Last 3 Spikes In The Ted Spread: Did Stocks Tank?

Ted Spread Highest Level In Seven Years

You may have seen warnings about the Ted Spread in recent days, along the lines of this blurb from The Wall Street Journal:

A measure of stress in financial markets, whose alarm bells heralded the 2008 financial crisis, just hit its highest level in over seven years.

Spikes In Ted And Stocks

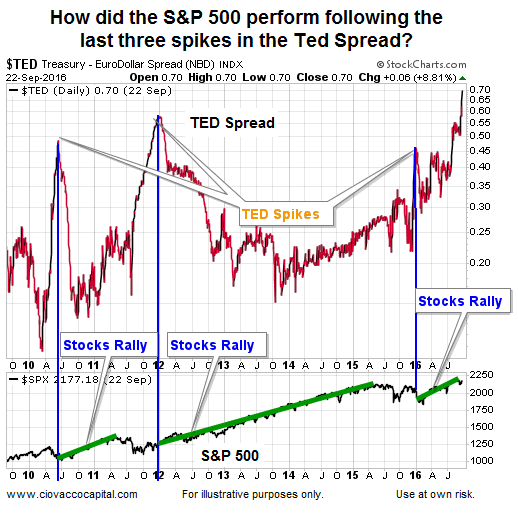

The last three times the Ted Spread spiked was it better to be buying stocks or selling stocks? Recent spikes in the Ted Spread have occurred during sell-offs in the stock market. However, the peaks in the Ted Spread occurred just prior to sharp rallies in the S&P 500.

New Regulations And The Ted Spread

Another factor to consider is the regulatory impact on the ongoing utility of the Ted Spread. From The Wall Street Journal:

But don’t worry. It turns out the so-called Ted Spread might be dead, an unlikely casualty of the recent changes in U.S. money-market regulation… The U.S. Securities and Exchange Commission’s new rules for money-market funds come into effect in the middle of October. They are designed to stop rapid outflows during periods of panic and include abandoning a fixed $1 share price and allowing these funds to impose fees on shareholders who withdraw assets. Funds can also suspend redemptions temporarily.

The Bigger Picture

The recent spikes in the Ted Spread did occur during periods of increasing fear in the equity markets. Therefore, as always, we remain open to all outcomes over the coming days and weeks, including bearish outcomes. This week’s stock market video covers a very rare shift that recently occurred in the financial markets; what could have caused the shift and what does history tell us about the present day stock market?

How Helpful Is The Ted Spread?

Indicators that have strong and consistent correlations to the S&P 500 can be helpful. As shown below, the correlation between the Ted Spread and the S&P 500 looks like an 8.0 magnitude earthquake on the Richter scale. Sometimes stocks go up when the Ted Spread goes up; sometimes stocks go down when the Ted Spread goes up.

From a long-term perspective, it is difficult to see how the Ted Spread would have been helpful in any manner for stock investors, except to confuse them. Given the look of the correlation chart above, a coin flip may be just as telling as the Ted Spread in terms of stock market odds. There are countless things to be concerned about; the recent spike in the Ted Spread is not high on the list.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more