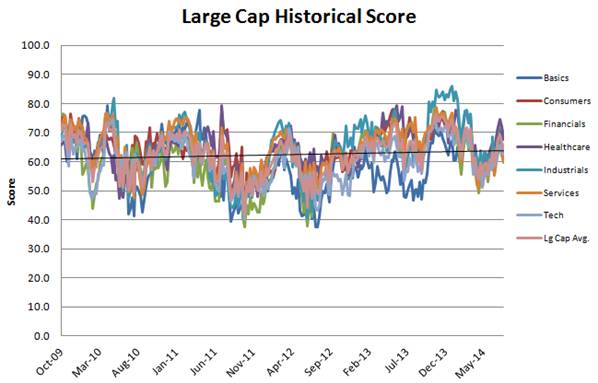

Large Cap Best & Worst Report - July 22, 2014

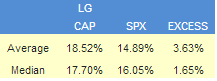

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 363 bps of excess to the SPX in the following year. The best performers from our list one year ago include MYL up 61%, CLR up 60%, ITT up 51%, and LEA up 46%.

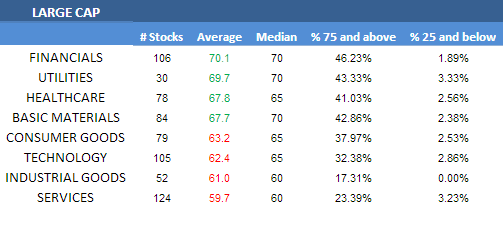

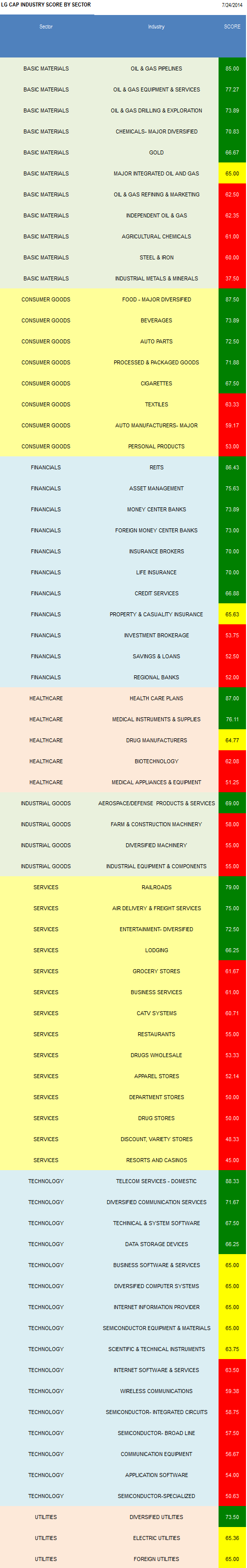

- The best large cap sector is financials.

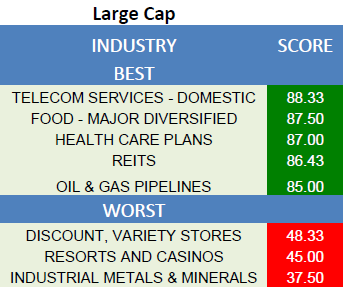

- The top large cap industry is domestic telecom.

The average large cap score is 64.68, below the four week moving average score of 67.20. The average large cap stock is trading -9.06% below its 52 week high, 3.59% above its 200 dma, has 4.49 days to cover held short, and is expected to grow EPS by 13.57% next year.

Financials, utilities, healthcare, and basic materials score above average. Consumer goods, technology, industrial goods, and services score below average.

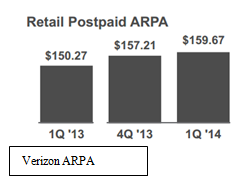

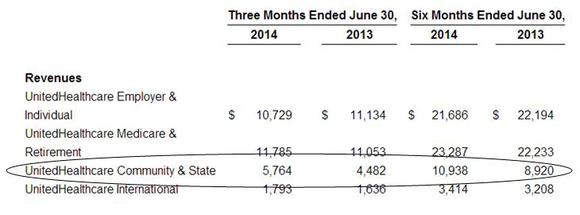

Domestic telecom (VZ, CTL, T) is the highest scoring large cap sector. Telecom ARPA/ARPU/ABPU benefits from rising high bandwidth data consumption. Major food (MDLZ, ADM) is top scoring. Emerging markets (urbanization driving consumption of higher value foods) and expansion through convenience store channels offers above trend growth. Robust Medicaid enrollment supports healthcare plans (HUM, CI, AET, UNH) and early success (pricing/profit) for exchange plans suggests insurers modeled correctly. Look for plans to trade up heading into the second open enrollment.

