Large Cap Best & Worst Report - January 14, 2015

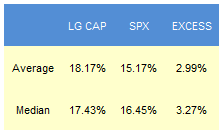

Since 2010, our top scoring weekly has outpaced the SPX by a median 327 bps in the following year.

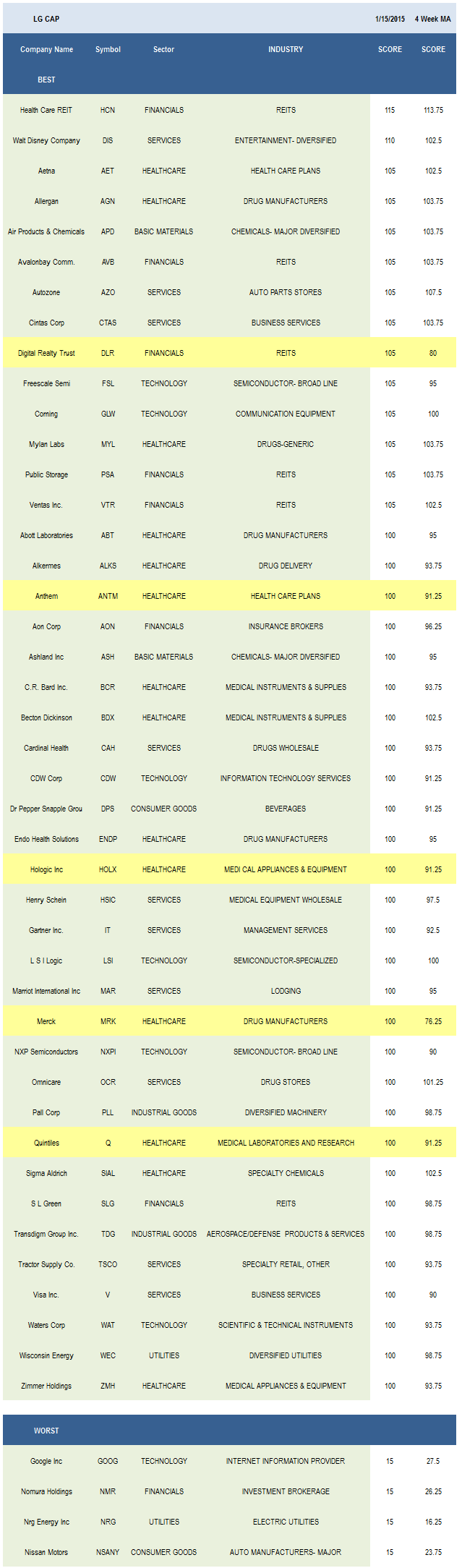

- The best large cap sector is healthcare.

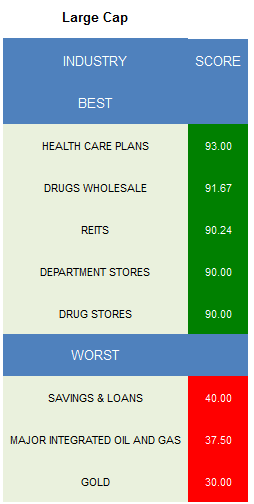

- The top large cap industry is healthcare plans.

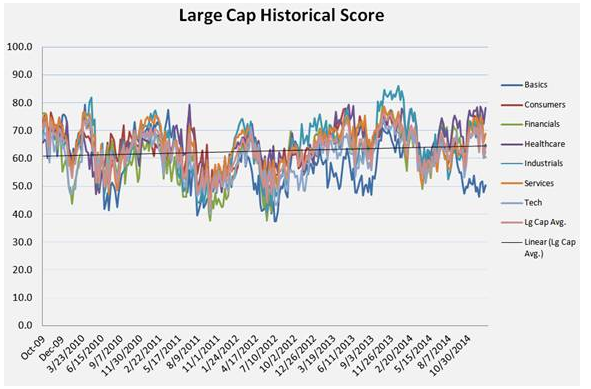

The average large cap stock score is 64.46, which is below the four week moving average score of 66.72. The average large cap stock is trading -12.87% below its 52 week high, 0.82% above its 200 dma, has 4.19 days to cover held short, and is expected to grow EPS by 9.58% next year.

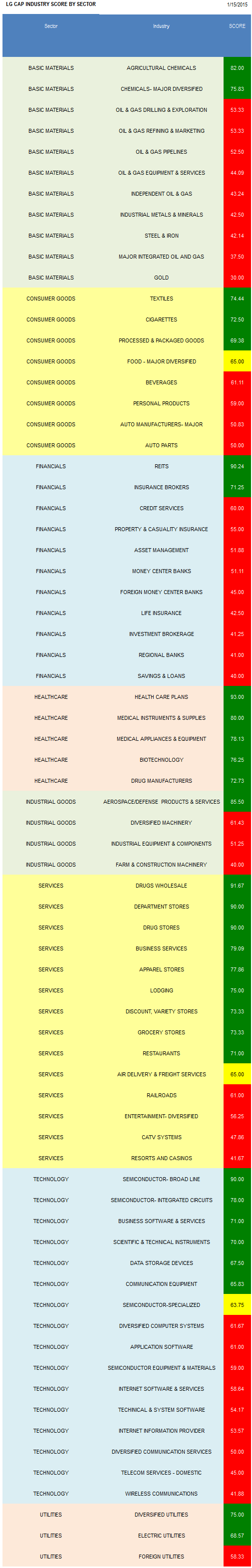

The top scoring large cap sector is healthcare. Services and utilities also score above average. Consumer goods score in line with the average large cap universe score. Technology, financials, and basic materials score below average.

Insurers (AET, ANTM, CI, HUM, UNH) are expected to post mid to high single digit EPS growth this year thanks to growing exchange enrollment and Medicaid expansion. Wholesale drug (CAH, MCK, ABC) demand benefits from rising script volume tied to an increasingly older and insured population. Capacity additions and ongoing effective rent strength support dividend growth for REITs (HCN, VTR, PSA, DLR, AVB, SLG). Retail sales through the holiday season gives sales and profit support to department stores (M, KSS, TJX) through the fourth quarter EPS reporting season. Drug stores (OCR, CVS, RAD, WBA) continue to enjoy top and bottom line growth fueled by higher script counts and expansion into new products and services, including clinics.

Across the large cap basic materials sector, only ag chemicals (CF, AGU, DD) and major chemicals (APD, ASH, SHW) score above average. In consumer goods, concentrate on textiles (HBI, VFC, NKE, LULU) and cigarettes (RAI, MO). Processed and packaged foods (CAG, MKC, K) also score high. REITs and insurance brokers (AON) are above average in financials. Every healthcare industry scores above average. Focus on healthcare plans, medical instruments (BDX, BCR, XRAY), and medical appliances (ZMH, ISRG, EW, MDT). The top scoring industrial goods group is aerospace/defense (TDG, RTN, LMT, GD, COL). In services, buy wholesale drugs, department stores, and drug stores. Broad line semiconductors (FSL, NXPI, TXN, ADI, INTC), semiconductor ICs (SWKS, BRCM, SUNE), and business software (FISV, JKHY) are top scoring in technology. In utilities, diversified (WEC, SCG, EXC) and electric utilities (FE, NEE, SO) are best.

Disclosure: None.