Market Briefing For Tuesday, Jan. 9

Daily action - this evening the S&P is a bit more defensive. Perhaps it's a delayed reaction to our final hour report about the Washington Post saying Trump may be asked to testify to Mueller. It's on all the networks tonight. It doesn't strike me as problematic; maybe the Oprah 20/20 is a bigger deal.

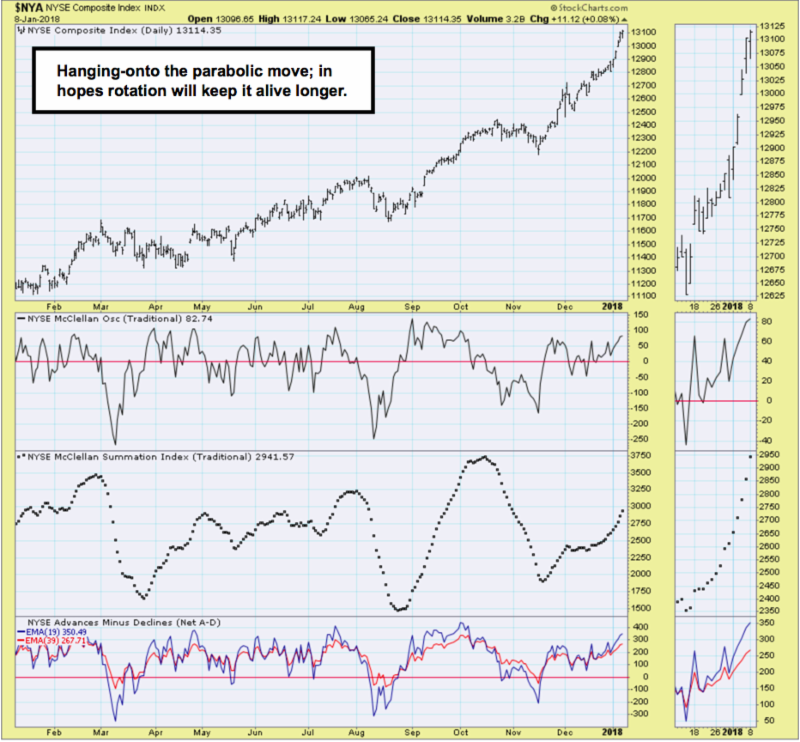

Market action at this point requires rotation to stay alive in this parabola. It is at such times you hear stories like "there's not enough stock to buy". Of course the buybacks helped engineer that structure; but since discounting already levitated equity prices; perhaps what they're really saying is that a 'bubble of historic proportions' is building; and nobody wants to tackle that.

The market is sluggish at best and even the most strident optimists not just trying to 'market' stocks, must recognize this market's entitled to chill a bit. If it does not that's the most bearish pattern feasible (straight up until hard breaks); whereas taking the foot off the accelerator for a few days not just hours, would be potentially a more constructive approach for the bulls.

Stay tuned; I spent a lot of time monitoring the Las Vegas keynotes today; and I see a lot of promise but not many new products 'available now' that are compelling. Yes Google introduced several new versions of its device, but Amazon has sort of cornered a good part of that and had good reviews as well. It's amazing that Apple has dragged so much in this area; but from one perspective it's a bit to chaotic for them to worry about. If they go into more serious 'over-the-top' broadband broadcasting (using the next Apple TV rendition presumably); that's when the competition will be interesting.

At the moment Apple is worried about the French contemplating action on a legal front, alleging 'deception' and 'planned obsolescence' as a charge. I'm surprised the media is only worried about what children do with phones and not this pending action out of Paris, which could gain traction.

Tuesday could also start defensively and try to rebound; but this market is on a short leash for the short-term, I should think. Caveat emptor. (Oh and if you want a CES pattern for technology stocks: it's often up at the start to find profit-taking by the time the weary attendees depart in a few days.)