Source: United Health Group

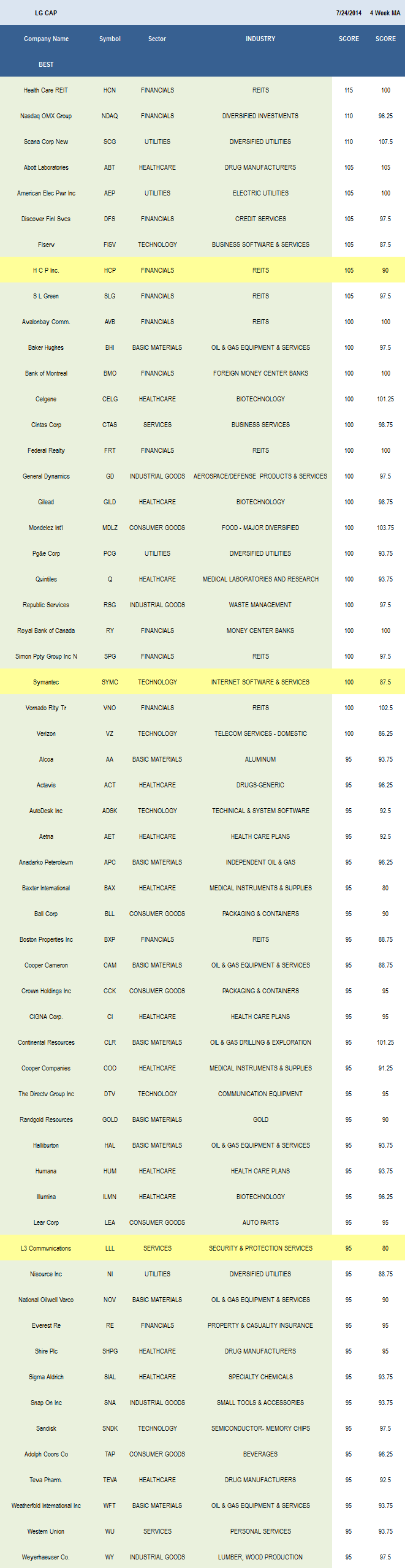

REITS (HCN, SLG, HCP, VNO, SPG, FRT, AVB) are the top scoring financials industry. Strength is in line with historical seasonal strength as managers tend to de-risk and embrace dividend stability through vacation season. Effective rents, new capacity (yet to negatively impact rent), and improving commercial/office vacancy rates continue to be leveraged against cheap money for profit upside. Pipelines (WMB, SE) throughput gains continue to support growth and dividend payout as capacity increases to meet shale production. For example, Pennsylvania state outflow capacity has grown from 13,951 MMcfe/d in 2010 to 16,746 MMcfe/d in 2013.

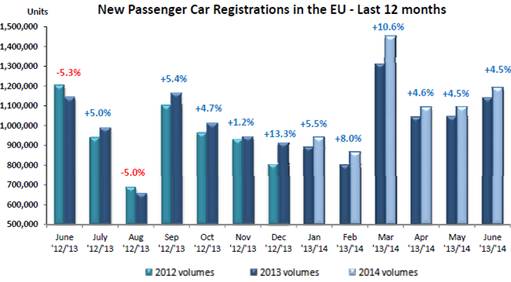

In large cap basics, focus your portfolio around pipelines, oil & gas equipment & services (BHI, WFT, NOV), and drillers (CLR, PBR, HP). There are 101 more active rigs in the U.S. than a year ago, according to BHI. Major food, beverages (TAP, STZ, KO), and auto parts (LEA, MGA, TRW) score best in consumer goods. European passenger car registrations increased 6.5% in the first six months and 4.5% in June versus a year ago.

Across financials, concentrate on REITs, asset managers (PFG, IVZ, AMP), and money center banks (RY, BNS, BK, WFC, STI). Loan activity continues to grow with C&I loans hitting new highs. Across healthcare, buy healthcare plans and medical instruments (COO, BAX, COV, CFN). Only aerospace/defense (GD, BEAV, SPR, HON) score above average in industrial goods. At Farnborough, Airbus generated orders worth $75 billion while Boeing got orders worth $40.2 billion. In services, buy rails (CP, NSC, KSU), air delivery (CHRW, EXPD), and diversified entertainment (DIS, TWX). Retail typically heads higher in Q4; so use weakness to position accordingly through quarter end. In technology, domestic telecom, diversified communication (AMT), and technical & system (ADSK, SNPS) software score highest.

Disclosure: None.