LinkedIn’s Opportunity To Outshine Tech Rivals Including Facebook And Twitter

(Photo Credit: Esther Vargas)

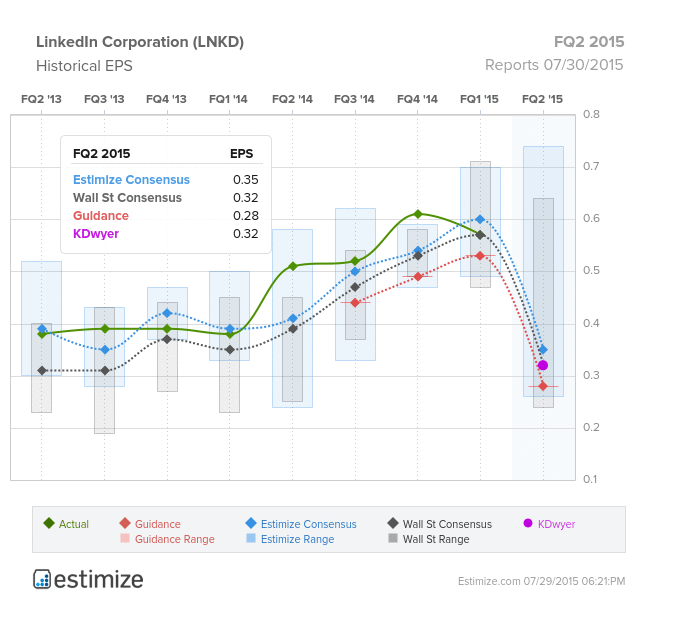

LinkedIn Corporation (LNKD) reports its FQ2 ’15 results after the closing bell today. The Estimize community is predicting an EPS figure of $0.35 and a revenue number of $685.93M. Wall Street analysts however, assume an EPS figure of $0.32 and forecast revenues of $681.56M.

LinkedIn has underperformed year-to-date (YTD) with a capital loss of -1.07% compared to the NASDAQ index which has appreciated 7.62%. As you can see from the chart below, LinkedIn shareholders were punished for holding the stock whilst management released the FQ1 ’15 results. Despite meeting Wall Street’s expectations, LinkedIn failed to beat the Estimize consensus, resulting in the stock getting punished the following trading day.

SOURCE: ChartIQ

LinkedIn is the global leader in online professional networking and continues to experience solid user acquisition growth numbers, posting a 23% increase in cumulative members in FQ1 ’15. LinkedIn’s management have also made an effort to penetrate the online learning sector with various acquisitions including Lynda.com. Further, LinkedIn are partnering and acquiring various companies in an attempt to enhance user experience and further encourage advertisers to use their site.

The most important part to LinkedIn’s business is clearly its talent solutions segment. This segment was most recently recorded to account for 62% of total revenues for LinkedIn. This particular side of the business focuses on selling products to recruiters. The most important thing for investors heading into the result will be how this segment faired in FQ2 ’15. With a dramatic 5% fall in YoY growth in FQ1, investors will want to see a better result YoY in FQ2.

The sentiment following today’s report will likely be dictated by the talent solutions segment’s performance, investors are advised to watch this number closely and pay attention to management’s outlook for this area of the business. In addition, investors will want to hear management’s outlook for expenses and R&D costs moving forward. During the FQ1 results, investors were given a nasty surprise when management informed the market that they intended on ramping up R&D and overall expenses in order to increase the company’s salesforce.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.