Markets: Another War?

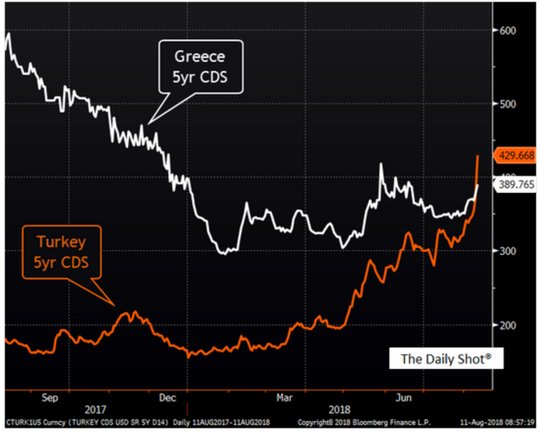

We started with trade wars, moved to currency wars and now are in economic war. Turkish President Erdogan uses the term as he rails like King Lear against the storm. The difference maybe just words but the sentiment is that all tools are available for retaliation. The sanctions from the US on Russia and Turkey are being blamed for the spark that caused this ongoing risk-off panic spread. The collateral damage is in ZAR where the currency is off 2.4% to 14.43 but touched 15.55 early. ARS is also reopening its wounds off another 4% to 29.22 now after touching 29.401 early.

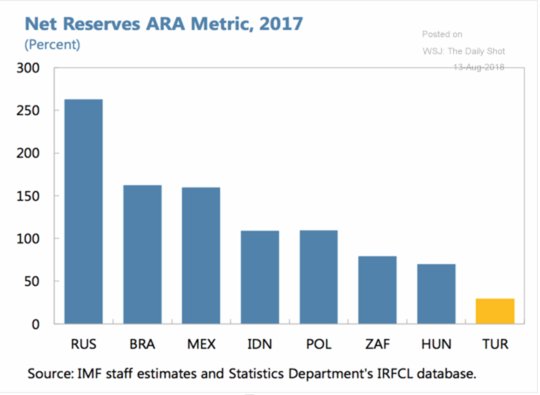

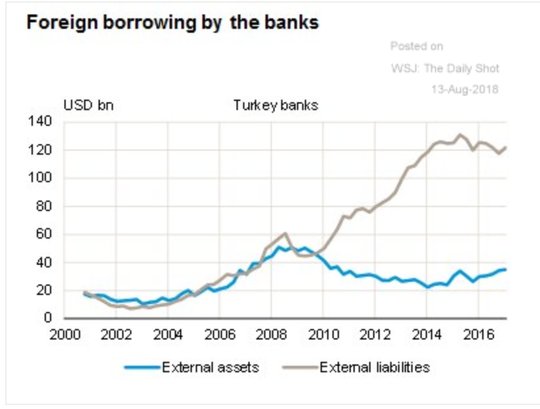

The root causes matter but the tinder for the present fire of fear has plenty of global fuel as investors rush to unwind long carry, long credit and short volatility trades everywhere. Whether today is a bottom or the capitulation moment for all risk positions won’t be clear for another few weeks. It’s not a bottom until you hit something. Perhaps it’s not a war until an economy fully crumbles – but given that TRY is off another 7% with 7.236 highs followed by intervention to 6.4469 and the inevitable bounce back, now 6.85 – it’s getting close if FX is the national barometer for economic health. The Turkish Central bank announced that banks would be provided all needed liquidity, collateral deposit limits were cut and banks were allowed to borrow FX deposits in 1-month maturity – effectively freeing up $6bn of liquidity and $3bn in gold. This works until the money runs out.Others are using the term economic war beyond Turkey. The US. is aiming for an "economic war" rather than trade war to restrict China's right to technological development, as the USD50 billion tariffs mainly target industries related to the development-focused "China 2025"campaign the 21st Century Business Herald said in a commentary. All of these point about economic war show up in markets today beyond EM FX.The sea of red for equities, the bid to bonds, the rise in volatility and the unwind of carry trades.

The game for today is going to be in watching for more headlines from Trump or Turkey or Russia or China as they now play beyond trade and currencies. The risk for USD intervention is on the rise accordingly. The best way to measure a panic in 2007-2008 was with AUD/JPY – watching 80 today maybe the right place to start if we are truly facing an economic war front.

