Logical Invest Investment Outlook - July 2017

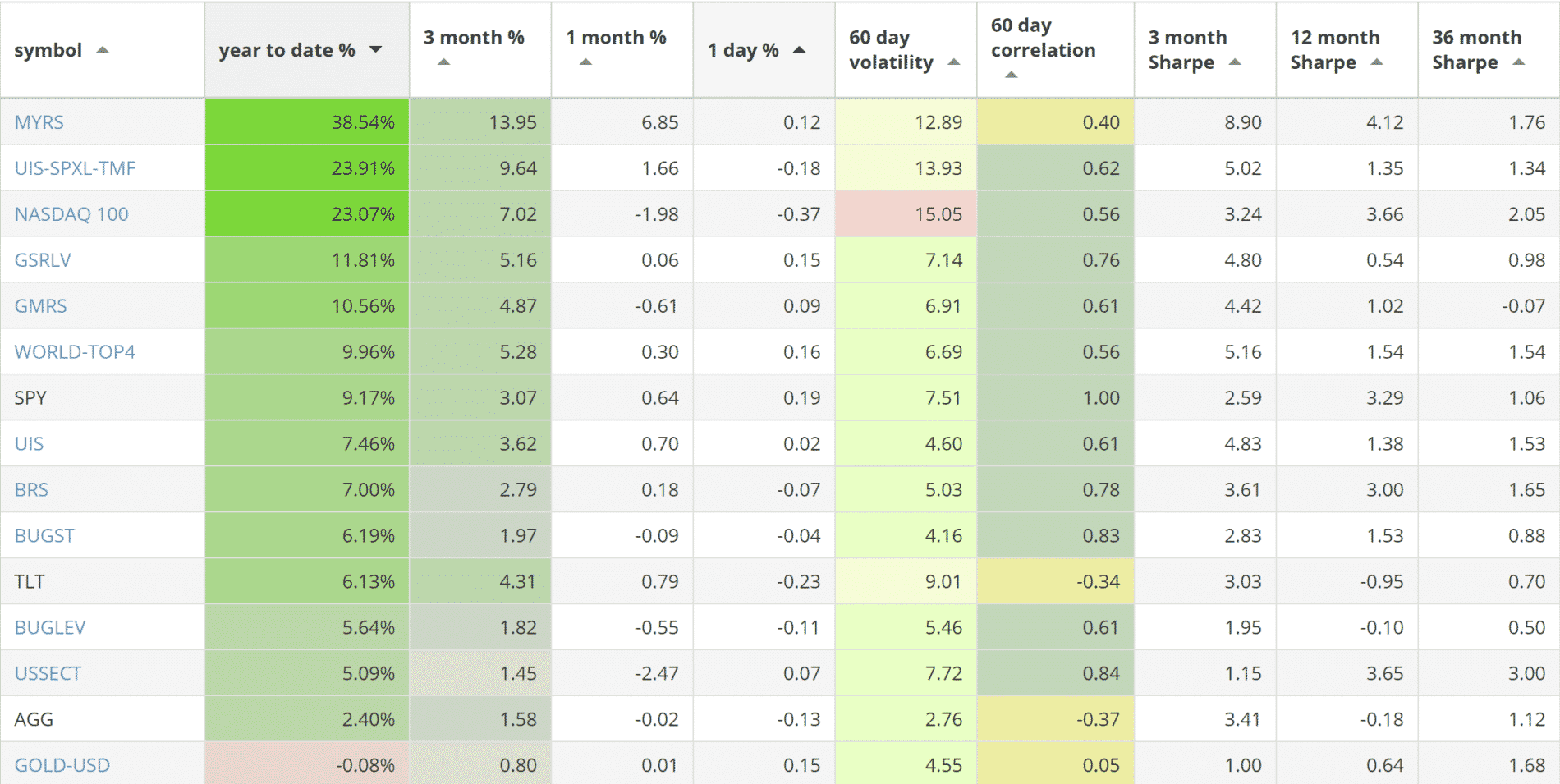

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 38.54% return.

- The Leveraged Universal strategy with 23.91% return.

- The Nasdaq 100 strategy with 23.07% return.

SPY, the S&P500 ETF, returned 9.17%.

News:

Our professional portfolio software QuantTrader continues to evolve and can now download data from 3 different providers: Tiingo, Yahoo and Google. Tiingo is an inexpensive solution for DYI investors that need good quality dividend-adjusted end of day data.

Market comment:

The U.S. Federal Reserve raised its benchmark federal-funds rate on June 15th by a quarter percentage point and hinted to further hikes. Individual investors remain skeptical of the bull market as the AAII survey shows 43.4% being neutral (historical average is at 38%). Mainstream market analysts keep a positive outlook quoting decreased risks and equity strength in Europe, global strength in developed and emerging markets, low unemployment in the U.S. and a sense that the Fed’s tightening is predictable.

We continue to see a low volatility environment and a weakness in U.S. dollar for 2017 which benefits non-U.S. stocks, bonds as well as gold. The European market returned 17% YTD while India and China achieved 20%+ returns for the year.

UUP ETF (U.S. Dollar Index)

Out top strategy, the Maximum Yield strategy, added another +6.85% to reach +38.5% return for the year. The Universal Investment 3x strategy had a correction in the last few days of July but came out positive adding +1.66% for a +23.9% YTD return. Both the Nasdaq 100 and the U.S. Sector strategies had corrections: -1.98% and -2.47% to achieve +23% and +5% YTD respectively. All other strategies remained flat with gains/losses below 1%.

A final note: We do keep a watchful eye on recent developments in the crypto-currency markets as Bitcoin and Ethereum are attempting to make their way into the mainstream. It may be worth watching the roller-coaster ride and how this ‘new’ market behaves as new people are drawn into unstoppable up-trends and initial coin offerings (ICO’s) only to get “shaken out” by deep and sudden drawdowns. A promising but difficult market and a good example why one needs a system of rules to adhere to.

We wish you a healthy and prosperous 2017.

Logical Invest, July 1, 2017

Logical Invest Performance June 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Thanks for sharing