Markets: Decisions

The trust but verify mood to markets is notable today. China-US trade talks restarting set the mood over the last 48 hours to embrace risk and search for value trades. The Turkish Central Bank hiking rates to 24% stabilized TRY further adding to the sense that we are in the reversion cycle over the fear one for emerging markets. Throw in that the ECB sounded hawkish and upbeat enough to keep the USD weaker against the EUR and you have the makings of a risk-rebound. The decisions from Trump, Draghi and Carney yesterday make investors have to decide today whether to chase the recovery or not. There is clear evidence that some investors are buying protection here, ready to take advantage of this modest calm. Witness the 20%-26% November VIX spread put on yesterday. There are good reasons to doubt. 1) China. The biggest story overnight is about China and its slowdown with retail sales and industrial production slightly better but investment slowing despite government efforts to stimulate. 2) Japan. The second story is from Abe on the BOJ. The Japanese PM noted that "he doesn't think that easing should go on forever," although Abe did stress that "it is up to the BOJ to decide when to end easy policy." Japan and the US are aiming for trade talks in late September. 3) UK. BOE Carney warns that a bad Brexit will be as bad as 2008 for UK economy. On the day – these stories didn’t matter – the risk mood and the weekend trading rules dominated. The decisions made yesterday to push forward with normalization in Europe is the stand out and the EUR is the new barometer to measure any changes more than rates or EM.

Question for the Day: Does a weaker USD mean a better global growth rate? The question for the day and perhaps the week ahead is whether a weaker USD helps stabilize emerging markets sufficiently to restart hopes for coordinated global growth.

The FOMC meeting at the end of the month is clearly in play after the modest CPI yesterday but the odds for any pause in hikes seems limited and so the rationality of the market in selling USD isn’t about rates as much as some trajectory of normalization outside the US – namely Europe. The biggest problem markets have is in believing in the rest of the world rather in than some tempering of FOMC rate hikes or in the US trade policy negotiations. Better growth isn’t about the USD that is like saying umbrellas cause rain. Nevertheless, the USD has had a bad week and that may be good for some US exporters and for those that were being squeezed into US assets at the expense of home investments.

What Happened?

- New Zealand August BNZ Business PMI up 52 from 51.2 – near expectations. The index remains below the long run average of 53.4. Production rose to 52.6 back into expansion from July. New orders rose to 53.2 but employment fell to 48.1 – worst since Aug 2016.

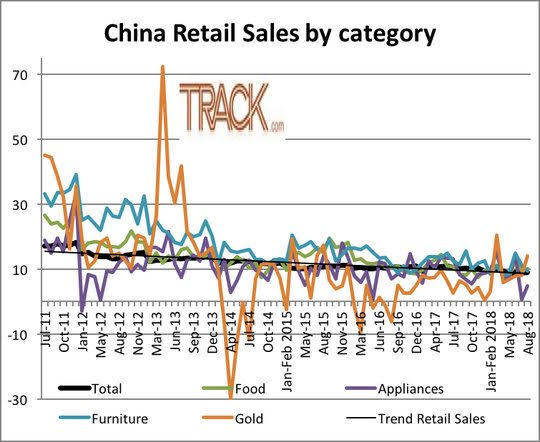

- China August retail sales up 0.65% m/m, 9% y/y after 0.69% m/m, 8.8% y/y - better than 8.8% y/y expected. The Jan-Aug retail sales were 9.3% y/y after 10.4% in 2017 same period. Gains in sales noted in gold 14.1% from 8.2% y/y, in Oil and gasoline 19.6% from 18.4%, grains and food 10.1% from 9.5% while autos -3.2% from -2%, communication equipment 6.4% from 9.6% and clothing 7% from 8.7%. The home related sales were mixed with furniture lower 9.5% from 11.1% y/y, but building materials and decorations 7.9% form 5.4% y/y.

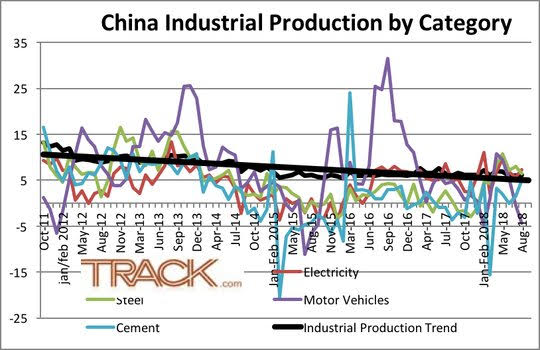

- China August industrial production up 0.52% m/m, 6.1% y/y from 0.47% m/m, 6% y/y - better than 6% y/y expected. The Jan-Aug output was 6.5% y/y compared to 6.7% in same period 2017. Mining as 2% from 1.3% y/y, Electricity/Gas/Water 9.9% from 9.0% while Manufacturing contracted to 6.1% from 6.2% y/y. By product – cement rose to 5% from 1.6% y/y, Steel fell to 6.4% from 8.0% y/y, Autos fell to -4.4% from -0.5% y/y, Coal rose 4.2% from -2% y/y and electricity rose 7.3% from 5.7% y/y. Overall, the increase was supported by fast-growing development in new energy, industrial