Question for the Day: What can fix the Turkey crisis? The start of the Turkish devaluation in 2018 wrapped around the February crisis and the decision of Erdogan to have snap elections. This led to a hit to central bank credibility as his economic plan and appointments and efforts to change the independence of the bank hit credibility. Then the jailing of a US pastor led to the Trump sanctions and we now have a full-blown crisis for the currency and economy. The government has a few ways to solve the problem:

- Cave in to US pressures.This would mean releasing the US prisoner. It would be a huge retreat for Erdogan and seems unlikely. However, it would mean US sanctions and tariffs would likely be reversed.

- Military Coup. While the failed coup in 2017 led to the Erdogan purge there is still many in the country that see the military in control and given the economic crisis they maybe in play – and the likely follow-through would be a repairing of US relations.

- Find new friends. Sunday, Erdogan said: “Our response to the person who wages a trade war against the whole world, including our country, is to head towards new markets, new co-operation and new alliances.” The problem here is that China, Russia and Qatar are all unlikely to be able to foot the $200bn a year that Turkey needs to keep its economy afloat. Only the US and EU are able to help enough to matter. Further, the Russia/Syria conflict seems an important problem for Turkey as it reaches out to Russia and China both of which have their own US issues hitting their economies.

- Radical restructuring. If you can’t borrow, you restructure – you restrict all capital and force deleveraging everywhere. Most see an IMF like bailout requiring $20-50bn something similar to the Argentina money. This would mean plunging the country into full blown recession and likely ending Erdogan’s political power.

What Happened?

- Spain June service sector sales up 7% y/y from 6.1% y/y with employment up 2.1% y/y. The June industrial orders were up 2.4% y/y.

- Italy July final CPI up 0.3% m/m, 1.5% y/y after 0.1% m/m, 1.5% y/y – slightly more than 1.4% expected. Food was up 2.4% with alcohol and tobacco up 4.2% y/y and transportation up 4.2% with deflation in communications -3% and education off 16.1% y/y.

Market Recap:

Equities: A sea of red, US S&P500 futures are off 0.35% after losing 0.71% Friday. The Stoxx Europe 600 is off 0.65% near opening levels, while the MSCI Asia Pacific fell 1.3% with Japan leading losses.

- Japan Nikkei off 1.98% to 21,857.43

- Korea Kospi off 1.50% to 2,248.45

- Hong Kong Hang Seng off 1.52% to 27,936.57

- China Shanghai Composite off 0.32% to 2,786.25

- Australia ASX off 0.40% to 6,341.30

- India NSE50 off 0.66% to 11,354.55

- UK FTSE so far off 0.45% to 7,632

- German DAX so far off 0.55% to 12,355

- French CAC40 so far off 0.35% to 5,396

- Italian FTSE so far off 0.85% to 20,906

Fixed Income: Bonds are bid with Turkey and other EM pain driving safe-haven core EU buying along with US. Italy suffers further and spreads are in focus everywhere. Both Italy and Spain cancelled their auctions this week leaving Germany tapping a 30Y bond for E1bn as the only supply ahead.

- Germany sold E2.075bn of Feb 2019 Bubills at -0.6317% with 1.8 cover – previously -0.6166% with 1.7 cover.

- US Bonds are bid with focus on belly of the curve and steepeners – 2Y off 1.2bps to 2.592%, 3Y off 1.6bps to 2.663%, 5Y off 1.7bps to 2.728%, 10Y off 1.1bps to 2.862% and 30Y up 0.4bps to 3.034%

- Japan JGB see curve flattening with risk-off driving – 10Y flat at 0.10% while 30Y off 1bps to 0.833% - lowest since Aug 2.

- Australian bonds rally on risk-off curve flattening after good auction – 3Y up 1bps to 2.015%, 10Y off 1bps to 2.58%. The AOFM sold A$400mn of 3.75% 20Y Apr 2037 bonds TB144 at 2.867% with 2.145 cover – previously 3.058% with 2.54 cover.

