Large Cap Best And Worst Report - November 4, 2014

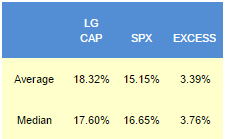

Since 2010, our top scoring weekly has outpaced the SPX by a median 376 bps in the following year. The best performers from our list one year ago are MU up 87%, RCL up 62%, GILD up 61%, FB up 50%, and HUM up 49%.

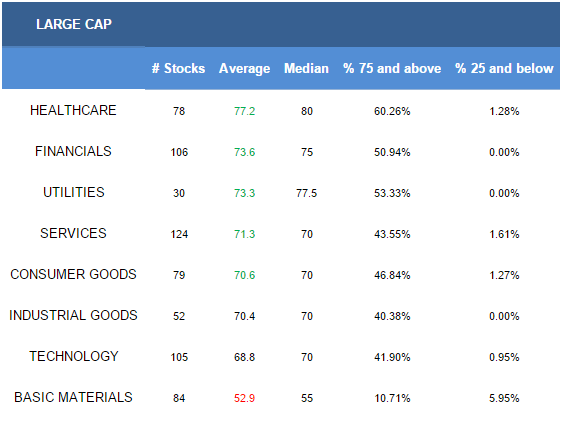

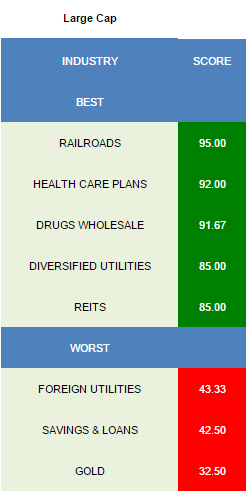

- Healthcare is the best scoring large cap sector.

- The top scoring large cap industry is railroads

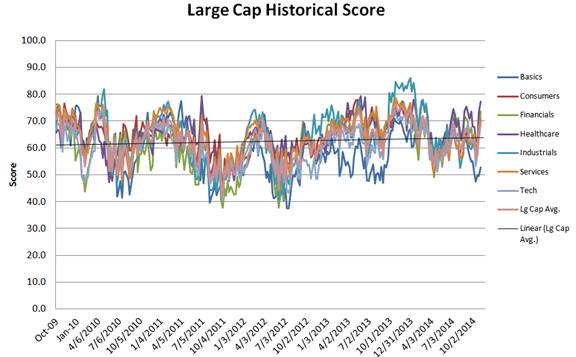

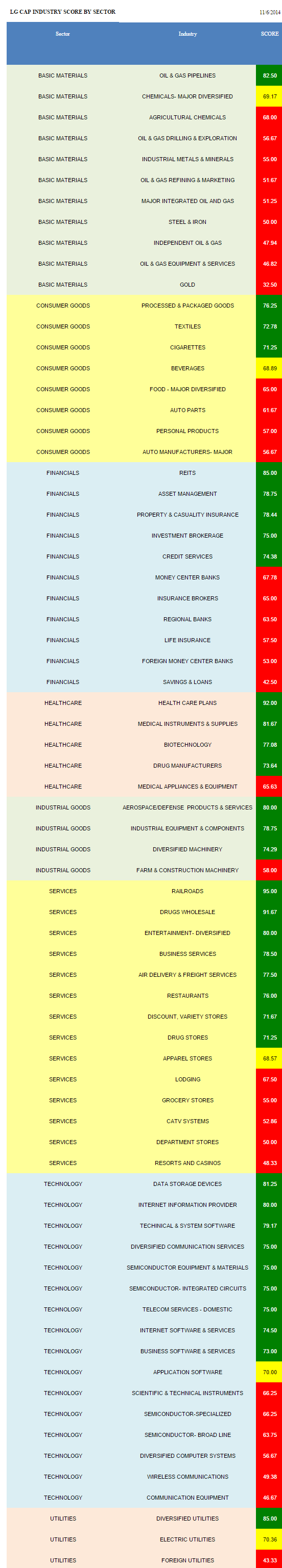

The average large cap score is 69.53, above the four week moving average score of 62.40. The average large cap stock is trading -10.26% below its 52 week high, 2.58% above its 200 dma, has 3.91 days to cover held short, and is expected to see EPS growth of 11.43% next year.

Healthcare, financials, utilities, services, and consumer goods all score above average. Industrial goods and technology score in line. Basics score below average.

