31 am and the Hampton Jitney. This wasn’t the case overnight but delays did play a role in the 3 stories moving markets:

- The IMF delays its economic review of Italy and the EUR drops, BTP yields skyrocket. 2Y Italy trades up 19bps to 1.16%, 10Y up 8bps to 3.01% - this is the story of the day – and the panic point – but all that unwinds after China PBOC actions and equities rebound.

- BOE Carney says the chance of UK no-deal Brexit “uncomfortably high.” In a BBC Radio interview on Friday, Carney said a disorderly Brexit is “highly undesirable.” This, of course, begs the question of why the BOE hiked yesterday.

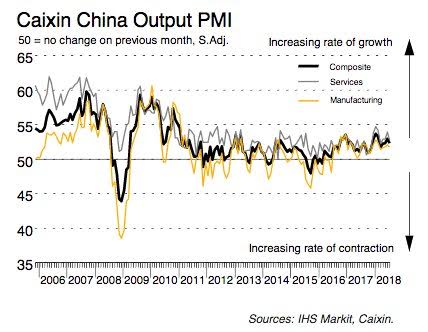

- PBOC fights against CNY weakness with higher reserve requirements for FX forwards from 0% to 20%, reverses Sep 2017 easing. US Commerce Secretary Ross signaled there’s more pain ahead for China unless the Asian nation changes its economic system, while Beijing repeated that it will never surrender to US trad threats. This drives the CNH near 6.90 along with the weaker Caixin Service PMI pointing to the need for more monetary easing along with the Politburo push for more fiscal spending. The question many are wondering is when the PBOC cuts the RRR again and when more leverage from government hits the economy vs. the paradoxical fight to hold CNY and CNH in check.

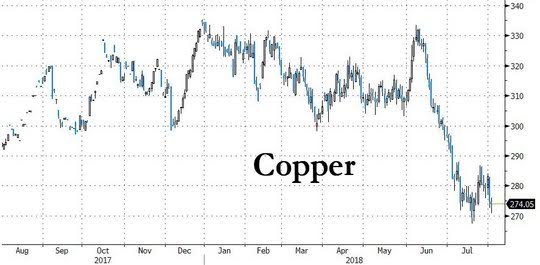

Stocks in Europe and futures in the US are shrugging off the Asia selling aided by the PBOC line in the sand. This moderates some of the “panic” stories above, but there remains a view that geopolitical risks are coming to a head, whether that is Iran military exercises in the Gulf Strait or China reactions to US tough talk or the UK politics getting even more complicated. All of which puts barometers for risk back in vogue and perhaps it makes for a Dr. Copper house call (with inevitable delays, of course.) Watching $2.70 and $2.80 with the present rebound matching US and EU shares.

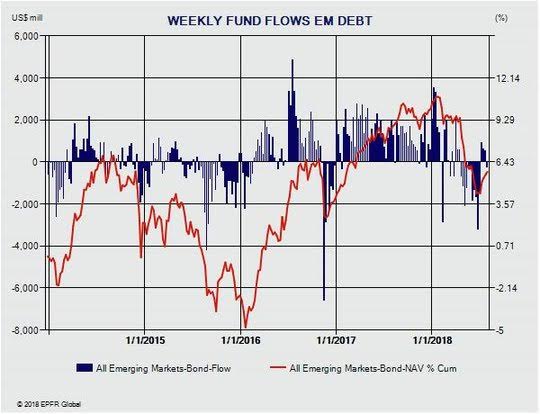

Question for the Day: Was July the bear market rally? The markets in EM are the canary in the coal mine. Many macro traders track the emerging market bond risks as the essential elixir for getting value, carry and momentum right. August is always a month of transition but like February, the ground hog momentum of when Autumn really starts is unclear and many remember August 2 as the start of the Iran/Kuwait war that led to Gulf War I and inevitably the quagmire of the US/Iraq invasion 13 years later. History doesn’t matter much today as markets are flying around trying to square risk with rates, growth and policy.

What Happened?

- Australian July Service PMI 53.6 from 63 –worse than 55 expected. Four of the five sub indices were up – inventories, employment, new orders – but all at slower rates. Property and finance and transport were steady while consumer sector sagged.

- Australian June retail sales up 0.4% m/m after 0.4% m/m – better than 0.3% m/m expected. The 2Q trade volume rose 1.2% q/q after 0.2% – better than 0.8% q/q expected.

- BOJ June 14-15 monetary policy minutes: Economic recovery will lead to CPI reaching 2% target. Some members remained cautious in the face of the stubborn deflationary mindset and slow wage growth.

