Major Market Analysis - Earnings - Economic Calendar

Our "Market Week" Show, published each Friday, is very popular. In that show, we give our analysis of five major markets for the coming week. Still, many market participants tell us they would rather not watch video and would rather read our comments. So were experimenting. And we admit, this is kind of a test for a newsletter. Note, the charts included are very different than those you might normally see. They include our cyclical projections, normally only available to our subscribers. This is actually a variation of our charts, showing both intermediate and short-term projections It would be helpful if you commented on this post, just to let us know your thoughts; Video or text and other comments?

Commentary and Technical Analysis on the Major Markets

Crude Oil: The energy complex has been under huge pressure. There has been talk of China dumping its overstock of gasoline. And just at the time one would, seasonally, expect inventories of gasoline to be drawn down by summer driving, there was a surprising build in inventories this week. This has brought from some analysts of $35 oil. We doubt that, as our analysis has a cyclical low due in the oil market. Actually, its a bit overdue. That is often a sign of capitulation and extreme negative sentiment. Thus, we expect oil to get some upward traction soon.You can see that on the chart below.

(Click on image to enlarge)

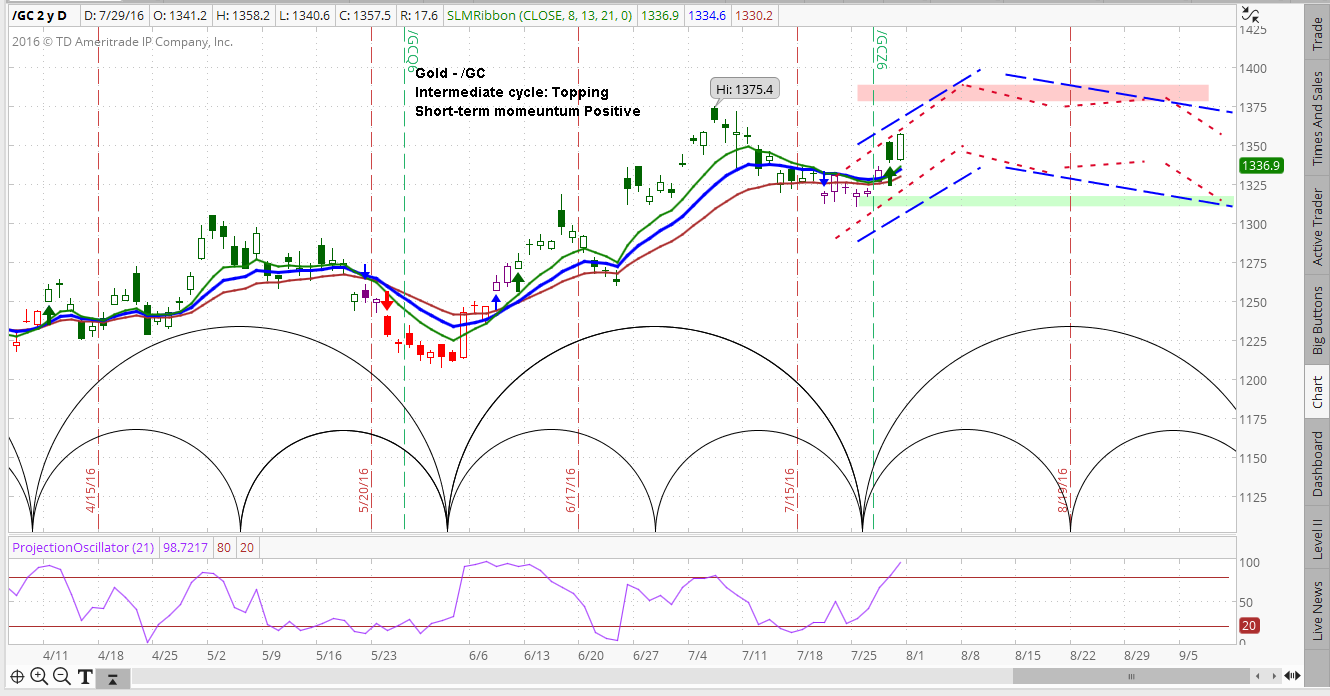

Gold: The intermediate pattern in gold is showing signs of stalling, Our recent analysis discussed a range of 1310 to 1370 for the near term. The inaction of the BOJ helped this week, as the yen weakened, hurting the US dollar. That gave gold a lift. Though the price of gold could test the recent high, even get through it by a bit, we expect it to be range bound for some weeks to come.

