Market Briefing For Monday, Oct. 1

Technology stocks 'tripped' a bit going into Quarter's end; emphasized by Facebook's acknowledgement of yet another large data privacy breach (details of which were not fully disclosed). That hit FANG+ stocks which as usual recovered 'somewhat', but not fully. It's really a gradual distribution.

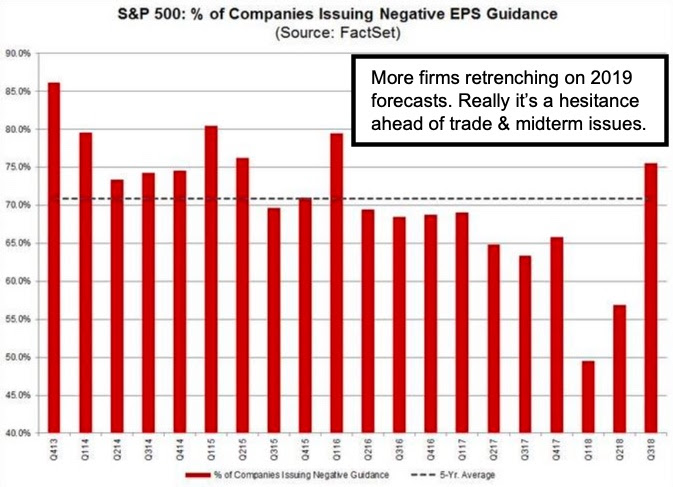

We think the overall market still continues to focus less on interest rates; less on Oil prices (rising as noted likely all the way since t40's/bbl area but helping the Senior Indexes hold up); and a lot on 'trade & tariff' issues, with the outcome of the Midterm Elections being very pertinent to how lots of firms will assess their CapEx and other plans for the year or two ahead.

Market stability is taking place at high levels, which contributes to jitters, as well as realization that 'even if' the market gets good news on trade, or for that matter meanders through the Midterms without any dramatic 'waves', it still leaves the market extended with limited areas of attractive valuation.

As to the market it remains heavy but not plunging; however again Oil has contributed to an illusion of Index stability the Averages don't deserve.

This weekend, since the overall market backdrop as we view it is known; I would like to touch on several FANG or other well-watched other stocks. I'll make just a few comments, and include a few charts related to techs too.

Bits & Bytes: starts with Facebook (FB); which is less of a technical alarm than media suggests; because consumers (unless they are advertisers) do not provide credit card or very private information to Facebook. However, this did impact over 50 million accounts; and is just another issue to address.

It's been my view that FB shares were appropriate for large partial sales, earlier in 2018, about the time Peter Thiel (Zuckerberg's first private holder incidentally, and eBay co-founder) liquidated around 70% of his shares. It should be noted that every since the dramatic July breakaway decline, FB never reestablished technical strength. Stocks rarely do after such shifts; or at least not for a long time or absent some fundamental developments. In this case look for Instagram to be more closely embedded, but FB really is a fairly mature stock with no particular investment attraction (for now).

For at least a couple months I've warned about Google; just because it's a key FANG stock, and that whole area looked vulnerable. I also believed its inclusion in the new XLC Communications ETF would weaken its structure along with Facebook; both of which were being shifted. The 'revelation' by their Officer today regarding trying to re-enter China with 'Search' possibly using a 'search engine' with a backdoor for Beijing authorities, is news that I hinted at twice in the past two weeks (perhaps intraday; unsure if noted in the evening report). Despite their efforts to skirt the issue with emphasize no decisions to deploy had been made; just working on it is controversial.

Of course Google is simply expensive and the share price came down as I outlined; and is holding within $100 of the highs. However it looks toppy at present, with most FANG+ types also in various stages of distribution or at lofty levels which should be viewed as concerning; and not very attractive.

Stalwart Apple has new products out, and more coming of course. To me it's the 'enterprise sector' which is most promising and least discussed. In that regard a Salesforce deal for Apps; similar to efforts with IBM, clearly illustrates the direction Cupertino is taking the Company. The upcoming or rumored (its coming) iPad Pro with sleeker styling (thin bezels) will aim at business customers, since most consumers are content with the new large 'semi-phablet', the iPhone Xs Max.

Basically, although everyone acknowledges the 'ecosystem', longer-term it seems skeptical analysts (about the Company not share price) miss taking full measure of the 'symbiotic relationship' this has with Apple customers, and how this can expand further over years to come. (Apple Music; their slow-to-start HomePod speaker; and CarPlay are just part of this. Just the 'App Store and Music' aspects make more revenue than most companies, and they are close to leading the sector. Their AppleTV4k is a sleeper that anyone with streaming television has come to appreciate more recently.) I note most can set-up similar capabilities with Google Android systems (as they do); but generally the view is that Apple has it down pat and generally recognized as more secure (IOS is encrypted; OSX is based on Unix).

Finally on this brief comment; I observe that Netflix remains pricey; and in time may be challenged by a redesigned DirecTV Now (AT&T operation) leveraging its HBO holdings. DirecTV Now carries local channels in most cities, and of course Netflix does not. As this gets refined (it's better than at the start), DTVN could erode Netflix's dominating position; Hulu too; a reason many of those 'other streamers' are starting to consolidate.

And I must finish FANG+ by mentioning uber-expensive Amazon. Sure, it opened a NYC retail storefront, and can acquire anything it wants. But now is not early-entry into this; and there is antitrust risk here and in Europe. It gets chatted about beyond market circles in that regard. Hence the risk is actually because Amazon is such an amazing adventure it can dominate a field if it wants too; and even watches sales of 'popular products' to see if they want to compete (itself a concern from an antitrust view). Hence this is an example of so much success that one should be wary.

A footnote: I didn't focus on Tesla (it's not FANG); but I warned about it for months from a competitive standpoint. I believe Elon mishandled things in a few cases that could have relieved tensions; but my concern was less on the regulatory front (though that's obvious), and more on the reality he did not have a deal with a conventional car manufacturer for a 'blended' power vehicle or portfolio of cars, to bridge the gap towards wider acceptance. If Tesla stumbles with Model 3, the risk will become lack of 'design' funding and a dealer/service network that isn't up to the likes of competitors, that at this point are starting to become more evident and relevant.

Simply put; GM can sell plenty of Chevy's to keep their dealers alive; with the Bolts and Volts not so essential or necessary to turn profits. Same with BMW, who can sell a few I-3's (and fewer supercar I-8's) and still monetize the rest of the lineup; until you get to the point of longer-range electric(s). I also note that Mercedes is bringing the A Series here for 2019. Modern as heck; with one of the best technology packages anywhere; and 40 mpg on top of it. It's not electric, but very good economy and well-priced. I saw it as well as the other end (like the Audi Q8 and new A7 and BMW 850i) in Berlin; and all are impressive and will compete for buyers Tesla wants. At some point perhaps Tesla makes a deal or competition eats them up. I do hope not; but I'm just being realistic. I had a terrific chat with a young new manager for Tesla Germany; but they really act like it's their sandbox.

In sum: the 3rd Quarter has ended with the Senior Index higher; with the New York Composite still well shy of the early-year highs; and with FANG stocks either well off their highs, or teetering. Interest rates are firmer; the market is on tenterhooks based on trade and political concerns; with U.S. Midterms just weeks away. Many future prospects hinge on that.