Mandarin Monday – China’s $200Bn Manipulation Not Enough – Now What?

It's the last day of the month and windows have been dressed.

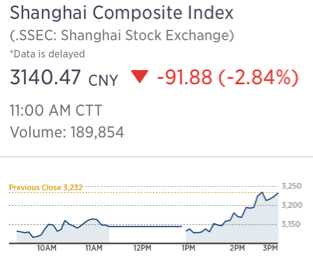

Our own markets have made a "remarkable" turnaround into the end of the month thanks to China's 400-point (14%) move off the bottom last week – but at what cost? According to the Financial Times, Beijing has already spent $200Bn propping up the equity markets and, despite that, we're still down 38% from the top and 200 points lower (5.8%) lower than we were when the Government officially stepped in to prop up the markets.

Click on picture to enlarge

“The problem they have now is that they’ve spent as much as $400bn supporting the currency and stock market and they are now worse off than when they started,” said one person with close ties to the PBoC. “I think they got overconfident and underestimated how strong the global reaction would be to the devaluation.”

That other $200Bn of currency intervention is also our problem as the PBOC, in order to play this game, has been selling about $10Bn per day for the last 20 trading days. That has depressed the Dollar's value (more Dollar supply on the market) and given us some poor results at recent treasury auctions as China is competing to sell our notes.

China is supposedly propping up the markets ahead of Thursday's 70th Anniversary Parade in honor of the “victory of the Chinese people’s war of resistance against Japanese aggression,” which is what they call WWII. The Chinese government has also officially begun prosecuting 22 cases of "insider trading, market manipulation and “spreading market rumours” as it is now technically illegal to short the Chinese markets. In Tuesday's drop alone, 11 people were detained for "illegal securities trading" including 8 managers of Citic Securities, one of China's largest brokerages and 4 others.

In a worrying signal for global investors with a presence in China, some officials have argued strongly for a crackdown on “foreign forces”, which they say have intentionally unsettled the market.

“If our own people have collaborated with foreign forces to attack the soft underbelly of the market and bet against the government’s stabilisation measures then they should be suspected of harming national financial security and we must take resolute measures to subdue them,” said an editorial in the state-controlled Securities Daily newspaper last week.

What will happen later this week if China stops spending $10Bn per day to prop up the markets in the last hour of trading (see chart) is worrying investors around the Globe – especially those that find themselves restricted from selling Chinese stocks they chased up at higher levels. Japan has already caught China's cold and the Nikkei too has fallen from 20,900 to 17,700 (15%) before bouncing back to 19,000 as of today's close.

In our 5% Portfolio, our very first trade idea was titled "Using Simple Puts To Leverage A Short Position On Japan's EWJ," which was published on August 10th at 3:05pm – at the almost exact top of the Nikkei with 10 EWJ Sept $14 puts at 0.90. Those already topped out at $2.40 (up 166%) and we took the money and ran, expecting the bounce but the real money was made on our Nikkei Futures Trade Idea (same post as a bonus to subscribers), which was:

This morning we are now shorting Japan Futures (/NKD) at 20,900 with a bit more conviction since 21,000 SHOULD get a pullback of 20% of the run from 20,600 so 400 points means that, as long as we scale in from 20,900 as follows:

- 1x short at 20,900

- 1x short at 20,950 (avg 20,925 – stop out of 1 even)

- 2x short at 20,995 (avg 20,960 – stop out of 2 even)

Click on picture to enlarge

As you can see from the above chart, we never quite hit 21,000 so it was just a 1x trade going short but the fall from 20,900 back to 18,000 alone was 1,900 points and, at $5 per point, per contract, that trade idea paid a profit $9,500 per contract – not a bad bonus for our 5% Portfolio Members, right? We give Live Trading Webinars every Tuesday at 1pm, where we discuss Futures trading – a service also available to our 5% Portfolio Subscribers (and here's a replay of last week's).

We played FXI for a bounce in the 5% Portfolio but we took that money and ran on Friday's bounce with a very nice $1,020 profit (136%) on the net $750 trade. I'm not telling you these things to brag but to illustrate how much money can be made with simple portfolio hedges like these (and the FXI spread required no margin at all) because NOW I'm going to talk about a couple of new ones.

