Market Briefing For Monday, Oct. 29

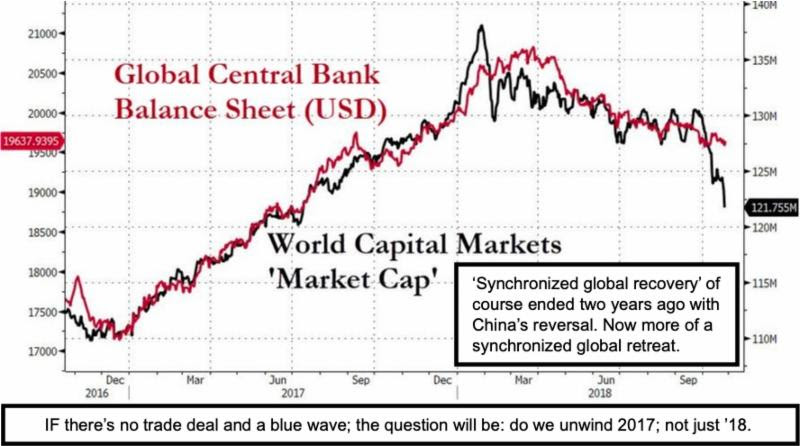

'Price Discovery' amidst more sober assessments of forward prospects is on the surface what this overall market decline is described fundamentally as being about. In reality this 'exploration' about valuation has been ongoing since the 'end' of the Trump-victory rally as nailed back in late January. And its approached was telegraphed by a clear monetary policy progression.

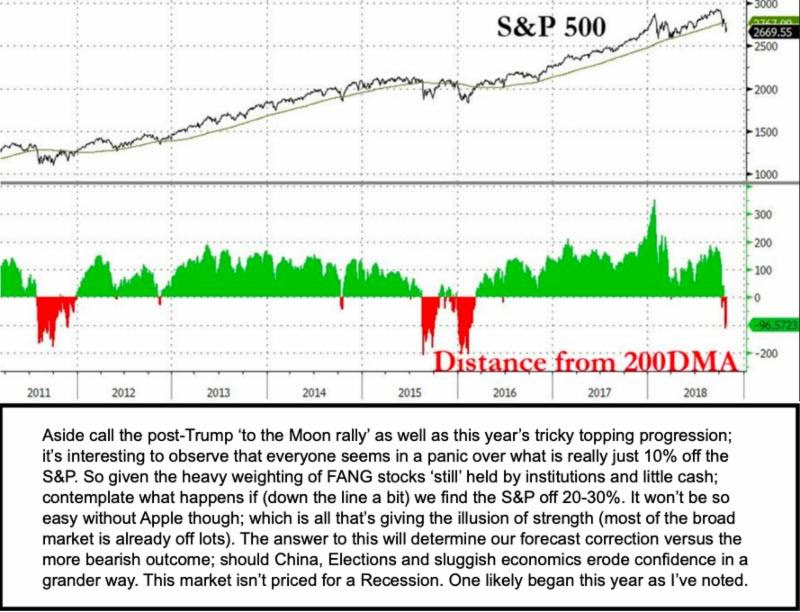

That matters, because while 'the Street' keeps seeking out new 'leadership', or ponders what happened to the horses that got 'em to the high levels, the reality is quite different. The broad herd of 'horses' has been correcting most of the year; while as you know (because I've assessed and charted realities in this regard for many months) the 'narrow' group of FANG+ stocks typically provided illusions of strength allowing upward cycle 'charades' to persist.

Now, as everyone talks about 'the big scare'; the reality is things indeed are changed; the perception about the year ahead, even if 'good', is not 'robust' to the dreams of the greedy buyers into strength we warned about this year. Plus there are domestic 'known unknowns' that will factor into November.

