Market Direction Is No Longer Important

In February of 2018 the financial dam welling up all asset prices sprang a leak, demonstrating to newer investors that markets can actually go down – a lot, and fast. However, the Fed’s derivative finger was quickly applied to plug up the hole, and financial waters again started to rise toward their previous level. With a current change in Federal Reserve’s leadership and direction, we are likely to experience increased market volatility with attendant significant and frequent fluctuations in asset values.

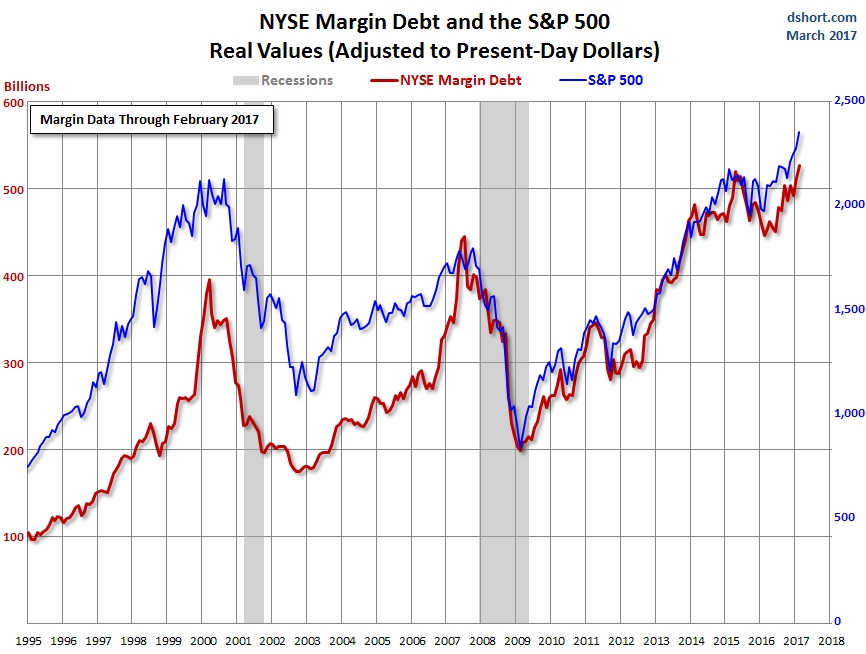

The partial recent recovery in financial markets likely provides comfort to those who in February experienced record declines in their investment portfolios. However, no such comfort should be taken. The high level of confidence among professional money managers previously relying on loose monetary policy by the Fed-levitating our equity and fixed income markets had caused a high percentage of money relative to total portfolio assets to be already invested, which leaves little cash reserves to further stimulate or maintain present market prices. And record high margin of debt among individual investors as well as hedge funds provides little room for additional borrowed money to add new investment into these markets. Rising interest rates or a modest market correction could easily start a more serious market decline, driven by margin calls and liquidation of assets.

Note in the preceding chart that at both market peaks in 2000 and 2007, margin debt had concomitantly risen to record heights. But more important is the rise in margin debt to even higher levels since the last market peak. Note also, that if one purchased stock in 2000 it took another eight years to break even; if one purchased stock in 2007, it took about seven years to break even. Our current markets index suggests that it may take an equal or longer time to break even after the current peak.

