Market Valuation Continues To Decline

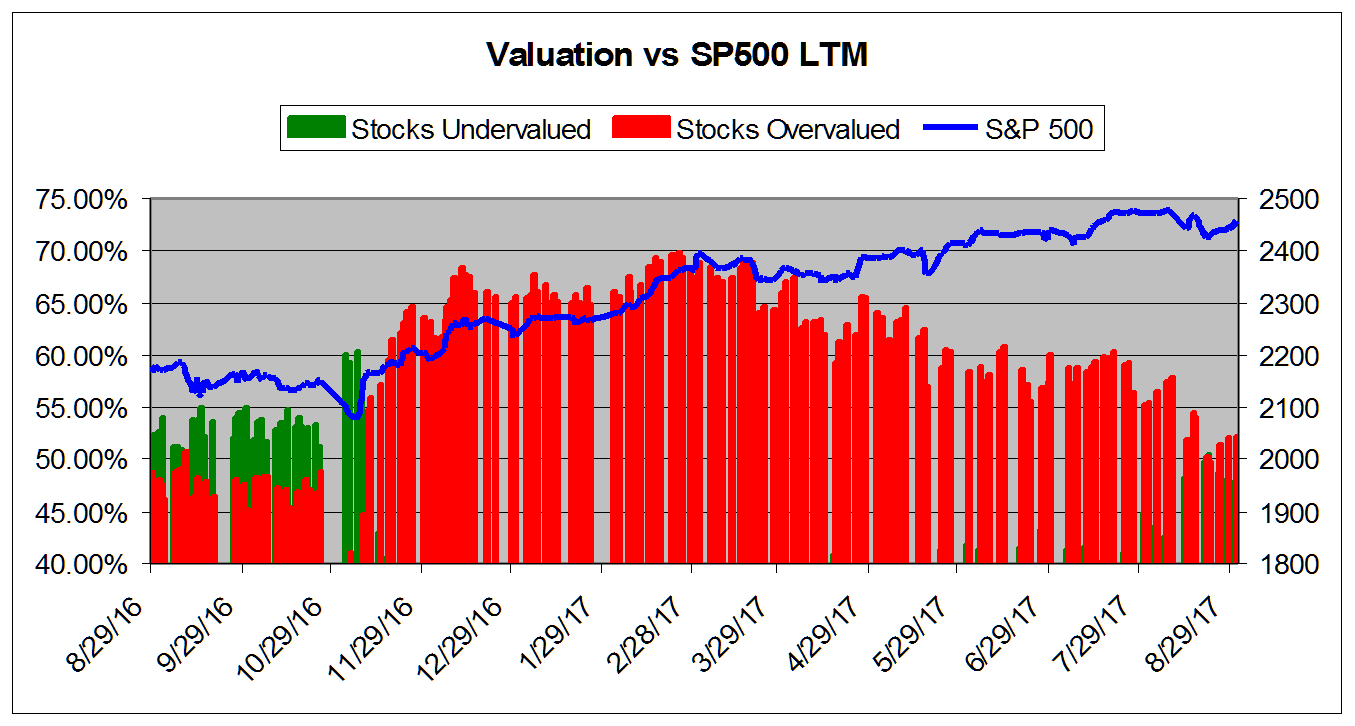

We now calculate that 52.16% of the stocks to which we can assign a valuation are overvalued and 19.68% of those stocks are overvalued by 20% or more. These numbers have declined fairly significantly below what we saw when we published our last valuation study in June. At that time, we saw an overvaluation figure of 58.8%.

We fell below the critical 60% threshold for an overvaluation watch near the end of July. Since then, we have seen lower overvaluation figures and we even saw a few days where undervalued stocks outnumbered those calculated to be overvalued last week.

Markets remain strong, but investors are clearly questioning whether the US President, Donald J Trump, will be able to deliver on any aspect of his proposed agenda. Jitters over the potential exit of economic advisor Gary Cohn in the aftermath of the right-wing riot and murder in Charlottesville--and Trump's lackluster response and subsequent "tantrum" over that response--provide evidence that it is no time to be sanguine about the markets despite the declining overvaluation.

