Logical Invest Investment Outlook - August 2017

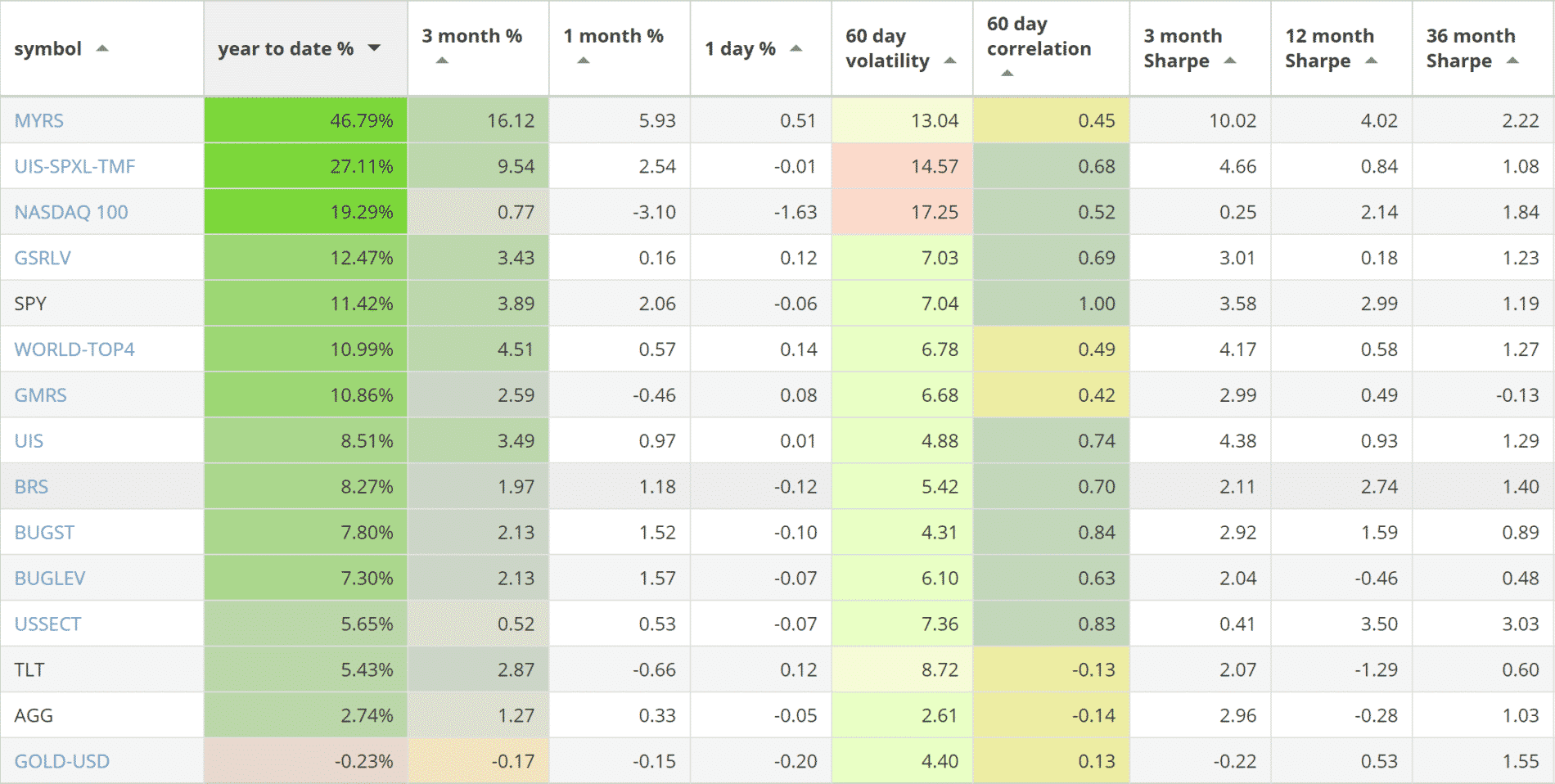

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 46.05% return.

- The Leveraged Universal strategy with 27.11% return.

- The Nasdaq 100 strategy with 19.29% return.

SPY, the S&P500 ETF, returned 11.42%.

News:

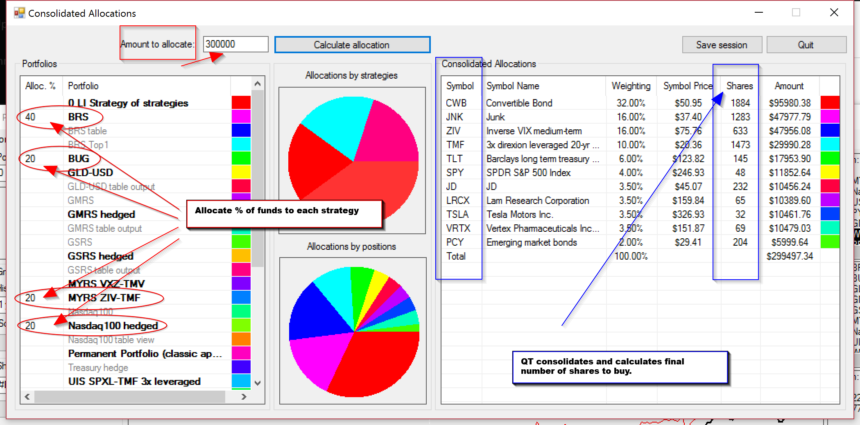

Our professional portfolio software QuantTrader has reached version 5.0 with improvements including being able to load your custom set of strategies and a new consolidated signals screen. You can now allocate your funds in multiple strategies and have QuantTrader calculate the number of shares of each stock/ETF you need to buy.

QuantTrader Consolidated Signals

Market comment:

Just as we mentioned in our last June newsletter, we continue to observe low volatility and a weakening dollar. The VIX index hit a record low on July 26th, falling temporarily to 8.84, a level last seen back in 1993. Moreover the index stayed under the 10 level for 10 consecutive days showing persistence. The U.S. dollar fell to a 13-month low against a basket of currencies. The Euro has broken to the upside, reaching 1.18 against the dollar, a level last seen before December 2014. The Euro is 11% up year-to-date. Certain commodities that have had terrible returns for the past years are this month’s top performers: Sugar, Gasoline, U.S. diesel Heating oil, Nickel, Coffee and U.S. oil (USO) ETFs all gave more than 10% returns for the month. Of course if you look at a graph you will see this is just a tiny reaction to multi-year bear markets.

Taking advantage of the extended low volatility environment, out top strategy, the Maximum Yield strategy, added another +5.93% to reach +46.79% return for the year. The Universal Investment 3x strategy added 2.54% for a +27.11% YTD return. All our other strategies were positive in July. The exception was the Nasdaq 100 strategy that corrected -3.1% causing this month’s allocations to change significantly. As a last note, our U.S. Sector strategy has allocations to both cash and to a small short position in one of the sectors.

We wish you a healthy and prosperous 2017.

Logical Invest, August 1, 2017

Logical Invest Performance July 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)