Similarities to the Great Depression

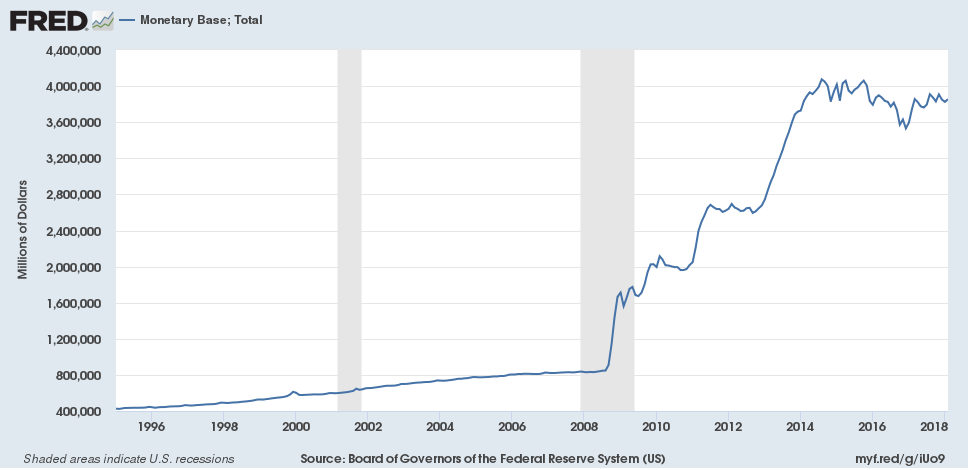

Our financial markets appear to be in a situation not dissimilar to that of the Great Depression of the late 1920’s, where stock market margin debt was record high, and interest rates were being raised by the Fed to reduce speculation. Over the last ten years, investors have been gaming the Fed by participating in markets as long as there is excessive money printing, euphemistically called quantitative easing.

At the time of the Great Depression, our government called for tariffs on foreign goods which accelerated economic decline and extended the depression. Recently president Trump has called for tariffs on steel and aluminum, which could be the single rolling stone that starts the global tit for tat avalanche of trade-restrictive policies. Protective tariffs can be vital to protecting and maintaining production capacity in strategically vital industries, and therefore are important for national security considerations. However, tariffs on trade did not help the global economy of the 1930’s; and this time such a gambit could be far more dangerous because of our large national debt held by foreign sovereign countries – for a trade war could escalate to the point where foreign U.S. Treasury security holders sell such securities into the open market either because of budgetary need or retaliation, starting a rout of our own bond and currency market.

Globalism and free markets

Over previous decades, the United States has been the primary leader in promoting globalism and free trade. As the country which was omnipotent after WWII, the emerging dollar as a globally preferred currency was a boon to America. Increasing trade based on America’s then great manufacturing infrastructure and the destruction of competing manufacturers due to devastating war bombing promoted increased economic and financial global dominance by the U.S. So arguing for “free trade”, which required other countries to reduce their tariffs, was an advantage to America.

At that time increasing the amount of currency by the Fed also worked incredibly well, because it allowed America’s elite to purchase war-torn foreign manufacturing operations at pennies on the dollar, or provide foreign investment dollars which translated into large equity ownership shares of strategic foreign businesses, or lend money on foreign government-backed surefire country projects at very attractive rates as those countries clamored to get more dollars for post-war rebuilding. Even after the closing of America’s gold window in 1971, demand for the dollar continued, as the ingenious idea of oil being purchased globally with only the use of dollars was sold to Saudi Arabia. Monetary growth facilitated veiled financial warfare which was then presented as generous country-saving or developing infrastructure loans. It took decades of actual borrowing experience before debtor countries collectively understood that the IMF and the World Bank were also America’s post-war financial warriors and conquerors.

US wanted free markets/globalization because as the most advanced and powerful country, its imposing open markets on the world benefited the US. Accordingly, globalism was pursued. Today, in one part due to our gargantuan national debt, and in second part due to China’s developing its BRI (Belt and Road Initiative) which will open new markets in presently economically backward regions or the world – and will be transacted utilizing the Chinese Yuan rather than the dollar, and utilize the Asian Infrastructure and Investment Bank (AIIB) rather than the International Monetary Fund (IMF) – the US will not benefit from this growth Accordingly, president Trump has already acted to restrict open markets, because as America slowly recedes from its hegemonic global leadership, free market globalism is no longer quite as attractive to the US. This is why it is the Chinese who are now promoting open markets because they now see that with their modern manufacturing infrastructure in place pursuing open markets and globalism will become increasingly financially and geopolitically attractive to them.

Predictive markets and manipulation

The stock market used to provide a reliable predictive signal for the direction of the economy, but it is important to understand that this is no longer true. Now, with so much FED market manipulation, it becomes at best a lagging indicator, or at worst no indicator at all. In February, a whistleblower surfaced and filed suit contending that the volatility index VIX was being manipulated. Actually, the leverage of financial derivatives has been utilized for decades to influence financial markets both foreign and domestic. Financial warfare has been practiced against friend and foe alike. For a recent example, consider that Bitcoin was in record price territory when a listing of derivative contracts freshly created on the CBOE and CME quickly reduced their market price by half. We are not arguing for any appropriate valuation for Bitcoin, but rather that its value quickly declined only after the derivative contracts were available for price manipulation.