- Japan July Service PMI 51.3 from 51.4 –weaker than 51.6 expected. Employment rose but output and new business grows at slower rates while price pressures rise.

- China July Caixin Service PMI 52.8 from 53.9 – weaker than 53.5 expected – lowest in 4-months. The July Composite fell to 52.3 from 53 – with slowing broad based. New orders lower, but jobs higher. Input costs were higher and output charges also rose but at a slower rate (lowest in 3 months). Optimism sagged with composite at 32-month lows.

- Swiss July CPI -0.2% m/m, 1.2% y/y after 0% m/m, 1.1% y/y – near expectations. The July HICP up 0.4% m/m, 1.2% y/y. The core CPI (ex-fresh food/energy) -0.2% m/m, +0.5% y/y.

- Eurozone June retail sales up 0.3% m/m, 1.2% y/y after revised 0.3% m/m – as expected. This puts 2Q retail sales up 0.6% q/q after 0% in 1Q.

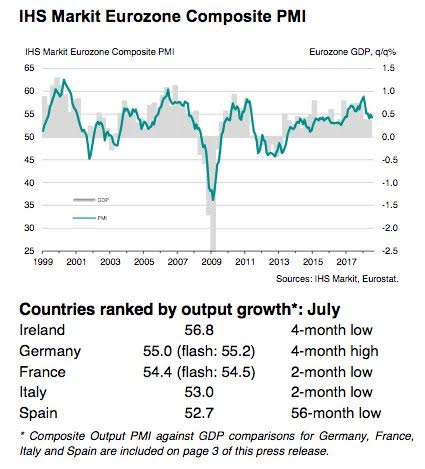

- Eurozone July final Service PMI 54.2 from 55.2 – weaker than 54.4 flash. The July final Composite PMI 54.3 from 54.9 – same as flash.

- Spanish July Service PMI 52.6 from 55.4 – weaker than 54.4 expected.

- Italy July Service PMI 54 from 54.3 – better than 53.4 expected.

- French July final Service PMI 54.9 from 55.9 – weaker than 55.3 flash. The Composite PMI 54.4 from 55 – weaker than 54.5 flash.

- German July final Service PMI 54.1 from 54.5 – weaker than 54.4 flash. The July Composite 55 from 54.8 – also weaker than 55.2 flash.

- Italy June industrial production up 0.5% m/m, 1.7% y/y. Capital, intermediate and consumer goods production all rose. Energy output fell 0.7% m/m. This puts 2Q production 0% q/q.

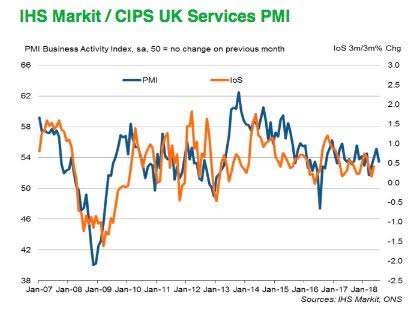

- UK July Service PMI 53.5 from 55.1 – weaker than 54.7 expected – 3-month lows. Job creation weakest since August 2016 but inflation moderates. "July data highlighted a disappointing start to the third quarter for the UK service sector, with business activity and incoming new work rising at softer rates than in June" says IHS Markit/CIPS.

Market Recap:

Equities: The US S&P500 futures are up 0.3% after 0.5% gain yesterday. The Stoxx Europe 600 is up 0.5% after opening near flat and shaking off Italy stories. The MSCI Asia Pacific fell 0.1% with China leading losses.

- Japan Nikkei up 0.06% to 22,525.18

- Korea Kospi up 0.77% to 2,287.68

- Hong Kong Hang Seng off 0.14% to 27,676.32

- China Shanghai Composite off 0.97% to 2,741.08

- Australia ASX off 0.02% to 6,326.40

- India NSE50 up 1.03% to 11,360.80

- UK FTSE so far up 0.8% to 7,636

- German DAX so far up 0.45% to 12,601

- French CAC40 so far up 0.3% to 5,477

Fixed Income: More risk-off means more bond buying and more pain in the periphery markets. German Bunds are bull flattening, 10Y off 3bps to 0.43%, UK Gilts opened bid and continue with 10Y yields off 3bps to 1.355%.

- US Bonds rally with rest of market waiting for jobs– 10Y off 1.3bps to 2.973% -touched 2.965% low in Europe was quiet in Asia.

