Markets Breakout - Tuesday, January 24

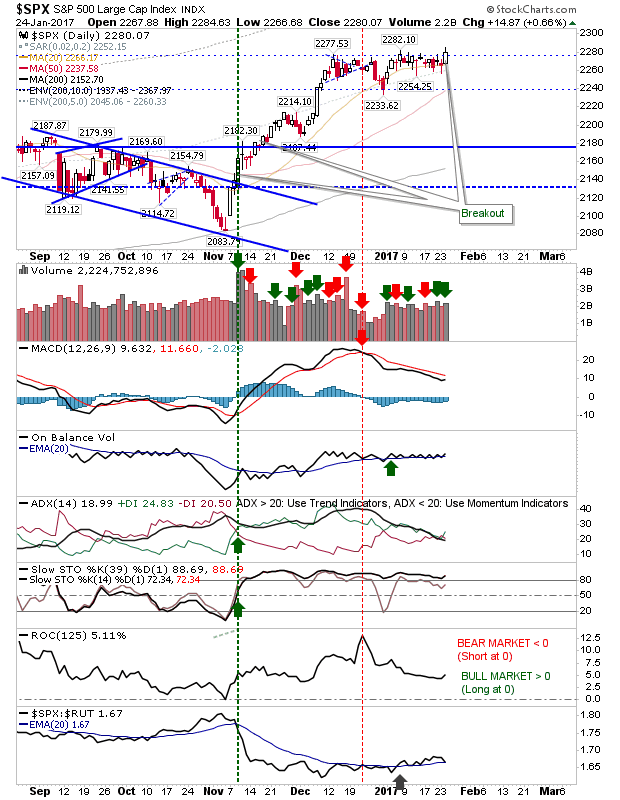

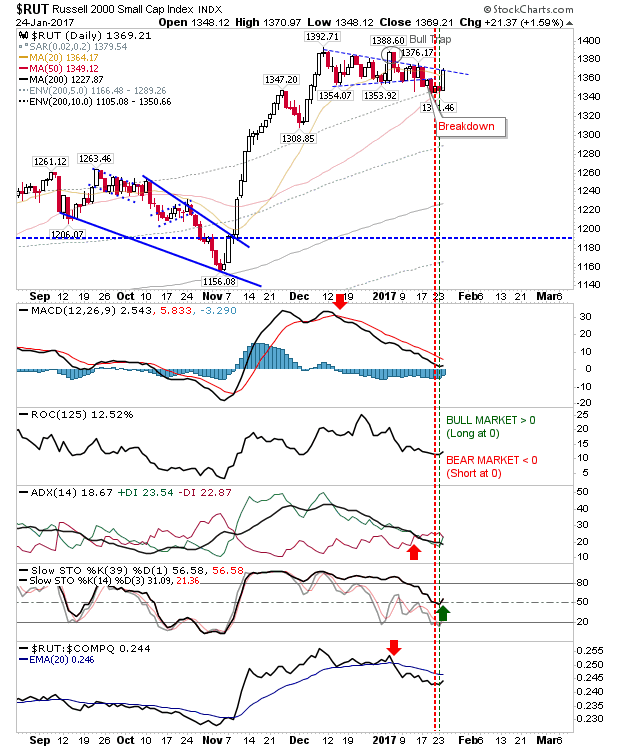

After yesterday saw the Russell 2000 finally switch to a net bearish turn in technicals, today saw markets move sharply higher. This generated breakouts for Tech and Large Cap indices.

The S&P enjoyed higher volume accumulation as it cleared the consolidation dating back to the start of December. The gains, while welcome, weren't enough to generate a MACD trigger 'buy'

The Nasdaq cleared resistance of a shorter handle from 2017. It did so with a MACD trigger 'buy' as all of its technicals are net bullish with strong relative out performance.

The Russell 2000 had the best of the action. As the index most exposed to shorting, traders are now on the defensive. The index hasn't yet gone to challenge the 'bull trap', but tomorrow could be the day. Slow stochastics have bounced off mid-line support in what may be later viewed as a buyers pullback. If the Russell 2000 is able to clear resistance it will leave a 'bear trap' - which itself will create its own bullish momentum and return the index to its November rally.

For tomorrow, shorts will be looking to become cover, or at the least adopt a more cautious approach going forward. Longs will be looking to take advantage of any weakness which brings indices back to fib retracement levels across today's intraday range.

Disclosure: None.

We hope too. Thanks