Large Cap Best & Worst Report - December 23, 2014

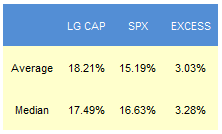

Since 2010, our top scoring weekly has outpaced the SPX by a median 328 bps in the following year. The best performers from our list one year ago are AGN up 96%, MAR up 61%, GD up 52%, and SIAL up 49%.

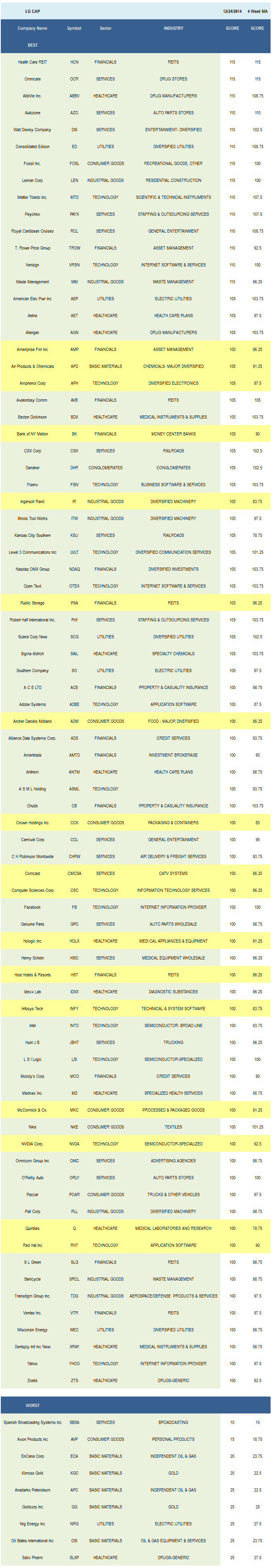

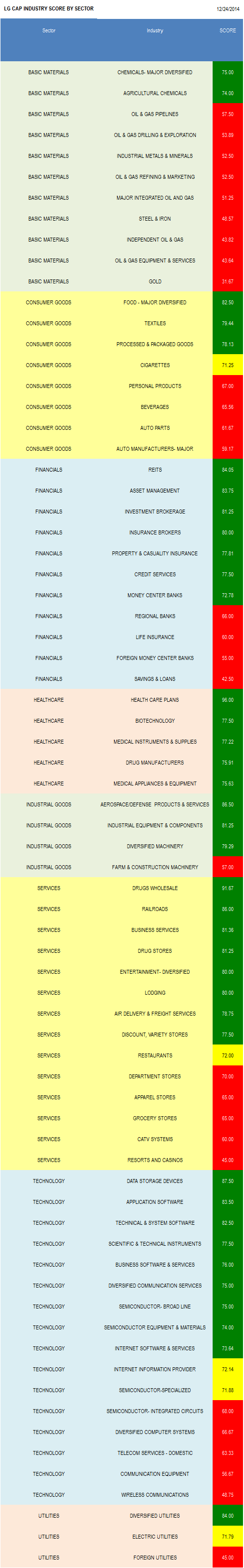

- Healthcare is the top scoring large cap sector.

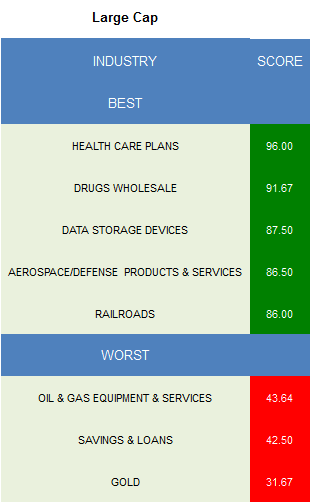

- The best scoring large cap industry is healthcare plans.

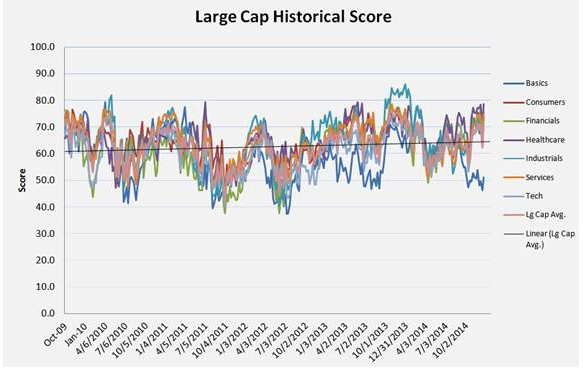

The average large cap stock across our universe has a score of 71.09, which is above the four week moving average score of 68.91. The average large cap stock is trading -10.89% below its 52 week high, 2.94% above its 200 dma, has 4.17 days to cover held short, and is expected to grow EPS by 9.78% next year.

The best large cap sector is healthcare. Financials, services, industrial goods, and consumer goods also score above average. Technology and utilities score in line. Basic materials score below average.

Enrollment in health insurance through the ACA exchanges is running ahead of projections and offers upside to healthcare plans (AET, ANTM, UNH, CI, HUM) in 2015. Private Medicaid insurers also benefit from more states embracing expansion and from enrollment growth tied to increased awareness. Wholesale drug (MCK, ABC, CAH) demand is climbing thanks to rising demand from ageing Americans and thanks to a rising proportion of Americans having health insurance. Data storage (WDC, NTAP, STX, EMC) scores highly, as it typically does at this time of the year. Big data and high bandwidth content demand continues to drive storage sales growth. Aerospace/defense (TDG, RTN, HON, GD, COL) benefit from rising aerospace production and clarity into DoD budgets. Rail (KSU, CSX, UNP) carload pricing continues to enjoy tailwinds thanks to NAFTA trade and port volume growth.

In large cap basics, buy major chemicals (APD, SHW, ASH) and ag chemicals (CF, DD, MON, AGU). In consumer goods, buy major food (ADM), textiles (NKE, MHK, RL, LULU, PVH), and processed & packaged goods (MKC, GMCR, CAG, MJN, CPB). The top financials groups are REITs (HCN, PSA, AVB, VTR, SLG, HST), asset managers (TROW, AMP, BLK, AMG), and investment brokers (AMTD, SCHW, GS). In healthcare, concentrate on healthcare plans, biotech (ILMN, BIIB, INCY, CELG, BMRN, REGN, MDVN), and medical instruments (BDX, XRAY, SYK, BCR). The top industrial goods industries are aerospace/defense and industrial equipment (ROP, PH). In services, buy wholesale drugs, railroads, and business services (CTAS, CME, CSGP, V). Data storage, application software (RHT, ADBE, MSFT, CTRX, INTU, CA, SPLK), and technical & system software (INFY, ANSS, ADSK, SNPS) score highest in technology.

Disclosure: None.