Markets: Contagion

The summer ended last night. Fear of economic war, contagion from EM, populist politics breaking the EUR – all that mixed with GDP reports from Japan and UK but we aren’t close to done with US CPI ahead begging the risk for more Fed hikes.

- Russia retaliation. Russian PM Medvedev said that Moscow saw the new US sanctions as economic war and that the country would respond economically,politically or by other means if needed.

- Turkey Contagion. The ECB is concerned about Turkey exposure at EU banks.This set the tone for the European morning with TRY trading to 6.30.

- Italian Budget. The EU/Italy fight over budget underway with DiMaio vowing to use tough tactics.

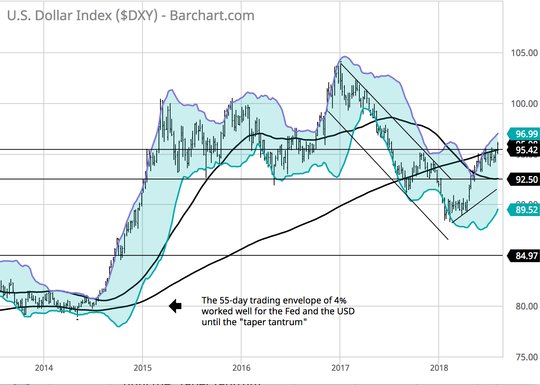

These stories mattered more than Japan GDP and UK GDP beating expectations. We are in a crisis mode market where CHF is bid, USD is bid against EM and bonds are bid – yields lower – as equities move into a sea of red. Notable exception was China where rates squeezed higher in 7-day to 2Y and where equities were flat while the CNY held steady. This maybe more by design and likely can’t hold given the bigger moves in other G10 currencies. The USD has broken out of its previous highs and unless we see some action from Trump tweeting about the USD being too strong, we will have the USD even higher after the US CPI today. Markets should be on watch for the US intervention risk as it now maybe something Trump can deliver to allies to soothe the troubled waters of markets.Watching the USD index today is key with 96.10-45 next but the big picture suggests we have lots of room for higher.

Question for the Day: How big is the Turkey exposure in Europe? There have been lots of headlines this morning but not a lot of data on the Turkey exposure to EU bonds. Credit rating agencies flagged this risk in July with Fitch and Moody’s cutting Turkey. Moody’s forecasts problem loans at Turkish banks will increase to more than 4 percent of loans over the next 12-18 months, off a low of 2.9 percent in May. Turkey made a lot of money for EU banks with big loan growth and high net interest margins. The ABN AMRO report highlighted BBVA, ING and BNP but noted overall EU exposures of $225bn. The FT article this morning drove more speculation and highlighted UniCredit as well.

According to cross-border banking statistics from the Bank for International Settlements, local lenders, including foreign-owned subsidiaries, have dollar claims worth $148bn, up from $36bn in 2006 and euro claims worth $110bn. Spanish banks are owed $83.3bn by Turkish borrowers, French banks are owed $38.4bn and Italian lenders $17bn in a mix of local and foreign currencies. Banks’ Turkish subsidiaries tend to lend in local currency.

What Happened?

- Japan 2Q preliminary GDP rose 0.5% q/q, 1.9% y/y after -0.2% q/q -0.9% y/y – better than 0.3% q/q, 1.4% y/y expected. 1Q annual revised lower from 0.6%. Domestics demand contributed 0.6 pp while net exports removed 0.1 pp. Overall 2Q consumption rose 0.7% q/q adding 0.4 pp while 2Q Capex rose 1.3% q/q adding 0.2pp. Public investment -0.1% q/q net 0% to growth.

