Markets Are Not Open To Simple Interpretations

“Davidson” submits:

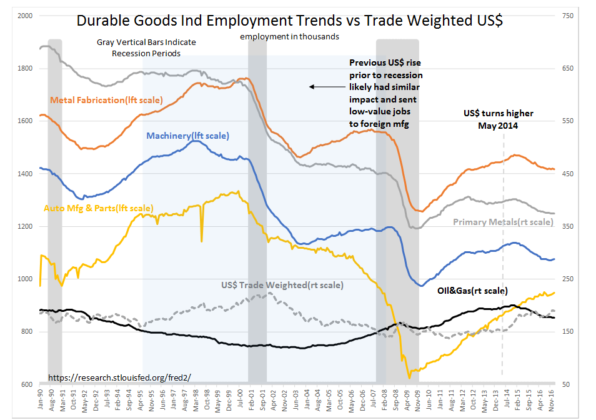

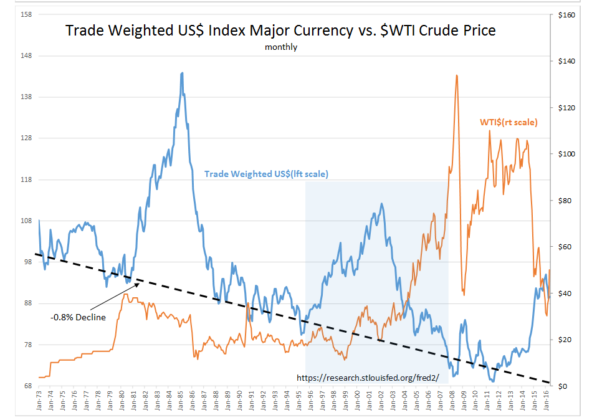

Our investment world is not simple. It is never open to simple interpretation. Often, what we think is occurring today is only explained in hindsight with a long term perspective. The complexity of markets can be seen through two charts. Durable Goods Ind Employment Trends vs Trade Weighted US$ shows the impact of US$ and recessions on employment in various Durable Goods sectors from 1990. The recession Feb to Oct in 2001 GRAY BAR was overlapped by a 1995-2008 strong US$ period(Light Blue Bar). Other periods of strong US$ can be seen in Trade Weighted US$ Index Major Currency vs. $WTI Crude Price. A strong US$ (higher than the long-term trend) began in 1995 and ended with the onset of 2008’s recession.

There are several important observations.

- US Durable Goods Industry employment is clearly and negatively impacted by periods of recession.

- It is also impacted when a strong US$ persists for several years as global investors seek higher returns in the US vs. global markets.

It can be seen in previous recessions and in the 2008-2009 recession that, as one would expect, Durable Goods employment falls in response to economic correction. But, one can also see that a strong US$ also lowers employment for Durable Goods companies involved in exports. The strong US$ period beginning in 1995 began to erode employment in these companies as the Internet Bubble raged well before the onset of recession in Feb 2001. The Internet Bubble drew global participants which in turn hurt Durable Goods. Machinery and Primary Metals sector employment peaked in Dec 1997. 2014-2016, again a strong US$ period, once again resulted in a Durable Goods recession in the middle of an economic expansion. Export sensitive employment peaked Jan 2015. The US$ rose sharply with the 2014 Russia invasion of Ukraine. The $WTI (West Texas Oil Price) plummeted shortly afterwards in response to algorithmic trading which had tied the US$ to $WTI. The US$/$WTI relationship had not been as correlated in prior strong US$ periods.

The US$ is in the context of global markets:

Markets are global. Markets are never open to simple interpretation. The US is the most productive and creative economy globally. We live here and often are unaware of the freedom and protections we have to individual rights and to individual property rights which are responsible for US economic achievement. US achievements have been many. In recent decades, the US created the Internet and the cell phone. The US invented thousands of products in the development and implementation of these two inventions. The iPhone is a phenomenal invention. The global impact on oppressed societies seeking Democracy is only recently being understood. No country put the resources to find a cure to Hepatitis C which has infected an estimated 100mil individuals till Gilead, a US company, produced this medical breakthrough. Medical breakthroughs, new cures and treatments are so routinely expected in the US that we are not overly surprised when they are announced.

Living in the US with new levels of creativity seemingly occurring every day, we take our inventiveness for granted. The 5th Amendment to the US Constitution provides individuals protection to benefit from their creative ideas. Individual property protections spur the benefits of individual creativity which we enjoy when businesses distribute them throughout a society seeking every advance in the standard of living. It is the attractiveness of our Free Market which periodically causes global capital to pool in the US resulting in a strong US$. Often, people refer to strong US$ periods as ‘currency manipulation’ by foreign governments. In my experience, it is investor perceptions (market forces) which dictate currency values relative to one another. Markets have far larger influence than government attempts to manipulate currencies. History is replete with government failures to peg one currency to another. Market forces respond to expected returns. Predicting when/why a global shift in market psychology is likely to occur is unpredictable. When a surprise strengthening to the US$ does occur, it is disruptive to our export industries. Note that Auto Mfg and Parts employment was not impacted Jan 2015. Vehicle sales are not overly export sensitive.

As the US enjoyed the current economic expansion, 2014-2015 was a period which drew global capital into the US. The US$ soared, 10yr Treasury rates fell and US REITs soared. In response, the export sensitive Durable Goods industries experienced a recession with employment falling 6%-8%. The Oil&Gas Extraction employment levels experienced the largest declines. Markets are never simple. They are a mosaic of economic fundamentals. The Russian invasion of Ukraine was a significant trigger of recent US$ strength and unpredictable.

All markets have cycles including the US$. At some point the US$ will return back to its long-term trend which is based on fundamentals involving US creativity and exporting its standard of living improvements overseas. As the US economic expansion continues, capital is already showing signs of returning back to the global markets from which it originated. It appears the US$ is gradually weakening and Intl markets are rising in response.

Markets are psychological while economics and business returns are fundamental. Capital has always been drawn towards better returns. I recommend that investors have Domestic and Intl exposures in portfolios with some specific exposure to the US$ sensitive commodity sector.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other ...

more