Large Cap Best And Worst Report - September 23, 2014

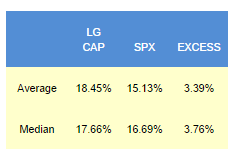

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 339 bps of excess to the SPX in the following year. The best performers from our list one year ago are RCL up 80%, AMP up 42%, H up 42%, and LEA up 37%.

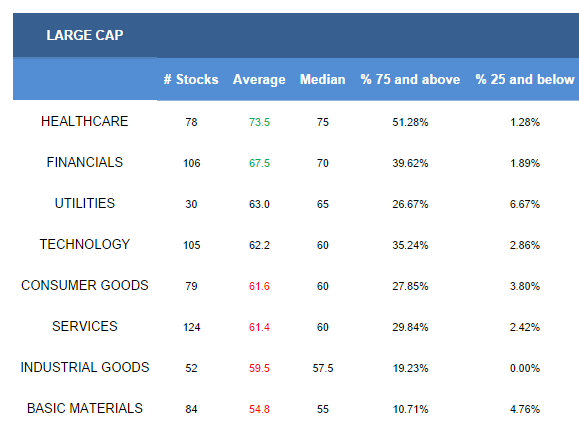

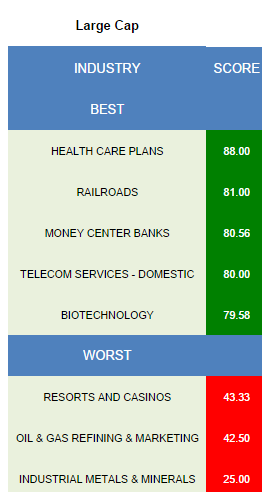

- Healthcare is the top scoring large cap sector.

- The best scoring large cap industry is healthcare plans.

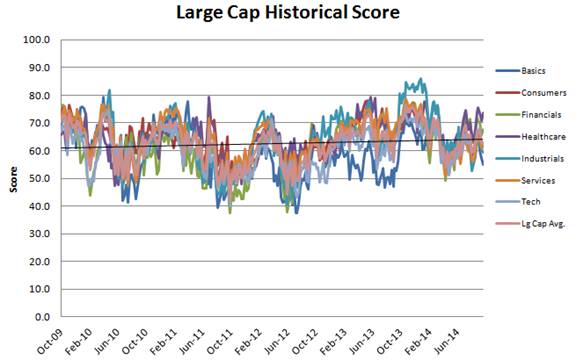

The average large cap score this week is 62.97, below the four week moving average score of 64.81. The average large cap stock is trading -10.38% below its 52 week high, 1.81% above its 200 dma, has 4.49 days to cover held short, and is expected to post EPS growth of 13.27% next year.

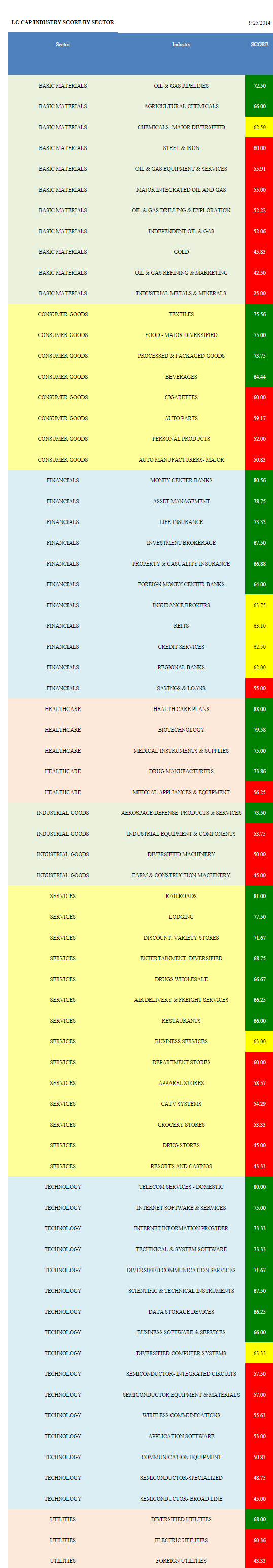

Healthcare and financials score above the universe average score. Utilities and technology score in line. Consumer goods, services, industrial goods, and basic materials score below average.