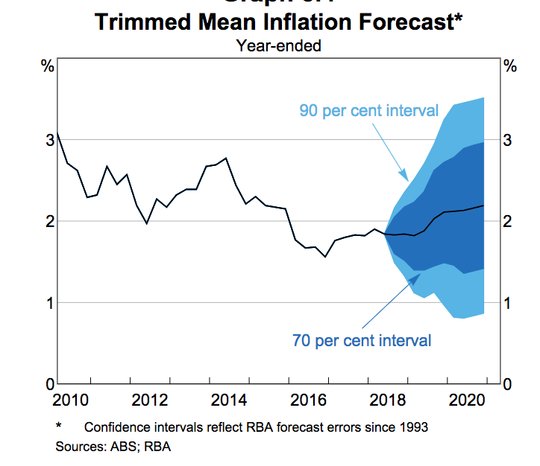

- RBA SOMP (statement of monetary policy): Forecast CPI below 2.5% to 2020, unemployment 5%. The RBA extended its forecast period to December 2020, and is forecasting headline consumer price index inflation at 2.25% versus expectation that it will be raised to 2.5%. Market expectation was based on Governor Philip Lowe's speech on Wednesday that, "Over the forecast period, we expect inflation to increase further to be close to 2.5% in 2020." he RBA is maintaining the optimism that the next move in the cash rate is likely to be up, and this was well-flagged by Lowe in the speech. However, there are too many uncertainties to the forecast and the "next move up" message appears less convincing. In the least, market may further push back pricing for RBA rate hike.

- French June industrial production rose 0.6% m/m after -0.2% m/m – better than 0.5% m/m expected – with Manufacturing up 0.6% m/m after -0.5% m/m.

- Sweden July CPIF up 0.5% m/m, 2.2% y/y after 0.3%m/m, 2.2% y/y – as expected. The CPI was steady at 2.1% y/y – slightly more than 2.0% y/y expected.

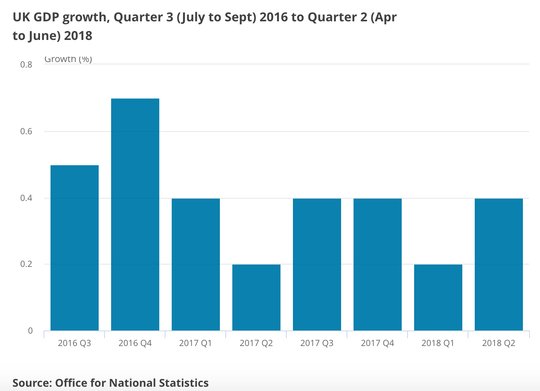

- UK 2Q preliminary GDP +0.4% q/q, 1.4% y/y after 0.2% q/q, 1.2% y/y – slightly better than 0.4% q/q, 1.3% y/y expected. Over the month of June GDP rose 0.1% down from 0.3% and weaker than 0.2% expected. The 2Q bounce in GDP came from Service output up 0.5% q/q after 0.4% q/q – still off the 0.6% q/q expected – and with services flat in June after 0.2% gain in May. Overall, consumptions rose 0.3% from 0.2% q/q – adding 0.2pp to growth. Business investment rose 0.5% after -0.4% q/q. Net trade took 0.8pp off growth as exports -3.6% and imports -0.8%. Industrial production was off 0.8% after +0.4% q/q.

- UK June industrial production up 0.4% m/m, +1.1% y/y after -0.4% m/m, 0.8% y/y – as expected. The manufacturing output rose 0.4% m/m, 1.5% y/y after 0.4% m/m, 1.1% y/y – more than the 1% y/y expected. Continued maintenance work at key pipelines

meant that the bulk of the rise in IOP output was provided by the manufacturing sector and specifically the exports of pharmaceuticals. The construction sector made up for lost work earlier in the year following up May's 2.9% m/m rise in work with a 1.4% expansion.

Market Recap:

Equities: The S&P500 futurres are off 0.5% after losing 0.1% yesterday, The Stoxx Europe is off 1.4% getting worse on Turkey, Italy with focus on banks. The MSCI Asia Pacific fell 1% with focus on Japan vs. China.

- Japan Nikkei off 1.33% to 22,298.08

- Korea Kospi off 0.91% to 2,282.79

- Hong Kong Hang Seng off 0.84% 28,366.62

- China Shanghai Composite up 0.03% to 2,795.31

- Australia ASX off 0.31% to 6,278.39

- India NSE50 off 0.36% to 11,429.50

- UK FTSE so far off 0.65% to 7690

- German DAX so far off 1.55% to 12,479

- French CAC40 so far off 1.15% to 5,439

- Italian FTSE so far off 0.90% to 21,300

Fixed Income: Core bonds rally with EM crisis fears – German 10Y Bund yields off 2.7bps to 0.345%, French OATs off 2.5bps to 0.685%, UK Gilts off 3bps to 1.265% - tempered by GDP and House of Fraser while periphery suffers with Italy up 3bps to 2.92%, Spain flat at 1.385%, Portugal flat at 1.75% and Greece up 7bps to 4.13%. Sweden post CPI sees yields 10Y drop 3.5bps to 0.465%.

