Many Advanced Economies Are Operating Close To Full Capacity

“It’s broadly believed that the output gap drives the inflation process over the long haul. Output gaps move in a positive direction (becoming less negative and eventually turning positive) when the economy is growing faster than potential or when demand is outpacing supply. As such, increasingly-positive output gaps can correspond with periods of accelerating inflation (and, conversely, increasingly-negative output gaps can correspond with periods of disinflation and deflation).” - Michael Gregory, Will Absent Economic Slack Finally Get Some Inflation Back? BMO Capital Markets, Jan. 12, 2018

It is standard economic thinking that when demand exceeds supply, prices must rise. A series of recent reports on the advanced economies all seem to conclude that the global economy has entered a new and potentially more inflationary phase than in the recent past.

Numerous forecasting organizations, including the IMF, the World Bank, key central banks, the U.S. Congressional Budget Office, and the European Union, have concluded rather forcefully that, for the advanced economies, demand, as represented by GDP growth, is growing faster than the long run potential growth.

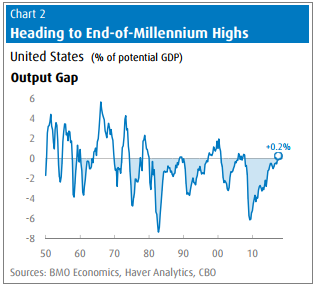

The worry is that the output gap, the estimated difference between actual GDP and potential GDP, has been eliminated for many of the advanced economies. In the American case, a recent study concluded that the economy was operating at above full capacity.

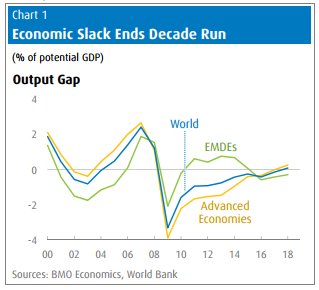

Moreover, even though an output gap still exists for many of the emerging market countries (EMDEs), when you combine all countries together there is no longer an output gap at the global level according to the World Bank.

The following two charts extracted from a recent BMO report summarizes some of the research which suggests that the global economy has entered a potentially more inflationary era.

The common-sense implication from all of this explains why major central banks intend, as soon as it is prudent, to raise interest rates to more normal levels.

This is so the central banks will have the needed interest rate room to influence financial markets should monetary stimulation once more be required.

Disclosure: None.