And ironically, as rash emotions overtake the misplaced enthusiasm seen in so many firms (and media) this year against a 'distributional backdrop' they pretended didn't exist, what we have are a broader majority of stocks nearer decent valuations, aside emotional liquidations, because they've corrected in a 'rolling Bear Market' since late January. But the macro picture suggests greater volatility persists; hence 'bottom fishers' should be very cautious. I'd rather 'pay a bit more' for a stock once a technical low is established, than try to guess where that base might form. Same for the S&P incidentally.

Now, we are not only closer to a 'Recession' than most think; because if it's designated as such, an irony there is that will be near lows for many stocks that (as noted) already declined 10-20% or more over the past 9 months. Of course my interest is gradually accumulating value, by nibbling once we get a semblance of a washout, somehow tested by the several ways a market's able to demonstrate a low. So far that is still pending.

Topping vs. Bottoming

Pundits will say identifying a bottom is hard. Not as hard as a top, I respond. Sure, everyone knows what happened this year, 'now', as hindsight; while I assessed this evolution as foresight from January. Again that matters since many of the 'fine' stocks I thought overpriced, are increasingly moving into a more attractive price/value relationship, or are already there. But there's not a shred of evidence of a bottom formation; even though some indicators are now suggesting daily or weekly oversold conditions; but not historically. We had a long (and a bit classic) distributional topping process.

That's why the plan of restraining buying earlier this year (generally) was so important; at the same time it was essential in-order to be in a mindset that's calm enough to be (as I often say) 'more excited about the bargains coming ahead, than worried about the core holdings you retained'. That's opposite, of course, the frenetic mood that swirls among hedge and other managers, now, who generally are at a loss as to what to do. That suggests more pain.The recognition of better 'valuation' is more overtly evident than excess; but at the same time we contended so much was excessive earlier this year. As we work lower, we'll keep an eye open for undervaluation; mostly not yet.

Again; price discovery. Sure; we might go closer to a 2 handle on GDP; you might see the Fed back off somewhat; and you should see still lower prices for the S&P; along with a 'paucity of bids' pending Midterms as well. I keep watching all that for the sake of S&P or similar trading; while looking at a few individual stocks (as I've recently outlined) that become 'less risky' as of course those who bought near the highs become more worried about risk.

Due to the market's structure (both management and ETF concentration); it took quite a process to top the market; even after January's climax. Similarly the bottoming process is being drawn-out (began rotationally in January as well), but ideally will at least temporarily conclude as a process which may or may not include a singular 'selling climax'. That's why we outlined intents to monitor evidence of an interim conclusion of this downside phase, which we are not seeing as of yet. Stay tuned.

That's how emotional or impulsive decisions play out most often; and how it can exhaust. We had a 'buying climax' in January (our first 'crash alert' this year); a series of 'Rinse & Repeat' moves; and a second 'crash alert' right at the Dow and S&P highs as it turns-out, less than a month ago. As noted we did not need to see a 'robust buying climax' because what we had at phony new highs (negative breadth or internal deterioration) was a secondary test of the January highs; unaccompanied by broad market participation. Hence I saw the ingredients for a significant October break; and called 'crash alert'.

Bottom line: while the majority continue walking a tightrope and debate all the nuances about the Fed, about tariffs and trade, about politics and more; all I need to say is we've outlined this for months; and don't need to remind of the spooky similarities of the 1920's and '30's and what's going on.

Global profits and international trade ARE inextricably linked; and that's why the only conservative interest has been in domestic-centric stocks. However even there most are 'in' ETF's or Indexes, thus are eroded or swept along in a sense with the broader purge of equities. That incidentally makes them at some point less risky and better values, because they get even cheaper.

It's that tie-in to ETF risk, that generally has us not jumping-the-gun on the buy side, even as the proper assessment of market conditions this year sure helped avoid damage; with most who concur with us in a very liquid bargain-hunting position. So we'll watch this action for evidence of a sustainable low; and that time is not here yet as signs of a sustainable bottoming-process for the most part actually aren't present. Price discovery rolls along.