Market Briefing For Monday, Nov. 12

Risks are more than murky for stocks in the wake of a big post-Election 'relief' (that it was over at least) rally. Yes there's lots of speculating about of course the Fed, and whether we've reached 'peak profits' or 'peak earnings' and of course how a 'trade relationship' with China plays into all this.

Well, we've explored the significance of these and other issues consistently since identifying the 'cycle top' few are willing to even concede occurred; of course I'm referring to the 'blow-off' parabolic thrust in late January this year and the rolling correction (and exodus) first in small-and-mid caps and then larger industrial types; and finally in the manipulated FANG stocks (largely a function of buybacks that enhance earnings along with tax cuts; masking in so many cases the 'slippage' of growth factors, such as basic revenue).

The numerous analytical misses on 'top line' (overall, not based on fewer shares as often is how they were few after the buybacks reduced floating supply) was significant. It also suggested companies were not deploying a lot of capital into CapEx to grow the business, but pleasing shareholders as they also (often) set-the-stage for 'enhanced executive compensation', just by virtue of not just share price, but the largest rise of 'insider sales' in years from what we've gathered.

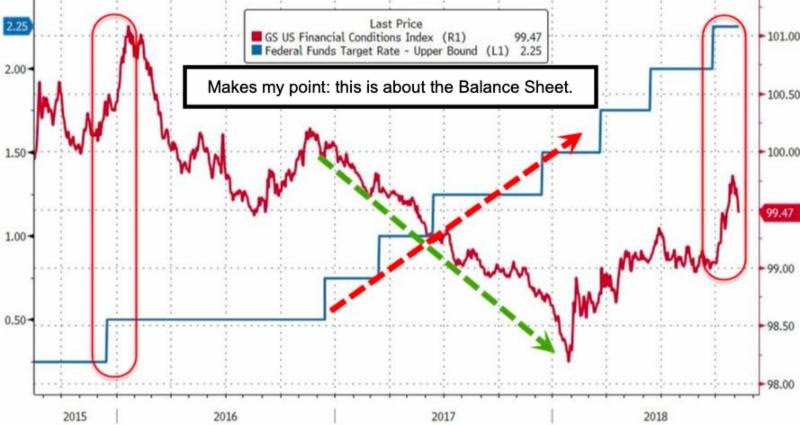

(Remember last night's chart: the Fed is nearing the Funds target goal. They say 'don't fear the Fed'; but 'they' fought the Fed throughout it all.)

So what else, besides the obvious wrangling in Washington; insular policies (such as the internet conference suggested) by China regarding more limits on freedoms for their own citizens online (expanded, modernized; but with restrictions on the Googles & Facebooks of the world offering services or chat other than what is seem as 'acceptable' to Beijing) ... what else is up? Of course Navarro's tougher talk; and Oil. But there's another item.

That largely unrecognized concern has already been reflected in a forecast breakdown of the market in September and broadly in October; and now of course the rebound failure ('Blue Wave' sloshes into 'Red Wall') suggests a further concern. So let's add 'Hedge Fund' liquidation waves. We've noted in the past how most under-performed for more than a year; primarily because they didn't believe us that if Trump won, the market would 'go to the Moon'. Their 'catch-up' scramble chased stocks to the edge of interstellar space.

What that meant is they hedgers were big participants in 'chasing upside' at high levels (as opposed to those who got in early). So we think that heavily nervous hedge funds were sellers in October, and that their investors largely are unhappy. OK. What that means though is potentially heavier than usual 'redemptions' may be forthcoming this year. And the 'deadline' for anyone (if desiring their money out this year) happens to be November 15.

Whether it matters or not is pending; but obviously there are headwinds that suggest at-best a ragged period of stable time (maybe very late this year) or 'if' we get a trade deal with China. But there is little suggesting the 'thumping chest' momentum gusto we saw back in 2017 or as the hedgers chased the upside at already high prices during much of this year.

Bottom line: simply be forewarned that there are more concerns out there to keep an eye on; besides a 'growth scare'; beside interest rates; and aside geopolitics. In our view, as often suggested, the peak was last January; not in the near-term, with respect to the old upward cycle and Trump rally.