We also see another issue here, good for stocks but perhaps cautionary as well. Despite the recent actions of the Fed vis-a-vis interest rates, the US dollar is NOT holding strong against traditional rivals such as the yen or Euro. Global crises, fear over North Korea, etc. have not seen the traditional "flight to safety" and global investors have not put their funds into dollars.

Concerns over US stability and the actions of Trump may be scaring people away from the dollar. That's not good. In addition, Trump's own recent comments, where he called for a US government shut down if Congress refuses to provide funding for a border wall--for which he promised Mexico would pay during the campaign-- is NOT the sort of policy/strategy that will ultimately benefit investors-- or their portfolios.

We do not believe that playing around with the full faith and credit of the United States is a good strategy for any leader in Washington, let alone one whose overall judgment and competence is being increasingly called into question--even by members within his own party.

We would hope that economic officials might take steps to reassure investors and the business community and take action to blunt some of the president's more problematic instincts when it comes to economic affairs--much as we have seen State Department and Defense officials like Rex Tillerson and James Mattis act within their own purviews. Like we see with so many policy issues, Trump has not demonstrated the sort of competence one expects to see from the occupant of the White House.

These concerns aside, overall we retain our positive outlook for the markets.

The chart below tracks the valuation metrics from August 2016. It shows levels in excess of 40%.