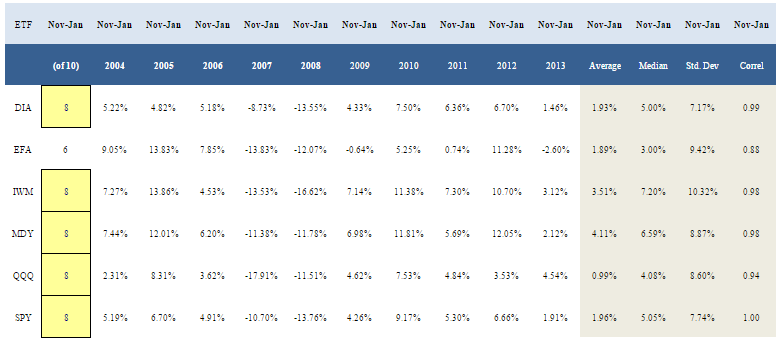

The following table breaks out seasonality across major market ETFs for the three month period beginning November and ending January 31st. Over the past decade, the SPY has gained in eight of the past 10 periods, returning a median 5.05%.

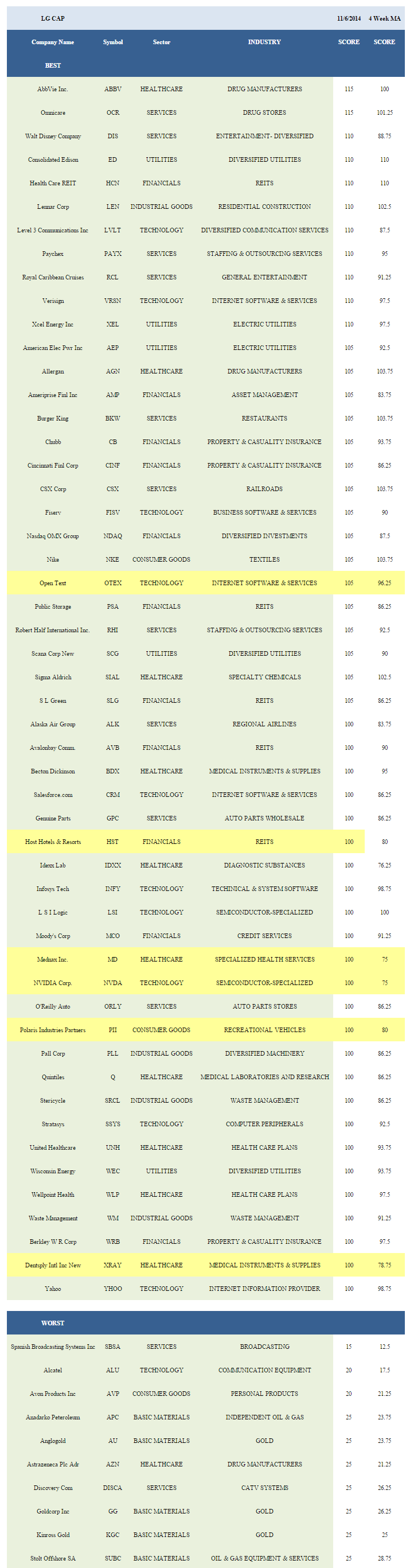

The best scoring large cap industry is railroads (CSX, UNP, NSC). Carload pricing continues to benefit from rising volume. Intermodal rail volume remains strong, climbing 6.7% YoY in the most recent week. Year-to-date, intermodal volume is up 5.5%. Healthcare plans (WLP, UNH, HUM, CI, AET) offer upside on rising membership revenue tied to ACA exchanges, Medicaid expansion, and rising demand for Medicare plans. In August, Medicaid enrollment of 67.931 million was 15% higher than last October when the ACA kicked-off. Wholesale drug (MCK, ABC, CAH) sales growth upside tied to increasing insurance enrollment supports revenue and earnings expansion. Year-over-year retail price increases support utilities (ED,S CG, WEC, AEE). Residential electricity retail rates were up 4% from a year ago in the most recently reported month of August. REITs (HCN, SLG, PSA, HST, AVB, SPG, MAC, VTR) benefit from effective rent growth in apartment and office space. Healthcare REIT utilization remains high and supported by ageing America.