robots and integrated circuit technology. - China August ytd fixed investment up 0.44% m/m, 5.3% y/y after 0.43% m/m, 5.5% y/y – less than 5.5% y/y expected – record lows. Property investment rose to 10.1% from 7.9% in 2017 but was down from Jan-July 2018. Despite slowing growth, the investment structure is believed to be optimizing, according to the NBS. Property investment cooled down in August, mainly due to a series of tightening policies on the property market.

- China August unemployment improves to 5% from 5.1%. Unemployment is stable at the middle of the range since it was first recorded in January by the government officially. The surveyed unemployment in the 31 big cities was reported even lower, at 4.9%.

- India August WPI drops to 4.53% y/y from 5.09% y/y – better than 4.65% y/y expected. The drop was led by food (-4.04% from +2.15%) and primary articles (-0.15% from +1.73%). However, “Build up inflation rate in the financial year so far was 3.18 per cent compared to a build-up rate of 1.41 per cent in the corresponding period of the previous year,” the Ministry statement said.

Market Recap:

Equities: The US S&P500 futures are up 0.1% after rising 0.53% yesterday. The Stoxx Europe 600 is up 0.3% from the start while the MSCI all-country World is up 0.3%. The MSCI Asia Pacific bounced up 1% but China fell. China A-shares rallied on Bloomberg story that FTSE Russell is considering including the space in its indices, potentially with a larger weighting than the one employed at MSCI, but profit taking and data doubts dominated.

- Japan Nikkei up 1.20% to 23,094.67

- Korea Kospi up 1.40% to 2,318.25

- Hong Kong Hang Seng up 1.01% to 27,286.41

- China Shanghai Composite off 0.18% to 2,681.65

- Australia ASX up 0.58% to 6.276.30

- India NSE50 rose 1.01% to 11,485.00

- UK FTSE so far up 0.15% to 7,292

- German DAX so far up 0.3% to 12,090

- French CAC40 so far up 0.3% to 5,344

- Italian FTSE so far up 0.15% to 20,877

Fixed Income: The EU bonds opened offered and continued with risk-on mood in equities, higher oil, hawkish ECB driving – UK Gilt 10-year yields up 2.7bps to 1.53%, German Bunds up 1bps to 0.43%, French OATs up 1bps to 0.74% while periphery outperforms with Italy up 0.5bps to 2.95%, Spain up 1bps to 1.47%, Portugal up 0.5bps to 1.855% and Greece up 2bps to 4.005% - Bank capital shift seems to be in price.

- US Bonds see modest profit taking from yesterday – 2Y up 0.9bps to 2.765%, 5Y up 1bps to 2.883% 10Y up 0.7bps to 2.977%, 30Y up 0.5bps to 3.112%.

- Japan JGBs quiet into holiday weekend with Rinban the noise, belly sold – The latest BOJ buying of Y650 was unchanged but saw offer to over ratios of 1-3Y at 3.10 from 3.26 and 3-5Y at 3.92 from 3.78. Abe comments generally ignored. 2Y up 0.1bps to -0.119, 5Y up 0.6bps to -0.073, 10Y up 0.7bps to 0.108%, 30Y up 0.3bps to 0.834%.

- Australian bonds watching corporate flows, RBA minutes next, bid with US – 3Y off 1.2bps to 2.018%, 10Y off 0.2bps to 2.60%

- China PBOC injects CNY150bn on the day, after adding CNY110bn in 7-day and CNY40bn in 14-day reverse repos. For the week, the central bank added CNY330bn with unchanged rates for repos with 7-day at 2.55% and 14-day at 2.70%. 2Y flat at 3.15%, 10Y off 0.5bps to 3.63%.

Foreign Exchange: The US dollar index is off 0.2% to 94.47 extending on yesterday’s selling with 94.20 and 93.90 next support. In EM USD mostly lower – EMEA USD bid: ZAR off 0.15% to 14.79, TRY flat at 6.0850, RUB off 0.25% to 68.48; ASIA USD offered: TWD up 0.2% to 30.735, KRW up 0.5% to 1117, INR 71.745 up 0.6% - WPI helping.

