Market Briefing For Wednesday, Aug. 8

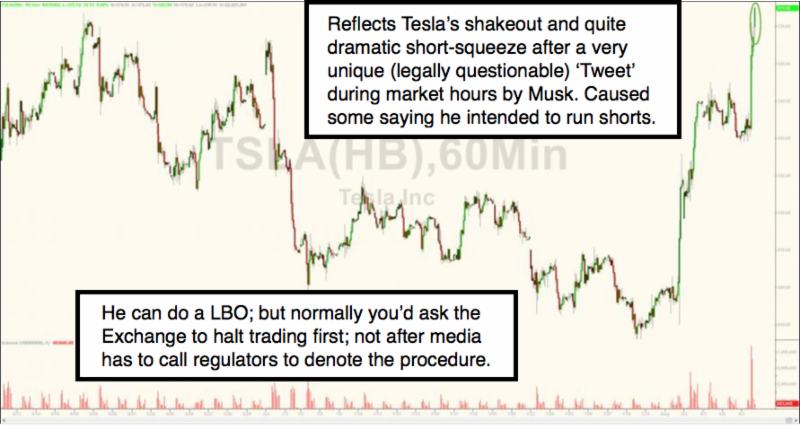

Sentiment remains skeptical and that's contributed to 'worry wall' S&P climbing, which as noted last night, 'can' (but needn't) extend much higher. I ponder whether moves like the Saudis investing in Tesla is somehow an effort to offset their immorality 'reveal' with implied threats against Canada, or for that matter contradictory swings in their oil price pronouncements. It was exciting; as a Leveraged Buyout (proposal in-theory) came from an airborne 'Tweet' by Elon Musk himself. At first few believed it was him. And we speculated it wasn't naivete as Musk often moaned of share price.

Aside Tesla, much of the market's focus still rotates around China trade of course (and I touched on the implicit threats against Apple in video); giddy optimism about new S&P or tech highs; or even an occasional reminder of Federal Reserve monetary policy 'QT' (perhaps the most significant); for sure you have a 'worry wall syndrome' helping technicals lift stocks along what is essentially working into overbought challenging a rising-tops line.

What you have are 'standard deviation bands' narrowing and thus upward action in the S&P persists bumping-along the high-end of the banks; but I should point-out, 'not quite' against an extension of the rising tops trend. It is 'presumed' by many that we get new highs; that S&P 3000 is 'in the bag' soon; and that China will come around. Perhaps. But not necessarily. That is a reason we think those who haven't done so are trimming a bit into this strength as it has prevailed.

(The idea of the S&P shortly declining because I'm traveling tomorrow to Brussels is sort of kidding; but the risks are growing as the complacency returns; ironically as it combats an existing 'worry wall'. In fact it's been Oil not so much tech helping on Tuesday; and broadening small caps gains.)

It's the conundrum which cannot be addressed with simplicity as some technicians (constantly shorting or even going long on strength) try with strictly linear thinking or just drawing lines. It's really a market that 'could' rip higher 'if' we had a surprising swift deal, in particular with China, but Mexico and/or Europe would help). And it's a market that could 'tank' if something like China 'actually' doing nationalistic extreme stupidity against, say, Apple. (China should stop threats and what they're doing and calm this down with some compromise rather than more demands for 'profit sharing' by Apple with the Chinese people. Tim Cook's face reading that Editorial must be priceless. Wonder if more iMac's will be built in the USA if Beijing goes full-Dragon on this.

In-sum: while all these issues simmer; and one can debate if the Saudis, with their $2 Billion investment in Tesla, are smart cookies or the latest 'Greater Fools' (actually I think it may be a decent move for them; 'if' they temper Musk's ego only to the point of an even greater deal such as with Apple, as some have periodically suggested; or as I suspect, Tesla will be a major success in China, where their new plant won't be subject to tariffs 'even if' we don't settle matters in the longer term; though I think we will).

It may be noticed that Musk has 'tweeted' the idea of taking Tesla private; for sure that would get some critics off his back and relieve his mind to move at his own pace. However, GM, BMW and others are chomping at his back both in hybrid or full-electric mode. It's real competition coming and new styling to challenge what is no longer so 'edgy' from Tesla. And I don't think Musk (who I admire) is actually allowed to 'tweet' about taking a company private; in market hours without requesting a 'trading halt' first.

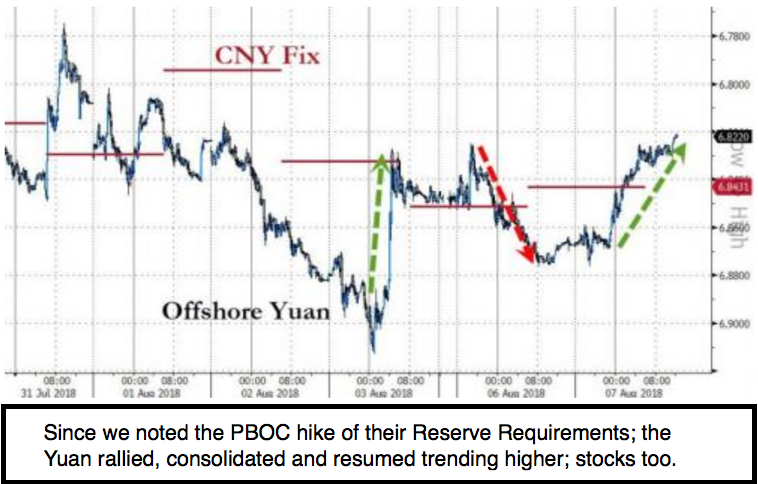

Bottom-line: ramifications are huge all over the map. An old saying 'when in doubt stay out' doesn't exactly apply; but the sentiment of a market that can swing (or stocks that can rock & roll) dramatically makes me smile, as these are diversions from the main focus of an extended market amidst an ongoing trade war (early stages and we think China both blinked currency wise, while verbally sounding tougher), amid Quantitative Tightening from a Fed nervous about inflation; growth; plus currency challenges.

Sure, I realize money managers are loathe to sell; or even to balance their holdings from a diversification guideline perspective. But this will pass, and if there is a single event on the horizon besides trade and monetary policy that I suspect contributes to shuffles ahead; it's an 'obligatory' re-allocation many managers must engage in especially as relates to shifts from ETF's with component changes. The most notable I've mentioned before and we will hear more analysts become aware of it before the mandatory cut-off of September 21. That relates to changes in the huge XLK ETF to the newer (and so far much smaller) Communications ETF called the XLC. Both key FANGs, Alphabet (Google) and Facebook, are moving from the XLK to the XLC, currently (and continuing) to include Verizon and AT&T.

Many thanks Sir