- China PBOC skips open market operations again, leaves liquidity neutral. This week sees CNY336.5bn of MLF maturing Wednesday.Money market rates rose with O/N up 29bps to 2.303% and 7-day up 14bps to 2.445%. 10Y bond yields rose 3bps to 3.58%.

Foreign Exchange: The US dollar index up 0.2% to 96.41 – new yearly highs – with 97 next big focus. In EM FX is USD bid – Asia: KRW off 0.45% to 1134, TWD off 0.35% to 30.83, INR off 1.4% to 69.83; EMEA: ZAR off 2.4% to 14.44, TRY off 6.5% to 6.88, RUB off 0.25% to 67.967

- EUR: 1.1385 off 0.25%. Range 1.1365-1.1412 with focus on stops to 1.1250 and Turkey/Italy fallout – talk of 1.10-1.15 barriers.

- JPY: 110.35 off 0.4%. Range 110.11-110.75 with EUR/JPY 125.60 off 0.7%. Focus is on equities and risk mood with 110 stops for 108.80 target. EURJPY 125 key as well.

- GBP: 1.2750 off 0.1%. Range 1.2724-1.2783 with EUR/GBP .8930 off 0.1% - stabile in comparison to EUR but 1.2550 beckons with data ahead this week key.

- AUD: .7275 off 0.35%. Range .7251-.7300 with .7250 the key now and AUD/JPY break of 80 looking dangerous – copper and risk off driving. NZD .6580 off 0.15% with .6550 key.

- CAD: 1.3150 up 0.1%. Range 1.3137-1.3177 with focus on EM/NAFTA and rates – risk off means 1.32 back in play.

- CHF: .9945 off 0.1%. Range .9921-.9957 with EUR/CHF 1.1325 off 0.3% - all about risk off and Italy/Turkey with 1.1250 key for cross and $1.00 holding.

- CNY: 6.8629 fixed 034% weaker from 6.8395 Friday fix, trades weaker to 6.8765 into London from 6.8574 official close Friday. The RMB index gained 0.24% to 92.91 in the last week and the move today still implies its trading at 3-week highs given other EM weakness.

Commodities: Oil up marginally, Gold off, Copper down – 0.65% to $2.7655.

- Oil: $67.65 flat. Range $67.29-$67.95. WTI watching $67.86 Aug 3 lows against $66.14 Aug 10 lows – with $66 key uptrend support in play. Brent $72.94 up 0.15% watching $74.96 – 55-day ma. – as key resistance with $71.30 July lows as support and $70.80 channel support.

- Gold: $1201.60 off 0.75%. Range $1201-$1207.50. Gold watching $1195 and $1180.60 for next minor support as August lows give way with $1215.80 Aug 7 highs now key resistance. Silver off 0.13% to $15.18 - watching $15.179 July lows then $14.79 April 2016 lows with rallies to $15.554 Aug 3 highs sold. Platinum off 1.6% to $814 and Palladium off 1.55% to $896.50.

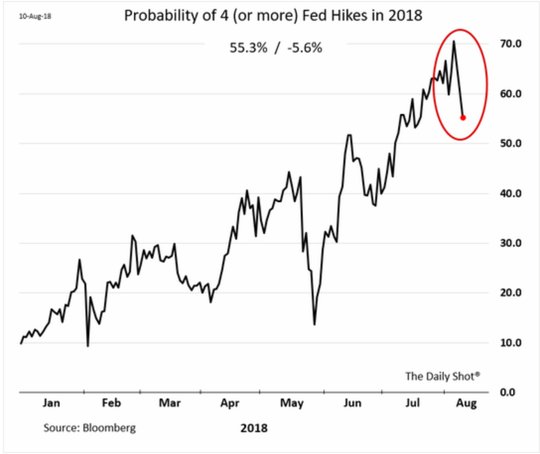

Conclusions: Does financial stability still matter? The Friday price action coupled with an expected CPI left markets watching stocks and the global EM moves as a guide. Today isn’t much different. The balancing act is whether the rest of the world matters to the FOMC. The moves in Turkey suggest they do and that is why the market is unwinding some of the bravado of 4 hikes in 2018 – but it may just mean 3 hikes in 2019 – time will tell.

Economic Calendar: No Major Releases

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.