Market Briefing For Monday, Feb. 12

As everyone focuses on the Olympics (and the South Korean President Moon's apparent acceptance of an invitation to visit Pyongyang soon to meet with Little Rocket Man); perhaps one should watch Sec'y of State Tillerson's visit to the Middle East this coming week; nobody noticing. At this point let's focus more directly on the stock market which has many if not gloomy, almost universally convinced it's just a dip along the way (of course they're generally a crowd that didn't agree the market would get to the moon if Trump won; and chased it higher later in the game).

For some time I had circled the areas around 2300 +/- for the S&P, as a 'reasonable' area we should ultimately be headed to. Traders focused on Moving Averages perhaps rightly identify battlegrounds; but miss the underlying reality that (so far and especially on the first break and rally that ensued) liquidations will break supports; and those attempting very classic efforts to 'buy dips and sell rallies'; actually had to move at nearly the speed of light; because moves were 'textbook', but incredibly swift.

As noted after visiting the 'Money Show' (only briefly) the other day; the mood was glum but 'resigned' toward an overdue setback for stocks. As far as I could tell, everyone (though not proactive like we were ahead of the crash) was describing this as a normal and healthy (if fast) market 'correction'; nobody was calling it a bear market; and more importantly none were advocating selling anything; but holding on, since it can't be expected to continue.

Well, not at the pace we've seen; but how to they know that? They don't. I like to say 'let the market tell us when it's done going down'. We have shared a couple 'possible' ways that could happen: a truly dramatic 'V' bottom (not seen yet); or a period of hammering on a 'base' (also not at all constructed as yet). Or maybe some dramatic intervention or 'PPT' (Plunge Protection Team) Fed move.

When the market rebounded on a few comments from Washington that everything was fine for the economy (of course; what else would they say?) that's irrelevant; and Bill Dudley (NY Fed) saying there's nothing for the Fed to do here.. well, they took that bullishly when in reality that's at this point a sign that the Fed would not intervene; and allow the market to find its own levels. Hence no rescue effort to be mounted (at least at the time of the statement; never know for the future; but they have very little maneuvering room because they didn't move rates higher earlier).

Finally; the vast majority of money has flowed into ETFs and that's not a plus... it was a palliative for money managers and it means leveraging is likely greater than known (beyond the highlighted 'short-vol' ETNs etc.); and the velocity of the moves may be severely exaggerated by internal structures; which makes this more than a 'run of the mine' correction.

Concurrently, the fairly myopic viewpoints about the US markets tend to focus on the 'blame-game' (since almost no one other than permabears called this move; and we were probably alone in pinning it on early-mid February with our January call) regarding 'short-volatility' funds or so on. I warned of a disastrous wipe-out coming to complacent option-writing, or similar spread strategies, for several weeks before this unwinding.

But I have a bigger point: some foreign markets have been hit more than the US markets. China is notably down more percentage-wise; and it's a market I forewarned last month was having a liquidity crunch with a 'begging' plea by bankers for people to deposit money into the banks. In my view this goes beyond 'vol' trades; hedging leverage in addition, and I dispute the contention that human-driven strategies are doing better. In fact those computer-driven strategies make swings wilder (both ways).

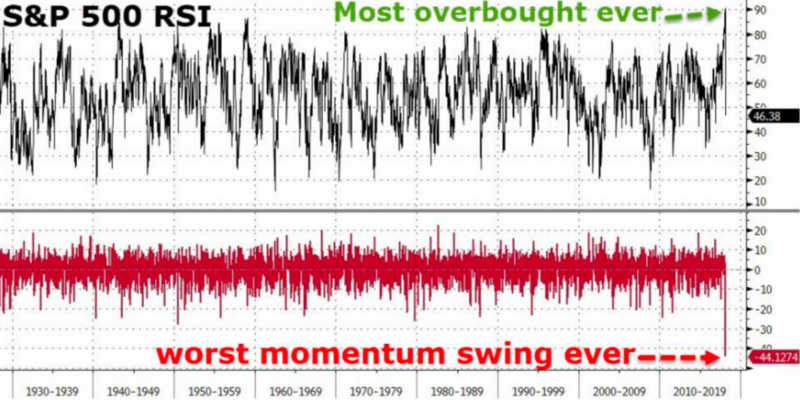

Aside the first typo (here instead of here's) this chart makes my point at the same time as the S&P range was closer to the MA. But again, if you view the uptrend from more than a 200-day perspective; or even from a 200-day view in the New York Composite, or even the Nasdaq, we've already broken the initial lows; and merely rebounded to breakdown or resistance points; something they had to try before we collapsed into a zone from which a further implosion would be a prospect. So let's see, as even in 'just' a correction this requires more time to work itself out.

In sum: risk-parity fund issues requiring paring back of assets; and that is ongoing. The volatility metrics are intended to be disciplined by algo trades (weighting and rotation have been churning this market for many months). That discipline was lost in essence due to going above trend in the January move I called unsustainable; and I suspect not only was it a classic sign of a blow-off; but also skewered their calculations.

Bottom line: efforts to hold this decline together (or bottom at least for a bounce of meaningful duration) should be expected; however, we do not have a technically sustainable bottom of the market to address, for now. Whether a 'V' bottom or something else; if I was going to invest as opposed to trade or scalp, I'd rather pay more once the market shows at least some indication of a formation that is supportive.