Market Briefing For Thursday, Oct. 18

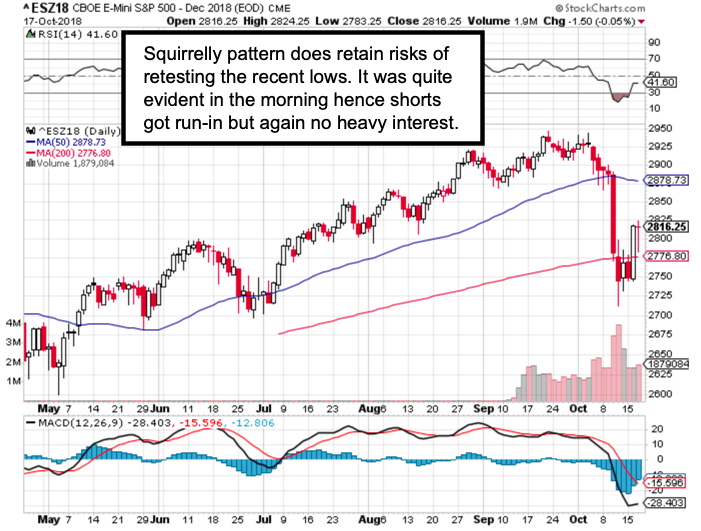

Warning Bulls not to declare victory yesterday, I suggested what we had, on relatively low volume, was primarily an 'essential' rebound off of a key 200-Day Moving Average for the S&P, that stocks had flirted with just above and below for a few days.

Now the 'infighting' on Wednesday by the S&P swings shows this clearly is not based simply on monetary, earnings, or even trading prospects; but on traders (and hedge managers) desperately trying to hold the pattern in a semblance of 'order', lest algorithmic selling triggers get activated on a closing break below that level.

In the interim, of course many got run-in if they shorted weakness. Retreat a couple weeks and you'll recall (even before a 'crash alert' warning right as the DJIA and S&P made record highs) our suggesting (especially for all FANG-type stocks) that investors or traders lighten-up 'as' the Averages at the time were climbing not just a 'worry wall', but the upper 'band' (or trend line if you prefer) trying to grind-out higher highs; but with underlying sales fairly evident, especially in the momentum stocks.

Then and now I believed the Bulls have virtually no chance of hitting stock market balls 'out of the ballpark' so to speak; aside special situations as of course always present themselves. But on a broader basis danger retains its pall over this market, regardless of proclamations of value some insist is there. It is in some stocks; it mostly absent for broad Senior Indexes.

Bits & Bytes: notes that the (desperate?) Appeal by the DOJ to overturn the completed AT&T / Time Warner (now Time Media) merger has a date.

During the deliberations, the DOJ had called on AT&T and Time Warner to sell all or part of Turner Broadcasting Group - the group of cable networks that includes CNN - or to sell-off DirecTV and keep the cable networks as a potential requirement for approving the pending deal.

After AT&T refused, the DOJ sued to block the merger; approve their $85 billion deal to buy Time Warner without preconditions and won their case. Despite it being a 'done-deal' and quickly combined, while many believed it was indeed a vertical integration with no logic to overturn; DOJ appealed it anyway. Today they received a court date of December 6th, 2018.

Now the FCC is supporting the DOJ appeal (hatred of CNN?). "While the Commission takes no position on the relevance of any document in this case, it's concerned that two of the rationales supplied by the District Court for discounting the probative value of submissions made to the FCC could reflect a misunderstanding of Commission procedures," the FCC wrote.

Also, the American Cable Association (represents the small &medium-size cable companies) joined the advocacy group Public Knowledge in an effort to overturn the earlier court ruling. For now, we have to wait and see what happens to the appeal, yet don't look for this to be resolved anytime soon. And we think AT&T as an investment will be satisfactory regardless; since it is first and foremost a 'dividend floor' play. The initiatives and products it can offer if the merger is left intact are the 'added value' potential for later.

In sum: the market has difficulty extending the move; and hence besides risk returning; it supports the idea yesterday was mostly short-covering.