Dramatic moves in oil and some currencies over short periods of time and the lack of rise in the price of gold can only be achieved with manipulation. Indeed the levitation of our equity and fixed income bubble markets cannot be achieved without the actions of our central bank. In addition to the Fed’s Open Market Operations, forward signaling of interest rate actions and announced quantitative easing (QE - money printing) or quantitative tightening (QT - reduction of money supply) informs and also manipulates markets. Finally, the circular argument that markets are safe because the economy is strong, which is supposedly confirmed by our ever-rising markets of the last ten years, is simply illogical and financially dangerous.

The only way these markets can continue to be maintained at present levels or advance is by the process of rapidly increasing destruction in the purchasing value of our fiat money. However, such destruction “solves” the problem and payback of our unsustainable national debt held by both foreign and domestic investors. By this reasoning, we could experience further increasing prices of financial assets – but this means that a market advance will not be satisfying because it will accelerate the complete loss of faith in our monetary system. That reduction of faith in the dollar would have global consequences – all of them immensely negative.

Market valuation and challenges

Former Federal Reserve Chairman Mr. Greenspan stated in a recent newscast interview that “we are in a bond market bubble, and stock prices will fall.” Many highly regarded money managers have made similar comments over the last several years.

However, now that the Fed is exercising quantitative tightening – that is, taking money out of the banking system, the markets have already started that downward readjustment. To put it in the vernacular of former Fed Chairman Bob McNamara, central banks are taking away the punch bowl, and the stock market party is ending.

Our economic challenges and problems have been well known for long periods of time, but our elected politicians have neither shown respect for voters by addressing or implementing their mandates, nor shown the courage to acknowledge our budget and accumulated debt problems at all. Budget deficits driven by welfare/entitlements will increasingly impoverish the nation and help undermine its currency. More deficits created by the inordinate cost of our dispersed military presence globally, which with today’s ballistic nuclear weapons also possessed by nations not friendly to the United States, does little to enhance our national borders and security. Then there is the expected dramatic escalation of interest costs to service our growing national debt. Let us not forget also our decade’s long inability or unwillingness to address our balance of trade problems. Despite president Trump’s valiant and successful efforts to increase national employment, competitive low cost labor abundant worldwide will eventually reduce again long term job availability for Americans, which together with robotics and artificial intelligence will exert unabated downward pressure on worker salaries.

China and CRISIS nations

The increased coalescing of countries around China’s Belt and Road Initiative together with its forming the Asia Infrastructure and Investment Bank (AIIB), the National Development Bank (NBD), Chinese International Payment System (CIPS), AESEAN trade group, regional protective group Shanghai Cooperation Organization (SCO), a new oil futures market priced in Yuan, and Shanghai Gold Exchange - all Asian versions of venerable western capitalist organizations confirm the unmistakable rise of the Asian region.

In 2006 the foreign ministers of Brazil, Russia, India, and China met to consider improved economic ties, and as South Africa was invited to join the group, the acronym of BRICS nations was born. Today, with the rapid and dramatic growth of countries joining the AIIB (84 approved members) that acronym is neither sufficient nor appropriate. With Iran and six South American countries approved as members, the increasing economic challenge and currency crisis that America will encounter will come from the CRISIS grouping of countries (China, Russia, India, South America, Iran, and South Africa) – not as a confrontation but rather emancipation from dollar’s prior duress. Their trade success will reduce the need, use and value of our dominant global reserve currency, and which will have unintended negative consequences for the value of the dollar and our living standard.

Arguably, even the smaller coalition of member countries in the SCO is too large in number of people, and too powerful militarily to be bombed into compliance by the U.S. or conquered with boots on the ground. But before WWI, when Germany became a self-assessed threat by and to Britain due to Germany’s economic growth and scientific development, a world war was fomented to stop its further advancement. Accordingly, it should not be altogether surprising if some physical conflicts were to arise as the world order readjusts from American hegemony to demands for sharing its power with other nations. Since the Chinese civilization appears to be increasingly re-embracing its Confucian culture, even as it follows Sun Tzu military principles which among them include winning a war without actual military conflict, suggests that military aggression will not likely come from Asia. Hopefully, America’s making room to share global decisions can at least match the surprisingly peaceful unraveling of the Soviet Union in 1990, which happened without a destructive nuclear war.

Obviously, all of the preceding stated issues influence global geopolitics, potential wars, economies, fiat currencies, and financial markets. The increasing instability of our economic and monetary system has been confirmed by previous market convulsions in 1987, 2000 and 2008. Even a slightly deflated market bubble is still a bubble; therefore, this secular decline is likely to persevere for the next several years. The 2018 February market decline is one of many minor market trembles before the onset of our financial earthquake.