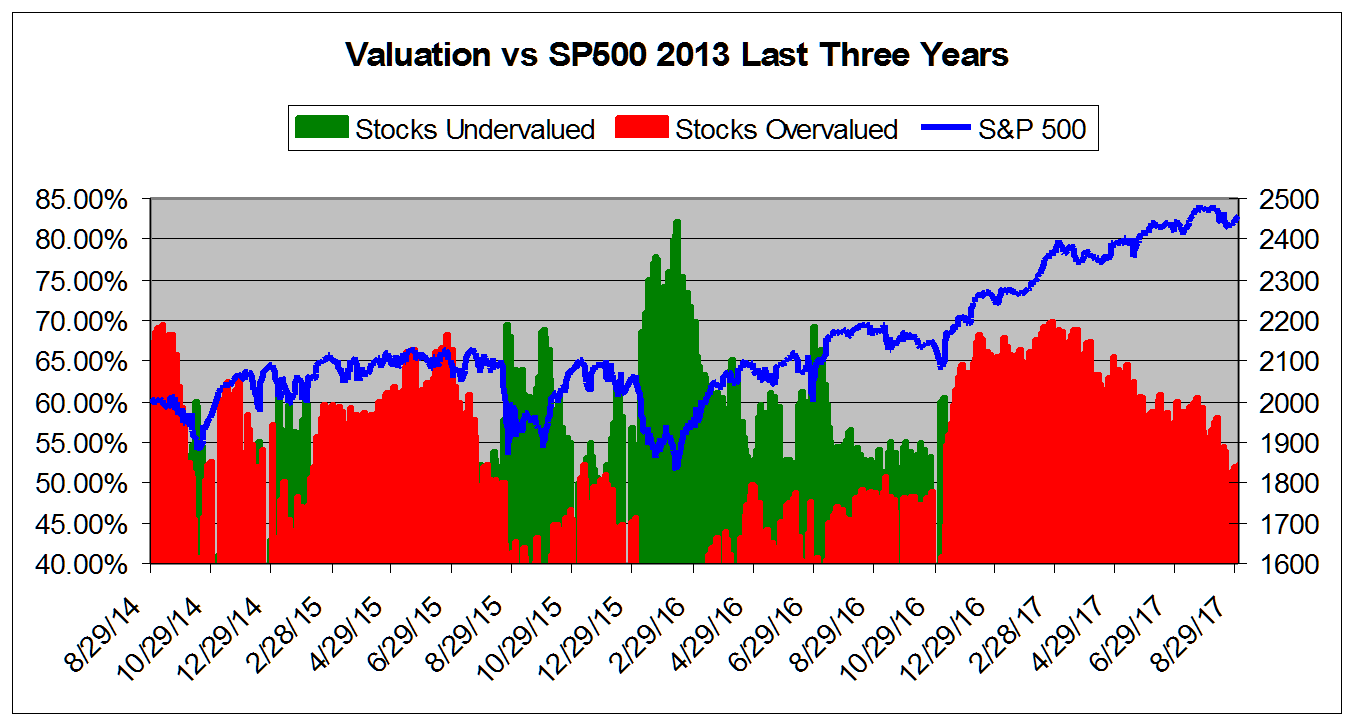

This chart shows overall universe over valuation in excess of 40% vs the S&P 500 from August 2014

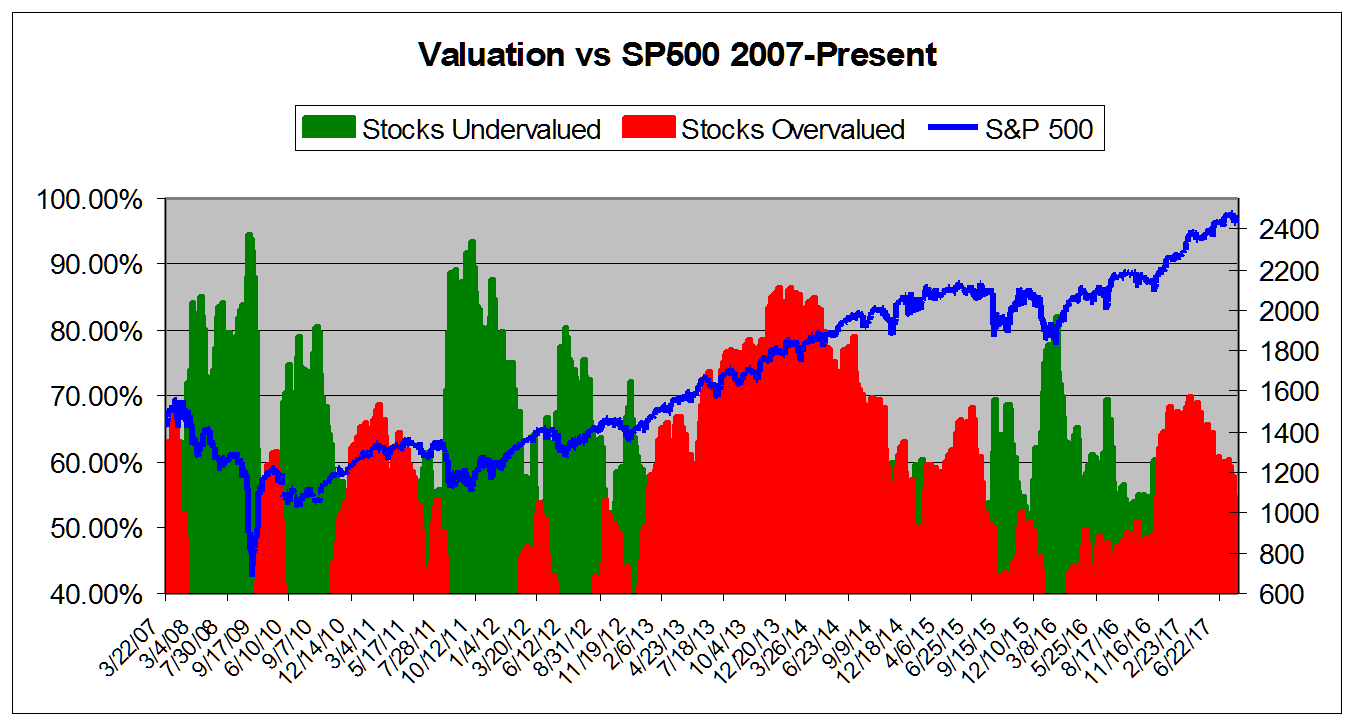

This chart shows overall universe under and over valuation in excess of 40% vs the S&P 500 from March 2007*

Disclosure: None.