Markets: 48

The focus on UK Brexit and the uncertainty of the EU/UK deal and the fate of UK PM May remains the headline story. There are 48 letters needed for a leadership challenge and the count is 20 so far. 48 is also the hours in the weekend and many seem to have that in mind as trading dwindles into the US Thanksgiving holiday week ahead. You can buy 48 chicken nuggets in a bucket in Japan, one for each hour of waiting. 48 is the tag for freight trains cars that hold truck containers. The point is that there is a trainload of events in the week ahead despite the noise of today to remind investors that risk is a four-letter word. We could wait for GBP to break 1.27 or 1.32 before trading anything and be happy (at least for the next 48 hours.). Or we could pay attention to what happened elsewhere and consider the opportunities. While this was the week that was supposed to lock in the Brexit deal and Italian budget fudges and US/China pre-talk agreements we have had no such certainty. Markets obsess about the US/China trade deals in the making and consider the brake to euphoria from Wilbur Ross late yesterday. China shares rally while Japan stumble again. We just have to wait for the G20 in Argentina for clarity there. NZD and AUD both rallied for the third week despite the China doubts on growth. NZD is the star performer and maybe the one to focus on into the next week if you are looking for clarity, as this is either a counter uptrend doomed for failure or the start of a massive global recovery led by 3 million people. No one can be sure of the outcomes and so its unlikely to see much joy in today’s tape for the US. Watching what moves maybe the best way to spend your next 48.

Question for the Day: Does the ECB Draghi speech open an extension of QE and lower for longer rate policy? The short-answer is no. But given the doubts about UK Brexit, Italy’s budget and politics whether Greek elections, Germany leadership – all have put 2019 as a tough year for bigger confidence for consumers or corporations in Europe. ECB President Draghi spoke today at the Frankfurt European Banking Congress about the outlook for the Eurozone economy. There is one key question he tries to answer – is the 2H2018 growth a soft-patch or the beginnings of a recession. One interesting point to remember is that this is a swan song, his last speech for the banking group with the Banking Union plans that he pushed back in 2011 still not finished in 2018. Here are my takeaways:

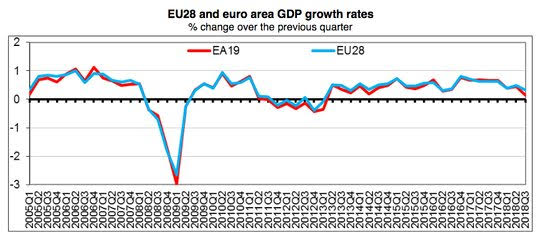

1) Draghi doubts this is anything more than a “soft-patch.”There is certainly no reason why the expansion in the euro area should abruptly come to an end. A gradual slowdown is normal as expansions mature and growth converges towards its long-run potential. But the expansion in the euro area is still relatively short in length and small in size.

2) There are logical reasons for the slowing. He cites one-off factors like weather, auto emission standards, global trade growth moderation.

3) There are some bigger supports for growth. Employment growth, with higher wages expected, supports consumption. Beyond that cycle is the larger structural changes like pension reform, more service sector growth over exports, better financing conditions – aided by ECB policy.

4) Forward guidance is data dependent. Draghi, much like the Fed, wants to have his cake and eat it too. While he intends to end QE and to keep rates low for longer, he notes – “If financial or liquidity conditions should tighten unduly or if the inflation outlook should deteriorate, our reaction function is well defined. This should, in turn, be reflected in an adjustment in the expected path of future interest rates.”

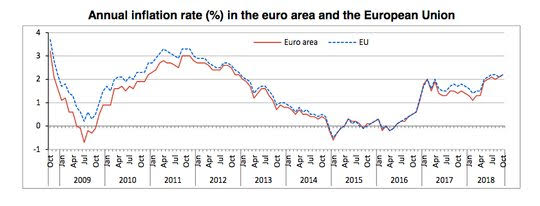

Here are the two charts that keep the ECB behind the risk curve for larger financial condition volatility – first is the rise in inflation which reflects energy moves first, then service inflation, then food. Second is the growth of the economy,

What Happened?