First of all, it's always about BALANCE. We don't like to be all bullish or all bearish, we like to always have some trades that make money in either direction and, when they make good money (like FXI), we take them off the table and use the profits to look for new trade ideas. For instance, as we cashed in some shorts, we looked for an upside way to play the bounce and found the following play for the 5% Portfolio last Monday, right after the market opened (9:44 am):

I think this is almost a flash-crash. Someone (thing) is selling with abandon. I think since we wanted to grab a long, we should and I nominate Dow at 15,600, which is more than 10% down for at least a bounce and the Dow ETF (DIA) Sept $155 calls at $6.75 were $13 on Friday and I like them for a gamble with the intention of selling the $159 calls for $6 on a bounce (now $5.20) so 20 of those for the 5% Portfolio with a stop at $6 or if the Dow can't hold 15,600.

Click on picture to enlarge

We held our line into the close and, since then, DIA has rebounded nicely to $166.27 as of Friday's close, putting that spread 100% in the money and, if that holds, the gain on a $1,500(20 100-unit contracts at 0.75) bet will be $6,500(433%). Of course, we have to wait until Sept 18th (options expiration) to collect the full amount, so we may take an early exit but, since we have $6,500 coming to us if the Dow simply stays where it is, this is an ideal time to add a short hedge to our Portfolio – just in case!

Looking at our indexes, it is the S&P and the Nasdaq who have made the biggest bounces off last week's low and, as much as I love Apple (AAPL), the fact that Netflix (NFLX) rocketed back to $117 (we're short) and Tesla (TSLA) zoomed back to $248 and Amazon (AMZN) jumped back to $518 makes me think traders have learned NOTHING from the crash and are right back to overvaluing momentum stocks.

Click on picture to enlarge

The Nasdaq Ultra-Short ETF (SQQQ) hit $45 last Monday and we were fine with that as we use it as a long-term hedge in our Short-Term Portfolio (I don't have time to explain that) but it fell right back to $24.40 at Friday's close. Clearly the potential is there for a big move on another Nasdaq pullback, so we like:

- Buying 10 SQQQ October $22 calls for $4.20 ($4,200)

- Selling 10 SQQQ October $28 calls for $1.90 ($1,900)

That's net $2,300 or $1.30 per option and your break-even price for SQQQ is $2.60 on expiration day (October 16th) so pretty much anything but a move lower in SQQQ will be a profit on this trade, up to $6 or $3,700 (160%) for the set. If you have a portfolio where you are bullish on Nasdaq stocks and worry about a 10% correction in the next two months costing you $10,000, you can mitigate that by placing just $2,300 in an insurance trade like this and you would get back $8,000 should the Nasdaq sell off. The assumption is, of course, that, if the Nasdaq goes higher, you should make your $2,300 back on your longs.

We're not looking for a pullback today and stay tuned to our 5% Portfolio, where we'll publish any specific hedges based on the action (the DIA play was a surprise but we nailed it last Monday, just 14 minutes after the market opened). Into the Holiday Weekend, we're going to want some kind of hedge but we're also watching our bounce lines, which closed on Friday at:

- Dow 16,200 (weak) and 16,650 (strong)

- S&P 1,900 (weak) and 1,950 (strong)

- Nasdaq 4,550 (weak) and 4,700 (strong)

- NYSE 10,050 (weak) and 10,300 (strong)

- Russell 1,130 (weak) and 1,160 (strong).

So the only change from Friday morning was the Russell hit it's 1,160 line but the other indexes stayed in their range. We need 3 strong greens and no reds for 2 consecutive closes to turn more bullish and, given that Chinese manipulation is behind the move up – we're going to error on the side of caution.

Of course, as I've been saying all summer, CASH!!! is your best form of portfolio protection. It allows you to remain flexible and take ADVANTAGE of OPPORTUNITIES when the market engages in wild swings like this. Just this morning, as a bonus, our 5% Portfolio Members got a copy of Part 2 of our review of Goldman's 25 Most Oversold Stocks and we found 3 more tradeable opportunities.

That's 8 bullish trades we liked last week off this list alone. Of course, last week we had a gigantic fire sale and 1,850 was our target for the S&P sell-off so it put us in a buying mood to see it hit and held – I'm only skeptical of the very quick, very low-volume bounce since then. Still, we'll give the markets a fair chance to prove themselves but we'll have our hedges ready – just in case!

Be careful this week.

more