March 2017 Texas Manufacturing Survey Continues To Expand

Of the four Federal Reserve districts which have released their March manufacturing surveys - all are in expansion. A complete summary follows.

Analyst Opinion of Dallas Fed Manufacturing Survey

One must assume with surveys that change in values is relative to the previous month. This survey remained in positive territory with both new orders and unfilled orders in positive territory, and both improved.

Expectations from Bloomberg / Econoday was 20.0 to 25.3 (consensus 22.0), and the reported value was 18.6. From the Dallas Fed:

Texas factory activity increased for the ninth consecutive month in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose two points to 18.6, suggesting output growth picked up pace this month.

Other measures of current manufacturing activity also indicated expansion in March. The new orders index inched down to 9.5, while the growth rate of orders index inched up to 3.2, registering a third positive reading in a row. The capacity utilization and shipments indexes moved down but stayed positive, posting readings of 13.2 and 6.5, respectively.

Perceptions of broader business conditions improved again this month. The general business activity index fell eight points but remained positive at 16.9, and the company outlook index was largely unchanged at 17.9. The March figures represent the sixth and seventh positive readings in a row for general business activity and company outlook indexes, respectively.

Labor market measures indicated employment gains and longer workweeks in March. The employment index posted a third consecutive positive reading and edged down from 9.6 to 8.4. Nineteen percent of firms noted net hiring, compared with 10 percent noting net layoffs. The hours worked index moved up one point to 8.7.

Upward price pressures eased a bit in March, and wages continued to rise at about the same pace. The raw materials prices index fell six points to 25.2, still very high but ending a five-month trend of rising readings. The finished goods prices index fell 12 points to 7.5. The wages and benefits index held fairly steady at 19.7, with nearly 80 percent of firms noting no change in compensation costs.

Expectations regarding future business conditions continue to improve. The indexes of future general business activity and future company outlook came in at 36.3 and 39.1, respectively, exhibiting mixed movements from their February readings but still solidly in positive territory. Most other indexes for future manufacturing activity slipped but remained positive.

Source: Dallas Fed

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

(Click on image to enlarge)

z richmond_man.PNG

Kansas Fed (hyperlink to reports):

(Click on image to enlarge)

z kansas_man.PNG

Dallas Fed (hyperlink to reports):

(Click on image to enlarge)

z dallas_man.PNG

Philly Fed (hyperlink to reports):

(Click on image to enlarge)

z philly fed1.PNG

New York Fed (hyperlink to reports):

(Click on image to enlarge)

z empire1.PNG

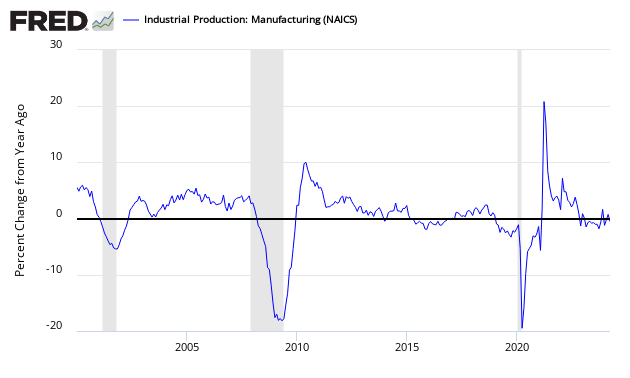

Federal Reserve Industrial Production - Actual Data (hyperlink to report):

(Click on image to enlarge)

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Dallas Fed survey (light blue bar).

Comparing Surveys to Hard Data:

(Click on image to enlarge)

z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Disclosure: None.