Lifetime Lows

On Tuesday, the market yet again printed (nauseatingly) record highs on many indexes, including the Nasdaq and the Dow Industrials. During troubled times like these, I find it interesting to see what stocks, in spite of the completely fabricated support being thrown at equities, are still down in the dumps. In a normal market, these companies would have already gone bankrupt (or at least been delisted).

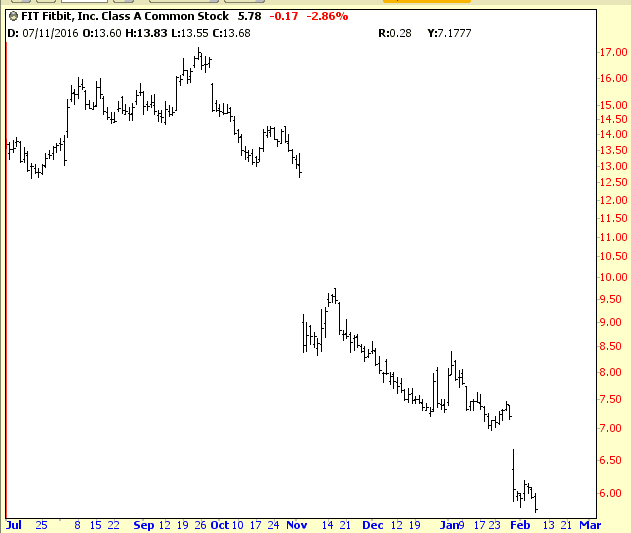

Take, for instance, FitBit (FIT), a one-hit wonder which continues to collapse into AAPL-created irrelevance.

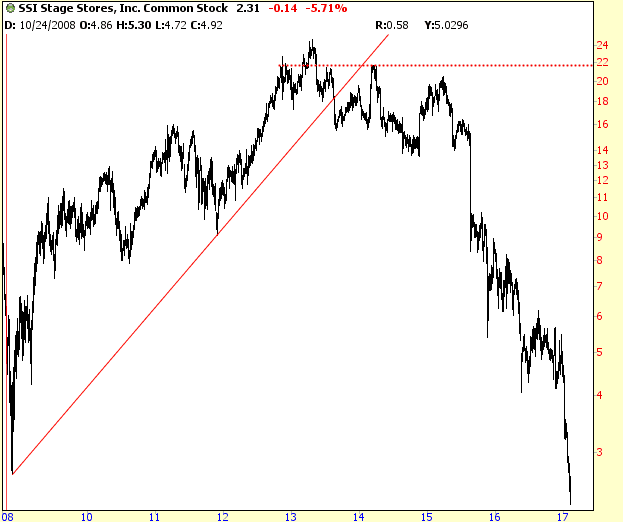

Retail is a favorite area for me to be shorting. Sears, for instance (SHLD) is at the lowest point in human history, so your days of yankin’ it to the lingerie section of the giant catalog are over. Smaller stores, too, are getting killed, including Stage Stores (SSI)………

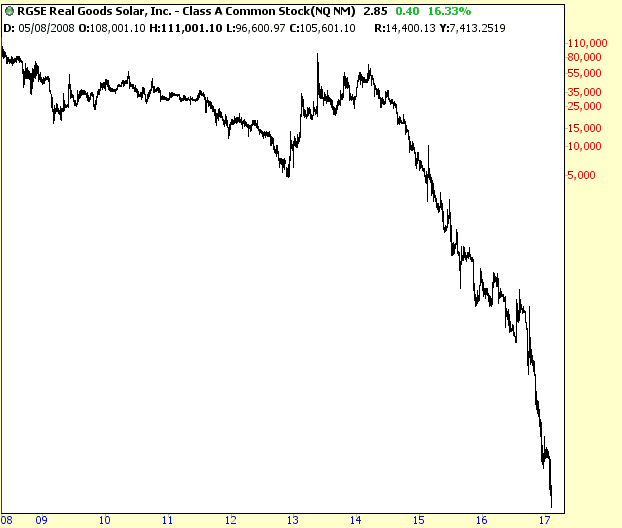

I have no idea what Real Goods Solar (RGSE) does (something with solar, I assume), but reverse splits have clearly been employed for this disaster:

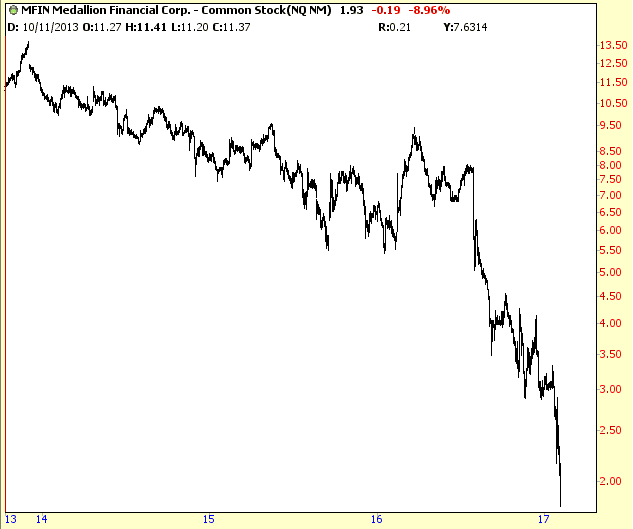

In a way, the one I’m most proud of is Medallion Financial (MFIN), which 2 1/2 years ago I devoted an entire post to shorting (back in those days, the ticker symbol was TAXI). It seems my prediction, based more on UBER’s existence than the chart itself, came very true:

Disclosure: None.

thanks for sharing