- Japan JGBs rally with risk-off, curve twists steeper. 10Y off 2bps to 0.105%, from 0.145% highs yesterday, 30Y up 1bps to 0.845%. The BOJ cut 5-10Y buying by Y10bn to Y400bn. Offer to cover eases to 2.7 from 3.2 while 10-25Y eases to 2.1 from 2.2 and 25Y+ ticks up to 3.1 from 1.84.

- Australian bonds tick higher but moderated by retail sales. 3Y flat at 2.12%, 10Y off 0.5bps to 2.725%.

- China PBOC skips open market operations for 11th day, net drains CNY210bn on the week. Money market rates fell with O/N off 11bps to 1.826% and 7-day off 3bps to 2.389%. 10Y bond rally – yields off 2bps to 3.45%.

Foreign Exchange: The US dollar index is off 0.1% to 95.07 with 95.53 and 94.95 hot points to watch today – was up 0.2% at EU open. In Asian EM FX, the 7th week of USD gains – KRW off 0.15% to 1128, TWD off 0.1 to 30.706, INR off 0.1% to 68.75. In EMEA, USD reverses gains – RUB up 0.15% to 63.233, ZAR up 0.9% to 13.316, TRY

- EUR: 1.1605 up 0.15%. Range 1.1568-1.1608. The bounce back in EUR comes with China PBOC watching 1.1550-1.1680 again into jobs.

- JPY: 111.55 off 0.1%. Range 111.52-111.84 with EUR/JPY 129.45 up 0.1% - BOJ and rates driving more than stocks with crosses pointing to 110.50 risk again.

- GBP: 1.3040 up 0.2%. Range 1.2980-1.3040 with EUR/GBP .8900 flat. US jobs vs. China PBOC relief vs. BOE Carney “Brexit” fears. 1.30 pivot for 1.2880-1.3120.

- AUD: .7405 up 0.55%. Range .7353-.7409 with NZD .6765 up 0.35%. All about crosses and China with copper barometer.

- CAD: 1.2985 off 0.3%. Range 1.3037-1.2983 – all about crosses, oil and US/China/NAFTA stories. BOC hike in September being priced.

- CHF: .9934 off 0.2%. Range .9933-.9964 with EUR/CHF 1.1530 off 0.1%. Italy vs. Equity bounce vs US/China worries.

- CNY: 6.8322 fixed 0.56% weaker from 6.7942, drops 0.5% to 6.8735 near close from 6.38 yesterday close but was off 0.85% early on. CNH off 0.2% to 6.8965 was off 0.45% early to 6.127.

Commodities: Oil up, Gold off, copper up 0.45% to $2.7745.

- Oil: $69.06 up 0.15%. Range $68.52-$69.22. Brent up 0.1% to $73.57 with focus on $74.50 and WTI $69.50. Iran begins military exercises in the Gulf, Genscape estimates a big draw in Cushing hub US oil – both stories support oil overnight despite USD up.

- Gold: $1210 off 0.1%. Range $1205-$1211. Failure to break over $1210 even with China/US pain means $1204.60 retest and $1190 next. Silver flat at $15.33.

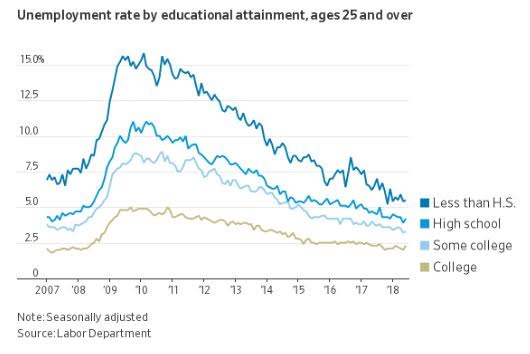

Conclusions: Jobs are more about wages and benefits? The link of jobs to inflation has been the debate at the FOMC and in Washington for years with today’s report another brick in that wall. The latest stories about studying the economic data revolve around the capacity of the workforce from its productivity drag to its actual size – as discouraged workers return to participate. The chart that the WSJ highlights is worth considering as many companies are hiring less skilled workers and training them up rather than spending up to get already qualified people – keeping a lid on wages for now but increasing the benefits part of the market.

Economic Calendar:

- 0830 am US July non-farm payrolls 213k p 185k e / Unemployment rates 4%p 3.9%e / average hourly earnings 0.2%p 0.3%e

- 0830 am US June trade deficit $43.1bn p $46bn e

- 0830 am Canada June trade deficit C$2.77bn p C$2.3bn e

- 0945 am US July Service PMI 56.5p 56.2e / Composite 56.2p 55.9e

- 1000 am US July Service ISM 59.1p 58.7.e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.