Large Cap Best And Worst Report - October 21, 2014

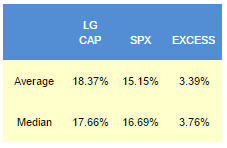

Since 2010, our top scoring weekly has outpaced the SPX by a median 376 bps in the following year. The best performers from our list one year ago include RCL up 48%, GILD up 48%, FB up 44%, and X up 44%.

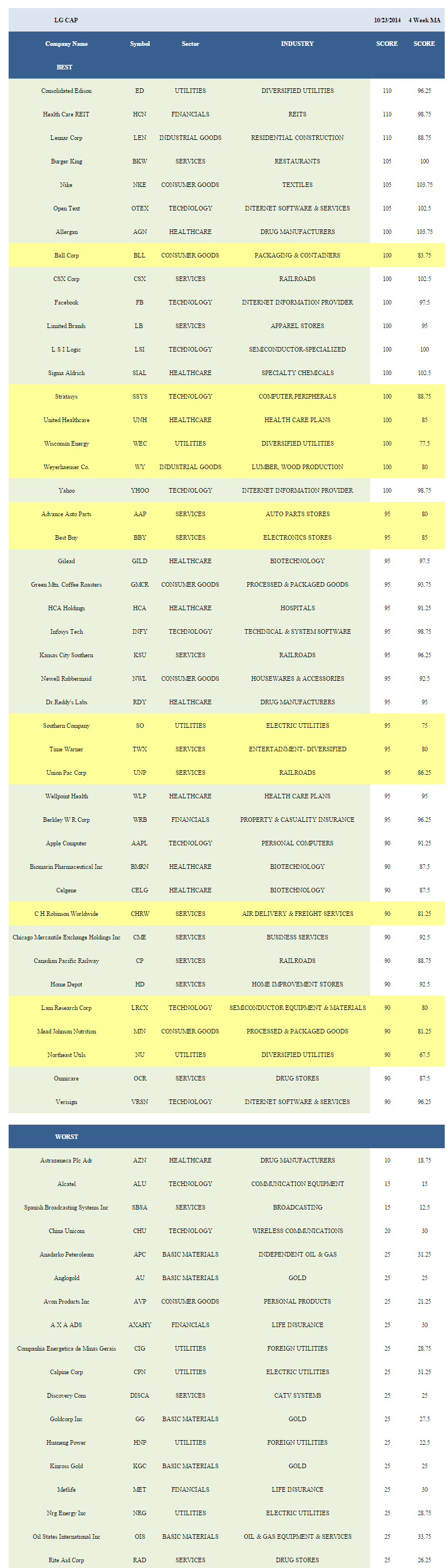

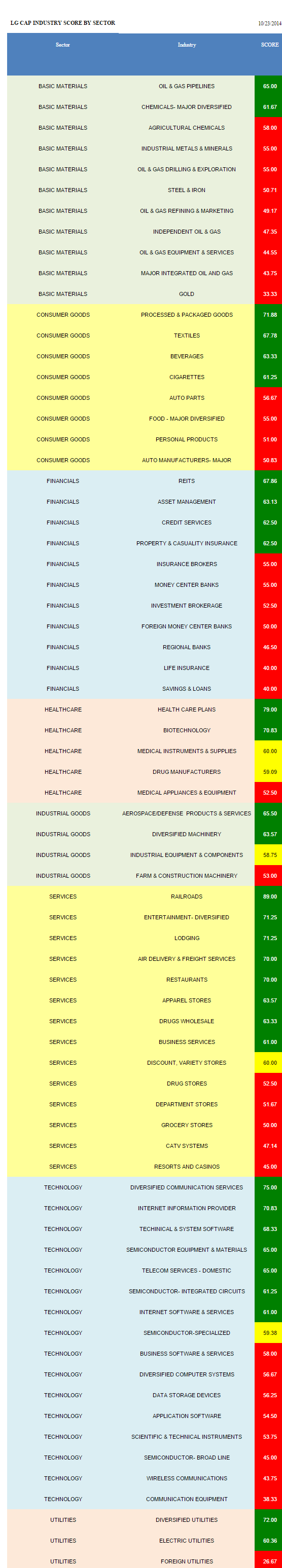

- Healthcare is the top scoring large cap sector.