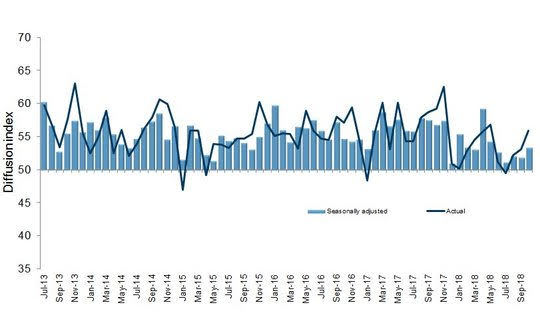

- New Zealand October BusinessNZ PMI rises to 53.5 from 51.9 – best since May. Employment rose 5o 51.3 from 48.9, production jumped to 59.4 form 51.5 and new orders rose to 59 from 56.4. In line with the improved overall result, the proportion of positive comments (58.3%) also increased, with demand for products from offshore customers noted throughout. Others noted seasonal impacts such as improving weather conditions, as well as pre-Christmas season orders. BNZ Senior Economist, Doug Steel said that "the improvement in the PMI is not large, but we see it as important to the broader economic narrative.”

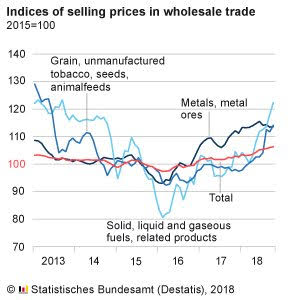

- German October WPI up 0.3% m/m, 4% y/y after 0.4% m/m, 3.5% y/y. Grains/Seeds rose 2.1% m/m, 17% y/y, animals fell 6.1% m/m, 9.7% y/y, Food/Drink -0.3% m/m, +1.7% y/y, Fruits/Vegetables -1.5% m/m, +9% y/y, clothing 0.1% m/m, 0.5% y/y, fuels and products 3.5% m/m, 24.1% y/y, metals and ores +0.2% m/m, 2.4% y/y.

- Italian September Industrial Orders -2.9% m/m, -0.9% y/y. The breakdown of orders was 0% for domestic and -6.7% for foreign m/m with the 3Q average -1.9% domestic and +2.6% foreign. The industrial sales were 0% m/m, up 3.9% y/y with domestic up 0.7% m/m, foreign -1.1% but 3M average -0.4% domestic, +1.3% foreign.

- Eurozone October final HICP unrevised at 0.2% m/m, 2.2% y/y after 0.5% m/m, 2.1% y/y – as expected. The core rate was also unrevised at 1.1% y/y after 0.9% y/y – as expected.

Market Recap:

Equities: The S&P500 futures are off 0.6% after rising 1.06% yesterday. The Stoxx Europe 600 is off 0.1% - down for the week. The MSCI Asia Pacific was flat. MSCI EM rose 0.1% - best in a week.

- Japan Nikkei off 0.57% to 21,680.34

- Korea Kospi up 0.21% to 2,092.40

- Hong Kong Hang Seng up 0.31% to 26,183.53

- China Shanghai Composite up 0.41% to 2,679.11

- Australia ASX off 0.04% to 5,822.80

- India NSE50 up 0.62% to 10,682.20

- UK FTSE so far off 0.3% to 7,018

- German DAX so far up 0.10% to 11,365

- French CAC40 so far flat at 5,033

- Italian FTSE so far up 0.20% to 18,945

Fixed Income: Risk confusion leaves bonds watching equities and awaiting more headlines on Brexit, trade, politics. UK Gilts are the front line of this game with 10-year yields up 4.5bps to 1.405% as UK May holds on. German Bunds up 1bps to 0.365% while French OATs up 0.7bps to 0.755%. Periphery better with Italy off 5.5bps to 3.43%, Spain off 0.5bps to 1.625%, Portugal off 0.5bps to 1.955% and Greece off 2bps to 4.515%.

- US Bonds see bear curve flattening with focus on Thanksgiving week next – 2Y up 0.8bps to 2.862%, 5Y up 0.3bps to 2.941%, 10Y up 0.4bps to 3.114%, 30Y up 0.4bps to 3.363%.

- Japan JGBs rally further, curve flattens on equities– BOJ left it’s buying unchanged at the Rinban. 2Y off 0.3bps to -0.15%, 5Y off 0.4bps to -0.1%, 10Y off 0.7bps to 0.092%, 30Y off 0.4bps to 0.849%.