Global money inflation

Equities and fixed income securities are not just overpriced in our own markets, but globally. This has been a result of one significant trade country seeking advantage by reducing the value of its currency in order to increase exports. Soon another country harmed by increased imports and decreased exports decides to counter this disadvantage by reducing the value of its currency. Soon many countries adjust their currencies as each country races to decrease the value of its own currency. No one country wins this “race to the bottom” but as a result, central bank stimulus has inflated their currencies which creates the globally overvalued bubble markets.

So now we have arrived at the surreal investment condition where a directional market change is neither important nor relevant. That is to say, if our financial markets decline due to any of the multitude of elements that can start that market rout, they will decline substantially because they were bubble markets. Such a decline in our equities and fixed income markets, in turn, will slow our domestic economic activity and global trade. This creates a self-reinforcing and ever amplified cycle that becomes increasingly destructive to the economy and to our financial markets.

If on the other hand financial markets remain high or even rise, it will be because of a further decline in the value of our fiat dollar even in defiance to much higher interest rates. In one case there will be far fewer dollars in one’s savings or professionally managed pension account with concomitant explosion in unfunded pension liabilities; in the second case, the value of those dollars will buy far fewer goods than previously expected. In both cases, financial institutions such as insurance, mortgage, and banks will be faced with insolvency or bankruptcy. Resultant individual savings and pension account values will undermine the dignity of a hoped-for retirement to millions, causing unimaginable social distress and unrest. So we have arrived at a point in our equity and fixed income markets, where neither an advance to financial asset prices nor a decline is constructive to maintaining the real value of our savings and investment.

With all of these previously noted but ignored economic problems and repeatedly dismissed market warnings, individuals who are still invested in the markets appear to have a financial death wish. Why anyone would gamble that one can buy or hold investments at the present time and price level yet sell higher – and increase ones net purchasing value is delusional. It does not matter at this time which way the markets move – you will lose. Unfortunately, we all will lose.

Conclusions

America’s relative military strength is and remains singularly formidable, but foreign country competitors have increased their collective forces and technology on a relative basis. America’s inflationary expansion of dollars clearly weakens it relative to other currencies, but foreign trade development has also independently strengthened their currencies relative to the dollar. The combined effect is for foreign competitors, even without any malevolence, to become more significant relative to America’s single country influence. America’s decades-long foreign trade imbalances driven most persistently by oil imports and later with China manufactured consumer goods, and financed by Treasury debt together with Fed easy money policies, which has bloated federal, corporate, mortgage, consumer credit card, student loan, automobile, and stock market margin debt created a mountain of debt which is likely to crash in an avalanche.

This is the time to be out of financial markets, and wait for that infamous buying moment which Baron Rothschild described over a century ago where he noted that the time to buy was “when there is blood in the streets”. That time is coming and is near. The alternative is to hold one’s portfolio, and then wait for a decade or two to break even in nominal value only. However, for the near and perhaps intermediate term the direction of our markets is inconsequential with the coming far larger financial event arrival.

DOW JONES INDUSTRIAL AVERAGE

Note in the preceding chart if one purchased stock in 1929 in took until 1959 to break even on a nominal basis – a really long time. Note also if one purchased stock in 1966, it took until 1979 to break even – also a very long period of time. Given the long market rally period since 1982, and our record stock index now with a seemingly confirmed bubble market, how many years might it take to break even this next time? The chart also confirms that one could have done far better by buying stock almost any time in the next 10-15 years after the huge decline. But of course, this is hindsight.

The Consumer Price Index in 1971 was 40.5, which rose to 245.1 for 2017. Accordingly, since 1971 the purchasing value of one dollar in this short period of time has declined to just 16.5 cents. Over the last ten years, the interest rate credited to savings accounts has been both negligible and insufficient for savers and pensioners – while legal interest charges to bank credit card balances is at 24%, a rate that would make a mafia don proud. The common man in America is losing a financial war waged against him on all fronts – the global economy, the rise of other nations both militarily and economically, our stock market, bond market, interest rates, jobs and wages, savings and pensions. In that scenario, do you think the market decline can last as long and be as steep as it was ninety years ago? In that scenario does any near-term move up or down of the Dow or S&P stock index movements matter relative to the coming tsunami of global military, economic, debt and currency issues?

Disclosure: None.

Good read, thanks.