Major Asset Classes | August 2015 | Performance Review

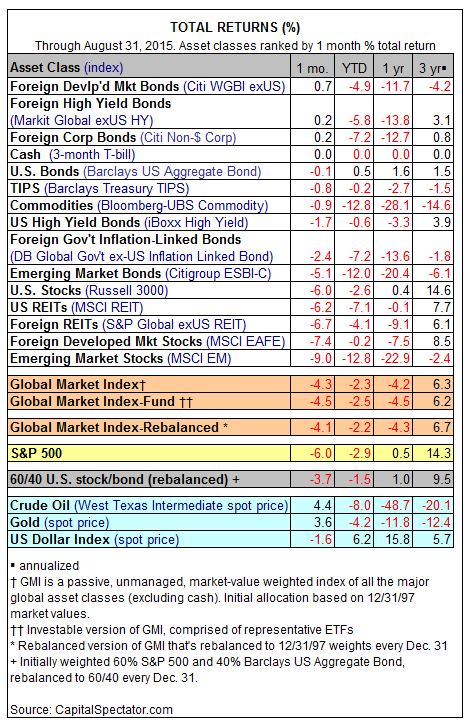

August was a painful month for most markets around the world. Other than fractional gains in foreign bond markets (mainly in developed countries), last month delivered a deep shade of red ink far and wide. The big loser: stocks in emerging markets (MSCI EM Index), which shed a hefty 9.0% in August–the biggest monthly setback in more than three years.

August’s best performer: foreign bonds in developed markets (Citi World Government Bond Index ex-US), which climbed 0.7% on a total return basis (in unhedged US dollar terms). A fair amount of the gain, however, was due to the dollar’s weakness last month–the US Dollar Index slipped 1.6% in August. The greenback’s retreat acted as a tailwind for assets denominated in foreign currencies after translating performances into US dollars.

Unsurprisingly, the broad based selling around the world weighed heavily on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI’s 4.3% decline in August is the biggest monthly setback in over three years. For the trailing one-year period, GMI is now in the red by 4.2%, although for the trailing three-year period the index remains comfortably ahead with an annualized 6.3% total return.

The weak performance for GMI lately may be a shock for some investors, but recent long-term projections of expected return for the benchmark have been hinting at softer returns for some time. In last month’s update on looking ahead, for instance, the outlook for GMI’s long-run return remained well below its trailing performance record in recent years.

Disclosure: None.