In basics, only oil & gas pipelines (WMB, SE) score above average. In consumer goods, focus on processed & packaged goods (GMCR, MJN, CAG, PEP, CPB), textiles (NKE, VFC, UA, PVH), and cigarettes (RAI, MO, LO). The top financials baskets include REITs, asset managers (AMP, IVZ, BLK), and P&C insurers (CINF, CB, WRB, HIG, TRV). Healthcare plans, medical instruments (XRAY, BDX, SYK, BCR), and biotech (ILMN, GILD, INCY, CELG, REGN, MDVN, BMRN) score best across healthcare. The highest scoring industrial goods group is aerospace/defense (RTN, GD, NOC, COL, BA). In services, concentrate on rails, wholesale drugs, and diversified entertainment (DIS, TWX). Data storage devices (WDC, NTAP, STX), Internet information (YHOO, FB, EXPE), and technical & system software (INFY, ADSK, SNPS) score best across technology. The top utilities basket is diversified utilities.

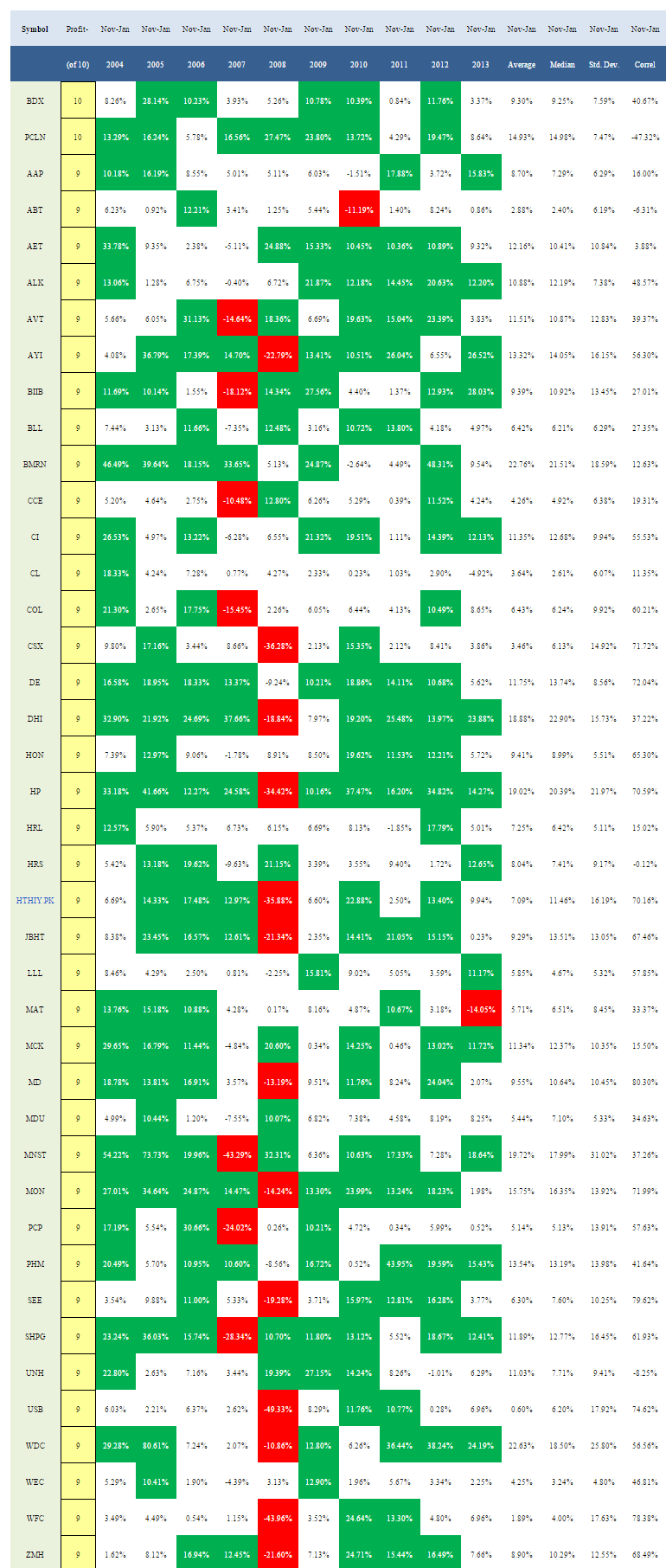

The following large cap stocks have the best seasonality for the three month period of November through January.

Disclosure: None.