Large Cap Best & Worst Report - July 15, 2014

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 367 bps of excess to the SPX in the following year. The best performers from our list one year ago include CLR up 63%, MYL up 56%, ITT up 53%, LO up 50%, LEA up 47%, and AMP up 45%.

.jpg)

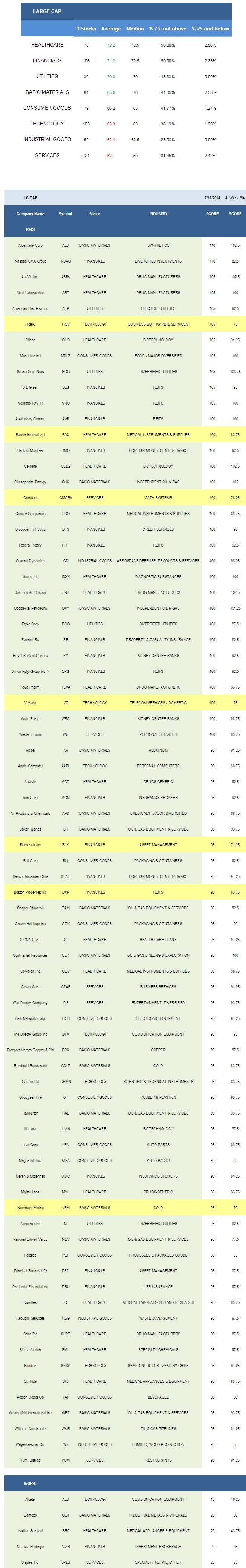

- Healthcare is the top scoring large cap sector this week.

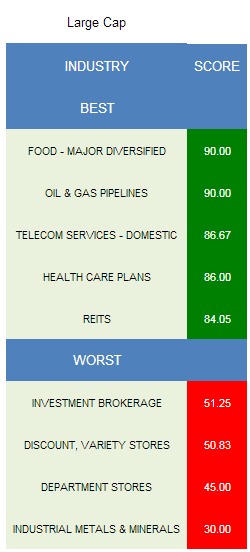

- The best scoring large cap industry is major food.

The average large cap score is 66.69 this week, below the four week moving average score of 66.96. The average large cap stock is trading -8.29% below its 52 week high, 4.45% above its 200 dma, has 4.49 days to cover held short, and is expected to post EPS growth of 13.55% next year.

Healthcare, financials, utilities, and basics score above average. Consumer goods score in line. Technology, industrial goods, and services score below average.

The top scoring industry is major food (MDLZ, ADM). Oil & gas pipelines (WMB, SE) benefit from capacity additions and shale driven production growth. Domestic telecom (VZ, CTL, T) is strong as high bandwidth consumption continues to support ARPU growth. Results from healthcare plans (CI, HUM, AET, UNH) will be watched closely this quarter given this past quarter was the first to fully include ACA membership. Keep a close eye on Medicaid membership results given expansion positively impacted related insurers in the first quarter. REITs (VNO, SLG, SPG, FRT, AVB, BXP) are also high scoring thanks to solid effective rents, falling vacancy rates, and new capacity additions. Financing markets remain favorable for the group.

In basics, buy oil & gas pipelines, oil & gas equipment & services (WFT, NOV, HAL, CAM, BHI), and gold (NEM, GOLD). In consumer goods, focus on major food, auto parts (MGA, LEA, JCI), and beverages (TAP, STZ, KO, BF.B). The best financials industries include REITs, asset managers (PFG, BLK, IVZ), and life insurance (PRU, SLF, MFC). In healthcare, concentrate on healthcare plans, medical instruments (COO, BAX, COV, CFN, BCR), and biotech (GILD, CELG, ILMN, REGN, JAZZ, MDVN). Only aerospace/defense (GD, BEAV, SPR, TDG) score above average across industrials. Watch for order news out of Farnborough for potential impacts on suppliers. In services, buy lodging (MAR, H, WYN), rails (NSC, CSX, CP), and diversified entertainment (DIS, TWX). Domestic telecom, diversified communication (AMT, LVLT), and business software (FISV, DOX) are best in technology.

Disclosure: None.