- Italy sold E6bn of 12M Aug 2019 bills at 0.679% with 1.79 cover – previously 0.337% with 2.01 cover.

- US Bonds are bid with safe-haven buying, curve flatter – 2Y off 0.8bps to 2.637%, 5Y off 2.5bps to 2.782%, 10Y off 2.7bps to 2.899%, 30Y off 2.1bps to 3.049%.

- Japan JGBs rally with equity risk-off – 10Y off 1.5bps to 0.09%. BOJ Rinban left buying unchanged at Y490bn, offer to cover moves notable 1-3Y eases to 3.28 from 3.75, 3-5Y up to 3.22 form 2.74, 10-25Y rises 3.85 form 2.06 and 25+Y 3.20 from 3.07.

- Australian bonds rally sharply after SOMP and track US move – 10Y off 6.5bps to 2.585%. AOFM sold A$1bn of 5Y 2.25% of Nov 2022 TB153 bonds at 2.1839% with 4.671 cover – previously 2.2034% with 7.683 cover.

- China PBOC skips open market operations, leaves liquidity neutral. Money market rates were mixed – O/N rose 19bps to 1.817%, 7-day fell 3bps to 2.309%, 10Y bonds holding 3.55%.

Foreign Exchange: The US dollar index up 0.6% to 95.99 with 95.65 pivot for 96.10 and 96.45 next. In EM FX – turmoil continues with USD bid – ZAR off 1.5% to 13.907, TRY off 6.85% to 5.91 with 6.3005 highs. RUB off 0.30% to 66.86, Asia: TWD off 0.3% to 30.725, KRW off 11% to 1129, INR off 0.25% to 68.83.

- EUR: 1.1460 off 0.6%. Range 1.1432-1.1536 – trouble with 1.15 break is that its now 1.1420 and 1.1380 and 1.1250 grind with risk for Trump talk and ECB noticing.

- JPY: 110.95 off 0.1%. Range 110.61-111.17 with EUR/JPY 127.15 off 0.7% - watching 125 next for barrier. The calm sees at odds with EM with 110.50 pain for 109.80 back in play.

- GBP: 1.2765 off 0.45%. Range 1.2736-1.2837 with EUR/GBP .8970 off 0.2% - its all about EUR not GBP today with GDP good enough but 1.2750 break opens 1.2550 still.

- AUD: .7310 off 0.85%. Range .7281-.7380 with focus on crosses, SOMP and China still .7250 key. NZD off 0.25% to .6595 already moved yesterday on RBNZ. .6550 key.

- CAD: 1.3095 up 0.35%. Range 1.3044-1.3123 – trouble continues into key data today with BOC hike risks muted by Saudi, oil and EM but NAFTA hopes higher 1.3050 pivot for 1.2950 or 1.32 again.

- CHF: .9945 up 0.1%. Range .9926-.9975 with EUR/CHF 1.1395 off 0.5% - risk off means EUR/CHF lower and its delivering on Italy, Turkey stories with 1.00 key for USD and 1.1250 for cross.

- CNY: 6.8395 fixed 0.11% weaker from 6.8317, trades weaker to 6.8355 into London from 6.8233 close yesterday. CNH stable at 6.8580.

Commodities: Oil up, Gold off, copper off 0.75% to $2.7860

- Oil: $66.90 up 0.1%. Range $66.14-$6704. WTI watching $66.29 July 18 lows against $67.86 Aug 3 lows. Brent $72.25 up 0.25%, watching 55-day at $74.89 against $71.30 July 18 lows. Trade fears, EM contagion vs. supply and oversold condition.

- Gold: $1210 off 0.2%. $1205.50-$1212.80. USD up driving but Russia/China worries key watching $1206 and $1204.60 still. Silver off 0.5% to $15.36 with $15.25 key. Pleaningum off 0.35% to $829.80 and Palladium off 0.45% to $904.40.

Economic Calendar:

- 0830 am US July CPI (m/m) 0.1%p 0.2%e (y/y) 2.9%p 3%e /core 2.3%p 2.3%e

- 0830 am Canada July jobs 31.8k p 20k e / unemployment 6%p 5.9%e

- 1200 pm US WASDE report

- 0200 pm US July budget deficit $75bn p $59bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.