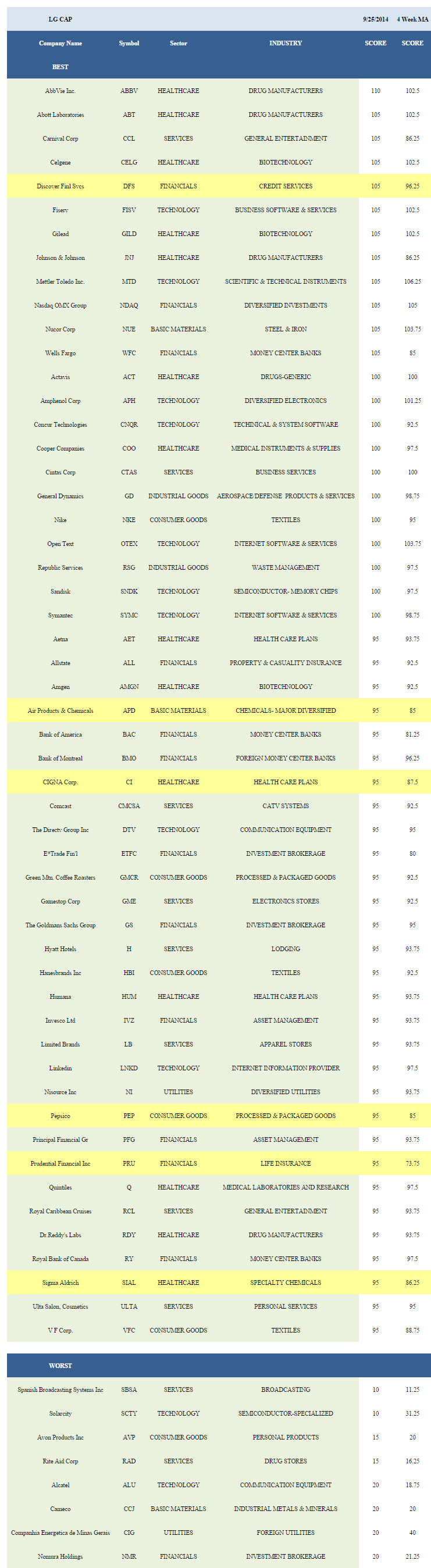

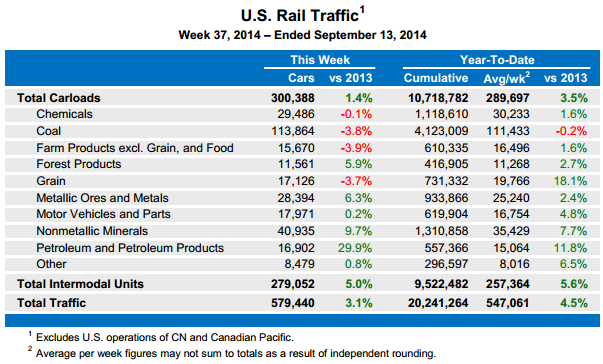

The top large cap industry is healthcare plans (HUM, CI, AET, UNH, WLP). Roughly 90% of those signing up for insurance on exchanges followed through with payments; an improvement over the ~80% rate estimated after the first quarter. Medicaid insurers are particularly intriguing as additional exchanges adopt expansion. Railroad (CP, NSC, CSX, KSU) traffic (see table below) continues to support carload pricing. Total carloads are 4.5% higher year-to-date than in 2013. Money center (WFC, RY, BAC, BK, STI, JPM) bank profit growth is supported by growing loan portfolios. Consumer revolving credit expansion similarly offers revenue and profit opportunity. Domestic telecom (CTL, T, VZ) is supported by next generation devices, including the Apple Watch, which are driving data consumption higher. High priced personalized biologics and label expansion support biotechnology (GILD, CELG, AMGN, REGN, JAZZ, BMRN, MDVN) -- increase exposure.

In large cap basic materials, only pipelines WMB and ag chemicals (DD, MON, CF) score above average. Textiles (NKE, VFC, HBI, UA, RL), major food MDLZ, and processed & packaged goods (PEP, GMCR, MJN) are best in consumer goods. The best scoring financial industries include money center banks, asset managers (PFG, IVZ, AMP, TROW), and life insurance (PRU, SLF, LNC). Buy healthcare plans, biotechnology, and medical instruments (COO, COV, CFN, BCR) in healthcare. Only aerospace/defense (GD, NOC, LMT, RTN) score above average across industrial goods. Rails, lodging (H, MAR, WYN), and discount/variety stores (TGT, COST, FDO) score highest in services. In technology, buy domestic telecom, Internet software (SYMC, OTEX, VRSN, FFIV, AKAM), and Internet information providers (LNKD, FB, NTES). Diversified utilities (NI, SCG, ED) are also attractive.

Disclosure: None.