Long And Short Of Short Interest - Friday, August 10

Here is a brief review of period-over-period change in short interest in the July 16-31 period in nine S&P 500 sectors.

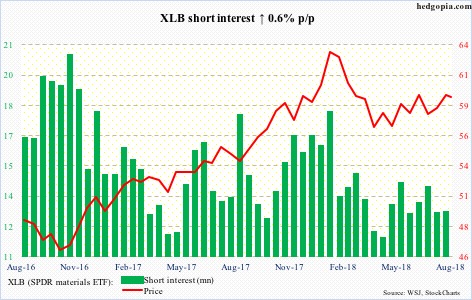

XLB (SPDR materials ETF)

XLB ($59.54) bulls continued to defend a rising trend line from early April. At the same time, a falling trend line from late January is intact. The ETF is barely above the 200-day moving average, with just south of $60 proving tough resistance. Near term, it can go test the trend-line support again.

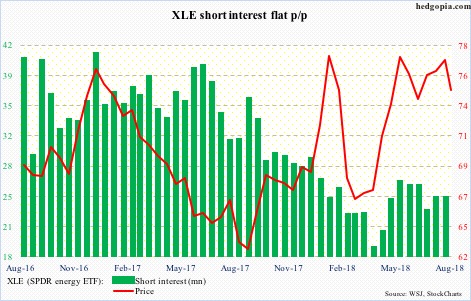

XLE (SPDR energy ETF)

Resistance at $78-79 on XLE ($74.83) has acted as a ceiling since last December, including in the last two sessions of July. In five of the last six sessions, the 50-day repelled rally attempts. The average is gradually rolling over. There is support at $74-plus, followed by $72.50-ish.

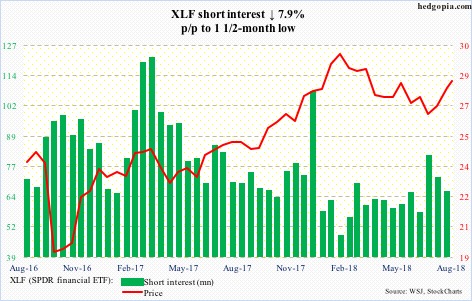

XLF (SPDR financial ETF)

End-June, XLF ($28.30) short interest rose to a six-and-a-half-month high. That was when support at $26.50-ish was briefly breached, and, as it turns out, falsely. A rally followed, and with that a decline in short interest. Monday, the ETF tested resistance at $28.50 – unsuccessfully. Daily momentum indicators are grossly extended. The likely path of least resistance is down.

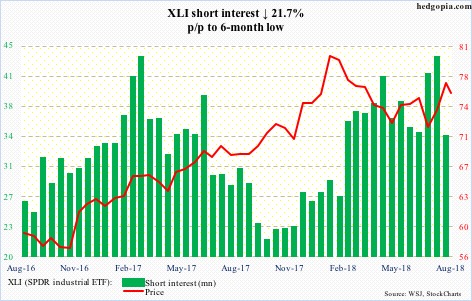

XLI (SPDR industrial ETF)

XLI ($75.74) rallied in July – squeezing the shorts – until it hit the wall on the 31st when it retreated from $76.99. For five months now, this level has provided resistance. Wednesday, a rising trend line from early July was broken, raising odds of continued pressure near term. The 200-day lies at $74.82.

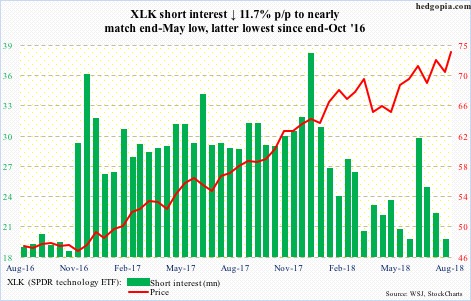

XLK (SPDR technology ETF)

XLK ($73.62) rallied to a new all-time high of $74.24 on July 25. Wednesday, it rose to $73.90 intraday before coming under slight pressure. The high 12 sessions ago was denied at the upper end of a six-month channel. In the meantime, all the build-up in short interest post-presidential election in November 2016 is gone. Shorts that stayed put have better odds of succeeding now.

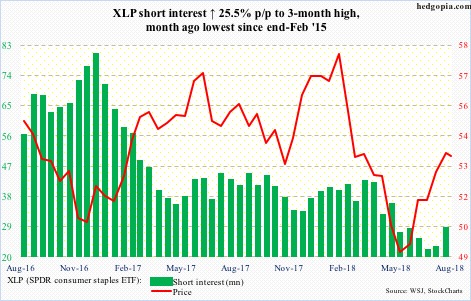

XLP (SPDR consumer staples ETF)

That is some rally XLP ($53.44) put up. After bottoming early May at just under $49, the ETF last week briefly even broke out of a three-month channel. It has since dropped back into the channel, closing Wednesday right on the 200-day. The 50-day lies at $52.03, which is where the bottom end of that channel lies. A test is likely.

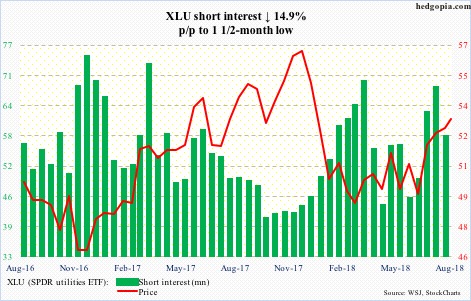

XLU (SPDR utilities ETF)

Since bottoming at north of $48 early June, XLU ($53.22) rallied strongly, only to hit the wall just north of $53 early July. Resistance has continued. Short interest is still elevated, but a squeeze increasingly looks less likely near term.

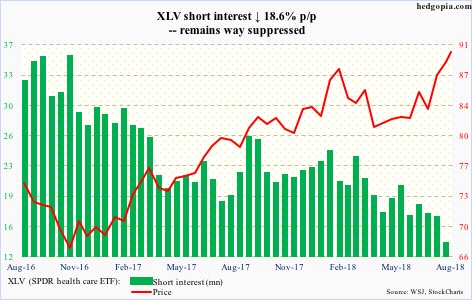

XLV (SPDR healthcare ETF)

For a while now, XLV ($90.02) shorts have gotten squeezed. This continued in the second half of July. The ETF in the meantime has rallied to striking distance of its all-time high from late January – $91.79 versus $90.38 Wednesday. Daily and weekly charts are way overbought, with some signs of fatigue in recent sessions.

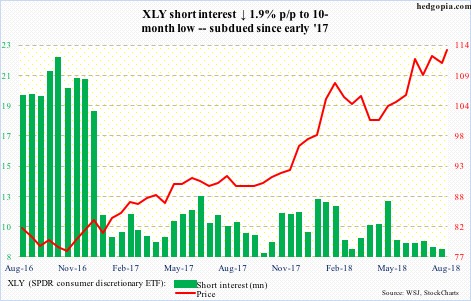

XLY (SPDR consumer discretionary ETF)

Since early 2017, XLY ($113.67) shorts have pretty much stayed on the sidelines. Rightly so. The ETF Wednesday rallied to a new intraday high of $114.07. That high also kissed the upper end of a rising channel, raising odds of a pullback.

Disclaimer: This article is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any ...

more