Large Cap Best & Worst Report - October 28, 2014

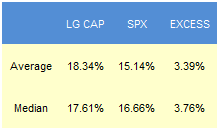

Since 2010, our top scoring weekly has outpaced the SPX by a median 376 bps in the following year. The best performers from our list one year ago include FB up 63%, GILD up 59%, and SIAL up 56%.

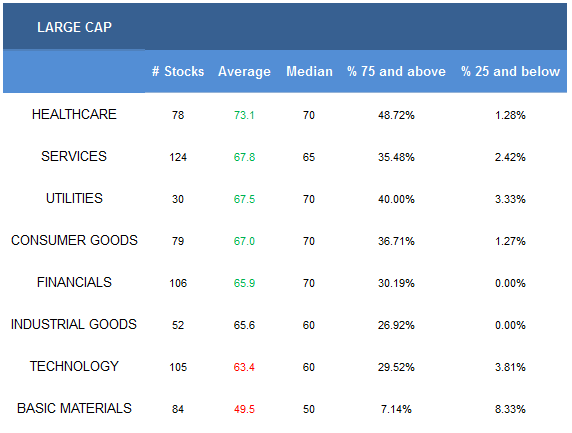

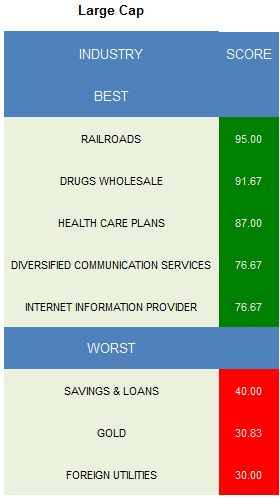

- Healthcare is the best scoring sector.

- Railroads is the top scoring industry.

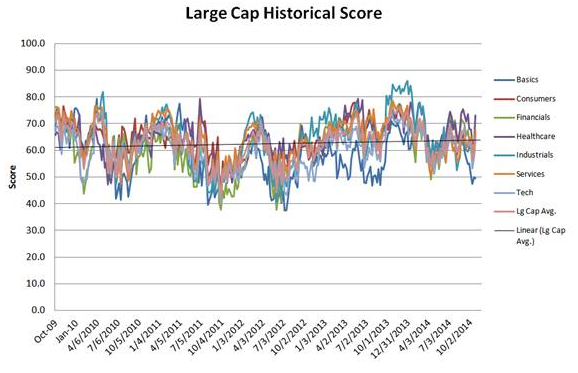

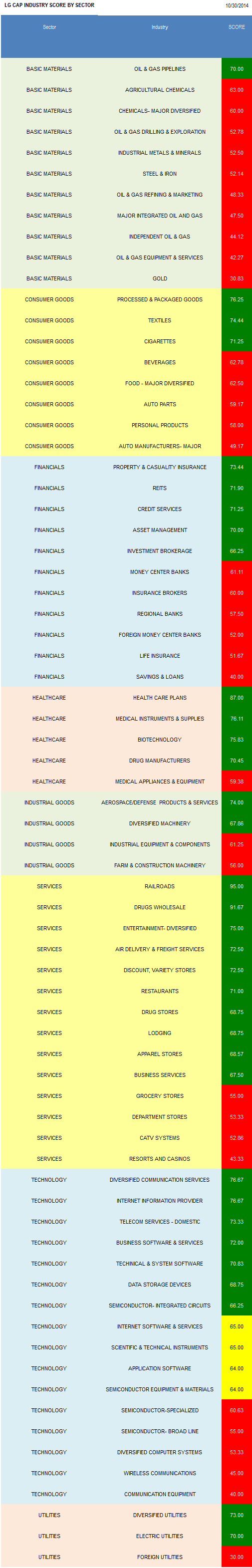

The average large cap score is 64.83 this week, above its four week moving average score of 60.64. The average large cap stock is trading -12.76% below its 52 week high, -0.72% below its 200 dma, has 3.91 days to cover held short, and is expected to post EPS growth of 11.9% next year.

Healthare, services, utilities, consumer, and financials score above average. Industrial goods score in line. Technology and basics score below average.

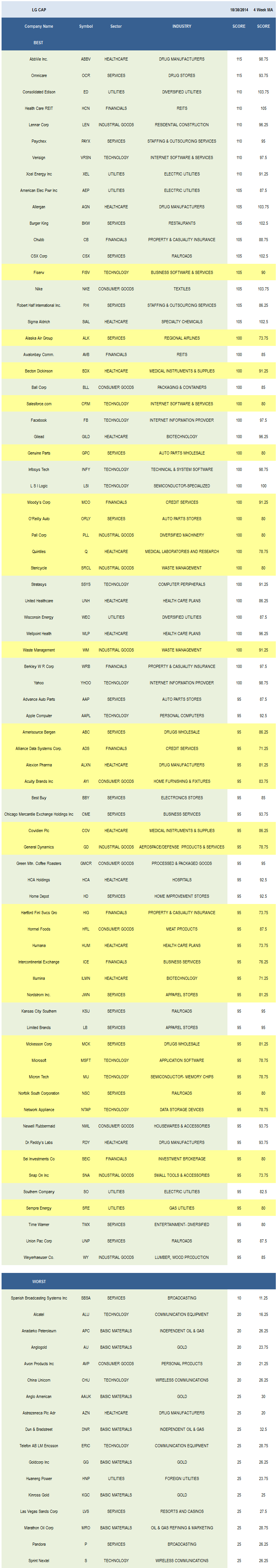

The best industry is railroads (CSX, UNP, NSC, KSU). North American carloads were 3% higher last week versus a year ago, bringing year-to-date volume growth to up 4.4% from 2013. Wholesale drug (MCK, ABC, CAH) demand is supported by ageing America, generic drug pricing power, and rising specialty drug volume. Healthcare plan (WLP, UNH, HUM) membership trends remain positive heading into the second open enrollment. Medicaid expansion remains a major profit tailwind. Long term demographics remain bullish for Medicare Advantage and Part D demand. Diversified communication systems (LVLT, CCI) and Internet information (YHOO, FB, NTES) continues to benefit from content consumption on mobile devices.

In large cap basics, only oil & gas pipelines (WMB, SE) score above average. In consumer goods, focus on processed & packaged goods (GMCR, MJN, PEP, CPB, CAG), textiles (NKE, VFC, PVH, UA), and cigarettes (RAI, MO, LO). The top financials groups are P&C insurers (CB, WRB, HIG, TRV, PRE, CINF), REITs (HCN, AVB, FRT, DLR, SLG, PSA), and credit services (MCO, ADS). Following a year of solid P&C pricing, rates should flatten absent a cat event; however, rising volume will continue to benefit the basket. In healthcare, buy healthcare plans, medical instruments (BDX, COV, CFN, BCR), and biotech (GILD, ILMN, CELG, REGN, BMRN, MDVN). Aerospace/defense (GD, NOC, TDG, LMT, BA) and diversified machinery are best across industrial goods. Boeing expects monthly 737 production will climb from 42 planes currently to 52 planes in 2018. The top services baskets are rails, wholesale drugs, and diversified entertainment (TWX, DIS). In technology, buy diversified communication, Internet information, and domestic telecom (VZ, T).

Disclosure: None.