Large Cap Best & Worst Report - August 19, 2014

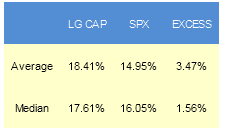

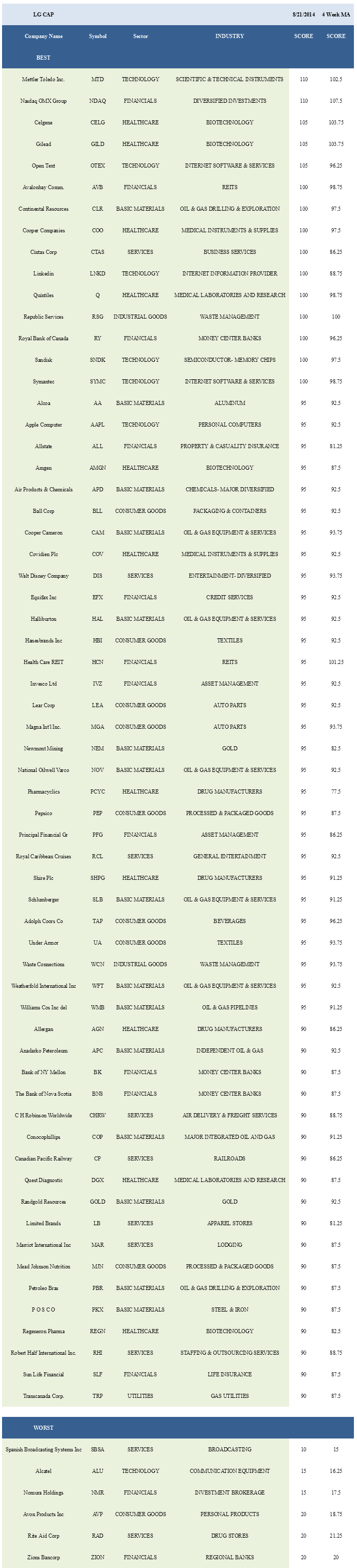

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 347 bps of excess to the SPX in the following year. The best performers from our list one year ago are RCL up 68%, FTR up 58%, and ITT up 41%.

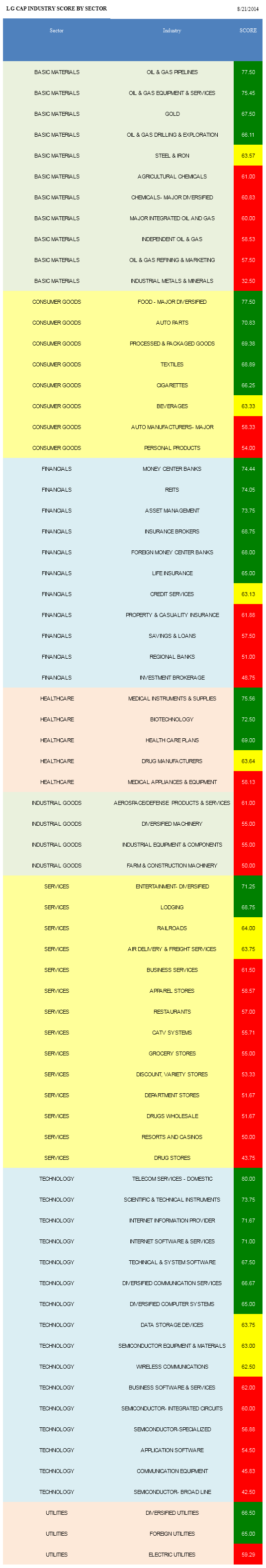

- The best scoring large cap sector is healthcare.

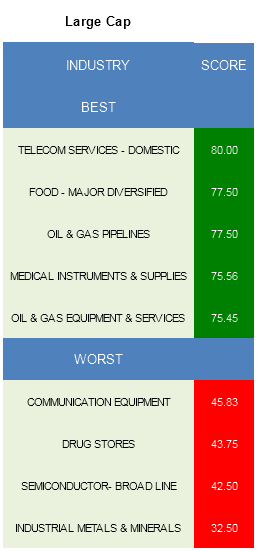

- The top scoring large cap industry is domestic telecom.

The average large cap stock score is 60.09, below the four week moving average score of 63. The average large cap is trading -9.43% below its 52 week high, 3.10% above its 200 dma, has 4.49 days to cover held short, and is expected to grow EPS by 13.32% next year.

Healthcare is the top large cap sector. Financials and basic materials also score above average. Utilities, technology, and consumer goods score in line. Services and industrial goods score below average.

Domestic telecom (CTL, T, VZ) is the top scoring large cap industry. Revenue growth is supported by growing demand for high bandwidth content and pricing innovation. Major food (MDLZ, ADM) offers sales growth thanks to expansion into emerging markets. Pipeline (WMB) throughput growth supports dividend increases. In- and out-patient admissions growth tied to increasing insurance enrollment and job creation supports demand for medical instruments (COO, COV, BCR, BDX). Year-over-year growth in rig activity reflects growing demand for oil & gas equipment & services (WFT, SLB, NOV, HAL, CAM).

In basics, focus on pipelines, oil & gas equipment & services, and gold (NEM, GOLD, GG). Major food, auto parts (MGA, LEA, TRW), and processed & packaged goods (PEP, MJN, MKC, K) score best in consumer goods. The top financials groups are money center banks (RY, BNS, BK, WFC), REITs (AVB, HCN, SLG, PSA, ESS), and asset managers (PFG, IVZ, TROW, BLK). Medical instruments, biotechnology (GILD, CELG, AMGN, REGN, MDVN), and healthcare plans (CI, WLP, HUM) score highest in healthcare. No large cap industrial goods baskets score above average this week -- drop down in market cap where possible. Across services, focus on diversified entertainment (DIS, TWX) and lodging (MAR, H). Retail is typically weak through the end of the quarter, but returns into favor early in the fourth quarter. The top technology industries include domestic telecom, scientific & technical instruments (MTD, GRMN), and Internet information (LNKD, FB, EXPE).

Disclosure: None.