(Click on image to enlarge)

Euro Currency: The euro is our proxy for the dollar, as it trades mostly inverse and offers deeper markets in ETFs and options. Our analysis shows a short-term bounce coming in the dollar, thus a dip in the euro. Overall, we believe in the intermediate and longer-term, the dollar offers a lot of downside risk.

(Click on image to enlarge)

10-Year Notes: We use the 10-year in our analysis, as that yield is the most wildly followed, though we also offer trade setups and analysis in the 30-year bond. In our work, treasuries have entered a very risky period. They have moved up to some minor resistance and are falling back, support our believe that the short-term and intermediate term patterns are headed lower.

(Click on image to enlarge)

Stock Market: We use SPX for our main analysis in the stock market. The Futures, with large discounts to start each cycle, just are not accurate enough. Stocks have been immensely strong. The SPX, the past two weeks in the flattest range in years, does not reflect the powerful advances in the Nasdaq and Russell. While the trend remains up on all time frames there is reason be believe the market will roll over in the month of August, at least for an intermediate correction. See that in our projection.

(Click on image to enlarge)

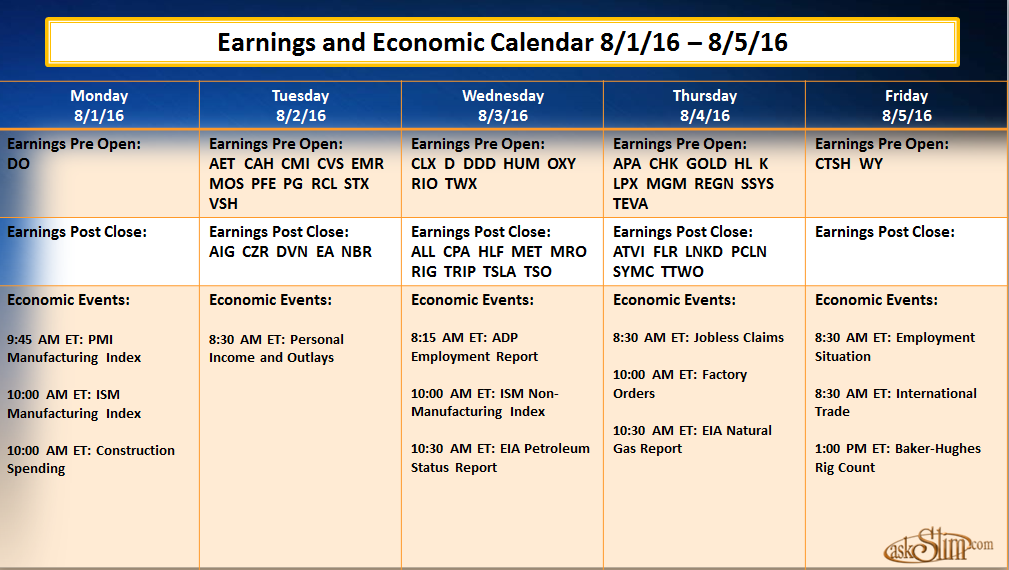

"Earnings and Economic Calendar" for the coming week. This week, the big event will be on Friday, when we get the employment report. Earnings reports are starting to wane. Overall, this has not been a great quarter. Gotta wonder what would happen if the FOMC pulled the plug on the "period of extraordinary ease." Don't get me started on central banks.

(Click on image to enlarge)

That's it for now! If this were the newsletter we were testing, we would also include our model portfolio.

Please do let us know your thoughts on this analysis.

Go to askslim.com and see our great videos for traders and investors, Rankings & Trade Setups, Charting Service and Coaching Services.