- Railroads are the top scoring large cap industry.

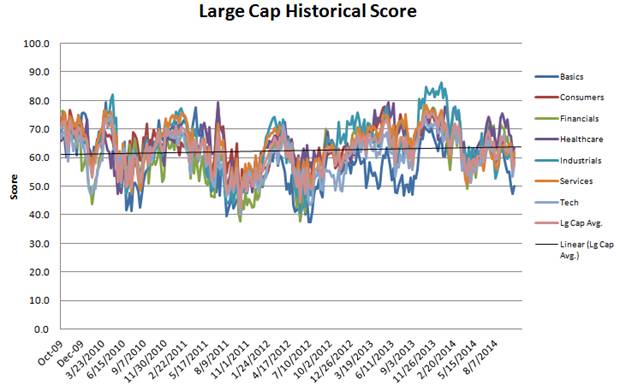

The average score across our large cap universe is 59.15, below the four week moving average score of 59.91. The average large cap stock is trading -15.17% below its 52 week high, -3.63% below its 200 dma, has 4.56 days to cover held short, and is expected to post EPS growth of 12.39% next year.

Healthcare, services, consumer goods, and utilities score above average across large cap. Industrial goods and financials score in line. Technology and basic materials score below average.

ssaaalalalaal.png)

dsddadadadaa.png)

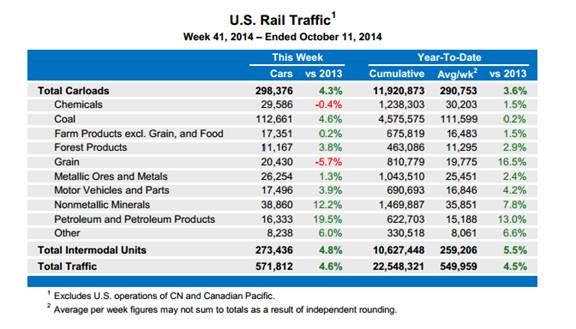

Total rail carload volume grew 4.6% in the past year to 571.8k carloads in the most recently reported week, bringing year-to-date carload growth up to 3.6%. Rail (CSX, UNP, KSU, CP) volume remains supported by intermodal volume and volume recovery this year in grains and coal lends support to carload pricing. The ACA's second open enrollment period kicks off on November 15th and major insurers (UNH, WLP, HUM) are slated to participate in more states. That participation will help offset sagging employer membership in the past year (particularly at UnitedHealth). Diversified communication system (LVLT, CCI) demand remains strong thanks to ongoing data consumption growth driven by consumer and corporate adoption of high bandwidth content like video. Diversified utilities (ED, WEC, NU, SCG) are strong scoring. Increasing opportunity in emerging markets and convenience store channels support processed & packaged goods (GMCR, MJN, CAG, CPB).

In large cap basics, buy pipeline (WMB) and major chemicals (SHW, APD). Processed & packaged goods, textiles (NKE, UA, MHK, HBI), and beverages (MNST, TAP, KO, STZ) score highest in consumer goods. Focus on REITs (HCN, DLR, SLG, PSA, HST, HCP), asset managers (TROW, AMP), and credit services (SLM, MCO, EFX) in financials. The top healthcare groups are healthcare plans and biotech (GILD, CELG, BMRN, REGN, MDVN). In industrial goods, concentrate on aerospace/defense (BA, TDG, RTN) and diversified machinery (IR, PLL). Railroads, diversified entertainment (TWX, DIS, NWS), and lodging (MAR, WYN) score best across services. Overweight diversified communication, Internet information providers (YHOO, FB, NTES), and technical & system software (INFY, CNQR) in technology. In utilities, diversified utilities and electric utilities (SO, XEL, ETR, DUK) score strongly.

Disclosure: None.