- EUR: 1.1705 up 0.15%. Range 1.1688-1.1722 with focus on 1.1740-80 for breakout and 1.18 behind that. The risk for 1.20 vs. 1.15 in play.

- JPY: 111.80 off 0.1%. Range 112.08-111.79 with focus on 112 barrier gone 112.50-113.40 targets. EUR/JPY 130.80 flat – watching 130 as the pivot with 131.80-132.50 next.

- GBP: 1.3130 up 0.2%. Range 1.3104-1.3139 with focus on politics and Brexit still. EUR/GBP .8915 flat with focus on .888 next.

- AUD: .7205 up 0.15%. Range .7177-.7216 with NZD up 0.3% to .6590 with .6530 base key. Metals are in play and copper dragging on A$ post mixed China data.

- CAD: 1.3000 flat Range 1.2983-1.3008 with NAFTA deal hopes still key and oil helping but most of this is cross action with 1.2880 still key.

- CHF: .9640 off 0.15%. Range .9635-.9671 with EUR/CHF 1.1275 off 0.1% - still flashing yellow and .97 pivot for .9550 test in $.

- CNY: 6.8362 fixed 0.2% stronger from 6.8488 yesterday. Now 6.8545 off 0.15% with 6.8429-6.8596 range.

Commodities: Oil up, Gold up, Copper off 0.85% to $2.6925

- Oil: 68.81 up 0.3%. Range $68.70-$69.14. WTI watching $66.86 Sep 7 lows against $71.40 Sep 4 highs. Brent $78.25 up 0.1% - watching $76.60 and $75.18 – the 55-day as bases against $80 and $82 resistance. Oil holding bid on IEA monthly with demand forecasts robust and supply worries lingering.

- Gold: $1207 up 0.45%. Range $1199-$1208. Gold dancing around $1200 most of Asia with USD and US rates the driver still, watching 55-day at $1215 against $1183 Aug 24 lows. Silver $14.22 up 0.1%, watching $14.00 as the pivotal base with $13.648 Dec 2015 lows behind it against $14.48 and $15.554 Aug 3 highs.

Conclusions: What are the surprise risks from Barcelona? The FX Trade Tech Europe Conference discussed and covered almost every topic possible relating to FX markets. For anyone in macro trading the interest was in what were the hot buttons and consensus views from the crowd. Most analysts see volatility rising into 4Q given the myriad of big events – with the US mid-term elections, ongoing trade tariff risks with China, Europe and Canada, and with the Italy budget, Brazil election and ongoing pressures of Turkey and Argentina all in play. The problem with buying volatility in any asset class in 2018 has been its not sustainable and that the spikes are fast and don’t last. Timing and risk management continue to define success in any trade idea. The investment views for risk in general was to stay the course but to be cautious. The need for protection or extra vigilance seems to be the common wisdom. As for FX, there was a lot of divergence over the path of JPY – some see 120 and others see 105. The views on EM were that they are nearly overdone but that catching the falling knife isn’t easy or obvious here. As for the USD most were bullish and see the USD remaining king until next year. The two turning points most see as key for turning the trend are 1) Trump intervention or 2) FOMC rate pauses. The one other macro view that stood out was the lack of inflation fear everywhere. This was in stark contrast to the start of 2018. The net result – I walk away watching this week’s price action and thinking that we could continue to bounce on risk assets into the FOMC meeting.

Economic Calendar:

- 0400 am Italy August final HICP (m/m) -1.4%p -0.1%e (y/.y) 1.9%p 1.7%e

- 0500 am Eurozone July trade surplus E22.5b p E18bn e

- 0600 am BOE Carney Speech

- 0630 am Russia central bank rate decision – no change from 7.25% expected

- 0830 am US August retail sales (m/m) 0.5%p 0.4%e /ex autos 0.6%p 0.3%e / control 0.5%p 0.4%e

- 0830 am US August import prices (y/y) 4.8%p 4.6%e /export prices 4.3%p 2.5%e

- 0900 am Chicago Fed Evans speech

- 0915 am US August industrial production (m/m) 0.1%p 0.3%e / Cap Utils 78.1%p 78.1%e

- 1000 am US Sep preliminary Univ. of Michigan consumer sentiment 96.2p 96.8e

- 1000 am US July business inventories 0.1%p 0.2%e

- 1030 am BOC Business Review

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.