- Australian bonds bounce back with China growth worries, US moves– 3Y off 2.5bpst o 2.075%, 10Y off 4bps to 2.675%.

- China PBOC skips open market operations again leaves liquidity neutral. China sold 50Y bonds at 3.82% with 3.0845 cover. China bonds extend rally 2Y off 1bps to 2.75%, 5Y off 2bps to 3.13%, 10Y off 3bps to 3.33%.

Foreign Exchange: The US dollar index rose 0.1% to 97.00 with 96.76-97.05 range – focus remains on EUR and GBP first. In Emerging Markets, USD mostly bid – EMEA: ZAR off 0.4% to 14.23, TRY flat at 5.3525, RUB off 0.45% to 66.16; ASIA: TWD off 0.1% to 30.887, KRW flat at 1128.50 and INR up 0.1% to 71.925.

- EUR: 1.1335 up 0.1%.Range 1.1322-1.1368 with 1.12-1.14 intact but Draghi sounded hawkish enough to help while UK Brexit and US data remain in play.

- JPY: 113.25 off 0.35%. Range 113.22-113.65 with EUR/JPY 128.40 off 0.3%. Doubt about global growth and US/China rising with 112-114 in play.

- GBP: 1.2815 up 0.3%.Range 1.2762-1.2834 with 1.26-1.29 still the death watch for Brexit and UK May –EUR/GBP .8845 off 0.25% - reprieved for now but .8750-.8950 key.

- AUD: .7255 off 0.3%. Range .725-.7288 with China doubts and equities moderating rally .7150-.7350 in play. NZD off 0.35% to .6805 with .6840 highs on better PMI.

- CAD: 1.3175 flat. Range 1.3149-1.3183 with oil helping, data mixed 1.3120-1.3280 consolidation.

- CHF: 1.0075 up 0.1%.Range 1.0053-1.0087 with EUR/CHF 1.1420 up 0.15% - watching Italy and Brexit with 1.0020-1.0180 key

- CNY: 6.9377 fixed 0.02% stronger from 6.9392, now off 0.15% to 6.95 with range 6.9275-6.9537.

Commodities: Oil up, Gold up, Copper off 0.15% to $2.8080. Worth noting that China iron ore rose 1.5% today, but off 0.8% on the week with mills facing winter pollution restrictions.

- Oil: $57.33 up 1.5%.Range $56.42-$57.66 with talk that $55 was the blow off stop zone and now key support with $60 the resistance. Focus is on OPEC response, global growth. Brent up 1.7% to $67.76 with $65-$70 consolidation game.

- Gold: $1216.45 up 0.25%. Range $1213-$1217. Silver flat at $14.30. Platinum flat at $842.65 and Palladium up 1% to $1169.30.

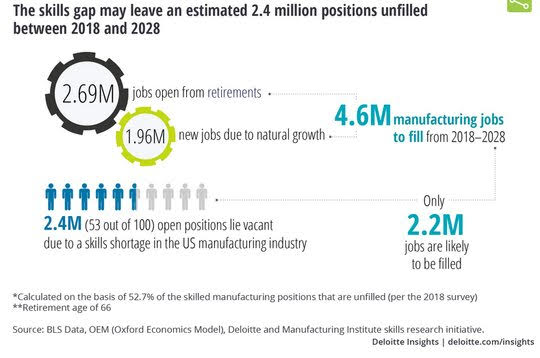

Conclusions: Is there a peak jobs market? The latest read on jobs is that they continue to grow. There is one read for the weekend to consider in the debate over 2019 and outlooks that are starting to populate the email inbox. Peak earnings and peak growth link to peak jobs. The article to read this weekend maybe the one from Deloitte on its manufacturing skill gap and jobs that need to be filled in the years ahead. The point is that without more workers with better skills, $0.5trn of manufacturing growth is at risk in the next decade. Something to consider when you start to stare at the US industrial production data and the capacity utilization figures today.

Economic Calendar:

- 0830 am Canada Sep Manufacturing sales (m/m) -0.4%p 0.4%e

- 0915 am US Oct Industrial Production (m/m) 0.3%p 0.2%e / Cap Utils 78.1%p 78.2%e

- 0400 pm US Sep TIC net capital flows $108.2bnp $128bn e / Long-term $131.8bn p $57bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.